- Home

- »

- Pharmaceuticals

- »

-

Onychomycosis Market Size & Share, Industry Report, 2033GVR Report cover

![Onychomycosis Market Size, Share & Trends Report]()

Onychomycosis Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Distal Subungual Onychomycosis, White Superficial Onychomycosis, Proximal Subungual Onychomycosis), By Treatment (Oral, Topical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-031-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Onychomycosis Market Summary

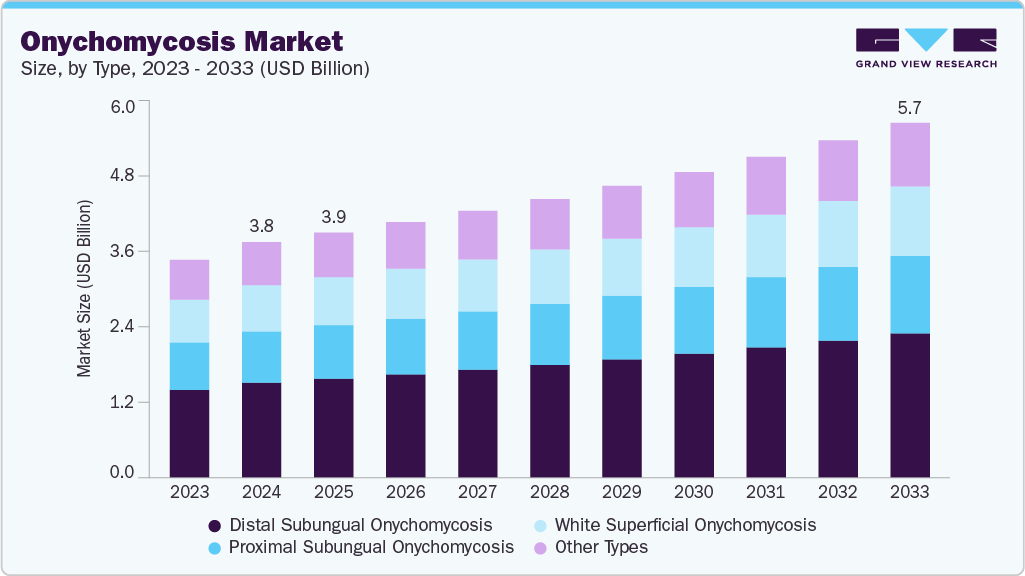

The global onychomycosis market was estimated at USD 3.81 billion in 2024 and is projected to reach USD 5.74 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The market is driven by the rising prevalence of fungal nail infections, increasing incidence of chronic conditions such as diabetes, an aging population, and advancements in treatment options such as topical solutions and laser therapies.

Key Market Trends & Insights

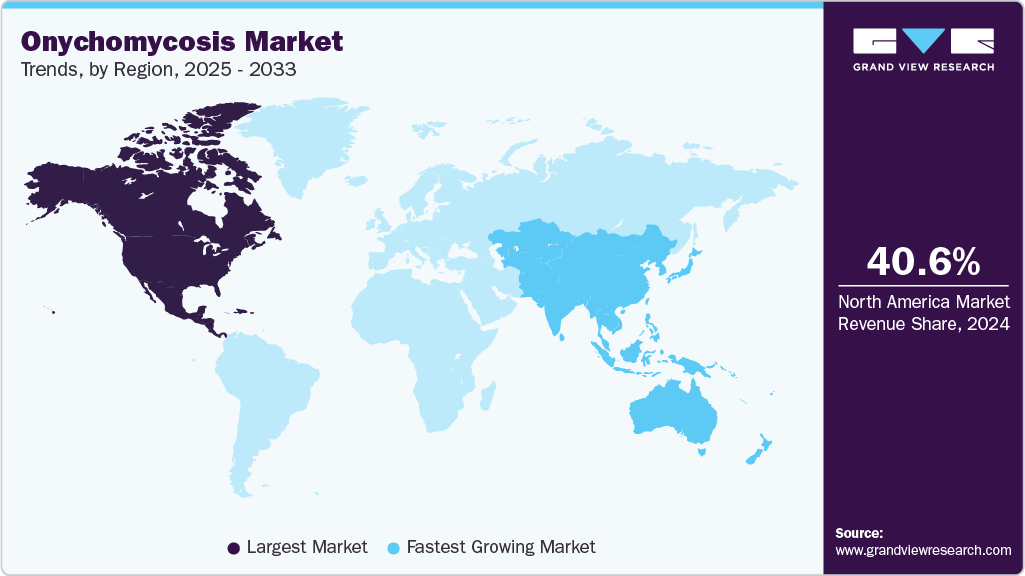

- North America onychomycosis market held the largest share of 40.32% of the global market in 2024.

- The onychomycosis industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the distal subungual onychomycosis segment held the highest market share of 40.39% in 2024.

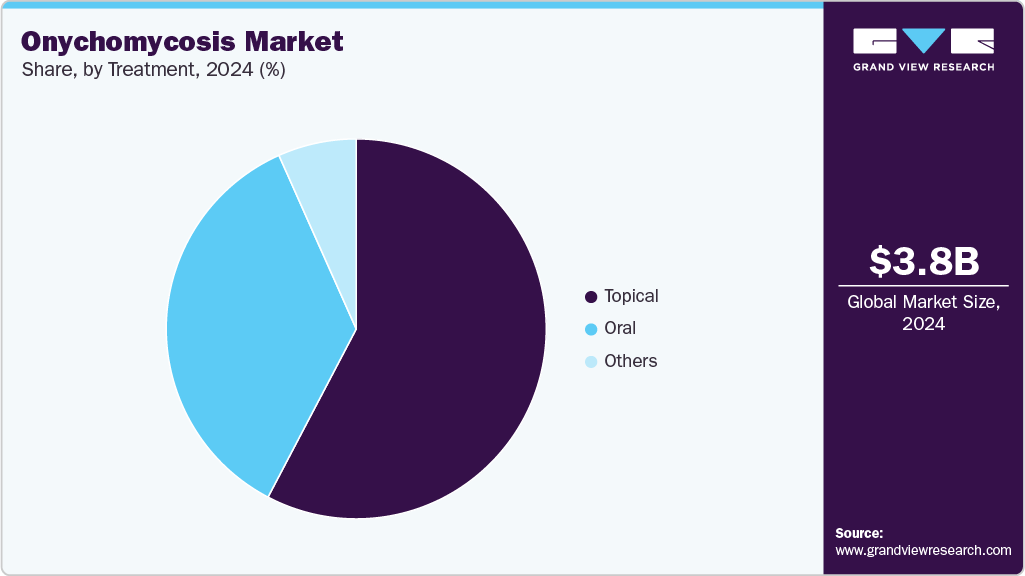

- By treatment, the topical segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.81 Billion

- 2033 Projected Market Size: USD 5.74 Billion

- CAGR (2025-2033): 4.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Fungal infections, including onychomycosis (nail fungus), are becoming a growing public health concern due to their increasing prevalence and impact on quality of life. Greater awareness and early diagnosis are key factors driving attention to these conditions. In response, initiatives such as the Centers for Disease Control and Prevention’s (CDC) annual Fungal Disease Awareness Week (FDAW), held from September 18 to 22, 2023, aim to educate the public about the risks and challenges posed by fungal diseases. These efforts have highlighted the need for improved diagnostic methods and treatment options, fueling demand in the onychomycosis market.

A variety of antifungal therapies are available, including oral medications, topical creams, sprays, and injectables. Investment in research and development continues to expand treatment options. A notable example is Moberg Pharma AB’s MOB-015, which received national authorization in Sweden in August 2023 for use in adults with mild to moderate nail fungus. While initially approved in Ireland, Sweden became the first country to allow the product’s sale as an over-the-counter remedy, signaling a move toward more accessible antifungal solutions and is expected to boost market uptake.

Furthermore, age is a significant factor influencing susceptibility to fungal infections, as immune function declines over time. Older adults are particularly at risk due to physical and cognitive changes that increase vulnerability to conditions like onychomycosis. This is underscored by demographic trends showing a rising elderly population worldwide. According to the World Health Organization, by 2030, one in six individuals will be over 60 years old, with the global elderly population growing from 1 billion in 2020 to 1.4 billion in 2030. The most rapid growth in older populations is expected in Eastern and South-Eastern Asia, followed by Central and Southern Asia, where the elderly population is projected to reach 328.1 million by 2050. These shifts highlight the growing need for targeted antifungal treatments designed for older adults.

Pricing Analysis

Pricing is critical in shaping the market for distal subungual onychomycosis (DSO) treatments by affecting patient access, prescribing habits, and overall market dynamics. High-cost topical treatments such as Jublia and Kerydin require prolonged use and deliver moderate effectiveness, which limits their adoption, especially among cost-sensitive or uninsured patients. This restricts their market penetration. In contrast, more affordable generic oral antifungals like terbinafine (Lamisil) and itraconazole (Sporanox), which are known for higher efficacy, are widely prescribed and contribute significantly to market demand. Patients and healthcare providers tend to prefer these cost-effective options.

The disparity in pricing often drives patients toward generic medications or over-the-counter products, which may be less effective, leading to lower overall treatment rates. Emerging therapies like BB2603 face challenges in gaining market share due to their pricing. Meanwhile, untreated onychomycosis cases may increase long-term healthcare costs, further intensifying competition within the market. This environment favors generics and treatments covered by insurance, as affordability remains a key factor in treatment selection.

Company

Product

Description

Approximate Price (USD)

Bausch Health Companies Inc.

Jublia (Efinaconazole 10% Solution)

Topical azole, daily for 48 weeks, for mild to moderate DSO. Cure rate: 15.2-25.6%.

500-850 (4 mL bottle)

Pfizer, Inc.

Lamisil (Terbinafine 250 mg Tablets)

Oral antifungal, daily for 6-12 weeks, for moderate to severe DSO. Cure rate: ~80%.

10-30 (30 tablets, generic)

Novartis AG

Sporanox (Itraconazole Capsules)

Oral antifungal, continuous or pulse dosing for 6-12 weeks. Cure rate: ~70%.

500-1,000 (30 capsules, generic)

Anacor Pharmaceuticals (Pfizer)

Kerydin (Tavaborole 5% Solution)

Topical boron-based antifungal, daily for 48 weeks. Cure rate: 6.5-9.1%.

1,000-1,500 (10 mL bottle)

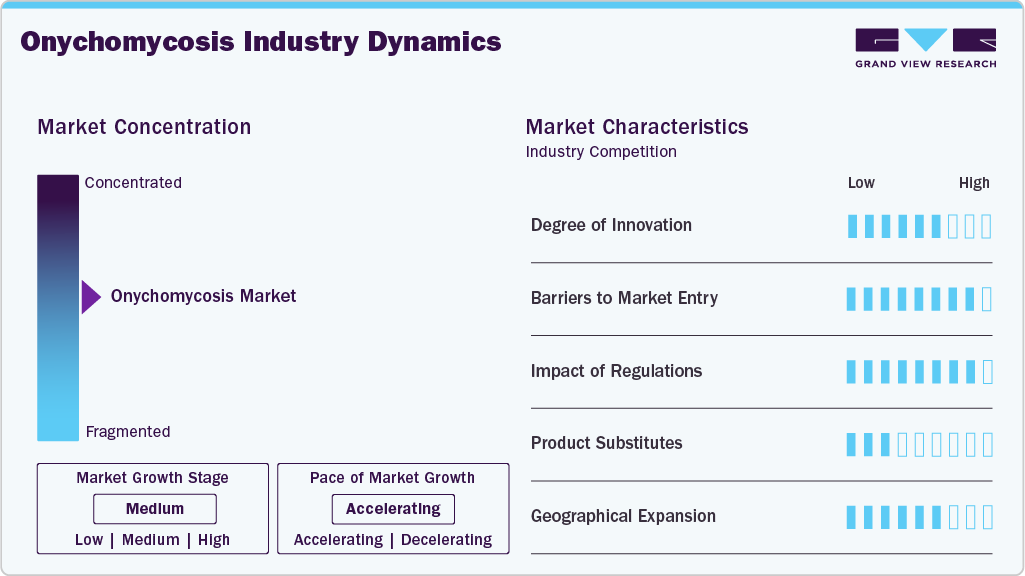

Market Concentration & Characteristics

Innovation in the onychomycosis market is steady, with a focus on enhancing treatment effectiveness and improving patient compliance. Companies are developing advanced topical formulations, including nail-penetrating lacquers such as efinaconazole, and investigating alternative approaches like laser and photodynamic therapies. New antifungal agents, such as Blueberry Therapeutics’ BB2603, are being designed to target resistant fungal strains and reduce treatment duration. Combination therapies that integrate oral and topical treatments are also becoming more common to better manage persistent infections. Research and development efforts by major companies, including Bausch Health and Pfizer, support these advances, although most progress remains incremental rather than revolutionary.

Barriers to entry in the onychomycosis market are moderately high due to stringent regulatory requirements and significant R&D costs. New entrants face challenges in developing effective treatments that penetrate the nail bed, requiring advanced technology and clinical trials. Established players like GSK and Merck benefit from brand loyalty, extensive distribution networks, and economies of scale. Patent protections and high capital requirements for manufacturing and marketing further deter startups. However, niche opportunities in innovative delivery systems can attract smaller firms.

The FDA and other global agencies impose rigorous clinical trial requirements, delaying market entry for new therapies. Compliance with these standards is critical for companies like Bausch Health and Novartis to gain trust and market access. Reimbursement policies also influence treatment adoption, particularly for costly laser therapies. While regulations foster innovation by prioritizing efficacy, they increase development costs and timelines.

Product substitutes in the market include alternative therapies like laser treatments, photodynamic therapy, and over-the-counter remedies such as tea tree oil. Laser therapy, approved by the FDA, is gaining popularity as a non-invasive option, though its high-cost limits adoption. Herbal and ayurvedic treatments appeal to patients seeking natural solutions, but their efficacy is often unproven. Oral antifungals like terbinafine remain dominant due to high cure rates, reducing the threat of substitutes. However, topical solutions and emerging therapies challenge traditional drugs.

Geographical expansion is a key strategy in the onychomycosis market, with Asia-Pacific showing the fastest growth due to high prevalence, urbanization, and improving healthcare infrastructure. North America dominates, driven by high awareness and an aging population, while Europe benefits from favorable reimbursement policies. Companies like Cipla and Sun Pharma target emerging markets in Latin America and the Middle East to capture untapped demand. Strategic partnerships like Almirall’s agreement with Kaken Pharmaceutical facilitate entry into new regions. Expansion is challenged by varying regulatory landscapes and healthcare access disparities.

Type Insights

The distal subungual onychomycosis segment dominated the market with the largest revenue share of 40.39% in 2024 due to its high prevalence as the most common form of nail fungal infection. Distal subungual onychomycosis affects the nail bed and underside of the nail, often caused by Trichophyton rubrum, and is particularly prevalent among immunocompromised individuals and those with diabetes. The segment’s dominance is supported by the availability of diverse treatment options, including topical antifungals such as efinaconazole and systemic therapies. Increased awareness of nail health and early diagnosis further boosts demand for distal subungual onychomycosis treatments. Advancements in drug delivery, such as nail-penetrating topical solutions, enhance treatment efficacy. Ongoing research and development for targeted therapies also contribute to the segment’s significant market share.

The white superficial onychomycosis segment is projected to grow at the fastest CAGR over the forecast period, fueled by rising cases and advancements in treatment options. White superficial onychomycosis, primarily caused by Trichophyton mentagrophytes, affects the nail plate’s surface and is increasingly diagnosed due to improved diagnostic techniques. For instance, in January 2024, the publisher PMC reported that the most frequent cause of onychomycosis was Trichophyton rubrum, with other dermatophytes such as Trichophyton mentagrophytes and Epidermophyton floccosum also implicated as causative agents. It was noted that dermatophytes were identified in 90% of toenail onychomycosis cases and 50% of fingernail onychomycosis cases, highlighting their predominant role in these infections.

Treatment Insights

The topical segment dominated the market with the largest revenue share of 57.69% in 2024, attributed to its ease of use and minimal systemic side effects. Topical therapies, such as nail lacquers, and solutions like efinaconazole, offer targeted treatment with improved nail penetration. Their popularity stems from patients' preference for non-invasive options, especially those with mild to moderate infections. Advancements in pharmaceutical technology have led to more effective topical formulations, enhancing patient compliance. The segment is further supported by recent product launches, such as Vanda Pharmaceuticals’ VTR-297 in 2024. Increased awareness of nail health and the availability of over-the-counter topical treatments also drive market share.

The oral segment is projected to grow at the fastest CAGR over the forecast period due to its high efficacy and shorter treatment durations. Oral antifungals, such as terbinafine, are preferred for severe or resistant onychomycosis cases due to their ability to target fungal infections systemically. In December 2024, Moberg Pharma secured a new terbinafine supplier with an authorized EU Certificate of Suitability, ensuring stable production of its nail fungus drug MOB-015. This milestone removed supply constraints, supporting planned launches across multiple European markets. The increasing prevalence of chronic conditions such as diabetes, which heighten infection severity, drives the demand for oral therapies. Innovations in oral formulations and the introduction of generics, such as Glenmark Pharmaceuticals’ terbinafine tablets, enhance the situation accessibility. Patient preference for faster results and improved outcomes supports the segment’s growth. Ongoing research into safer oral antifungals with fewer side effects propels market expansion.

Regional Insights

North America onychomycosis market held the largest share of 40.62% in 2024, driven by advanced healthcare infrastructure and high awareness of nail fungal infections. The region benefits from widespread access to dermatological care and innovative treatment options, such as topical antifungals and laser therapies. The high prevalence of onychomycosis, particularly among aging populations and diabetic patients, fuels the demand for treatments. The presence of major pharmaceutical companies, like Pfizer and Valeant, supports robust product development and market penetration. Strategic partnerships and frequent product launches, such as new antifungal formulations, enhance market growth. Increased consumer spending on personal care and aesthetics further strengthens the region’s market position.

U.S. Onychomycosis Market Trends

The U.S. led the onychomycosis market in North America in 2024, holding a significant revenue share due to its advanced medical research and high adoption of novel therapies. The country’s large diabetic and elderly populations drive the prevalence of nail fungal infections, increasing treatment demand. Access to cutting-edge treatments, including efinaconazole and tavaborole, supports market growth. Strong marketing efforts by companies like Bausch Health promote awareness and product uptake. The rise in outpatient dermatology clinics facilitates early diagnosis and treatment. High consumer awareness of nail health and aesthetic concerns further boosts the U.S. market.

Europe Onychomycosis Market Trends

Europe held a substantial share of the onychomycosis market in 2024, driven by a well-established healthcare system and growing demand for antifungal treatments. The region’s aging population, particularly in countries like Italy and Spain, increases the incidence of onychomycosis, fueling market growth. The availability of advanced therapies, including oral antifungals like terbinafine, supports effective treatment outcomes. Collaborative efforts among pharmaceutical firms, such as Galderma’s research initiatives, enhance product innovation. Rising awareness of nail health and cosmetic concerns drives consumer demand for topical solutions. The region’s focus on dermatological advancements further solidifies its market position.

UK onychomycosis market contributed significantly to the European market in 2024, driven by high awareness of fungal infections and access to advanced dermatological care. The country’s aging population and increasing prevalence of chronic conditions, such as diabetes, elevate the need for effective treatments. Topical therapies, like amorolfine nail lacquer, are widely adopted for their ease of use. Pharmaceutical companies, including GlaxoSmithKline, invest in research to develop targeted antifungal solutions. Growing consumer focus on personal grooming and nail aesthetics supports market expansion. The UK’s robust healthcare infrastructure ensures the widespread availability of treatments.

Onychomycosis Market in Germany held a strong position in the European market in 2024, supported by its advanced healthcare system and high adoption of innovative therapies. The country’s large elderly population increases the prevalence of nail fungal infections, driving treatment demand. The availability of effective oral and topical antifungals, such as itraconazole, enhances treatment outcomes. Companies like Hexal AG focus on developing affordable generic options and improving market access. Rising awareness of nail health and aesthetic concerns boosts consumer demand for therapies. Germany’s emphasis on dermatological research further strengthens its market share.

France onychomycosis market maintained a notable share of the onychomycosis market in 2024, driven by its focus on dermatological advancements and high consumer awareness. The country’s aging population and rising cases of diabetes contribute to the high incidence of nail fungal infections. Topical treatments, such as ciclopirox, are popular due to their accessibility and minimal side effects. Pharmaceutical firms like Pierre Fabre invest in innovative antifungal solutions, supporting market growth. Increasing demand for cosmetic nail treatments fuels market expansion. France’s well-developed healthcare system ensures widespread access to effective therapies.

Asia-Pacific Onychomycosis Market Trends

The Asia Pacific region is projected to grow at the fastest CAGR over the forecast period, fueled by rising healthcare investments and increasing awareness of nail infections. Rapid urbanization and changing lifestyles contribute to a higher prevalence of onychomycosis, particularly in humid climates. Growing access to affordable antifungal treatments, including generics, drives market expansion. Strategic partnerships enhance product availability, such as those between local and global pharmaceutical firms. The region’s large population and rising disposable incomes boost demand for topical therapies. Advancements in diagnostic technologies further accelerate market growth.

Japan onychomycosis market is expanding rapidly, driven by its aging population and high prevalence of nail fungal infections. The country’s advanced healthcare system supports early diagnosis and access to treatments like oral antifungals. Topical solutions, such as luliconazole, are gaining popularity due to their efficacy and ease of use. Companies like Sato Pharmaceutical invest in research to develop innovative therapies, boosting market growth. Increasing consumer focus on nail aesthetics and personal care drives demand. Japan’s robust dermatological research ecosystem further supports market expansion.

Onychomycosis market in China is growing steadily, fueled by its large population and increasing healthcare awareness. The humid climate in many regions contributes to a high incidence of nail fungal infections, driving treatment demand. Affordable generic antifungals, including terbinafine, enhance market accessibility. Pharmaceutical companies like Sinopharm expand their portfolios with innovative topical solutions. Rising disposable incomes and focus on personal grooming support market growth. Improvements in diagnostic capabilities and healthcare infrastructure further propel the market.

Latin America Onychomycosis Market Trends

Latin America’s onychomycosis market is developing steadily, driven by improving healthcare access and rising awareness of fungal infections. The region’s warm and humid climate increases the prevalence of onychomycosis, boosting treatment demand. Affordable topical treatments, such as clotrimazole, are widely adopted due to cost-effectiveness. Partnerships between local firms and global players, like EMS S/A in Brazil, enhance product availability. Growing consumer interest in nail health and aesthetics supports market growth. Investments in dermatological care further drive the region’s market expansion.

Brazil onychomycosis market holds a significant share of the Latin American onychomycosis market, driven by its large population and increasing dermatological care access. The country’s tropical climate contributes to a high prevalence of nail fungal infections, increasing treatment demand. Topical antifungals, like ketoconazole, are popular due to their affordability and availability. Companies such as Aché Laboratórios invest in innovative therapies, supporting market growth. Rising awareness of nail aesthetics and personal care drives consumer demand. Brazil’s expanding healthcare infrastructure further accelerates market development.

Middle East & Africa Onychomycosis Market Trends

The Middle East & Africa onychomycosis market is growing steadily, driven by increasing healthcare investments and awareness of nail fungal infections. Warm climates in many regions contribute to a higher incidence of onychomycosis, boosting treatment demand. Affordable generic antifungals, including oral terbinafine, enhance market accessibility. Partnerships with global pharmaceutical firms improve the availability of innovative therapies. Rising consumer focus on personal grooming and nail health supports market expansion. Improvements in diagnostic tools and dermatological care further drive growth.

Onychomycosis market in Saudi Arabia is expanding, fueled by increasing healthcare awareness and access to advanced treatments. The country’s hot and humid climate contributes to a high prevalence of nail fungal infections, driving demand for therapies. Topical treatments, such as amorolfine, are gaining traction due to their ease of use and effectiveness. Investments by companies like Jamjoom Pharma in antifungal research support market growth. Growing consumer emphasis on aesthetics and nail care boosts demand. The country’s improving healthcare infrastructure further enhances market potential.

Key Onychomycosis Market Company Insights

Major players such as Bausch Health Companies Inc., Pfizer Inc., and Novartis AG dominate the onychomycosis treatment market, leveraging strong brand recognition, regulatory approvals, and extensive global distribution networks. Competitive dynamics are shaped by innovation in topical and oral antifungal therapies, pricing strategies, and supply chain optimization. Further, manufacturers in emerging markets, particularly in Asia-Pacific, such as Cipla and Sun Pharmaceutical Industries Ltd., are gaining traction with cost-effective formulations. As healthcare systems worldwide prioritize accessible and effective treatments for fungal nail infections, market competition is expected to intensify. The onychomycosis market is projected to grow significantly during the forecast period, driven by rising prevalence, an aging population, and advancements in treatment options.

Key Onychomycosis Market Companies:

The following are the leading companies in the onychomycosis market. These companies collectively hold the largest market share and dictate industry trends.

- Bausch Health Companies Inc.

- GSK plc

- Abbott

- Pfizer Inc

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Cipla

- Merck & Co., Inc.

- Novartis AG

- Sun Pharmaceutical Industries Ltd.

Recent Developments

-

In August 2023, Moberg Pharma AB revealed that MOB-015 gained national approval in Sweden, the company's home market. This authorization allows the treatment of mild to moderate fungal nail infections in adult patients.

-

In March 2023, Moberg Pharma AB submitted a marketing authorization application for MOB-015, a treatment for nail fungus. The application was filed in Europe through the decentralized procedure, with the company aiming for market approval by the end of 2023.

-

In July 2022, Zydus Lifesciences obtained U.S. FDA approval for its Efinaconazole topical solution, designed to treat toenail onychomycosis in patients.

Onychomycosis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.96 billion

Revenue forecast in 2033

USD 5.74 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, treatment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bausch Health Companies Inc.; GSK plc; Abbott; Pfizer Inc; Bayer AG; Teva Pharmaceutical Industries Ltd.; Cipla; Merck & Co., Inc.; Novartis AG; Sun Pharmaceutical Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Onychomycosis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global onychomycosis market report based on type, treatment, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Distal Subungual Onychomycosis

-

White Superficial Onychomycosis

-

Proximal Subungual Onychomycosis

-

Other Types

-

-

Treatment Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Topical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global onychomycosis market size was estimated at USD 3.52 billion in 2023 and is expected to reach USD 3.81 billion in 2024.

b. The global onychomycosis market is expected to grow at a compound annual growth rate of 4.44% from 2024 to 2030 to reach USD 4.94 billion by 2030.

b. North America dominated the onychomycosis market with a share of 40.91% in 2023. This is attributable to better access to healthcare, presence of a wide target population, and high adoption of treatment.

b. Some key players operating in the onychomycosis market include Bausch Health Companies Inc., GSK plc, Abbott, Pfizer Inc., Bayer AG, Teva Pharmaceutical Industries Ltd., Cipla Inc., Merck & Co., Inc., Novartis AG, and Sun Pharmaceutical Industries Ltd.

b. Key factors that are driving the market growth include the increasing incidence of onychomycosis and chronic diseases aided by rising awareness about treatment, rising R&D pertaining to the development of novel drugs, and the growing geriatric population and diabetic population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.