- Home

- »

- Next Generation Technologies

- »

-

Open Source Services Market Size & Share Report, 2030GVR Report cover

![Open Source Services Market Size, Share & Trends Report]()

Open Source Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Services (Integration & Deployment, Training & Consulting, Managed Services), By Deployment, By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-059-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Open Source Services Market Summary

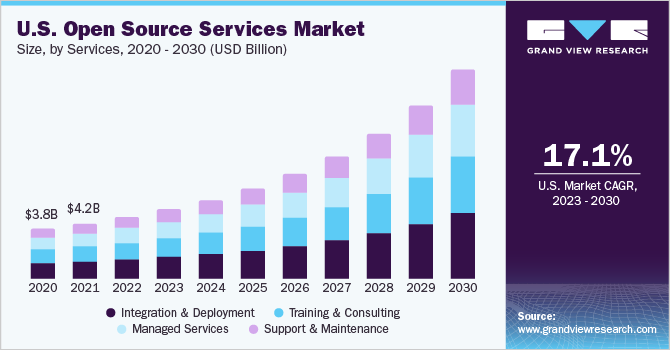

The global open source services market size was estimated at USD 25.03 billion in 2022 and is projected to reach USD 83.87 billion by 2030, growing at a CAGR of 16.9% from 2023 to 2030. One of the primary driving factors is the rise of digital transformation in various industries.

Key Market Trends & Insights

- North America dominated the open source services market with a share of 26.96% in 2022.

- By deployment, the hybrid segment dominated the market in 2022 with a revenue share of more than 39.0%.

- By services, the integration & deployment segment dominated the market in 2022 with a revenue share of above 31.0%

- By end use, Small & Medium Enterprises (SMEs) is anticipated to register the fastest growth over the forecast period.

- The Asia Pacific regional market is expected to emerge as the fastest-growing market over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 25.03 Billion

- 2030 Projected Market Size: USD 83.87 Billion

- CAGR (2023-2030): 16.9%

- North America: Largest market in 2022

Companies are increasingly using digital technologies to optimize their operations, reduce costs, and improve customer experience. Open source tools provide cost-effective and flexible solutions that can be easily integrated into existing systems. This has led to an increase in demand for open source services as companies seek to leverage the benefits of digital transformation.

Moreover, the growth of cloud computing is another growth driver. Cloud computing has become an essential component of digital transformation, offering businesses the ability to scale their operations and reduce infrastructure costs. Companies are looking for innovative solutions that can help them stay ahead of the competition. Open source platforms are a natural fit for cloud computing, as they provide a flexible and cost-effective way to build and deploy cloud-based applications.

The proliferation of Artificial Intelligence (AI) and Machine Learning (ML) technologies is fueling demand for open source services. These technologies offer significant advantages for businesses seeking to automate their operations, optimize their workflows, and improve their decision-making capabilities.

Open source services provide a flexible and cost-effective platform for developing and deploying AI and ML solutions, enabling companies to harness the full potential of these technologies without the need for significant investment in proprietary software. Furthermore, the availability of open source libraries, frameworks, and tools has lowered the barriers to entry for businesses seeking to adopt these technologies, allowing them to leverage the latest innovations without incurring significant costs.

With the increasing prevalence of cyber threats, companies are searching for secure solutions to safeguard their data and systems. Open source systems provide a transparent and collaborative approach to security, which enables greater scrutiny and faster detection and resolution of vulnerabilities. This is because open source projects are typically available for anyone to view, test, and modify, which can improve their overall security posture. In addition, open source solutions are frequently audited by a large community of users and contributors, which can further enhance their security and reliability.

One of the restraints of the open source market is the perceived lack of support and accountability compared to proprietary software. While open source solutions are typically well-supported by vibrant developer communities, some businesses may feel more comfortable with proprietary software providers that offer dedicated support and service-level agreements.

To overcome this restraint, open source service providers can invest in building robust support and training programs that offer customers the same level of accountability and responsiveness they would expect from a proprietary software vendor. In addition, open source providers can leverage emerging technologies like AI and ML to provide intelligent, automated support and troubleshooting that enhances the customer experience and reduces the need for human intervention.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a significant impact on the open source services market. With the shift to remote work and digital operations, businesses across all industries have increasingly relied on technology to maintain productivity and stay connected. This has led to a surge in demand for open source services as companies seek flexible and cost-effective solutions that can be easily integrated into existing systems.

Moreover, the open source community has played a critical role in the pandemic response, with developers around the world contributing to the development of tools and solutions to address the unique challenges of the pandemic. This has raised the profile of open source services, as businesses have come to appreciate the value of collaborative and community-driven software development.

Services Insights

The integration & deployment segment dominated the market in 2022 and accounted for a revenue share of above 31.0%. Organizations are increasingly adopting open source software solutions for their business needs, which has led to a surge in demand for experts who can help integrate and deploy these solutions. Moreover, open source technologies are highly modular and can be customized to suit specific business needs.

This requires expertise in integration and deployment as organizations seek to integrate these solutions into their existing IT infrastructure seamlessly. Furthermore, the integration and deployment of open source solutions can be complex, and organizations are seeking to work with experts who can guide them through the process and ensure the successful implementation of these solutions.

The managed services segment is anticipated to register significant growth over the forecast period. As more organizations adopt open source technologies, they require specialized skills and expertise to manage and maintain these solutions. Managed services providers (MSPs) offer a range of services, including monitoring, maintenance, and troubleshooting, which can help organizations reduce their IT costs and increase their operational efficiency.

The managed services segment is also growing due to the increasing complexity of IT environments, which has led to a shortage of skilled IT professionals. By partnering with MSPs, organizations can access a team of experienced professionals who can manage their IT infrastructure effectively and efficiently, allowing them to focus on their core business activities.

Deployment Insights

The hybrid segment dominated the market in 2022 and accounted for a revenue share of more than 39.0%. Many organizations have unique IT requirements and operate in complex environments that require a combination of on-premises and cloud-based solutions.

The hybrid deployment model offers the flexibility to leverage the benefits of both environments while minimizing the potential drawbacks. Moreover, open source solutions are highly modular and can be customized to fit specific business needs. The hybrid deployment model allows organizations to leverage these benefits while maintaining the ability to scale and add new capabilities as needed.

The cloud segment is anticipated to register significant growth over the forecast period. Cloud deployment provides numerous benefits, such as scalability, agility, and reduced IT infrastructure costs, making it an attractive option for organizations of all sizes. Open source solutions are well-suited for cloud deployment, as they are highly modular and can be easily integrated into cloud environments.

Moreover, open source technologies are often developed with the cloud in mind, providing organizations with access to a wide range of cloud-native tools and services. Cloud deployment also allows organizations to leverage advanced analytics and machine learning capabilities, which are increasingly becoming critical components of modern business operations.

Application Insights

The IT & ITeS segment dominated the market in 2022 and accounted for a revenue share of more than 25.0%. The IT & ITeS industry is a key driver of innovation and is at the forefront of digital transformation. Open source technologies are flexible and customizable, making them an ideal fit for IT & ITeS applications. Moreover, open source solutions are often developed by communities, making them highly collaborative and transparent. This allows organizations to leverage the expertise of a vast network of developers and users to develop innovative solutions and address complex business challenges.

The BFSI segment is anticipated to register significant growth over the forecast period. The BFSI industry is highly regulated and requires robust, secure, and scalable technology solutions to manage large volumes of sensitive data. Open source solutions offer a transparent and collaborative approach to security, which allows organizations to identify and remediate vulnerabilities quickly. Moreover, open source solutions can be easily integrated with existing IT infrastructure, enabling BFSI organizations to modernize their technology stack without disrupting their operations.

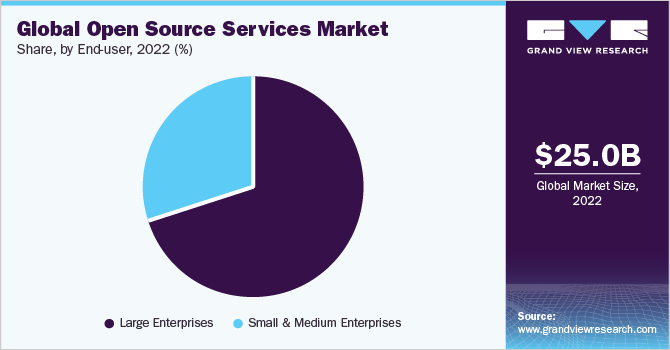

End-user Insights

The large enterprises segment dominated the market in 2022 and accounted for a revenue share of more than 69.0%. Large enterprises have dominated the end-user segment owing to their ability to invest heavily in research and development, which allows them to leverage cutting-edge open source technologies and drive innovation within the market.

Large enterprises also have the resources to build and maintain internal teams of open source experts, which enables them to optimize their use of open source solutions and contribute to the community. In addition, large enterprises often have global operations and require solutions that can be easily scaled and localized to meet the needs of different regions and markets. Open source solutions provide the flexibility and customization required to address these challenges, making them an attractive option for large enterprises.

The Small & Medium Enterprises (SMEs) segment is anticipated to register the fastest growth over the forecast period. Open source solutions offer cost savings and reduce vendor lock-in, which is critical for SMEs with limited IT budgets and resources. Open source solutions often have lower upfront costs and provide greater flexibility to SMEs to optimize their IT spending. SMEs can leverage open source solutions to develop and implement innovative solutions quickly without being limited by the constraints of proprietary software.

Regional Insights

North America dominated the open source services industry in 2022 and accounted for a revenue share of more than 26.0%. The region has a strong culture of collaboration and innovation, which has helped to foster the growth of open source communities and networks of expertise.

Moreover, the region has a highly skilled and educated workforce, which has helped to drive the development and adoption of open source solutions across a wide range of industries. Furthermore, the region has well-established regulations and standards for data privacy and security, making it an attractive market for companies looking for secure and transparent open source solutions.

The Asia Pacific regional market is expected to emerge as the fastest-growing market over the forecast period. The region has a large and rapidly expanding technology market, with many companies and organizations looking for cost-effective and customizable solutions to meet their IT needs.

Open source solutions offer an attractive option for these companies, as they provide flexibility and scalability, as well as cost savings compared to proprietary software. The region has a large and growing pool of startups and entrepreneurs who are increasingly turning to open source solutions to drive innovation and growth.

Key Companies & Market Share Insights

Market players are adopting various strategies to gain a competitive advantage and drive growth. Many companies are partnering with other organizations to combine complementary open source technologies and services or acquiring smaller firms to gain access to their expertise and customer base. This approach allows companies to quickly expand their capabilities and reach and to offer more comprehensive solutions to their customers. Moreover, the companies are also investing in R&D to innovate and differentiate their offerings.

In May 2021, Databricks, a company specializing in Data and AI, introduced its latest open-source project, known as Delta Sharing. The tool has been designed to enable data sharing with any SaaS product or cloud infrastructure in a vendor-neutral manner. Delta Sharing is part of the larger Databricks open-source Delta Lake project. Some prominent players in the global open source services market include:

-

Red Hat, Inc. (IBM)

-

MuleSoft (Salesforce, Inc.)

-

Amazon Web Services, Inc. (Amazon)

-

Databricks

-

HashiCorp

-

Alphabet, Inc. (Google)

-

Cisco

-

Microsoft

-

Oracle

-

SAP SE

Open Source Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 28.09 billion

Revenue forecast in 2030

USD 83.87 billion

Growth rate

CAGR of 16.9% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Services, deployment, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Red Hat, Inc. (IBM),; MuleSoft (Salesforce, Inc.); Amazon Web Services, Inc. (Amazon); Databricks; HashiCorp; Alphabet, Inc. (Google); Cisco; Microsoft; Oracle; SAP SE

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Open Source Services Market Report Segementation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global open source services market report based on services, deployment, application, end-user, and region.

-

Services Outlook (Revenue, USD Million, 2017 - 2030)

-

Integration & Deployment

-

Training & Consulting

-

Managed Services

-

Support & Maintenance

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

Hybrid

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

IT & ITeS

-

Telecommunication & Media

-

Industrial

-

Retail & E-commerce

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global open source services market size was estimated at USD 25.03 billion in 2022 and is expected to reach USD 28.09 billion in 2023.

b. The global open source services market is expected to grow at a compound annual growth rate of 16.9% from 2023 to 2030 to reach USD 83.87 billion by 2030.

b. North America dominated the open source services market with a share of 26.96% in 2022. The region has a strong culture of collaboration and innovation, which has helped to foster the growth of open source communities and networks of expertise.

b. Some key players operating in the open source services market include Red Hat, Inc. (IBM), MuleSoft (Salesforce, Inc.); Amazon Web Services, Inc. (Amazon); Databricks, HashiCorp; Alphabet, Inc. (Google); Cisco; Microsoft; Oracle; SAP SE.

b. Key factors that are driving the market growth include digital transformation across industries and easy availability of open source libraries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.