- Home

- »

- Healthcare IT

- »

-

Operating Room Management Software Market Report, 2033GVR Report cover

![Operating Room Management Software Market Size, Share & Trends Report]()

Operating Room Management Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Anesthesia Information Management, Data Management & Communication), By Deployment, By End Use, By Region, And Segment Forecast

- Report ID: GVR-4-68040-152-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Operating Room Management Software Market Summary

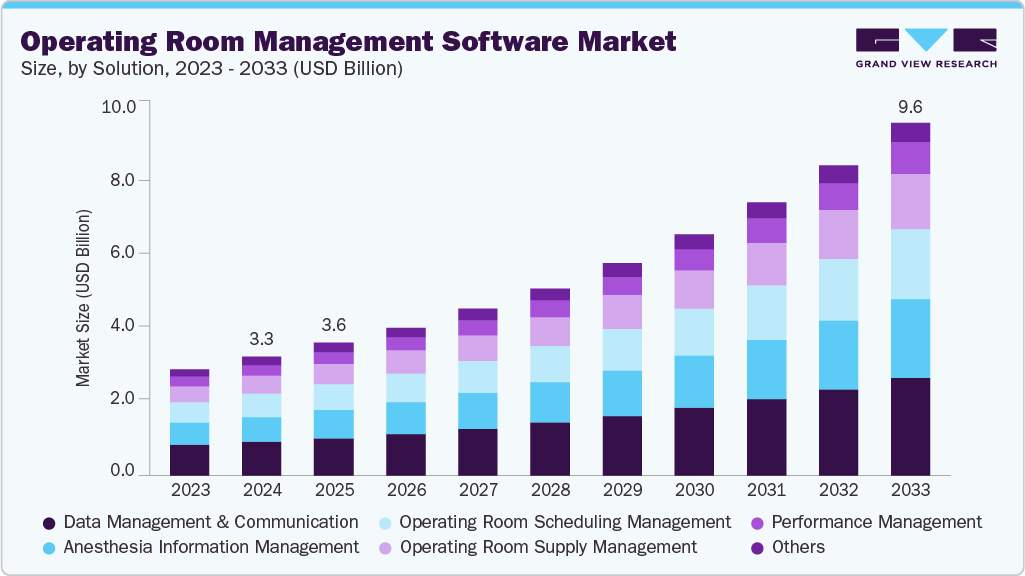

The global operating room management software market size was estimated at USD 3.25 billion in 2024 and is projected to reach USD 9.64 billion by 2033, growing at a CAGR of 13.01% from 2025 to 2033. This market growth is attributed to rising adoption of electronic health records, a surge in surgical procedures, a growing focus on cost reduction and efficiency enhancements in hospitals and ambulatory surgery centers (ASCs), and advancements in technology for managing operating rooms.

Key Market Trends & Insights

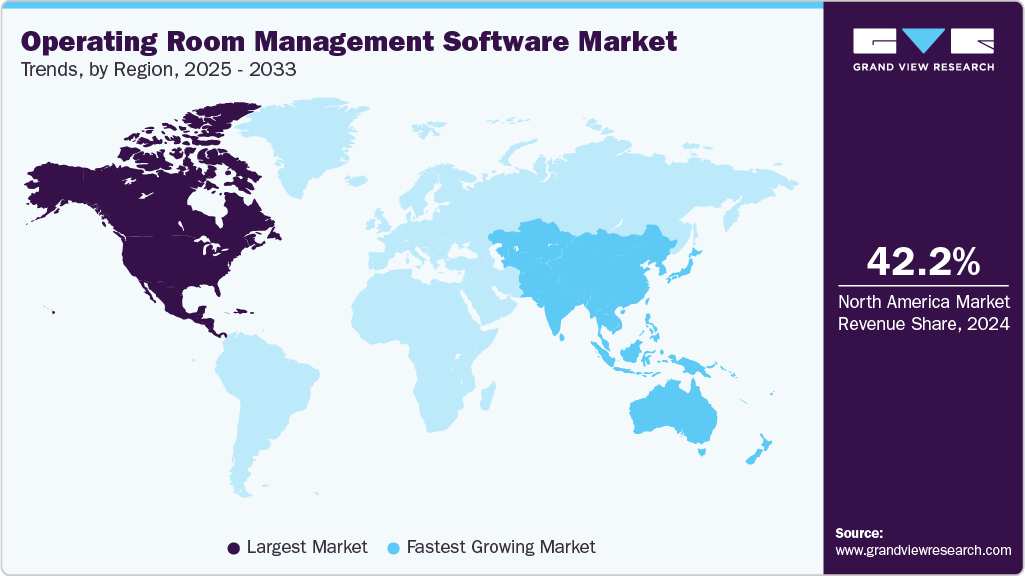

- North America operating room management software market held the largest share of 42.18% of the global market in 2024.

- The operating room management software industry in the U.S. is expected to grow significantly over the forecast period.

- By solution, the data management & communication segment held the highest market share of 28.31% in 2024.

- Based on deployment, the Cloud & Web Based segment held the highest market share of 87.15% in 2024.

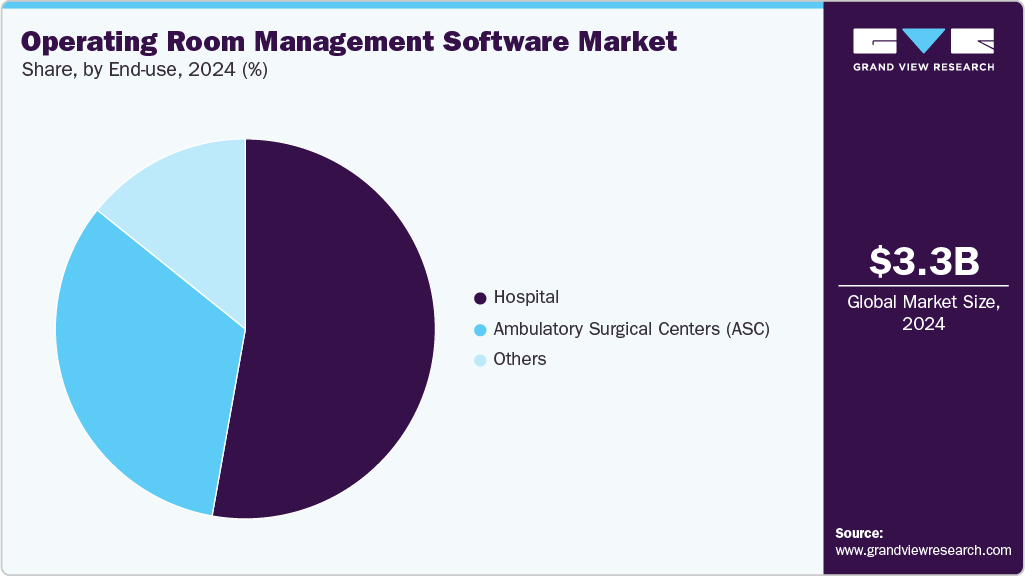

- By end use, the hospitals segment held the highest market share of 52.80% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.25 Billion

- 2033 Projected Market Size: USD 9.64 Billion

- CAGR (2025-2033): 13.01%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

The market is poised for remarkable growth. With the healthcare sector increasingly embracing digital transformation, these software solutions are becoming essential. They optimize surgical scheduling, resource allocation, and patient data management, enhancing efficiency and patient care quality. As the global healthcare industry expands and evolves, the demand for such software is expected to increase. In addition, advancements in artificial intelligence and data analytics are expected further to drive the market growth over the forecast period.Moreover, the increasing prevalence of chronic diseases worldwide is a significant reason for the growing need for operating rooms. Severe chronic illnesses often require surgery. For instance, according to an article by the WHO in September 2023, more than 300 million surgical procedures are performed worldwide yearly. This rise in surgical procedures is anticipated to boost the demand for operating room management software, ultimately driving market expansion.

Furthermore, rising investments in developing operating room management software are expected to drive market growth over the forecast period by launching innovative products. For instance, in October 2023, U.S.-based Avail Medsystems introduced a new capability to host third-party clinical software applications in operating rooms as part of broader platform enhancements to improve surgical collaboration, workflow efficiency, and access to clinical intelligence.

Technological advancements in operating room management software are driving market growth. For instance, Electronic Health Records (EHR) improve data accuracy, streamline clinical workflows, and facilitate real-time access to patient information during surgeries. As healthcare providers increasingly invest in cutting-edge solutions to improve patient outcomes and workflow efficiency, the solution providers are seizing the opportunity to provide cutting-edge technology and gain the highest possible market share. For instance, in September 2024, Oracle launched new Electronic Health Record (EHR) innovations in the U.S., aiming to improve patient care, streamline clinical workflows, and improve health data management through advanced automation, integrated analytics, and user-friendly digital interfaces.

The COVID-19 pandemic has had a significant impact on the market. The initial phase of the pandemic saw a decrease in the number of surgeries due to lockdowns and suspensions of medical procedures, which negatively affected market growth. This had a negative effect on market growth. According to a study published in the British Journal of Surgery, COVID-19 resulted in the postponement or cancellation of 28 million surgeries worldwide in 2020, with many of these surgeries being rescheduled for 2021. This delay in surgeries has created a greater need to improve scheduling efficiency. As a result, companies in the market have introduced various technologies to meet the growing demand. For instance, in June 2021, Getinge announced the release of the "Torin" AI-based operating room management system in the U.S. This technology aims to address the challenges posed by the pandemic and improve the management of operating rooms.

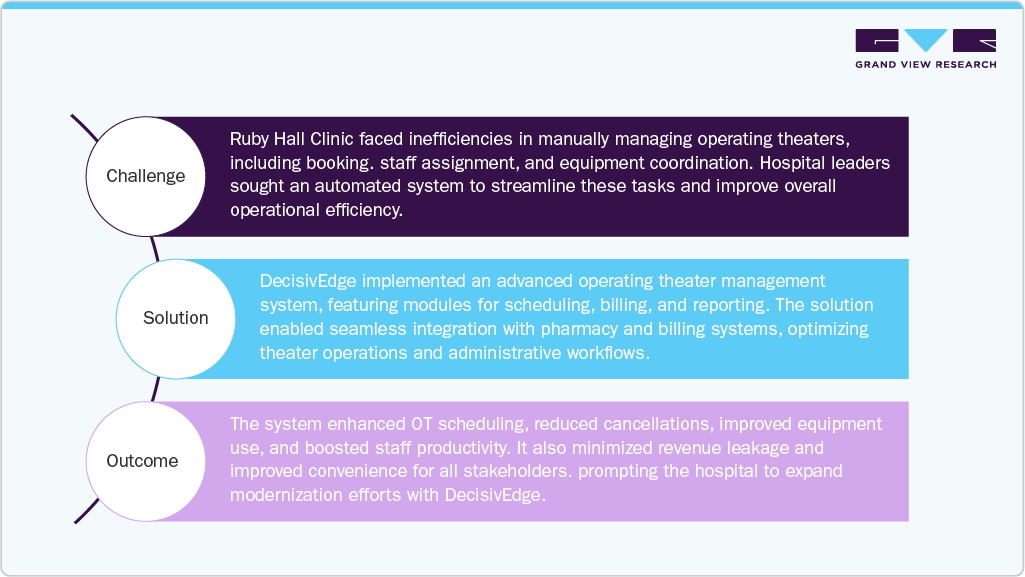

Case Study: Ruby Hall Clinic Transforms Operating Theater Management with DecisivEdge’s Automated Solution.

Introduction: Efficient operating theater management is critical to hospital performance and patient care. To address the challenges, Ruby Hall Clinic partnered with DecisivEdge to overcome manual operational challenges through a modern, automated theater management system.

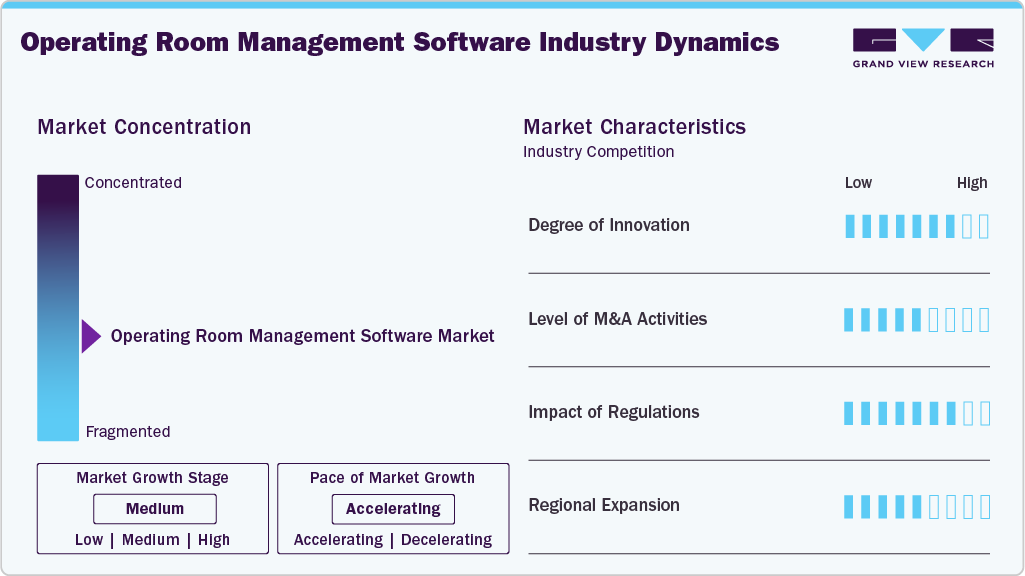

Market Concentration & Characteristics

The degree of innovation in the operating room management software industry is high, driven by advancements in artificial intelligence, machine learning, and data analytics. Software developers are introducing real-time surgical dashboards, predictive scheduling, and integrated communication tools to streamline OR workflows. Customizable platforms with improved interoperability are also gaining traction, enabling seamless data exchange with EHR systems and surgical equipment.

The industry's level of mergers and acquisitions (M&A) is moderate, as key players aim to expand their product portfolios, acquire innovative technologies, and strengthen their market presence. Strategic collaborations between healthcare IT firms and surgical solution providers are common, allowing for integrated offerings that cater to growing hospital needs. These M&A activities drive technological synchronicity and help companies scale rapidly in response to the rising demand for advanced OR management systems across global healthcare facilities.

The impact of regulations on the operating room management software industry is high. Companies and service providers need to meet regulatory standards with HIPAA in the U.S. and GDPR in Europe. Data protection laws are essential for patient privacy and secure data handling. In addition, software systems must adhere to medical device and clinical software certification protocols, including FDA and CE approvals.

Regional expansion in the industry is moderate. While North America leads in adoption due to advanced healthcare infrastructure and favorable reimbursement models, the Asia Pacific is emerging as a high-growth region. Increasing investments in hospital digitization, rising surgical volumes, and government initiatives to modernize healthcare systems encourage vendors to enter new markets. Localization strategies, partnerships with regional health providers, and tailored solutions are central to expanding global market reach.

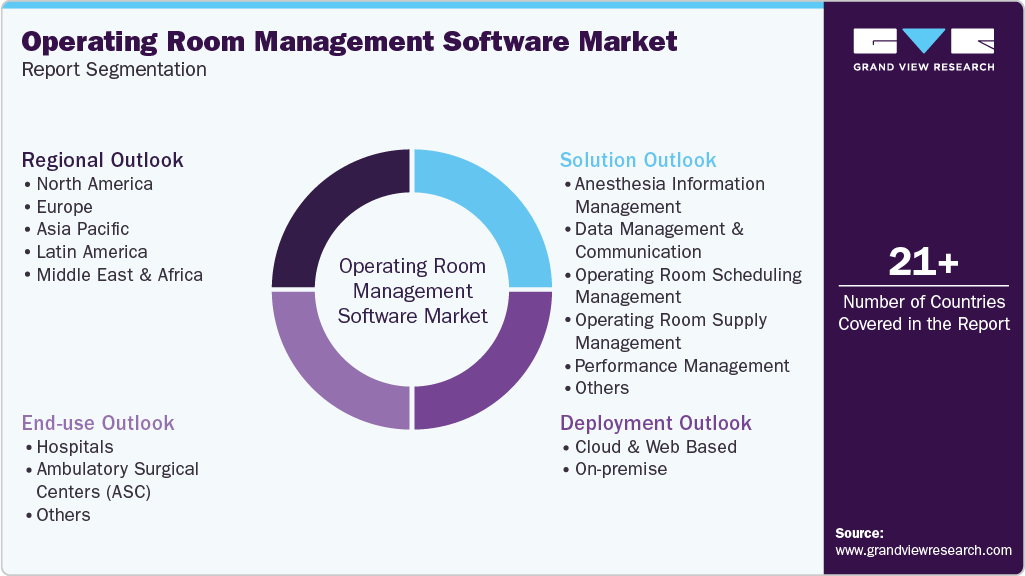

Solution Insights

Based on the solution, data management and communication solutions held the largest revenue share of 28.31 % in 2024. These solutions enable efficient data sharing, smooth communication, and effective collaboration among surgical teams. They establish a central storage system for patient information, allowing medical professionals to access essential data in real-time. Moreover, these solutions make it easy to share patient status updates across various stages of perioperative care, assist in ensuring schedule compliance, and streamline the exchange of media and case-related information among different operating rooms and hospital departments.

Anesthesia information management is anticipated to grow at the fastest CAGR over the forecast period. This growth is driven by the increasing demand for accurate, real-time documentation of anesthesia records, improved patient safety, and enhanced clinical decision-making. For instance, in June 2024, AI-powered anesthesia monitoring systems were launched in India to improve surgical safety and precision and overcome the limitations of traditional anesthesia monitoring methods. These advanced systems enabled real-time patient monitoring and decision support, representing a significant step forward in medical technology adoption.

Deployment Insights

Based on the deployment mode, the market is segmented into cloud & web-based and on-premise. The cloud & web-based segment has dominated the global market with a revenue share of 87.15% in 2024 and is projected to grow at the fastest CAGR during the forecast period. The growth is attributed to the increasing adoption of cloud solutions in clinics to improve efficacy and reduce costs. Cloud solutions offer scalability, allowing healthcare organizations to adjust or expand their software usage as required. This flexibility helps them efficiently manage growing hospital needs and serve a larger patient population without substantial infrastructure investments. In addition, the cloud provides benefits like real-time data sharing, secure data handling, flexible storage options, and reliable performance. As a result, these factors drive the increasing adoption and demand for cloud-based operating room management software, enabling healthcare organizations to streamline their operations, improve patient care, and optimize resource utilization.

The on-premise segment is expected to grow substantially during the forecast period. The availability of new on-premises software provides healthcare organizations with enhanced offline access, adherence to compliance requirements, customization capabilities, and greater control over their data. It also gives organizations more control over system upgrades, long-term cost management, and the flexibility to integrate with existing systems. These factors drive the healthcare sector's demand for and adoption of on-premises software.

End Use Insights

Based on end use, the global market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment accounted for the largest revenue share of 52.80 % in 2024 due to the growing number of surgical procedures. According to the American Cancer Society, there were over 2 million new cancer cases and 611,720 cancer-related deaths in 2024 in the U.S. alone. These conditions often require surgical intervention, contributing to increased demand for efficient operating room management solutions. In addition, hospitals are rapidly adopting advanced software to streamline workflows and improve patient safety during complex procedures.

The ambulatory surgical centers segment is anticipated to grow at the fastest CAGR over the forecast period. This is attributable to the shift from inpatient to outpatient surgical procedures, driven by advancements in minimally invasive techniques, reduced healthcare costs, and shorter recovery times. In addition, ASCs increasingly adopt digital tools to optimize scheduling, resource allocation, and patient throughput.

Regional Insights

North America dominated the market, with a revenue share of over 42.18% in 2024. This can be attributed to the rapid adoption of technologically developed products. Regional growth is driven by factors such as the well-established infrastructure, the growing adoption of operating room management software, and major market players in the region.

U.S. Operating Room Management Software Market Trends

The operating room management software market in the U.S. is poised for growth due to key industry players' innovative strategies. For instance, in July 2021, Hillrom introduced the Helion Integrated Surgical System to the U.S. market to advance connected care within operating rooms (ORs). The Helion System enhances connectivity, flexibility, and communication among surgical teams in the OR, ultimately improving patient outcomes. These product launches are expected to increase operating room management software adoption, thus driving regional market growth.

Europe Operating Room Management Software Market Trends

The operating room management software market in Europe is growing due to the rising focus on patient safety, operational efficiency, and healthcare cost containment. Countries are investing in modernizing surgical departments and adopting digital operating room systems. Favorable regulatory standards and funding initiatives across EU nations support implementing OR management software, particularly in public hospitals, enhancing workflow coordination and clinical outcomes across the region.

The UK operating room management software market is showing significant growth over the forecast period. It is getting a boost from the National Health Service’s (NHS) digital transformation goals, which emphasize surgical efficiency, patient safety, and reduced wait times. With the increasing adoption of minimally invasive surgeries and structured clinical protocols, hospitals are investing in OR software to streamline processes and maximize resource use. Government funding and collaborations with tech firms accelerate digital adoption in surgical environments.

Asia Pacific Operating Room Management Software Market Trends

The operating room management software market in the Asia Pacific is anticipated to experience significant growth in the forecast period. This growth can be attributed to several factors, including a high prevalence of chronic diseases, a large patient population, and the increasing number of hospitals and healthcare facilities with expanding infrastructure in the region. In addition, many governments in the Asia Pacific region are making significant investments in cloud and related healthcare technologies to facilitate digital transformation, which has the potential to drive market growth. For instance, in August 2021, the government of Delhi announced a USD 19 million project to establish a cloud-based hospital information management system, a move that was expected further to support the healthcare technology market in the region.

China operating room management software market growth is fueled by healthcare modernization, rising surgical demand, and government focus on digital health. The country’s large population and aging demographic drive surgical volumes, prompting hospitals to invest in efficient OR management systems. Domestic and international vendors are actively expanding in China, offering AI-enabled, localized software platforms tailored to Chinese hospitals' regulatory and workflow needs.

Latin America Operating Room Management Software Market Trends

The operating room management software market in Latin America is growing significantly over the forecast period, driven by gradual healthcare infrastructure upgrades and an increasing focus on surgical care efficiency. Public-private partnerships and pilot implementations are helping introduce OR software in the region. Countries like Mexico and Argentina are increasingly exploring web and cloud-based systems to overcome cost and integration challenges.

Brazil operating room management software market is growing due to its expanding private hospital sector and increasing number of surgical procedures. Adopting health IT solutions is gaining traction, particularly among urban healthcare providers focused on improving operational performance and patient care quality. Government initiatives for healthcare modernization and rising investments in health tech startups contribute to the country's growing OR software adoption.

Middle East & Africa Operating Room Management Software Market Trends

The operating room management software market in the Middle East and Africa region is witnessing significant growth over the forecast period, led by rising healthcare investments in Gulf countries and ongoing hospital expansions. Governments in the region are focusing on digital health infrastructure to manage increasing patient loads and surgical cases. Moreover, partnerships with global vendors are gradually improving access to advanced OR technologies across the Middle East and Africa.

South Africa operating room management software market dominated the Middle East and Africa region in 2024 due to increasing demand for surgical care, growing private healthcare investments, and the modernization of hospital IT systems. Urban medical centers are more likely to adopt OR management software to address workflow inefficiencies and improve surgical scheduling. However, public sector adoption remains limited due to resource constraints, creating opportunities for low-cost, scalable digital solutions in the future.

Key Operating Room Management Software Company Insights

The market is competitive owing to the presence of systems providers. The market players are adopting various strategies, such as partnerships, new product launches, and regional expansion, to gain higher market shares. For instance, in September 2023, Fujitsu and Baptist Health South Florida announced the launch of an innovative solution to transform operating room scheduling. The primary objectives of this newly launched solution are to boost utilization rates and improve the financial health of the surgical discipline. Such improvements in operating room scheduling can have significant benefits, including reducing wait times for patients, maximizing the utilization of costly surgical facilities, and potentially lowering healthcare costs.

Key Operating Room Management Software Companies:

The following are the leading companies in the operating room management software market. These companies collectively hold the largest market share and dictate industry trends.

- Surgical Information Systems

- Veradigm LLC (Allscripts Healthcare Solutions, Inc)

- Picis Clinical Solutions, Inc., a division of N. Harris Computer Corporation.

- GE Healthcare

- Koninklijke Philips N.V.

- BD

- Oracle Corporation

- PerfectServe, Inc.

- Getinge

- Max Systems Inc.

Recent Developments

-

In November 2024, the US-based North American Partners in Anesthesia launched NAPA Managed Services, a comprehensive suite developed to meet essential operating room (OR) operational needs for health systems.

-

In October 2022, OMNIMED introduced SmartOR, a modular, AI-driven platform for hospital operating rooms. The system captured and analyzed millions of intraoperative data points, such as pose, sterile zones, and heat mapping, to enhance workflow efficiency and patient safety

Operating Room Management Software Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 3.62 billion

The revenue forecast in 2033

USD 9.64 billion

Growth rate

CAGR of 13.01% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, end use, region

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Surgical Information Systems; Veradigm LLC (Allscripts Healthcare Solutions, Inc); Picis Clinical Solutions, Inc., a division of N. Harris Computer Corporation; GE Healthcare; Koninklijke Philips N.V.; BD; Oracle Corporation; PerfectServe, Inc.; Getinge; Max Systems Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Operating Room Management Software Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global operating room management software market based on solution, deployment, end use, and region:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Anesthesia Information Management

-

Data Management & Communication

-

Operating Room Scheduling Management

-

Operating Room Supply Management

-

Performance Management

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud & Web Based

-

On-premise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASC)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global operating room management software market size was estimated at USD 3.25 billion in 2024 and is expected to reach USD 3.62 billion in 2025.

b. The global operating room management software market is expected to grow at a compound annual growth rate of 13.01% from 2025 to 2033 to reach USD 9.64 billion by 2033.

b. North America dominated the operating room management software market with a share of over 42% in 2024. This is attributed to the well-established infrastructure, the growing adoption of operating room management software, and the presence of major market players in the region.

b. Some key players operating in the operating room management software market include Surgical Information Systems; Veradigm LLC (Allscripts Healthcare Solutions, Inc); Picis Clinical Solutions, Inc., a division of N. Harris Computer Corporation; GE Healthcare; Koninklijke Philips N.V.; BD; Oracle Corporation; PerfectServe, Inc.; Getinge; and Max Systems Inc.

b. Key factors that are driving the operating room management software market growth include rising adoption of electronic health records, a surge in surgical procedures, a growing focus on cost reduction and efficiency enhancements in hospitals and ambulatory surgery centers (ASCs), and advancements in technology related to managing operating rooms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.