- Home

- »

- Next Generation Technologies

- »

-

Operational Technology Security Market Size Report, 2030GVR Report cover

![Operational Technology Security Market Size, Share & Trends Report]()

Operational Technology Security Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-Premises), By Enterprise Size, By Vertical, By Region And Segment Forecasts

- Report ID: GVR-4-68040-119-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Operational Technology Security Market Summary

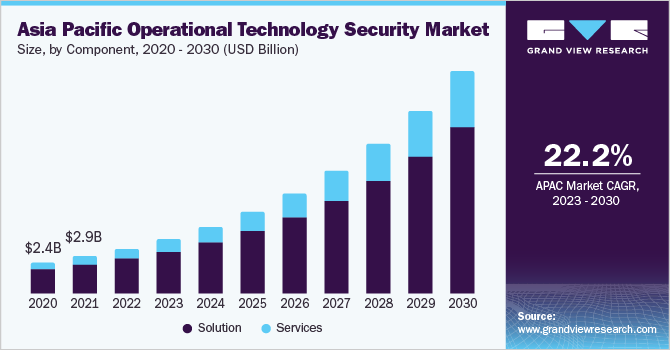

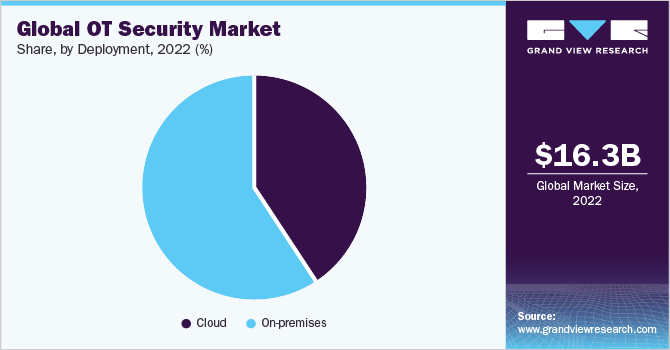

The global operational technology security market size was estimated at USD 16.32 billion in 2022 and is projected to reach USD 61.50 billion by 2030, growing at a CAGR of 18.2% from 2023 to 2030. This growth is driven by the expanding connectivity and digitization of industrial control systems (ICS) used in critical infrastructure like power grids and manufacturing plants.

Key Market Trends & Insights

- North America dominated the market in 2022, accounting for over 41% share of the global revenue.

- By component, the solutions segment led the market in 2022, accounting for over 76% share of the global revenue.

- By deployment, the on-premises segment held the largest revenue share of over 58% in 2022.

- By enterprise size, the large enterprises segment dominated the market in 2022 and accounted for a revenue share of over 72%.

- By vertical, the oil & gas operations segment led the market in 2022, accounting for over 21% of global revenue.

Market Size & Forecast

- 2022 Market Size: USD 16.32 Billion

- 2030 Projected Market Size: USD 61.50 Billion

- CAGR (2023-2030): 18.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

This increased connectivity heightens vulnerability to cyberattacks. Organizations increasingly recognize these risks and invest in protective solutions, while stringent government regulations propel demand for compliant security measures. Introducing technologies such as cloud computing, artificial intelligence, and the Internet of Things (IoT) poses new security challenges to OT systems. For instance, in April 2023, Trustwave Holdings, Inc. introduced its operational technology (OT) security maturity diagnostic offering, designed to assess and advise organizations on their OT security status. This offering utilizes the NIST cybersecurity framework and the IEC 62443 standards, evaluating OT security across people, processes, and technology. The assessment encompasses key areas such as security training, asset management, access control, network security, vulnerability management, and incident response.The OT security market is experiencing swift expansion due to factors such as the growing convergence of IT and OT networks, which amplifies the vulnerability of OT systems to cyberattacks. Adopting cloud computing and mobile devices within OT environments introduces new security risks. The rising complexity of cyber attackers has resulted in more frequent and effective targeting of OT systems. The primary goals of OT security include protecting critical infrastructure from cyber threats, upholding the safety and reliability of industrial operations, and ensuring compliance with regulatory requirements.

The growth of the operational technology (OT) security market is propelled by integrating government initiatives into security standards and the increasing adoption of cloud-based OT security solutions. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness compared to traditional on-premises alternatives. They also ensure easier updates to counter evolving threats. Moreover, governments worldwide emphasize OT security through guidelines and recommendations by the US's CISA (Cybersecurity & Infrastructure Security Agency). These initiatives raise awareness and foster demand for effective OT security solutions safeguarding critical infrastructure.

The surge in government investments in operational technology security drives the market's growth. The connection of OT systems to the internet has heightened their vulnerability to operational technology attacks. Governments are addressing this risk by allocating resources to OT security technologies, establishing regulatory frameworks, and delivering training and support to organizations that manage OT systems. This proactive approach aims to safeguard these vital systems from potential threats. For instance, in February 2023, the Technology Modernization Fund (TMF), a government initiative that allocates funds to federal agencies to upgrade their technology systems, announced that it raised around USD 650 million to enhance cybersecurity and digital services through various projects. This funding is designed to bolster agencies' cybersecurity measures, reduce their dependence on outdated systems, and enhance service delivery.

Component Insights

The solutions segment led the market in 2022, accounting for over 76% share of the global revenue. The high share can be attributed to organizations' growing inclination towards adopting OT security solutions to safeguard their critical infrastructure against cyberattacks. The market is primarily characterized by two main types of OT security solutions, namely integrated platform and standalone. Integrated platform solutions encompass a comprehensive suite of OT security products and services designed to work seamlessly together, providing a unified and comprehensive approach to addressing OT security challenges. In contrast, standalone solutions entail individual OT security products or services that can be procured and implemented separately, often proving cost-effective for organizations seeking specific security solutions.

The services segment is predicted to foresee significant growth in the forecast years. The growth can be attributed to organizations outsourcing their OT security needs to third-party providers. OT security services comprise monitoring, incident detection and response, and training and consulting services. Monitoring, incident detection, and response aids organizations in threat monitoring and incident handling. Training and consulting services also play a crucial role by educating organizational personnel about optimal OT security practices and assisting in successfully deploying efficient OT security solutions.

Deployment Insights

The on-premises segment held the largest revenue share of over 58% in 2022. The high share can be attributed to organizations prioritizing the on-premises approach to maintain absolute control over their OT security solutions. Concerns about security and privacy further drive this preference, as on-premises solutions mitigate potential risks associated with cloud-based alternatives. The demand for optimal performance and the continuous availability of OT security solutions contribute to the segment's growth.

The cloud segment will witness significant growth in the coming years. The surge in demand for heightened security measures for OT systems due to the increase in cyberattacks propels the momentum toward cloud-based OT security solutions. These solutions safeguard such critical systems from malicious intrusions. Furthermore, the availability of a diverse array of cloud-based OT security solutions streamlines the adoption process for organizations, augmenting the attractiveness of cloud-based options.

Enterprise Size Insights

The large enterprises segment dominated the market in 2022 and accounted for a revenue share of over 72%. The high share can be attributed to the complex and crucial nature of their operational technology (OT) landscapes, which attract cyber threats. These enterprises possess interconnected OT systems that enable attackers to move laterally within networks with ease. Additionally, their numerous remote access points provide fertile ground for exploitation. The drive for cyber attackers is heightened by high-value proprietary data and intellectual property within these organizations. Moreover, the consequences of a data breach for large enterprises were more substantial, encompassing financial implications and disruptions in operations. Thus, these enterprises invested considerably in OT security to safeguard against such risks.

The SMEs segment is anticipated to grow significantly in the coming years. There are numerous small and medium-sized businesses in nearly every country. SMEs prefer the more affordable option due to their limited financial resources. These organizations are increasingly seen as attractive targets, so their vulnerability contributes to the rising threat landscape. Thus, due to this vulnerability, SMEs are expected to invest substantially in enhancing their OT security infrastructure. Despite SMEs' limited financial resources, the market is expected to expand due to the increasing scalability of OT security solutions, widespread accessibility, and cloud-based deployments.

Vertical Insights

The oil & gas operations segment led the market in 2022, accounting for over 21% of global revenue. The segment's growth is attributed to the crucial role of OT security in managing oil & gas operations, which have become a central focus of cyber threats. These systems oversee and regulate core processes such as drilling, refining, and transportation, often interconnected with the internet, rendering them susceptible to cyber-attacks. Further, the surge in internet-connected OT systems, the advancing complexity of cyber threats, compliance mandates, and increased recognition of the significance of OT security have led to the segment's growth in the market.

The manufacturing segment is expected to show significant growth over the forecast period. The segment's surge can be attributed to the rising integration of OT systems and devices into networks, accentuating their vulnerability to cyberattacks. The manufacturing industry's role as an essential infrastructure potential cyber incident could profoundly disrupt production and supply chains. The sector's increasing adoption of digital technologies such as cloud computing and big data analytics further enhances the vulnerability to cyber threats. Additionally, imposing more stringent regulatory requirements compels manufacturers to allocate resources toward bolstering OT security to ensure compliance.

Regional Insights

North America dominated the market in 2022, accounting for over 41% share of the global revenue. The region's growth can be attributed to the critical infrastructure, advanced industrial sectors, and the heightened demand for robust security measures. Moreover, North America's strict regulatory frameworks, exemplified by the North American Electric Reliability Corporation (NERC) Critical Infrastructure Protection (CIP) standards, mandate the implementation of comprehensive OT security protocols. These regulations have played a pivotal role in fostering an awareness of the significance of OT security across the North America region.

Asia Pacific is likely to possess lucrative market opportunities in the coming years. The region is home to some of the world's fastest-growing economies, including China, India, and Indonesia, actively channeling investments into automation and digitization. This drive fuels the adoption of OT solutions, which are pivotal for overseeing critical infrastructure such as power plants, water treatment facilities, and transportation systems. As the need for OT solutions increases, the demand for OT security also increases. Furthermore, growing awareness of OT security risks is compelling organizations throughout the Asia Pacific to invest in solutions to safeguard their critical infrastructure against potential cyber-attacks.

Key Companies & Market Share Insights

Well-established and emerging players have exhibited traction for inorganic and organic strategies to tap into the global markets. In doing so, industry players are poised to focus on partnerships, mergers & acquisitions, geographical expansion, innovation, technological advancements, and product offerings. For instance, in June 2023, L&T Technology Services Limited partnered with Palo Alto Networks as a managed security service provider (MSSP) partner for OT Security offerings. This partnership aims at L&T Technology Services Limited, extending security services to end customers in industrial sectors. By leveraging L&T Technology Services Limited's engineering, operations, and security proficiency with Palo Alto Networks' OT security solutions, the partnership aims to aid customers in safeguarding their vital infrastructure from cyberattacks. Some of the prominent players in the global operational technology (OT) security market include:

-

Broadcom

-

Cisco Systems, Inc

-

CyberArk Software Ltd.

-

Darktrace Holdings Limited.

-

Fortinet, Inc.

-

Forcepoint

-

Nozomi Networks Inc.

-

Qualys, Inc.

-

Sophos Ltd.

-

Zscaler, Inc.

Operational Technology Security Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.10 billion

Revenue forecast in 2030

USD 61.50 billion

Growth Rate

CAGR of 18.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Broadcom; Cisco Systems, Inc; CyberArk Software Ltd.; Darktrace Holdings Limited; Fortinet, Inc.; Forcepoint; Nozomi Networks Inc; Qualys, Inc.; Sophos Ltd; Zscaler, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Operational Technology Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global operational technology (OT) security market report based on component, deployment, enterprise size, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing

-

Transportation & Logistics

-

Energy & Utilities

-

Oil & Gas Operations

-

Government

-

Healthcare & Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global operational technology security market size was estimated at USD 16.32 billion in 2022 and is expected to reach USD 19.10 billion in 2023.

b. The global operational technology security market is expected to grow at a compound annual growth rate of 18.2% from 2023 to 2030 to reach USD 61.50 billion by 2030.

b. North America dominated the market in 2022, accounting for over 41% share of the global revenue. The region's growth can be attributed to the critical infrastructure, advanced industrial sectors, and the heightened demand for robust security measures.

b. Some key players operating in the operational technology security market include Broadcom; Cisco Systems, Inc; CyberArk Software Ltd.; Darktrace Holdings Limited; Fortinet, Inc.; Forcepoint; Nozomi Networks Inc; Qualys, Inc.; Sophos Ltd; Zscaler, Inc.

b. Key factors driving the operational technology security market growth include the growing adoption of cloud-based OT security solutions and the rise in integration of government initiatives in security standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.