- Home

- »

- Medical Devices

- »

-

Ophthalmic Clinical Trials Market Size & Share Report, 2030GVR Report cover

![Ophthalmic Clinical Trials Market Size, Share & Trends Report]()

Ophthalmic Clinical Trials Market Size, Share & Trends Analysis Report By Product (Devices, Drugs), By Phase (Discovery Phase, Preclinical Phase, Clinical Phase), By Indication, By Sponsor Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-085-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

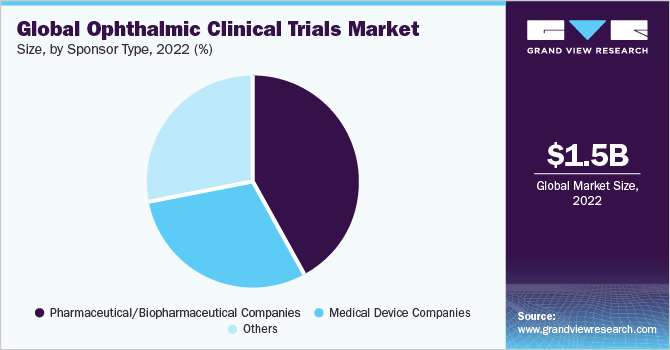

The global ophthalmic clinical trials market size was valued at USD 1.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. Increasing demand for ocular treatment therapies is one of the key factors augmenting the growth of the ophthalmic clinical trials market. Development in the field of ophthalmology is crucial for the treatment and prevention of several optic ailments, and relevant research and development activities are growing rapidly, forming valuable knowledge networks for treating complex ocular conditions.

Diseases such as macular degeneration, glaucoma, and a few other optical diseases were previously considered irreparable blindness-causing ailments. However, therapeutic advancements have been made to alleviate or cure them by using new technologies or modulating new targets. For instance, in October 2022, NGM Biopharmaceuticals, Inc. announced successful topline safety and efficacy results from its double-masked, randomized, sham-controlled Phase 2 trial of NGM621 in patients with age-related macular degeneration.

In addition, growing research funding pertaining to ocular therapeutics is another prominent factor supporting the growth of the ophthalmic clinical trials market. For instance, in November 2022, as per Healio approximately 2,102 ophthalmologists were reported to have received USD 825.4 million in industry research payments. Furthermore, the article also stated that ophthalmic industry research investments witnessed a significant surge of 203% between 2014 and 2020.

The outbreak of the COVID-19 pandemic had a damaging effect on the overall healthcare industry, and ophthalmic research was no different! However, the companies operating across the ophthalmic clinical trials market have opted for several measures, such as mergers, acquisitions, and partnerships, to mitigate the impact of the COVID-19 pandemic and thereby rebound their market presence.

In addition, several companies are focusing on building a knowledge hub to ensure smooth operations across ophthalmic research, thereby creating innovative therapeutic solutions for complex ocular conditions. For instance, in April 2023, Ocular Therapeutix presented its clinical and pre-clinical data at the 2023 Association for Research in Vision and Ophthalmology annual meeting. The symposium discussed the benefits of using the hydrogel platform and its potential to provide solutions for reducing the burden and complexity of a number of ailments in both the front and back of the eye.

Product Insights

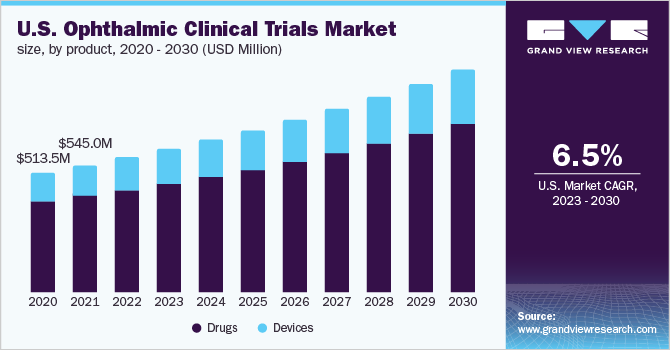

The drugs segment dominated the ophthalmic clinical trials market and accounted for the largest revenue share of 75.5% in 2022. The growing pipeline of optical therapeutics is one of the prominent factors supporting the segment’s robust revenue shares during the analysis timeframe. Furthermore, the segment is driven by the high demand for novel ophthalmic pharmaceuticals and biopharmaceuticals across the globe. For instance, in February 2023, Apellis Pharmaceuticals, Inc., announced the U.S. Food and Drug Administration (FDA) approval of SYFOVRE drug for the treatment of geographic atrophy (GA). SYFOVRE is the first and only FDA-approved treatment for GA. Such initiatives are anticipated to strongly support the development of novel drugs, including generics, thereby supporting the segment’s growth in the ophthalmic clinical trials market.

The devices segment, on the other hand, is anticipated to register a stable CAGR of 6.4% in the ophthalmic clinical trials market during the forecast period of 2023 to 2030. Considerable growth of this segment is attributed to the growing technological advancements pertaining to ocular medical devices. The incorporation of artificial intelligence in detecting and diagnosing eye conditions is one of the major technological advancements witnessed across ocular medical devices, thereby supporting its growth rate in the ophthalmic clinical trials market. For instance, in September 2022, Ora, Inc., an ophthalmology clinical research firm, announced the launch of its mobile research platform, Ora EyeCup. The platform helps transform patient data capture through artificial intelligence (AI) analysis, high-resolution imaging, and real-time patient feedback.

Indication Insights

The retinopathy segment dominated the ophthalmic clinical trials market and accounted for the largest revenue share of 27.5% in 2022. The segment is driven by increasing research and development activities across the retinopathy indication. Several companies are on the verge of developing novel treatment options for the condition, thereby boosting its pipeline and simultaneously supporting segmental growth across the ophthalmic clinical trials market. For instance, in January 2023, Ocuphire Pharma, Inc., a clinical-stage company, announced the successful topline safety and efficacy results from its Phase 2 ZETA-1 trial assessing oral APX3330 for the treatment of diabetic retinopathy. Such initiatives are anticipated to strongly support the segment’s growth in the ophthalmic clinical trials market.

The glaucoma segment, on the other hand, is anticipated to register a lucrative CAGR of 7.3% in the ophthalmic clinical trials market during the forecast period of 2023 to 2030. The high growth of this segment is attributed to the increasing pipeline of glaucoma therapeutics and the rising investment by contract researchers in the development of glaucoma drugs. For example, the glaucoma pipeline as of 2022, presented by Jobson Medical Information LLC, includes potential compounds/elements such as NCX 470, Cromakalim prodrug 1, Omidenepag isopropyl, QLS-101, GS010, and a few others for the therapeutic treatment of the condition.The aforementioned factors strongly support the growth of the glaucoma segment in the ophthalmic clinical trials market.

Phase Insights

The clinical phase segment dominated the ophthalmic clinical trials market and accounted for the largest revenue share of 79.4% in 2022. High shares of the segment are primarily due to the increasing clinical research across the ophthalmology treatment industry. The majority of the therapeutics are under observational clinical practices, thereby supporting the segment’s growth. For instance, in March 2023, Bausch + Lomb and Novaliq GmbH announced the successful phase III results on nov03 (perfluorohexyloctane) in the American Journal of Ophthalmology. In addition, in March 2023, Chengdu Shengdi Pharmaceutical Co., announced the marketing authorization approval from the Chinese National Medical Products Administration (NMPA) for its drug cyclosporine ophthalmic solution eye drops in treating dry eye disease. Hence, the presence of a robust pipeline of products under clinical phases, including phase I, to the observational commercialization phase is one of the major factors supporting the growth of the clinical phase segment in the ophthalmic clinical trials market.

The preclinical phase, on the other hand, is poised to witness a lucrative CAGR of 7.6% across the analysis timeframe. The high growth of the segment is majorly due to growing interest among researchers pertaining to the discovery and development of novel therapeutics for the treatment of ocular diseases. Hence, the increasing research and development activities have led contract research organizations (CROs) to play a significant role in the market. Several pharmaceutical and biopharmaceutical companies have outsourced their preclinical services to CROs with the aim to fast tract the drug discovery processes. For instance, in May 2020, Iris Pharma validated and developed two new experimental models in mice and rats to mimic the signs of dry eye disease. The company has a substantial number of approximately 40 animal models designed for preclinical testing in ophthalmic research. The presence of a huge number of CROs in the preclinical ophthalmic research industry is one of the considerable factors propelling the segment growth in the ophthalmic clinical trials market.

Sponsor Type Insight

The pharmaceutical/biopharmaceutical companies dominated the ophthalmic clinical trials market and accounted for the largest revenue share of 41.8% in 2022. High shares of the segment are majorly due to the increasing number of companies focusing on the research and development of novel ophthalmic drugs. For instance, in December 2022, Ocuphire Pharma, Inc., an ophthalmic research-based biopharmaceutical company, submitted a new drug application to the U.S. FDA for the Ophthalmic Phentolamine Solution in treating presbyopia, reversal of pharmacologically-induced mydriasis, and night vision disturbances. Hence, such factors are anticipated to boost the segment’s growth in the ophthalmic clinical trials market.

The other segment, which includes CROs and medical institutes, etc., is poised to register a lucrative CAGR of 6.8% during the forecast period. The high growth of the segment is largely due to the increasing trend of outsourcing clinical research to contract developers. For instance, in July 2022, RegeneRx Biopharmaceuticals, Inc., a drug development company, announced that its U.S. joint venture partner HLB Therapeutics (HLBT), has initiated an agreement with the global ophthalmology contract research organization to conduct phase III clinical trials for patients with neurotrophic keratitis (NK). Increasing partnerships between pharmaceutical/biopharmaceutical companies and CROs are anticipated to support the discovery of novel ocular products further, thereby supporting the segment’s growth in the ophthalmic clinical trials market.

Regional Insights

North America dominated the ophthalmic clinical trials market and accounted for the largest revenue share of 44.1% in 2022. The increasing prevalence of eye diseases, rising demand for personalized medicine, and R&D investments by pharmaceutical companies are the key factors driving the growth of the market in the region. Furthermore, the U.S. accounted for the largest market for ophthalmic clinical trials in North America due to a favorable regulatory environment, healthcare infrastructure, and a large patient pool. For instance, Santen Pharmaceutical Co., Ltd. is currently developing three therapies in the U.S., including treatments for glaucoma ocular hypertension, Fuchs Endothelial Corneal Dystrophy (FECD), and Presbyopia. In September 2022, the company also received regulatory approval from U.S. FDA for its ophthalmic solution, OMLONTI (omidenepag isopropyl), for the reduction of elevated intraocular pressure (IOP) in patients with ocular hypertension or primary open-angle glaucoma.

Asia Pacific is anticipated to register the fastest CAGR of 7.2% during the forecast period in the ophthalmic clinical trials market. The key factors driving the market are the increasing prevalence of eye diseases, growing aging population, and the rising number of clinical trials being conducted in the region, primarily in the countries like India, Japan, and China. For instance, in 2023, Aurion Biotech announced that it has received regulatory approval for its innovative cell therapy vyznova from the Pharmaceutical and Medical Devices Agency (PMDA) of Japan. The therapy is aimed at treating keratopathy of the cornea, and it is the world’s first allogeneic cell therapy to obtain regulatory approval for corneal endothelial disease treatment.

Key Companies & Market Share Insights

The major players operating across the ophthalmic clinical trials market are focused on the adoption of in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. Furthermore, several players are focusing on the development of novel therapeutics, thereby supporting the growth of the global ophthalmic clinical trials market. For instance, in October 2022, Nanoscope Therapeutics, Inc., a biotechnology company focused on the development of gene therapy for retinal diseases, along with Charles River Laboratories International, Inc., announced a manufacturing partnership, utilizing Charles River’s wide-ranging contract research and development services in both viral vectors and plasmid DNA. Some of the prominent players in the ophthalmic clinical trials market include:

-

Charles River Laboratories International, Inc.

-

ICON Plc

-

IQVIA

-

Laboratory Corporation of America Holdings

-

Vial

-

Medpace

-

ProTrials Research, Inc.

-

Syneos Health

-

Worldwide Clinical Trials, Inc.

-

ProRelix Services LLP.

Ophthalmic Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.6 billion

Revenue Forecast in 2030

USD 2.5 billion

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments Covered

Product, Indication, Phase, Sponsor Type, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Charles River Laboratories International, Inc.; ICON Plc; IQVIA; Laboratory Corporation of America Holdings; Vial; Medpace; ProTrials Research, Inc.; Syneos Health; Worldwide Clinical Trials, Inc.; ProRelix Services LLP.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ophthalmic clinical trials market report on the basis of product, indication, phase, sponsor type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Devices

-

Surgical & Diagnostics Devices

-

Vision care Devices

-

-

Drugs

-

OTC Drugs

-

Prescription Drugs

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Macular Degeneration

-

Glaucoma

-

Dry Eye Disease

-

Retinopathy

-

Uveitis

-

Macular Edema

-

Blepharitis

-

Cataract

-

Optic Neuropathy

-

Others

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Discovery Phase

-

Preclinical Phase

-

Clinical Phase

-

-

Sponsor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical/Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic clinical trials market size was estimated at USD 1.5 billion in 2022 and is expected to reach USD 1.6 billion by 2023.

b. The global ophthalmic clinical trials market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 2.5 billion by 2030.

b. By product, the drugs segment held a market share of 75.5% in 2022. The growing pipeline of optical therapeutics is one of the prominent factors supporting the segment’s robust revenue shares during the analysis timeframe. Furthermore, the segment is driven by the high demand for novel ophthalmic pharmaceuticals and biopharmaceuticals across the globe.

b. Some key players operating in the ophthalmic clinical trials market include Charles River Laboratories, ICON Plc, IQVIA, Laboratory Corporation of America Holdings, and others.

b. Increasing demand for ocular treatment therapies is one of the key factors augmenting the growth of the ophthalmic clinical trials market. Development in the field of ophthalmology is crucial for the treatment and prevention of several optic ailments, and relevant research and development activities are growing rapidly, forming valuable knowledge networks for treating complex ocular conditions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."