- Home

- »

- Pharmaceuticals

- »

-

Ophthalmic Drugs Market Size, Share & Trends Report, 2030GVR Report cover

![Ophthalmic Drugs Market Size, Share & Trends Report]()

Ophthalmic Drugs Market Size, Share & Trends Analysis Report By Drug Class (Steroidal drugs, Anti-VEGF Agents), By Disease, By Dosage Form, By Route of Administration, By Product Type, By Product, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-010-1

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Ophthalmic Drugs Market Size & Trends

The global ophthalmic drugs market size was estimated at USD 37.82 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.34% from 2024 to 2030. The market growth is attributed to rising prevalence of retinal disorders, advancement in drug delivery, and an increasing focus on research for development of novel therapeutics in the market. Moreover, increasing investment by public and private organizations is further propelling the growth of market. For instance, in July 2023, the National Eye Institute announced a funding of USD 2.5 million for over 5 years to advance the glaucoma treatment research at Missouri University of Science and Technology.

Increase in the prevalence of eye-related disorders, such as macular degeneration, diabetic retinopathy, and presbyopia, is one of the major factors driving the growth of the overall market. The increasing prevalence of these conditions is expected to boost the market. As per WHO, in 2019, approximately 2.2 billion people were visually impaired globally. In addition, over 39 million were blind, nearly 188.5 million people were suffering from mild vision impairment, and over 217 million people experienced moderate-to-severe vision impairment.

Drug delivery to the human eye is rapidly expanding but is challenging for the pharmaceutical industry. With the introduction of genes and other innovative medicines, the adoption of ocular injectable drugs is rapidly increasing. Nonetheless, topicals (mainly liquids including solutions and suspensions, but also semi-solids) continue to be the most common dosage form for ophthalmic commercialized and in-development medicines. For each molecule under development, it is determined whether the medicine has the potential to significantly improve the lives of people suffering from a vision-threatening disease. Key players operating in the market offer medications to patients and are continually focusing on adopting innovative technologies that can help provide relief as well as improve the quality of life of people.

Despite the availability of approved medicines, there is still an unmet need and an opportunity to provide alternative therapeutic options to help patients better control their ophthalmic disease by presenting a novel option with a different mechanism of action than currently existing medications. Moreover, key players operating in the market are constantly focusing on the development and launch of novel therapeutics with an enhanced drug delivery system, which is anticipated to provide opportunities for market growth.

Changes in vision and the increasing necessity for corrective devices can be troubling for a patient with nascent presbyopia. Both spectacle and contact lenses can correct near vision acuity, but they must be cared for and maintained. With a rapidly aging population and people becoming increasingly reliant on multiscreen devices, the burden of retinal disease is anticipated to increase in the future.

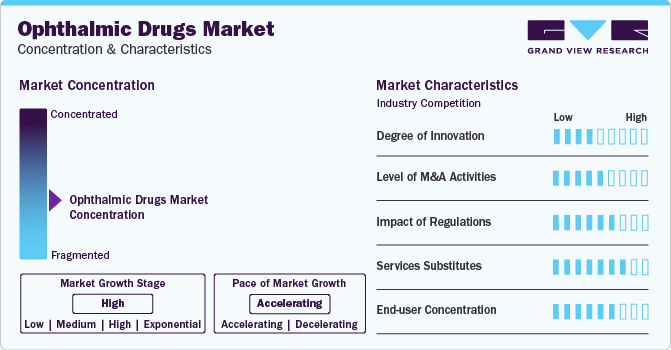

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid advancements in drug delivery.The emergence of gene therapies as a potent drug-delivery mechanism is one of the strongest drivers of the market. Potential advancements in drug delivery are anticipated to be in two forms—the creation of new pharmacologic agents or more effective delivery of currently available agents.

The market is also characterized by a high level of partnership and collaboration activity by the leading players. It is one of the most adopted strategies by players in the market to enhance early commercialization of their products and improve the availability of products. For instance, in November 2019, Aerie Pharmaceuticals, Inc. acquired Avizorex Pharma, S.L., an ophthalmic pharmaceutical company in Spain that was developing products for dry eye disease. Avizorex Pharma, S.L. completed a Phase 2a clinical trial of AVX-012 for the treatment of DED subjects in early 2020 as its lead product candidate. The acquisition was expected to expand Aerie’s footprint in ophthalmology.

Investors are funding companies to support the clinical development of novel treatments for eye diseases. For instance, in July 2023, SpyGlass Pharma announced funding of USD 90 million in Series C funding for enhancing novel therapeutics used in the treatment of glaucoma and other chronic ophthalmic diseases. In February 2019, Oyster Point Pharma, Inc. received USD 93 million in series B financing from Invus Opportunities, Flying L Partners, New Enterprise Associates (NEA), Versant Ventures, and Vida Ventures. The company’s product candidates include OC-01 and OC-02 in a Phase 2b clinical trial.

To successfully develop a topical eye solution, it is critical to understand the intricate, multilayered nature of the eye's surface. The capacity to construct relevant and meaningful models of this particular barrier to choose appropriate medications and refine formulations within the laboratory can substantially improve this understanding. Such knowledge increases the likelihood that a product will provide good health benefits to the patient.

End-user concentration is a significant factor in the market. Hospitals are preferred for care due to availability of various services under one roof. The presence of a well-distributed network of clinical laboratories and hospitals is enabling an improved market penetration of ophthalmic drugs.

Drug Class Insights

Anti-VEGF agents led the market and accounted for 32.71% of the global revenue in 2023. The segment growth is attributed to the rising prevalence of retinal disorders globally. This is anticipated to propel the sales of anti-VEGF agents, boosting segment growth. These agents are useful in ophthalmology for treating eye conditions that cause swelling or growth of new blood vessels around the retina. Moreover, increasing research activities related to anti-VEGF drugs for different ophthalmic disorders are improving the introduction of novel drugs in the market. In February 2023, Bayer AG submitted a regulatory approval application to the European Medicines Agency (EMA) for aflibercept 8 mg for neovascular (wet) age-related macular degeneration (nAMD) and diabetic macular edema (DME).

Gene and cell therapy segment is anticipated to grow at the fastest growth rate over the forecast period. Gene & cell therapy is a comparatively newer therapeutic option for treating eye diseases. The increasing adoption of these products due to high efficacy and effectiveness of drugs is expected to drive the segment growth significantly. Moreover, the increasing product approval and service providers in the market are driving segment growth. For instance, OHSU Casey Eye Institute is offering gene therapy treatment for people with inherited retinal disease due to mutation in both copies of RPE65 gene.

Disease Insights

Retinal disorders led the market in 2023 and are anticipated to grow at the fastest growth rate over the forecast period. Growing incidence of retinal disorders around the globe and the need for effective and affordable treatment options for the same has driven the market. The National Eye Institute estimated that by 2050 and 2030, around 14 and 10 million people respectively will suffer from diabetic retinopathy in America. The leading drugs for treating retinal disorders are Lucentis, Eylea, and Avastin. Moreover, Platelet-Derived Growth Factor (PDGF) therapy is anticipated to be the new revolution in treating retinal disorders.

Infection segment is anticipated to grow at lucrative growth over the forecast period. The growth of the segment is attributed to the rising prevalence of eye infections. Bacterial conjunctivitis is one of the most prevalent ophthalmic infections. According to an article published by WebMD LLC., in 2019, conjunctivitis affects 6 million people in the U.S. annually and accounts for 1% of the total primary care office visits. Moreover, 30% of patients with conjunctivitis have bacterial conjunctivitis, and 80% of them are treated with antibiotics. Medications used to treat conjunctivitis typically include broad-spectrum antibiotics as the first line of treatment.

Route of Administration Insights

Topical route of administration led the market in 2023. Topical drug dosage forms generally include suspensions, solutions, and ointments. The cornea is the primary route of topical absorption that poses significant anatomical barriers. Availability of several drugs delivered via topical route of administration is estimated to be the major driver of this segment. For instance, phenylephrine, tetrahydrozoline, oxymetazoline, and naphazoline are currently available in the market as OTC ophthalmic decongestants. The topical use of oxymetazoline is generally indicated for improving symptoms such as itching, burning, and tearing associated with allergic conjunctivitis.

Local ocular route of administration segment is anticipated to grow at the fastest growth rate over the forecast period. Intraocular delivery route facilitates direct entry of drugs into blood retinal barrier and, therefore, the highest peak of drug concentration can be achieved. It achieves maximum intraocular bioavailability in posterior segment tissues of the eye, such as cone-containing fovea or macula. However, this is the most invasive route of administration, involving penetration of drugs in the eye and, thus, is not free of injection-related complications. These may include retinal hemorrhage, raised IOP, floaters, transient blurry vision, vitreous hemorrhage, retinal tears, retinal detachment, endophthalmitis, and cataracts.

Dosage Type Insights

Eye drops led the market in 2023 and are anticipated to grow at the fastest growth rate over the forecast period. Eye drops are the most preferred form of drug delivery used for treating ocular diseases such as acute allergies, corneal ulcers, and glaucoma. Eye drops are relatively cost-effective compared with other forms of dosage. For example, azithromycin, besifloxacin, timolol eye drops, besivance (besifloxacin hydrochloride—suspension/drops; ophthalmic). Alcon and Bausch & Lomb are some of the leading companies in ophthalmic eye drops market. Moreover, owing to increasing usage and rising prevalence of various eye-related diseases, there is an increasing demand for ophthalmic drugs.

The eye solutions & suspensions segment is anticipated to grow at lucrative growth rate over the forecast period. Eye solutions facilitate direct drug delivery, which is a distinct clinical advantage. Some of the most commonly used eye solutions include Moxeza, Ocuflox, and Neosporin. Eye solutions may also contain certain excipients to regulate viscosity, pH, and osmotic pressure. Presence of advanced technology for drug delivery in order to improve physicochemical stability & bioavailability is anticipated to boost the market growth. For instance, in January 2022, Sun Pharma launched its cyclosporine ophthalmic solution, CEQUA 0.09%, a novel treatment for DED affecting over 6 million Canadians living with the condition.

Product Type Insights

Prescription drugs led the market in 2023. Prescription medications are the major reason for increased healthcare spending. According to studies published by American Academy of Ophthalmology, in 2018, eye care providers including optometrists and ophthalmologists accounted for around USD 2.4 billion out of the total USD 103 billion Medicare Part D costs for prescription drugs and, thus, produced the highest percentage of claims for brand medications among all other specialties. Support from various private & public authorities to increase sales of prescription medicines is anticipated to boost segment growth. In May 2023, the U.S. FDA approved Bausch & Lomb and Novaliq’s Miebo for treating DED. It is the first & only prescription drop to receive the U.S. FDA approval for DED.

OTC drugs are anticipated to grow at the fastest growth rate over the forecast period. The growth of the segment is attributed to the increasing penetration of generics in the market aided by the loss of patent exclusivities of major drugs. The relatively low cost of these drugs makes it affordable for a large patient base in low- and middle-economic countries. OTC drugs for ophthalmic use have anti-inflammatory, anti-infective, and antibiotic properties. They are commercially available in various dosage forms including emulsions, capsules, ointment, gels, and drops. Some of the top-selling ophthalmology OTC products include Otrivine-Antistin (Novartis Consumer Health); Alaway (Bausch & Lomb, Inc.); Golden Eye Ointment (Sigma Pharmaceuticals); Zaditor (Alcon, Inc.); Brolene (Sanofi); GelTears (Bausch & Lomb); and Viscotears (Alcon, Inc.).

Product Insights

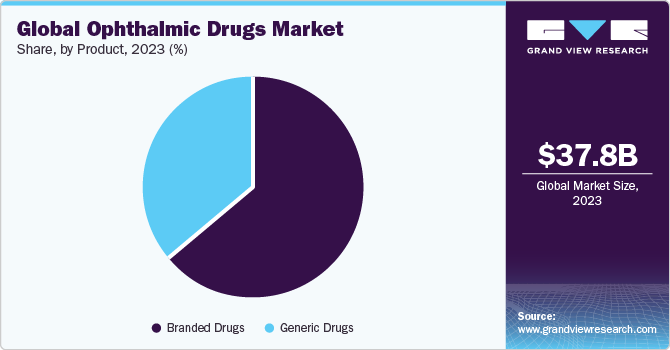

Branded drugs dominated the market in 2023 due to the growing need for novel therapies and treatments. Several players are engaged in developing new treatments for various conditions, such as dry eye and glaucoma, as current treatments are known to provide temporary symptomatic relief. Hence, companies are developing long-acting, hands-free therapies to combat such challenges. In addition, ophthalmic pharmaceutical companies are entering into strategic initiatives, such as collaborations, acquisitions, and partnerships, to expand their product pipeline with new clinical-stage candidates, which is expected to boost the market.

The generic drugs segment is projected to witness the fastest growth rate over the forecast period. Cost-effectiveness and patent expiry of branded drugs are some of the key factors supporting segment growth. Moreover, the generic drug is similar to an existing approved brand name drug in terms of safety, dosage form, route of administration, quality, strength, and performance characteristics. However, the cost of generics is low, which provides an advantage to generic drugs for more prescription, especially in developing economies. Moreover, government bodies are motivating drug manufacturers to increase the development of generic drugs as they are top-selling ophthalmology drugs. For instance, in September 2021, the U.S. FDA approved the first biosimilar to Byooviz (SB-11) for treating multiple eye conditions. Such initiatives are propelling market growth.

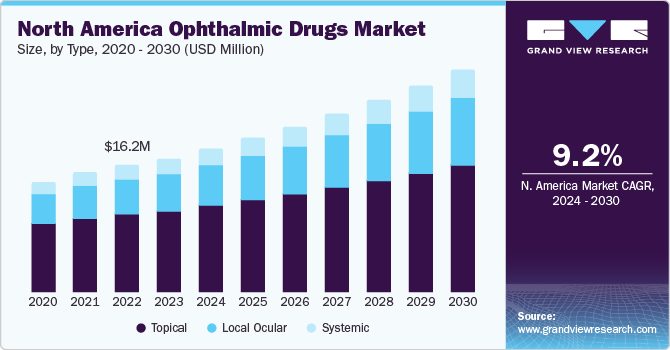

Regional Insights

North America dominated the market and accounted for a 44.99% share in 2023. This high share is owing to the rising prevalence of retinal diseases and favorable government initiatives in the region. North America is a developed region with high healthcare expenditure. The local presence of regulatory entities in North American countries is expected to boost the development of ophthalmic drugs in the near future. This is mainly because these entities play a pivotal role in creating awareness among people about the potential of dry eye treatment therapies in disease management. Moreover, the high prevalence and increasing eye treatment procedures aid expansion in the region.

Asia Pacific is anticipated to witness the fastest growth rate. The increasing burden of ophthalmic disorders and rising consumer awareness are expected to drive market growth in Asia Pacific. Nearly two-thirds of the Asia Pacific population is vision impaired or blind. Moreover, the development of various novel technologies by research institutes in developing economies, such as China and India, is expected to improve healthcare facilities in the region. The presence of a well-distributed network of clinical laboratories and hospitals in India is enabling an improved market penetration of ophthalmic drugs.Furthermore, developed countries in the region, such as Australia, are approving the entry of new treatments such as Cationorm emulsion into the market.

Key Ophthalmic Drugs Company Insights

Some of the leading players operating in the market include AbbVie, Inc. (Allergan); Novartis AG; Regeneron Pharmaceuticals, Inc.; and Alcon. Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced technology and infrastructure, allowing them to efficiently process & analyze a large volume of samples. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Eyenovia, Inc., TearSolutions, Coherus BioSciences, Inc., and Aldeyra Therapeutics are some of the emerging market participants in the ophthalmic drugs market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Ophthalmic Drugs Companies:

The following are the leading companies in the ophthalmic drugs market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these ophthalmic drugs companies are analyzed to map the supply network.

- Pfizer Inc.

- Alcon

- Novartis AG

- Bausch Health Companies Inc.

- Merck & Co., Inc

- Regeneron Pharmaceuticals Inc

- Allergan (AbbVie Inc)

- Bayer AG

- Genentech, Inc. (F. Hoffmann-La Roche Ltd)

- Nicox

- Coherus Biosciences, Inc.

Recent Developments

-

In May 2023, Bausch Health Companies, Inc. received FDA approval for Miebo, a dry eye treatment prescription drug.

-

In February 2023, Bayer AG submitted aflibercept 8 mg for regulatory approval in the EU for two major retinal diseases.

-

In January 2023, Bausch Health Companies, Inc. launched PreserVision AREDS 2 Formula minigel eye vitamins in the U.S. It was developed for people with moderate-to-advanced AMD.

Ophthalmic Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.86 billion

Revenue forecast in 2030

USD 66.06 billion

Growth rate

CAGR of 8.34% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, disease, route of administration, dosage form, product type, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil Mexico; Argentina; South Africa; UAE; Kuwait; and Saudi Arabia

Key companies profiled

Pfizer Inc.; Alcon; Novartis AG; Bausch Health Companies Inc.; Merck & Co., Inc.; Regeneron Pharmaceuticals Inc.; Allergan (AbbVie Inc); Bayer AG; Genentech, Inc. (F. Hoffmann-La Roche Ltd); Nicox; Coherus Biosciences, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic drugs market report based on drug class, disease, route of administration, dosage type, product type, product, and region:

-

Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

-

Anti-allergy

-

Anti-inflammatory

-

Non-steroidal drugs

-

-

Steroidal drugs

-

Anti-VEGF Agents

-

Anti-glaucoma

-

Others

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dry Eye

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Allergies

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Glaucoma

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Eye Infection

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Infection

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Retinal Disorders

-

Retinal Disorder Treatment Market, By Type,

-

Macular Degeneration

-

Diabetic Retinopathy

-

-

Retinal Disorder Treatment Market, By Dosage Type,

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

-

Uveitis

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Others

-

-

Dosage Form Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gels

-

Eye Solutions & Suspensions

-

Capsules and Tablets

-

Eye Drops

-

Ointments

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Topical

-

Retinal Disorders

-

Subconjunctival

-

Intravitreal

-

Retrobulbar

-

Intracameral

-

-

Local Ocular

-

Systemic

-

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription Drugs

-

OTC

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Branded Drugs

-

Generic Drugs

-

-

Regional Outlook (Revenue, USD Billion, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic drugs market size was estimated at USD 37.82 billion in 2023 and is expected to reach USD 40.86 billion in 2024.

b. The global ophthalmic drugs market is expected to grow at a compound annual growth rate of 8.34% from 2024 to 2030 to reach USD 66.06 billion by 2030.

b. North America dominated the ophthalmic drugs market with a share of 44.99% in 2023, driven by a high disease burden, rising consumer awareness regarding the advantages of ophthalmic drugs, proactive government measures, technological advancements, and improvements in healthcare infrastructure.

b. Some of the major companies in the ophthalmic drugs market include Bausch & Lomb, Inc.; Novartis AG; Pfizer, Inc.; Regeneron Pharmaceuticals Inc., Merck & Co., Inc.; AbbVie Inc; Bayer AG; Johnson & Johnson Private Limited.; Santen Pharmaceutical Co., Ltd., and Genentech, Inc.

b. Key factors that are driving the ophthalmic drugs market growth include the rising prevalence of eye diseases and disorders along with the presence of a robust pipeline of molecules.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Drug Class

1.2.2. Disease

1.2.3. Route of Administration

1.2.4. Dosage Type

1.2.5. Product Type

1.2.6. Product

1.2.7. Regional scope

1.2.8. Estimates and forecasts timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.4.5.1. Data for primary interviews in North America

1.4.5.2. Data for primary interviews in Europe

1.4.5.3. Data for primary interviews in Asia Pacific

1.4.5.4. Data for primary interviews in Latin America

1.4.5.5. Data for Primary interviews in MEA

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Drug class and disease outlook

2.2.2. Route of administration and dosage type outlook

2.2.3. Product type and product outlook

2.2.4. Regional outlook

2.3. Competitive Insights

Chapter 3. Ophthalmic Drugs Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Increasing disease prevalence

3.2.1.2. Strong developmental pipeline

3.2.1.3. Advancement in drug delivery

3.2.1.4. Promising investment scenario

3.2.2. Market restraint analysis

3.2.2.1. Patent expiry of blockbuster drugs

3.3. Ophthalmic Drugs Market Analysis Tools

3.3.1. Industry Analysis – Porter’s

3.3.1.1. Supplier power

3.3.1.2. Buyer power

3.3.1.3. Substitution threat

3.3.1.4. Threat of new entrant

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political landscape

3.3.2.2. Technological landscape

3.3.2.3. Economic landscape

3.3.3. Pricing Analysis

3.3.4. Pipeline Analysis

3.3.5. Patent Expiry Analysis

Chapter 4. Ophthalmic Drugs Market: Drug Class Estimates & Trend Analysis

4.1. Drug Class Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Ophthalmic Drugs Market by Drug Class Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Anti-allergy

4.4.1.1. Anti-allergy market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.2. Anti-VEGF Agents

4.4.2.1. Anti-VEGF agents market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.3. Anti-inflammatory

4.4.3.1. Anti-inflammatory market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.3.2. Non-steroidal drugs

4.4.3.2.1. Non-steroidal drugs market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.3.3. Steroids

4.4.3.3.1. Steroids market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.4. Anti- glaucoma

4.4.4.1. Anti- glaucoma market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.5. Gene and Cell Therapy

4.4.5.1. Gene and cell therapy market estimates and forecasts 2018 to 2030 (USD Billion)

4.4.6. Others

4.4.6.1. Others market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 5. Ophthalmic Drugs Market: Disease Estimates & Trend Analysis

5.1. Disease Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Ophthalmic Drugs Market by Disease Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Dry Eye

5.4.1.1. Dry eye market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.2. Allergies

5.4.2.1. Allergies market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.3. Glaucoma

5.4.3.1. Glaucoma market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.4. Infection

5.4.4.1. Infection market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.5. Retinal Disorders

5.4.5.1. Retinal disorders market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.5.2. Macular Degeneration

5.4.5.2.1. Macular degeneration market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.5.3. Diabetic Retinopathy

5.4.5.3.1. Diabetic retinopathy market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.5.4. Others

5.4.5.4.1. Others market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.6. Uveitis

5.4.6.1. Uveitis market estimates and forecasts 2018 to 2030 (USD Billion)

5.4.7. Others

5.4.7.1. Others market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 6. Ophthalmic Drugs Market: Route of Administration Estimates & Trend Analysis

6.1. Route of Administration Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Global Ophthalmic Drugs Market by Route of Administration Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. Topical

6.4.1.1. Topical market estimates and forecasts 2018 to 2030 (USD Billion)

6.4.2. Local Ocular

6.4.2.1. Local ocular market estimates and forecasts 2018 to 2030 (USD Billion)

6.4.2.2. Subconjunctival

6.4.2.2.1. Subconjunctival market estimates and forecasts 2018 to 2030 (USD Billion)

6.4.2.3. Intravitreal

6.4.2.3.1. Intravitreal market estimates and forecasts 2018 to 2030 (USD Billion)

6.4.2.4. Retrobulbar

6.4.2.4.1. Others market estimates and forecasts 2018 to 2030 (USD Billion)

6.4.2.5. Intracameral

6.4.2.5.1. Intracameral market estimates and forecasts 2018 to 2030 (USD Billion)

6.4.3. Systemic

6.4.3.1. Systemic market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 7. Ophthalmic Drugs Market: Dosage Type Estimates & Trend Analysis

7.1. Dosage Type Market Share, 2023 & 2030

7.2. Segment Dashboard

7.3. Global Ophthalmic Drugs Market by Dosage Type Outlook

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.4.1. Gels

7.4.1.1. Gels market estimates and forecasts 2018 to 2030 (USD Billion)

7.4.2. Eye Solutions and Suspensions

7.4.2.1. Eye solutions and suspensions market estimates and forecasts 2018 to 2030 (USD Billion)

7.4.3. Capsules and Tablets

7.4.3.1. Capsules and tablets market estimates and forecasts 2018 to 2030 (USD Billion)

7.4.4. Eye Drops

7.4.4.1. Eye drops market estimates and forecasts 2018 to 2030 (USD Billion)

7.4.5. Ointments

7.4.5.1. Ointments market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 8. Ophthalmic Drugs Market: Product Type Estimates & Trend Analysis

8.1. Product Type Market Share, 2023 & 2030

8.2. Segment Dashboard

8.3. Global Ophthalmic Drugs Market by Product Type Outlook

8.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

8.4.1. OTC

8.4.1.1. OTC market estimates and forecasts 2018 to 2030 (USD Billion)

8.4.2. Prescription Drugs

8.4.2.1. Prescription drugs market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 9. Ophthalmic Drugs Market: Product Estimates & Trend Analysis

9.1. Product Market Share, 2023 & 2030

9.2. Segment Dashboard

9.3. Global Ophthalmic Drugs Market by Product Outlook

9.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

9.4.1. Branded Drugs

9.4.1.1. Branded drugs market estimates and forecasts 2018 to 2030 (USD Billion)

9.4.2. Generic Drugs

9.4.2.1. Generic drugs market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 10. Ophthalmic Drugs Market: Regional Estimates & Trend Analysis

10.1. Regional Market Share Analysis, 2023 & 2030

10.2. Regional Market Dashboard

10.3. Global Regional Market Snapshot

10.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

10.5. North America

10.5.1. U.S.

10.5.1.1. Key country dynamics

10.5.1.2. Regulatory framework/ reimbursement structure

10.5.1.3. Competitive scenario

10.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Billion)

10.5.2. Canada

10.5.2.1. Key country dynamics

10.5.2.2. Regulatory framework/ reimbursement structure

10.5.2.3. Competitive scenario

10.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Billion)

10.6. Europe

10.6.1. UK

10.6.1.1. Key country dynamics

10.6.1.2. Regulatory framework/ reimbursement structure

10.6.1.3. Competitive scenario

10.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Billion)

10.6.2. Germany

10.6.2.1. Key country dynamics

10.6.2.2. Regulatory framework/ reimbursement structure

10.6.2.3. Competitive scenario

10.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Billion)

10.6.3. France

10.6.3.1. Key country dynamics

10.6.3.2. Regulatory framework/ reimbursement structure

10.6.3.3. Competitive scenario

10.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Billion)

10.6.4. Italy

10.6.4.1. Key country dynamics

10.6.4.2. Regulatory framework/ reimbursement structure

10.6.4.3. Competitive scenario

10.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Billion)

10.6.5. Spain

10.6.5.1. Key country dynamics

10.6.5.2. Regulatory framework/ reimbursement structure

10.6.5.3. Competitive scenario

10.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Billion)

10.6.6. Norway

10.6.6.1. Key country dynamics

10.6.6.2. Regulatory framework/ reimbursement structure

10.6.6.3. Competitive scenario

10.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Billion)

10.6.7. Sweden

10.6.7.1. Key country dynamics

10.6.7.2. Regulatory framework/ reimbursement structure

10.6.7.3. Competitive scenario

10.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Billion)

10.6.8. Denmark

10.6.8.1. Key country dynamics

10.6.8.2. Regulatory framework/ reimbursement structure

10.6.8.3. Competitive scenario

10.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Billion)

10.7. Asia Pacific

10.7.1. Japan

10.7.1.1. Key country dynamics

10.7.1.2. Regulatory framework/ reimbursement structure

10.7.1.3. Competitive scenario

10.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Billion)

10.7.2. China

10.7.2.1. Key country dynamics

10.7.2.2. Regulatory framework/ reimbursement structure

10.7.2.3. Competitive scenario

10.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Billion)

10.7.3. India

10.7.3.1. Key country dynamics

10.7.3.2. Regulatory framework/ reimbursement structure

10.7.3.3. Competitive scenario

10.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Billion)

10.7.4. Australia

10.7.4.1. Key country dynamics

10.7.4.2. Regulatory framework/ reimbursement structure

10.7.4.3. Competitive scenario

10.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Billion)

10.7.5. South Korea

10.7.5.1. Key country dynamics

10.7.5.2. Regulatory framework/ reimbursement structure

10.7.5.3. Competitive scenario

10.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Billion)

10.7.6. Thailand

10.7.6.1. Key country dynamics

10.7.6.2. Regulatory framework/ reimbursement structure

10.7.6.3. Competitive scenario

10.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Billion)

10.8. Latin America

10.8.1. Brazil

10.8.1.1. Key country dynamics

10.8.1.2. Regulatory framework/ reimbursement structure

10.8.1.3. Competitive scenario

10.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Billion)

10.8.2. Mexico

10.8.2.1. Key country dynamics

10.8.2.2. Regulatory framework/ reimbursement structure

10.8.2.3. Competitive scenario

10.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Billion)

10.8.3. Argentina

10.8.3.1. Key country dynamics

10.8.3.2. Regulatory framework/ reimbursement structure

10.8.3.3. Competitive scenario

10.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Billion)

10.9. MEA

10.9.1. South Africa

10.9.1.1. Key country dynamics

10.9.1.2. Regulatory framework/ reimbursement structure

10.9.1.3. Competitive scenario

10.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Billion)

10.9.2. Saudi Arabia

10.9.2.1. Key country dynamics

10.9.2.2. Regulatory framework/ reimbursement structure

10.9.2.3. Competitive scenario

10.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Billion)

10.9.3. UAE

10.9.3.1. Key country dynamics

10.9.3.2. Regulatory framework/ reimbursement structure

10.9.3.3. Competitive scenario

10.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Billion)

10.9.4. Kuwait

10.9.4.1. Key country dynamics

10.9.4.2. Regulatory framework/ reimbursement structure

10.9.4.3. Competitive scenario

10.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Billion)

Chapter 11. Competitive Landscape

11.1. Recent Developments & Impact Analysis, By Key Market Participants

11.2. Company/Competition Categorization

11.3. Vendor Landscape

11.3.1. List of key distributors and channel partners

11.3.2. Key customers

11.3.3. Key company market share analysis, 2023

11.3.4. Pfizer Inc.

11.3.4.1. Company overview

11.3.4.2. Financial performance

11.3.4.3. Product benchmarking

11.3.4.4. Strategic initiatives

11.3.5. Alcon

11.3.5.1. Company overview

11.3.5.2. Financial performance

11.3.5.3. Product benchmarking

11.3.5.4. Strategic initiatives

11.3.6. Novartis AG

11.3.6.1. Company overview

11.3.6.2. Financial performance

11.3.6.3. Product benchmarking

11.3.6.4. Strategic initiatives

11.3.7. Bausch Health Companies Inc.

11.3.7.1. Company overview

11.3.7.2. Financial performance

11.3.7.3. Product benchmarking

11.3.7.4. Strategic initiatives

11.3.8. Merck & Co., Inc.

11.3.8.1. Company overview

11.3.8.2. Financial performance

11.3.8.3. Product benchmarking

11.3.8.4. Strategic initiatives

11.3.9. Regeneron Pharmaceuticals Inc.

11.3.9.1. Company overview

11.3.9.2. Financial performance

11.3.9.3. Product benchmarking

11.3.9.4. Strategic initiatives

11.3.10. Allergan (AbbVie Inc)

11.3.10.1. Company overview

11.3.10.2. Financial performance

11.3.10.3. Product benchmarking

11.3.10.4. Strategic initiatives

11.3.11. Bayer AG

11.3.11.1. Company overview

11.3.11.2. Financial performance

11.3.11.3. Product benchmarking

11.3.11.4. Strategic initiatives

11.3.12. Genentech, Inc. (F. Hoffmann-La Roche Ltd)

11.3.12.1. Company overview

11.3.12.2. Financial performance

11.3.12.3. Product benchmarking

11.3.12.4. Strategic initiatives

11.3.13. Nicox

11.3.13.1. Company overview

11.3.13.2. Financial performance

11.3.13.3. Product benchmarking

11.3.13.4. Strategic initiatives

11.3.14. Coherus BioSciences

11.3.14.1. Company overview

11.3.14.2. Financial performance

11.3.14.3. Product benchmarking

11.3.14.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America ophthalmic drugs market, by region 2018 - 2030 (USD Billion)

Table 3 North America ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 4 North America ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 5 North America ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 6 North America ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 7 North America ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 8 North America ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 9 U.S. ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 10 U.S. ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 11 U.S. ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 12 U.S. ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 13 U.S. ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 14 U.S. ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 15 Canada ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 16 Canada ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 17 Canada ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 18 Canada ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 19 Canada ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 20 Canada ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 21 Europe ophthalmic drugs market, by region 2018 - 2030 (USD Billion)

Table 22 Europe ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 23 Europe ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 24 Europe ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 25 Europe ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 26 Europe ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 27 Europe ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 28 Germany ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 29 Germany ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 30 Germany ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 31 Germany ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 32 Germany ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 33 Germany ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 34 UK ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 35 UK ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 36 UK ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 37 UK ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 38 UK ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 39 UK ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 40 France ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 41 France ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 42 France ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 43 France ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 44 France ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 45 France ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 46 Italy ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 47 Italy ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 48 Italy ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 49 Italy ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 50 Italy ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 51 Italy ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 52 Spain ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 53 Spain ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 54 Spain ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 55 Spain ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 56 Spain ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 57 Spain ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 58 Denmark ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 59 Denmark ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 60 Denmark ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 61 Denmark ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 62 Denmark ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 63 Denmark ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 64 Sweden ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 65 Sweden ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 66 Sweden ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 67 Sweden ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 68 Sweden ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 69 Sweden ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 70 Norway ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 71 Norway ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 72 Norway ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 73 Norway ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 74 Norway ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 75 Norway ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 76 Asia Pacific ophthalmic drugs market, by region 2018 - 2030 (USD Billion)

Table 77 Asia Pacific ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 78 Asia Pacific ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 79 Aisa Pacific ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 80 Aisa Pacific ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 81 Aisa Pacific ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 82 Aisa Pacific ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 83 China ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 84 China ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 85 China ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 86 China ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 87 China ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 88 China ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 89 Japan ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 90 Japan ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 91 Japan ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 92 Japan ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 93 Japan ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 94 Japan ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 95 India ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 96 India ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 97 India ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 98 India ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 99 India ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 100 India ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 101 South Korea ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 102 South Korea ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 103 South Korea ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 104 South Korea ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 105 South Korea ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 106 South Korea ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 107 Australia ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 108 Australia ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 109 Australia ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 110 Australia ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 111 Australia ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 112 Australia ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 113 Thailand ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 114 Thailand ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 115 Thailand ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 116 Thailand ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 117 Thailand ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 118 Thailand ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 119 Latin America ophthalmic drugs market, by region 2018 - 2030 (USD Billion)

Table 120 Latin America ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 121 Latin America ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 122 Latin America ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 123 Latin America ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 124 Latin America ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 125 Latin America ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 126 Brazil ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 127 Brazil ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 128 Brazil ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 129 Brazil ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 130 Brazil ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 131 Brazil ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 132 Mexico ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 133 Mexico ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 134 Mexico ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 135 Mexico ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 136 Mexico ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 137 Mexico ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 138 Argentina ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 139 Argentina ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 140 Argentina ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 141 Argentina ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 142 Argentina ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 143 Argentina ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 144 MEA ophthalmic drugs market, by region 2018 - 2030 (USD Billion)

Table 145 MEA ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 146 MEA ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 147 MEA ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 148 MEA ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 149 MEA ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 150 MEA ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 151 South Africa ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 152 South Africa ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 153 South Africa ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 154 South Africa ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 155 South Africa ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 156 South Africa ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 157 Saudi Arabia ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 158 Saudi Arabia ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 159 Saudi Arabia ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 160 Saudi Arabia ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 161 Saudi Arabia ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 162 Saudi Arabia ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 163 UAE ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 164 UAE ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 165 UAE ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 166 UAE ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 167 UAE ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 168 UAE ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

Table 169 Kuwait ophthalmic drugs market, by drug class 2018 - 2030 (USD Billion)

Table 170 Kuwait ophthalmic drugs market, by disease 2018 - 2030 (USD Billion)

Table 171 Kuwait ophthalmic drugs market, by route of administration 2018 - 2030 (USD Billion)

Table 172 Kuwait ophthalmic drugs market, by dosage type 2018 - 2030 (USD Billion)

Table 173 Kuwait ophthalmic drugs market, by product type 2018 - 2030 (USD Billion)

Table 174 Kuwait ophthalmic drugs market, by product 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Ophthalmic drugs market: market outlook

Fig. 14 Tumor ablation competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Ophthalmic drugs market driver impact

Fig. 20 Ophthalmic drugs market restraint impact

Fig. 21 Ophthalmic drugs market strategic initiatives analysis

Fig. 22 Ophthalmic drugs market: Drug class movement analysis

Fig. 23 Ophthalmic drugs market: Drug class outlook and key takeaways

Fig. 24 Anti-allergy market estimates and forecast, 2018 - 2030

Fig. 25 Anti-VEGF agents estimates and forecast, 2018 - 2030

Fig. 26 Anti-inflammatory market estimates and forecast, 2018 - 2030

Fig. 27 Anti-glaucoma estimates and forecast, 2018 - 2030

Fig. 28 Gene and cell therapy market estimates and forecast, 2018 - 2030

Fig. 29 Others estimates and forecast, 2018 - 2030

Fig. 30 Ophthalmic drugs market: Disease movement analysis

Fig. 31 Ophthalmic drugs market: Disease outlook and key takeaways

Fig. 32 Dry eye market estimates and forecast, 2018 - 2030

Fig. 33 Allergies estimates and forecast, 2018 - 2030

Fig. 34 Glaucoma market estimates and forecast, 2018 - 2030

Fig. 35 Infection estimates and forecast, 2018 - 2030

Fig. 36 Retinal disorders market estimates and forecast, 2018 - 2030

Fig. 37 Uveitis estimates and forecast, 2018 - 2030

Fig. 38 Others estimates and forecast, 2018 - 2030

Fig. 39 Ophthalmic drugs market: Route of administration movement analysis

Fig. 40 Ophthalmic drugs market: Route of administration outlook and key takeaways

Fig. 41 Topical market estimates and forecast, 2018 - 2030

Fig. 42 Local ocular estimates and forecast, 2018 - 2030

Fig. 43 Systemic market estimates and forecast, 2018 - 2030

Fig. 44 Ophthalmic drugs market: Dosage type movement analysis

Fig. 45 Ophthalmic drugs market: Dosage type outlook and key takeaways

Fig. 46 Gels market estimates and forecast, 2018 - 2030

Fig. 47 Eye solutions and suspensions estimates and forecast, 2018 - 2030

Fig. 48 Capsules and tablets market estimates and forecast, 2018 - 2030

Fig. 49 Eye drops estimates and forecast, 2018 - 2030

Fig. 50 Ointments market estimates and forecast, 2018 - 2030

Fig. 51 Ophthalmic drugs market: Product type movement analysis

Fig. 52 Ophthalmic drugs market: Product type outlook and key takeaways

Fig. 53 OTC market estimates and forecast, 2018 - 2030

Fig. 54 Prescription drugs estimates and forecast, 2018 - 2030

Fig. 55 Ophthalmic drugs market: Product movement Analysis

Fig. 56 Ophthalmic drugs market: Product outlook and key takeaways

Fig. 57 Branded drugs market estimates and forecasts, 2018 - 2030

Fig. 58 Generic drugs market estimates and forecasts,2018 - 2030

Fig. 59 Global ophthalmic drugs market: Regional movement analysis

Fig. 60 Global ophthalmic drugs market: Regional outlook and key takeaways

Fig. 61 Global ophthalmic drugs market share and leading players

Fig. 62 North America market share and leading players

Fig. 63 Europe market share and leading players

Fig. 64 Asia Pacific market share and leading players

Fig. 65 Latin America market share and leading players

Fig. 66 Middle East & Africa market share and leading players

Fig. 67 North America: SWOT

Fig. 68 Europe SWOT

Fig. 69 Asia Pacific SWOT

Fig. 70 Latin America SWOT

Fig. 71 MEA SWOT

Fig. 72 North America, by country

Fig. 73 North America

Fig. 74 North America market estimates and forecasts, 2018 - 2030

Fig. 75 U.S. key country dynamics

Fig. 76 U.S. market estimates and forecasts, 2018 - 2030

Fig. 77 Canada key country dynamics

Fig. 78 Canada market estimates and forecasts, 2018 - 2030

Fig. 79 Europe

Fig. 80 Europe market estimates and forecasts, 2018 - 2030

Fig. 81 UK key country dynamics

Fig. 82 UK market estimates and forecasts, 2018 - 2030

Fig. 83 Germany key country dynamics

Fig. 84 Germany market estimates and forecasts, 2018 - 2030

Fig. 85 France key country dynamics

Fig. 86 France market estimates and forecasts, 2018 - 2030

Fig. 87 Italy key country dynamics

Fig. 88 Italy market estimates and forecasts, 2018 - 2030

Fig. 89 Spain key country dynamics

Fig. 90 Spain market estimates and forecasts, 2018 - 2030

Fig. 91 Denmark key country dynamics

Fig. 92 Denmark market estimates and forecasts, 2018 - 2030

Fig. 93 Sweden key country dynamics

Fig. 94 Sweden market estimates and forecasts, 2018 - 2030

Fig. 95 Norway key country dynamics

Fig. 96 Norway market estimates and forecasts, 2018 - 2030

Fig. 97 Asia Pacific

Fig. 98 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 99 China key country dynamics

Fig. 100 China market estimates and forecasts, 2018 - 2030

Fig. 101 Japan key country dynamics

Fig. 102 Japan market estimates and forecasts, 2018 - 2030

Fig. 103 India key country dynamics

Fig. 104 India market estimates and forecasts, 2018 - 2030

Fig. 105 Thailand key country dynamics

Fig. 106 Thailand market estimates and forecasts, 2018 - 2030

Fig. 107 South Korea key country dynamics

Fig. 108 South Korea market estimates and forecasts, 2018 - 2030

Fig. 109 Australia key country dynamics

Fig. 110 Australia market estimates and forecasts, 2018 - 2030

Fig. 111 Latin America

Fig. 112 Latin America market estimates and forecasts, 2018 - 2030

Fig. 113 Brazil key country dynamics

Fig. 114 Brazil market estimates and forecasts, 2018 - 2030

Fig. 115 Mexico key country dynamics

Fig. 116 Mexico market estimates and forecasts, 2018 - 2030

Fig. 117 Argentina key country dynamics

Fig. 118 Argentina market estimates and forecasts, 2018 - 2030

Fig. 119 Middle East and Africa

Fig. 120 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 121 South Africa key country dynamics

Fig. 122 South Africa market estimates and forecasts, 2018 - 2030

Fig. 123 Saudi Arabia key country dynamics

Fig. 124 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 125 UAE key country dynamics

Fig. 126 UAE market estimates and forecasts, 2018 - 2030

Fig. 127 Kuwait key country dynamics

Fig. 128 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 129 Market share of key market players- Ophthalmic drugs marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Ophthalmic Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

- Anti-allergy

- Ophthalmic Drug Disease Outlook (Revenue, USD Billion, 2018 - 2030)

- Dry Eye

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Allergies

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Glaucoma

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Infection

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorders

- Retinal Disorder Treatment Market, By Type,

- Macular Degeneration

- Diabetic Retinopathy

- Retinal Disorder Treatment Market, By Dosage Type,

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorder Treatment Market, By Type,

- Uveitis

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Others

- Dry Eye

- Ophthalmic Drug Dosage Form Outlook (Revenue, USD Billion, 2018 - 2030)

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

- Others

- Ophthalmic Drug Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

- Topical

- Local Ocular

- Retinal Disorders

- Subconjunctival

- Intravitreal

- Retrobulbar

- Intracameral

- Systemic

- Ophthalmic Drugs Dosage Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

- Ophthalmic Drug Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Prescription Drugs

- OTC Drugs

- Ophthalmic Drugs Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Branded Drugs

- Generic Drugs

- Ophthalmic Drugs Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

- North America Ophthalmic Drugs Market, By Disease

- Dry eye

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Allergies

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Glaucoma

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Infection

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorders

- Retinal Disorder Treatment Market, By Type

- Macular Degeneration

- Diabetic Retinopathy

- Retinal Disorder Treatment Market, By Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorder Treatment Market, By Type

- Uveitis

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Others

- Dry eye

- North America Ophthalmic Drugs Market, by Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

- North America Ophthalmic Drugs Market, by Route of Administration

- Topical

- Local Ocular

- Retinal Disorders

- Subconjunctival

- Intravitreal

- Retrobulbar

- Intracameral

- Systemic

- North America Ophthalmic Drugs Market, by Product Type

- Prescription Drugs

- OTC Drugs

- North America Ophthalmic Drugs Market, By Product

- Branded Drugs

- Generic Drugs

- U.S.

- U.S. Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

- U.S. Ophthalmic Drugs Market, By Disease

- Dry eye

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Allergies

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Glaucoma

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Infection

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorders

- Retinal Disorder Treatment Market, By Type

- Macular Degeneration

- Diabetic Retinopathy

- Retinal Disorder Treatment Market, By Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorder Treatment Market, By Type

- Uveitis

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Others

- Dry eye

- U.S. Ophthalmic Drugs Market, by Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

- U.S. Ophthalmic Drugs Market, by Route of Administration

- Topical

- Local Ocular

- Retinal Disorders

- Subconjunctival

- Intravitreal

- Retrobulbar

- Intracameral

- Systemic

- U.S. Ophthalmic Drugs Market, by Product Type

- Prescription Drugs

- OTC Drugs

- U.S. Ophthalmic Drugs Market, By Product

- Branded Drugs

- Generic Drugs

- U.S. Ophthalmic Drugs Market, By Drug Class

- Canada

- Canada Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

- Canada Ophthalmic Drugs Market, By Disease

- Dry eye

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Allergies

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Glaucoma

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Infection

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorders

- Retinal Disorder Treatment Market, By Type

- Macular Degeneration

- Diabetic Retinopathy

- Retinal Disorder Treatment Market, By Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorder Treatment Market, By Type

- Uveitis

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Others

- Dry eye

- Canada Ophthalmic Drugs Market, by Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

- Canada Ophthalmic Drugs Market, by Route of Administration

- Topical

- Local Ocular

- Retinal Disorders

- Subconjunctival

- Intravitreal

- Retrobulbar

- Intracameral

- Systemic

- Canada Ophthalmic Drugs Market, by Product Type

- Prescription Drugs

- OTC Drugs

- Canada Ophthalmic Drugs Market, By Product

- Branded Drugs

- Generic Drugs

- Canada Ophthalmic Drugs Market, By Drug Class

- North America Ophthalmic Drugs Market, By Drug Class

- Europe

- Europe Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

- Europe Ophthalmic Drugs Market, By Disease

- Dry eye

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Allergies

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Glaucoma

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Infection

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorders

- Retinal Disorder Treatment Market, By Type

- Macular Degeneration

- Diabetic Retinopathy

- Retinal Disorder Treatment Market, By Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorder Treatment Market, By Type

- Uveitis

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Others

- Dry eye

- Europe Ophthalmic Drugs Market, by Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

- Europe Ophthalmic Drugs Market, by Route of Administration

- Topical

- Local Ocular

- Retinal Disorders

- Subconjunctival

- Intravitreal

- Retrobulbar

- Intracameral

- Systemic

- Europe Ophthalmic Drugs Market, by Product Type

- Prescription Drugs

- OTC Drugs

- Europe Ophthalmic Drugs Market, By Product

- Branded Drugs

- Generic Drugs

- Germany

- Germany Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

- Germany Ophthalmic Drugs Market, By Disease

- Dry eye

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Allergies

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Glaucoma

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Infection

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorders

- Retinal Disorder Treatment Market, By Type

- Macular Degeneration

- Diabetic Retinopathy

- Retinal Disorder Treatment Market, By Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorder Treatment Market, By Type

- Uveitis

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Others

- Dry eye

- Germany Ophthalmic Drugs Market, by Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

- Germany Ophthalmic Drugs Market, by Route of Administration

- Topical

- Local Ocular

- Retinal Disorders

- Subconjunctival

- Intravitreal

- Retrobulbar

- Intracameral

- Systemic

- Germany Ophthalmic Drugs Market, by Product Type

- Prescription Drugs

- OTC Drugs

- Germany Ophthalmic Drugs Market, By Product

- Branded Drugs

- Generic Drugs

- Germany Ophthalmic Drugs Market, By Drug Class

- U.K.

- U.K. Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

- U.K. Ophthalmic Drugs Market, By Disease

- Dry eye

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Allergies

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Glaucoma

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Infection

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorders

- Retinal Disorder Treatment Market, By Type

- Macular Degeneration

- Diabetic Retinopathy

- Retinal Disorder Treatment Market, By Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Retinal Disorder Treatment Market, By Type

- Uveitis

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops

- Ointments

- Others

- Dry eye

- U.K. Ophthalmic Drugs Market, by Dosage Type

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

- U.K. Ophthalmic Drugs Market, by Route of Administration

- Topical

- Local Ocular

- Retinal Disorders

- Subconjunctival

- Intravitreal

- Retrobulbar

- Intracameral

- Systemic

- U.K. Ophthalmic Drugs Market, by Product Type

- Prescription Drugs

- OTC Drugs

- U.K. Ophthalmic Drugs Market, By Product

- Branded Drugs

- Generic Drugs

- U.K. Ophthalmic Drugs Market, By Drug Class

- France

- France Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

- France Ophthalmic Drugs Market, By Disease

- Dry eye

- Gels

- Eye Solutions & Suspensions

- Capsules & Tablets

- Eye Drops