- Home

- »

- Medical Devices

- »

-

Ophthalmic Ultrasound Devices Market Size Report, 2030GVR Report cover

![Ophthalmic Ultrasound Devices Market Size, Share & Trends Report]()

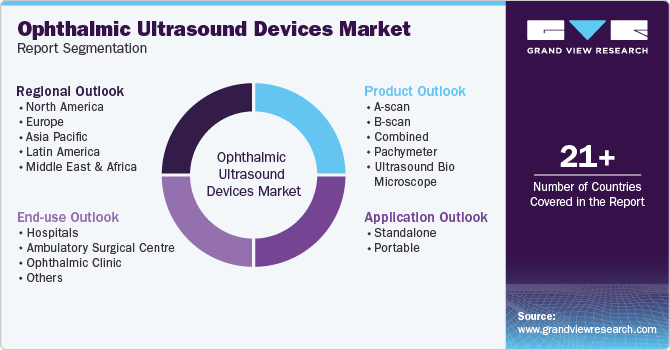

Ophthalmic Ultrasound Devices Market Size, Share & Trends Analysis Report By Product (A-scan, B-scan, Combined), By Application (Standalone, Portable), By End-use (Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-457-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

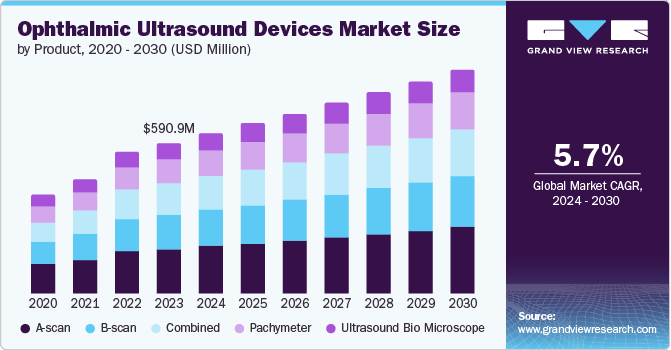

The global ophthalmic ultrasound devices market size was valued at USD 590.9 million in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The ophthalmic ultrasound devices market is a dynamic sector within the medical technology industry, essential for diagnosing and treating a range of eye conditions. These devices create high-resolution images of the eye's internal structures using sound waves, allowing ophthalmologists to examine both the front and back segments accurately. The market's expansion is influenced by factors such as the increasing occurrence of eye ailments such as cataracts, glaucoma, and retinal diseases, which has created a higher demand for accurate and non-invasive diagnostic tools.

Cataract surgeries are on the rise worldwide, with the National Eye Institute estimating that the number of cataract patients in the U.S. is likely to reach approximately 40 million by 2030. Cataract surgeries are the most effective treatment option, and they are only performed after undergoing ocular ultrasound imaging to ensure precise placement of the lens. Following the procedure, thorough examinations are conducted to confirm the correct positioning of the lens. As initiatives are implemented to increase access to cataract treatment in rural areas of developing economies, the demand for these devices is expected to experience significant growth over the forecast period.

The rising prevalence of lifestyle- and age-related eye conditions, as well as the increasing incidence of diabetic retinopathy in developed and developing regions, is expected to drive up the demand for products. Diabetic retinopathy is the most common eye complication in diabetic individuals and a primary cause of blindness, affecting 1 in 3 patients, according to the CDC. The growing diabetic population is expected to lead to a surge in vision problems.

The scarcity of ophthalmic surgeons has resulted in extended wait times, prompting more patients to opt for alternative treatment options instead of traditional ocular surgeries. Meanwhile, the number of cataract cases is expected to double in the coming years, significantly boosting demand for surgeries.

Product Insights & Trends

The A-scan segment dominated the market, accounting for 29.5% in 2023, driven by the growing demand for advanced A-scan instruments and their increasing use in pre-operative visualization of detached retinas. A-scan's benefits in cataract surgeries, such as improved accuracy and reliability, have fueled high demand. The latest transducer and electronic technologies have further enhanced its performance in ophthalmology practices.

The combined products segment is expected to witness the fastest growth over the forecast period, registering a CAGR of 6.3%. The medical device, combining A-scan and B-scan ultrasound systems, is used in ophthalmology to examine and understand ocular pathology and anatomy. B-scan devices capture images of the back of the eye, aiding in diagnosing conditions such as retinal detachments, vitreous opacities, and tumors. Their extensive clinical use and valuable insights have solidified their prominent position in the market.

Application Insights & Trends

The portable devices segment accounted for the largest market revenue share of 53.9% in 2023. The growing demand for portable ocular ultrasounds is driven by limited clinic space, competitive pricing, and rising healthcare standards. To stay ahead, leading companies are offering exchange programs for individual devices, capitalizing on the strong demand for portable devices and expanding their market presence.

The standalone devices segment is projected to experience the most rapid CAGR of 5.8% over the forecast period due to their real-time imaging capabilities, particularly with B-scan ultrasound, which allows ophthalmologists to visualize eye structures, assess movement, and track changes over time. Their portability and compact design make them ideal for various clinical settings, driving demand for advanced diagnostic technologies.

End-use Insights & Trends

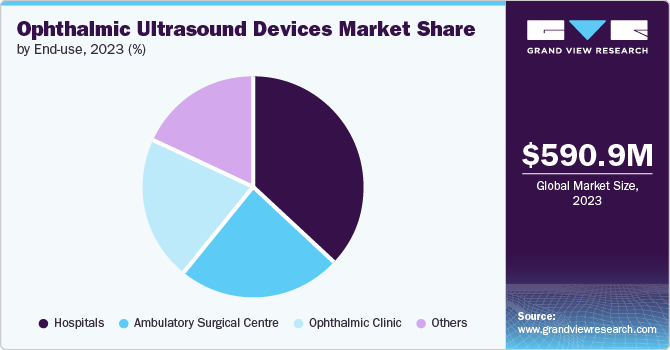

Hospitals held the largest share of market with 37.0% of the total revenue in 2023. Hospitals, with their established infrastructure and comprehensive services, are the primary destination for ophthalmic care, offering a range of diagnostics and treatments. Their presence of skilled professionals and state-of-the-art equipment solidifies their dominance, positioning them for significant growth in the future.

Ambulatory surgical centers (ASCs) are expected to witness the most lucrative growth over the forecast period with a CAGR of 6.1%. This is attributable to their convenient and cost-effective setting, advancements in medical technology enabling safe outpatient surgeries, increasing demand for efficient diagnosis and treatment of age-related eye disorders, and expanded access to specialized care in developing regions.

Regional Insights & Trends

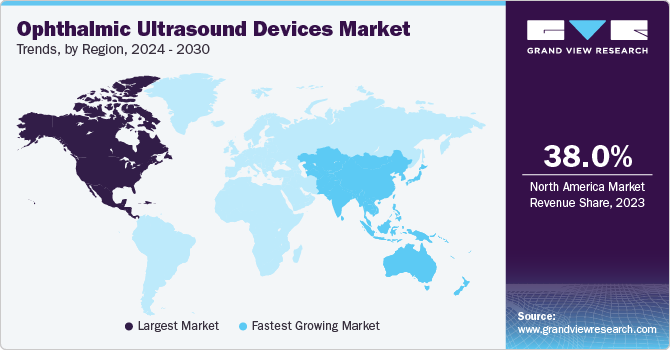

North America ophthalmic ultrasound devices held the largest market share of 38.0% in the global ophthalmic ultrasound devices market in terms of revenue, primarily driven by the strong demand for technologically advanced medical devices such as A-scan, B-scan, and combined devices. This demand is mainly attributed to the rising prevalence of diabetes in the region. Furthermore, the market is expected to be propelled by the significant presence of numerous global players and suppliers.

U.S. Ophthalmic Ultrasound Devices Market Trends

The ophthalmic ultrasound devices market in the U.S. dominated the North America region with a share of 82.4% in 2023, owing to factors such as a strong healthcare system, a high incidence of eye conditions, and substantial investments in cutting-edge medical technologies.

Europe Ophthalmic Ultrasound Devices Market Trends

In 2023, the Europe ophthalmic ultrasound devices market held the second-largest portion of the global market. This rapid growth can be attributed to the active participation of various ophthalmology societies such as the European Society of Cataract and Refracting Surgeons and the European Society of Ophthalmology, which aim to advance the field of modern ophthalmology through promotion and research.

The ophthalmic ultrasound devices market in the UK dominated the market due to the increasing number of elderly individuals and the rising prevalence of eye disorders are posing significant challenges.

Asia Pacific Ophthalmic Ultrasound Devices Market Trends

The Asia Pacific ophthalmic ultrasound devices market, comprising nations such as China, India, and Japan, is expected to grow at the fastest CAGR of 6.3% from 2024 to 2030. This growth can be attributed to several factors, including the region's substantial population, rising healthcare expenditure, and increasing awareness about advanced medical diagnostics. Furthermore, the prevalence of age-related eye conditions such as cataracts and glaucoma in the aging population has driven the demand for state-of-the-art diagnostic tools. Moreover, government initiatives focused on enhancing healthcare infrastructure and accessibility have contributed to the rapid expansion of this market in the region.

The ophthalmic ultrasound devices market in China is poised to experience substantial growth due to several factors, such as its large population, increasing healthcare expenditure, and growing awareness of advanced diagnostics. The region's high incidence of eye diseases such as cataracts and diabetic retinopathy has driven demand for efficient diagnostic tools, while the government's focus on healthcare infrastructure and spending has increased access to advanced technologies, including ophthalmic ultrasound devices.

Key Ophthalmic Ultrasound Devices Company Insights

Some key companies in the global ophthalmic ultrasound devices market are Appasamy Associates, Quantel Medical, Optos, NIDEK CO. Ltd., Halma plc, and Escalon Medical Corp, among others. Market participants are actively funding research and development initiatives to introduce cutting-edge ultrasound technologies that enhance imaging accuracy and assist in the early detection and treatment of different eye conditions. In addition, strategic partnerships, mergers, and acquisitions are influencing the competitive landscape as companies work towards expanding their product ranges and increasing their global market footprint.

Key Ophthalmic Ultrasound Devices Companies:

The following are the leading companies in the ophthalmic ultrasound devices market. These companies collectively hold the largest market share and dictate industry trends.

- Optos.

- NIDEK CO. Ltd.

- Appasamy Associates

- MicroMedical Devices

- Halma plc

- DGH Technology

- Quantel Medical

- Escalon Medical Corp

- Ellex

- Carl Zeiss Meditech AG

- MEDA Co., Ltd.

- Sonogage, Inc.

- Insight Instruments, Inc.

- MicroSurgical Technology (MST)

- EyeKon Medical, Inc.

Recent Developments

-

In March 2023, Topcon launched the Sonovue 700, a new portable ophthalmic ultrasound device that offers high-resolution imaging of the anterior and posterior segments of the eye.

-

In January 2023, Optovue, Incorporated made a significant breakthrough with the launch of the Clarity 720+. This advanced handheld ophthalmic ultrasound device revolutionizes imaging by providing exceptional clarity and resolution for both the anterior and posterior segments of the eye.

Global Ophthalmic Ultrasound Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 627.6 million

Revenue forecast in 2030

USD 875.3 million

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Optos.; NIDEK CO. Ltd.; Appasamy Associates; MicroMedical Devices; Halma plc; DGH Technology; Quantel Medical; Escalon Medical Corp; Ellex; Carl Zeiss Meditech AG; MEDA Co., Ltd.; Sonogage, Inc.; Insight Instruments, Inc.; MicroSurgical Technology (MST); EyeKon Medical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Ultrasound Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic ultrasound devices market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

A-scan

-

B-scan

-

Combined

-

Pachymeter

-

Ultrasound Bio Microscope

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone

-

Portable

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centre

-

Ophthalmic Clinic

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Latin America

-

Brazil

-

Argentina

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."