- Home

- »

- Medical Devices

- »

-

Ophthalmic Viscosurgical Devices Market Size Report, 2030GVR Report cover

![Ophthalmic Viscosurgical Devices Market Size, Share & Trends Report]()

Ophthalmic Viscosurgical Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Dispersive, Cohesivem Viscoadaptive), By Source (Animal, Biological & Semi-synthetic), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-887-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

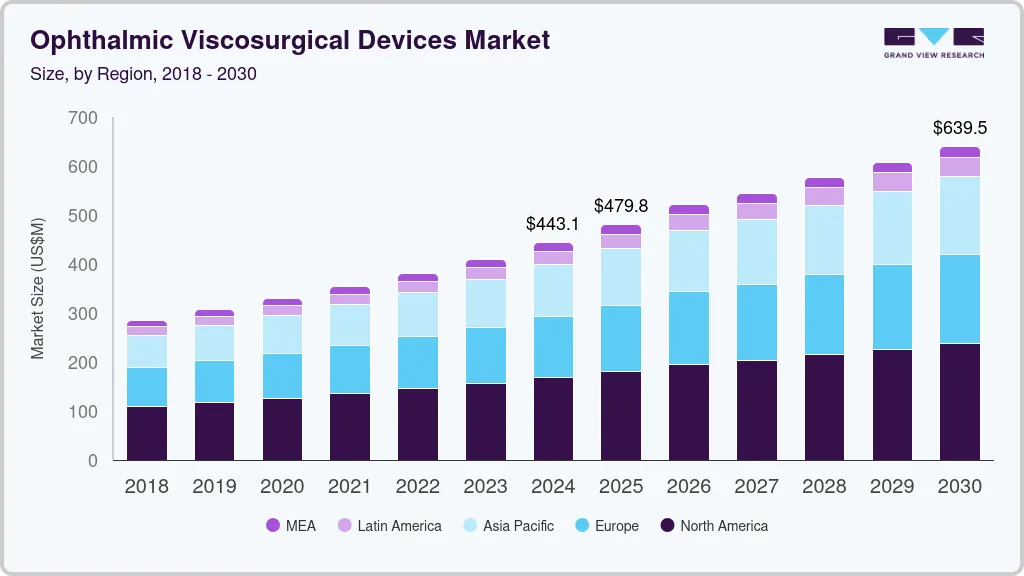

The global ophthalmic viscosurgical devices market size was valued at USD 443.1 million in 2024 and is projected to reach USD 639.5 million by 2030, growing at a CAGR of 6.3% from 2025 to 2030. Rising geriatric population, the prevalence of diabetes, and age-related ocular disorders are the factors expected to contribute to the growth. According to the National Health Institute, over 500 million adults worldwide have diabetes, a figure projected to skyrocket to nearly 800 million by 2045.

The global population is aging, leading to a surge in age-related eye diseases such as cataracts, glaucoma, and macular degeneration. According to WHO,the global population aged 60 and over will surge from 900 million in 2015 to 2 billion by 2050, representing a rapid shift from 12% to 22% of the total population. Diabetes is a significant risk factor for eye complications, increasing the demand for ophthalmic surgeries. Increased patient awareness regarding eye health and available treatments has led to higher rates of diagnosis and treatment for ocular disorders.

Innovations in ophthalmic surgery techniques, including minimally invasive procedures, enhance the effectiveness and safety of surgeries. These advancements often require specialized OVDs that can improve surgical outcomes and reduce complications. Increased public awareness about eye care is encouraging early diagnosis and treatment of eye diseases. The establishment of specialized ophthalmic centers is further fueling the market growth.

Type Insights

The dispersive segment dominated the market with 37.6% of revenue share in 2023. This is due to their ability to provide effective protection to corneal endothelial cells during cataract surgery. These devices create a stable viscoelastic environment that helps maintain intraocular pressure and prevents damage to delicate tissues. The growing incidence of cataracts, particularly among the aging population, has led to a higher demand for surgical interventions where dispersive OVDs play a crucial role.

The viscoadaptive segment is anticipated to witness the fastest CAGR of 7.7% over the forecast period. This growth is attributed to their unique ability to adapt their viscosity based on shear stress during surgical manipulation. This adaptability allows for enhanced control during procedures such as phacoemulsification and intraocular lens implantation. As surgeons increasingly seek tools that offer precision and ease of use, viscoadaptive OVDs have become a preferred choice.

Source Insights

The biological segment dominated the market with 39.4% of revenue share in 2023. This is due to their biocompatibility and enhanced performance during ocular surgeries. Derived from natural sources, these OVDs offer enhanced tissue protection and healing properties, making them increasingly preferred for delicate eye surgeries. Moreover, the growing emphasis on natural and minimally invasive procedures is driving the demand for biological OVDs.

The semi-synthetic segment is anticipated to witness the fastest CAGR of 7.3% over the forecast period. This is due to their customizable properties and versatility in application. These OVDs offer a balance of biocompatibility and viscoelastic properties, making them suitable for a wide range of ophthalmic procedures. The increasing number of cataract surgeries, coupled with the preference for reliable and affordable OVDs, is fueling the demand for semi-synthetic options.

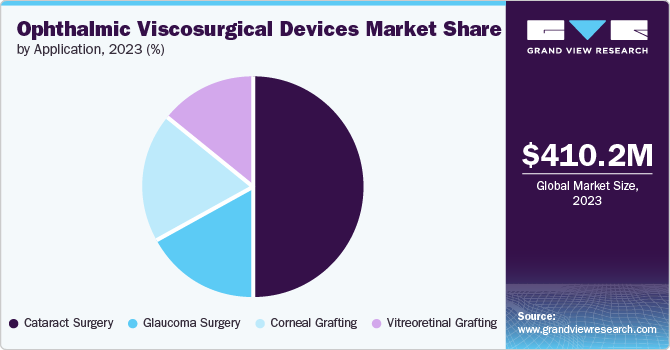

Application Insights

Cataract surgery dominated the market with 50.5% share in 2023. The increasing prevalence of cataracts, driven by an aging population and rising rates of diabetes, has significantly boosted the demand for OVDs in cataract surgery. Cataract is among leading cause of vision impairment and blindness at global level, affecting approximately 65.2 million people. According to American Academy of Ophthalmology,over 10 million cataract operations are performed each year worldwide. The use of OVDs in cataract surgery is crucial for maintaining anterior chamber stability, protecting delicate ocular tissues, and enhancing surgical visibility, thereby contributing to improved outcomes.

Vitreoretinal grafting is projected to grow the fastest CAGR of 6.7% over the forecast period. Vitreoretinal surgery is witnessing growing OVD usage due to the rising incidence of retinal disorders such as diabetic retinopathy and macular degeneration. According to Glaucoma Research Foundation, in US, diabetic retinopathy affects nearly 7.7 million people of age 40 and older.

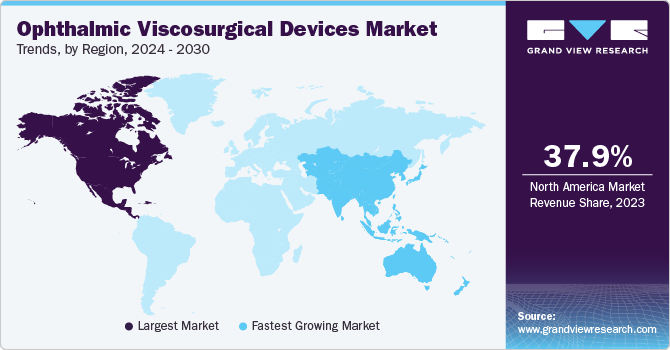

Regional Insights

North America ophthalmic viscosurgical devices (OVD) market dominated the market with 37.9% share in 2023. North America has a significant population with ophthalmic disorders such as cataracts and glaucoma, which necessitate surgical interventions. The presence of a robust healthcare infrastructure and increasing investment in research and development by key players in the market also contribute to this trend.

U.S. Ophthalmic Viscosurgical Devices Market Trends

The U.S. ophthalmic viscosurgical devices market dominated the North America market in 2023 due to its large geriatric population, high prevalence of chronic diseases, and extensive healthcare coverage. According to Population Reference Bureau, the number of Americans aged 65 and older projected to increase by 47% and account for 23% of the total population by 2050.

Europe Ophthalmic Viscosurgical Devices Market Trends

The Europe ophthalmic viscosurgical devices market was identified as a lucrative region in this industry due to rising geriatric population, increasing prevalence of diabetic retinopathy, and advancements in ophthalmic surgical techniques. According to European Commission, more than one fifth of European population is aged 65 years and over.

The Germany ophthalmic viscosurgical devices (OVD) market is expected to grow rapidly in the coming years due to advanced research facilities and a strong focus on innovation in medical technology. Furthermore, Germany’s demographic trends show an increasing elderly population that requires more frequent eye surgeries, thereby propelling market growth. According to National Institute of Health, about 700,000 people in Germany have cataract surgery each year.

Asia Pacific Ophthalmic Viscosurgical Devices Market Trends

Asia Pacific market is anticipated to witness fastest CAGR in the coming years. This growth is due to the burgeoning population, increasing prevalence of diabetic retinopathy, and rising disposable incomes.

The ophthalmic viscosurgical devices (OVD) market in India held a substantial share in 2023 due to its large population, rising incidence of cataracts and other eye diseases, and increasing affordability of healthcare services.

Key Ophthalmic Viscosurgical Devices Company Insights

Some of the key companies in the ophthalmic viscosurgical devices market are Bausch + Lomb, Carl Zeiss Meditec AG, Bohus BioTech AB, BVI, Nordic Pharma, Inc., Truviz Ophthalmic and others. Companies in the market are focusing on launching new products to gain a competitive edge in the industry.

-

Bausch + Lomb is an American-Canadian company specializing in eye health products. It is one of the largest suppliers of intraocular lenses, lens care products, contact lenses, pharmaceuticals, and products related to eye care.

Key Ophthalmic Viscosurgical Devices Companies:

The following are the leading companies in the ophthalmic viscosurgical devices market. These companies collectively hold the largest market share and dictate industry trends.

- Bausch + Lomb

- Carl Zeiss Meditec AG

- Johnson & Johnson Services, Inc.

- Alcon

- Rayner Group

- Bohus BioTech AB

- BVI

- Nordic Pharma, Inc.

- Truviz Ophthalmic

Recent Developments

-

In April 2024, Carl Zeiss Meditec AG announced the acquisition of the Dutch Ophthalmic Research Center (D.O.R.C.). This strategic move aims to consolidate the companies' strengths and drive innovation in ophthalmic medical devices and surgery.

-

In June 2024, Alcon received FDA clearance for its UNITY Vitreoretinal Cataract System (VCS) and UNITY Cataract System (CS). These are the first products from Alcon's new Unity portfolio. This clearance marks a significant milestone for Alcon, as it expands its offerings in the eye care market. The UNITY systems are expected to provide innovative solutions for cataract surgery.

Ophthalmic Viscosurgical Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 479.8 million

Revenue forecast in 2030

USD 639.5 million

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

Bausch + Lomb, Carl Zeiss Meditec AG, Johnson & Johnson Services, Inc., Alcon , Rayner Group, Bohus BioTech AB, BVI, Nordic Pharma, Inc., Truviz Ophthalmic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Viscosurgical Devices Market Report Segmentation

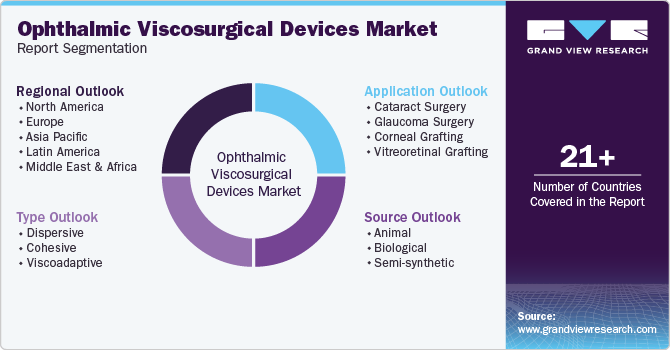

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic viscosurgical devices market report based on type, source, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dispersive

-

Cohesive

-

Viscoadaptive

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Animal

-

Biological

-

Semi-synthetic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cataract Surgery

-

Glaucoma Surgery

-

Corneal Grafting

-

Vitreoretinal Grafting

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.