- Home

- »

- Medical Devices

- »

-

Optical Imaging Systems Market Size & Share Report, 2030GVR Report cover

![Optical Imaging Systems Market Size, Share & Trends Report]()

Optical Imaging Systems Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology, By Product, By Application (Pathological, Intraoperative), By Therapeutic Area, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-943-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Optical Imaging Systems Market Summary

The global optical imaging systems market size was valued at USD 1.99 billion in 2022 and is projected to reach USD 4.65 billion by 2030, growing at a CAGR of 11.2% from 2023 to 2030. Optical imaging systems offer great potential for diagnosis, improving disease prevention and treatment in the healthcare sector.

Key Market Trends & Insights

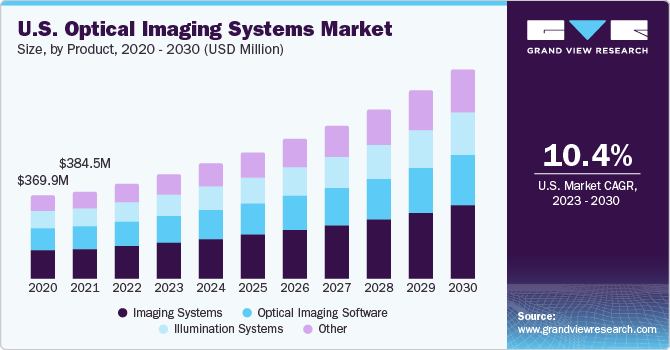

- North America dominated the market with the largest revenue share of around 35% in 2022.

- The Asia Pacific region is expected to grow at the fastest CAGR of 12.2% over the forecast period from 2023 to 2030.

- Based on end use, the research labs segment dominated the market with the largest revenue share of over 40% in 2022.

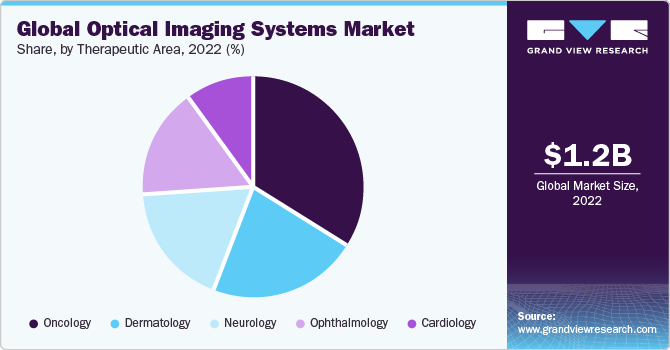

- In terms of therapeutic area, the oncology segment dominated the market with the highest revenue share of over 30% in 2022.

- Based on product, the imaging systems segment dominated the market and held the largest share of around 35%.

Market Size & Forecast

- 2022 Market Size: USD 1.99 billion

- 2030 Projected Market Size: USD 4.65 billion

- CAGR (2023-2030): 11.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Widening areas of application and increasing preference for noninvasive technology, coupled with the rising prevalence of chronic diseases and eye disorders, are major factors driving the growth of the market. The sales of optical imaging systems are projected to increase rapidly due to the rising demand for effective solutions and focus on the early detection of diseases. Furthermore, the COVID-19 disease is not only a public health crisis and a global pandemic; it has also severely disrupted the global economy and the financial markets.Transport, manufacturing, and overall supply chain disruption severely affected some of the major markets. While the pandemic greatly threatened human life, it also presented an equal threat to the overall economies globally. Many markets faced severe losses due to the imposition of restrictions and lockdowns as a preventive measure to curb the spread of the virus.

The market for optical imaging systems experienced a similar negative impact due to the pandemic. Changes in healthcare priorities and reduced patient hospital visits led to a fall in sales of optical imaging systems. Moreover, the complete lockdowns that led to a delay in the R&D activities also affected the market negatively. However, with the world slowly moving towards normalcy and governments of different economies focusing on R&D activities in the healthcare sector post-pandemic, the market is expected to attain substantial growth during the forecast period.

Optical imaging systems are used in preclinical research, diagnosis of disease, and scanning of multiple cellular and molecular in vivo processes such as protein integration, protein degradation, and protease activity. The market has gained widespread acceptance by biotechnological and pharmaceutical companies. Additionally, optical imaging technology offers great flexibility owing to its multispectral potential and high resolution, which helps diagnose and treat atherosclerosis and related diseases.

The widening application of optical imaging systems will boost market growth during the forecast period. An increase in the prevalence of eye disorders is another factor that is majorly contributing to the growth of optical imaging systems. Ophthalmologists use optical imaging systems for the diagnosis of eye disorders. Thus, the increase in the prevalence of eye disorders is leading to a rise in the patient pool, which in turn is driving the sales of optical imaging systems.

For instance, according to the Centers for Disease Control and Prevention, in the U.S., about 6.8% of children younger than 18 years have a diagnosed eye and vision condition. Moreover, the organization also states that approximately 12 million people 40 years and over in the United States have vision impairment, including 3 million who have vision impairment after correction, 1 million who are blind, and 8 million who have vision impairment due to uncorrected refractive error.

Technology Insights

Based on technology, the market is segmented into photoacoustic tomography, optical coherence tomography, hyperspectral imaging, and near-infrared spectroscopy. The optical coherence tomography segment dominated the market with the highest revenue share of over 60% in 2022, owing to the rise in the adoption of optical imaging systems for intravascular imaging in the diagnostic field. Recent technological advancements in optical coherence tomography are estimated to favor market growth. Several major market players are focusing on developing advanced optical coherence tomography devices to strengthen their market position.

The photoacoustic tomography segment is expected to witness the fastest growth, representing a CAGR of 12.5% during the forecast period. Photoacoustic tomography is a hybrid noninvasive modality for both molecular and functional imaging. The rise in preference for noninvasive technology and the superior performance represented by optical tomography in biomedical imaging compared to conventional optical imaging counterparts contribute to this technology's rapid growth.

Product Insights

Based on product, the optical imaging systems are segmented into imaging systems, optical imaging software, and illumination software. The imaging systems segment dominated the market and held the largest share of around 35%, owing to the increasing use of imaging systems across various applications to diagnose diseases. The ability of optical imaging to transcend wide spatial imaging scales ranging from cells to organ systems has rejuvenated interest in using this technology for medical imaging. Moreover, optical imaging has diverse contrast mechanisms for distinguishing normal from pathologic processes and tissues at its disposal.

The other segment is expected to grow at the fastest CAGR of 11.8% over the forecast period from 2023 to 2030. This is due to the increasing use of catheters and probes in preclinical and clinical studies. Additionally, increasing focus on R&D by the government and private players in pharmaceutical and biotechnological companies is further anticipated to help the segment grow significantly.

Application Insights

The market is segmented into pathological and intraoperative based on application. The pathological segment dominated the market with the largest revenue share in 2022 and is also expected to grow at the fastest CAGR during the forecast period from 2023 to 2030. This is due to the rise in chronic diseases due to the rise in adoption of a sedentary lifestyle leading to unhealthy food habits and lack of exercise, a growing geriatric population, and increased consumption of processed foods. According to the National Cancer Institute, in January 2019, an estimated 19.6 million cancer survivors were there in the U.S. This number is projected to increase to 22.2 million by 2030. Thus, this continuous rise in the prevalence of chronic diseases is leading to the dominance of the pathological segment throughout the forecast period.

End Use Insights

Based on end use, the optical imaging systems market is segmented into research labs, hospitals & clinics, and pharmaceutical and biological companies. The research labs segment dominated the market with the largest revenue share of over 40% in 2022 and is also expected to grow at the fastest CAGR of 11.7% over the forecast period from 2023 to 2030, owing to the increasing focus on R&D activities to develop various new applications of optical imaging. Increasing applications of optical imaging methods in preclinical research and drug discovery processes are projected to augment segment growth. Increasing research and development activities in the life sciences sector is anticipated to strengthen market growth further.

The pharmaceutical and biotechnological companies segment is expected to grow at a lucrative CAGR during the forecast period due to the increasing use of optical imaging systems in these companies' preclinical and clinical studies. Moreover, strategic initiatives to develop new and technologically advanced products by companies with huge investments in the R&D sector are projected to drive segment growth during the forecast period. For instance, according to the Information Technology and Innovation Foundation, the pharmaceutical industry invested $83 billion in R&D in 2019 across the U.S.

Therapeutic Area Insights

The market is divided into ophthalmology, cardiology, oncology, dermatology, and neurology based on therapeutic areas. The oncology segment dominated the market with the highest revenue share of over 30% in 2022. This is because the optical method of investigating tissues has the advantages of high sensitivity, relatively low cost, high resolution, and the ability to sense both the biochemical and structural characteristics of the tissue. The technology is also gaining importance as it is non-invasive and helps in early cancer detection.

Thus, the increasing prevalence of cancer coupled with the advantages optical imaging offers in the early detection of cancer is anticipated to foster the growth of this segment during the forecast period as well. Technology also plays an important role in treating cataracts and other ophthalmic disorders, which is expected to lead to the sector's growth in the coming years.

Regional Insights

North America dominated the market with the largest revenue share of around 35% in 2022. Factors such as the availability of skilled professionals, well-developed research infrastructure, and government initiatives to encourage technological advancement in the industry by offering investments and funds are promoting the growth of the market in this region. Moreover, faster adoption of technologically advanced products in the region is estimated to boost market growth further.

The Asia Pacific region is expected to grow at the fastest CAGR of 12.2% over the forecast period from 2023 to 2030. This is due to the low cost required for research, favorable regulatory guidelines, and the increasing geriatric population highly susceptible to developing chronic diseases. Moreover, the increasing focus on the healthcare sector by the government is another factor that is driving the segment growth during the forecast period.

Key Companies & Market Share Insights

Key manufacturers in the market are focusing on securing their position by carrying out strategic acquisitions, partnerships, and the launch of technologically advanced products. There is a threat of new mid or small-sized stars mainly focusing on optical imaging technology. To encounter this challenge, the existing key players are constantly focusing on their R&D activities and acquiring companies that will help them secure their market position. For instance, in July 2021, Topcon Corporation completed the acquisition of VISIA Imaging S.r.l. The company is an ophthalmic device manufacturer and is headquartered in Italy.

Key Optical Imaging Systems Companies:

- Abbott

- PerkinElmer Inc.

- Carl Zeiss Meditec AG

- Koninklijke Philips N.V.

- TOPCON CORPORATION

- Leica Microsystems

- Canon Inc.

- Heidelberg Engineering GmbH

- Optovue Corporation

- Headwall Photonics

Optical Imaging Systems Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 2.20 billion

The revenue forecast in 2030

USD 4.65 billion

Growth Rate

CAGR of 11.2% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Technology, product, application, end use, therapeutic area, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; PerkinElmer Inc.; Carl Zeiss Meditec AG; Koninklijke Philips N.V.; TOPCON CORPORATION; Leica Microsystems; Canon Inc.; Heidelberg Engineering GmbH; Optovue Corporation; Headwall Photonics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Optical Imaging Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical imaging systems market report based on technology, product, application, end use, therapeutic area, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Photoacoustic Tomography

-

Optical Coherence Tomography

-

Hyperspectral Imaging

-

Near-Infrared Spectroscopy

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Imaging Systems

-

Optical

-

Spectral

-

-

Optical Imaging Software

-

Illumination Systems

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pathological

-

Intraoperative

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Labs

-

Hospitals & Clinics

-

Pharmaceutical and Biotechnological Companies

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Ophthalmology

-

Cardiology

-

Oncology

-

Dermatology

-

Neurology

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global optical imaging systems market size was estimated at USD 1.99 billion in 2022 and is expected to reach USD 2.20 billion in 2023.

b. The global optical imaging systems market is expected to grow at a compound annual growth rate of 11.2% from 2023 to 2030 to reach USD 4.65 billion by 2030.

b. North America dominated the optical imaging system market with a share of 34.46% in 2022. This is attributable to high R&D investments, the presence of key market players, and increasing demand for medical testing of chronic diseases.

b. Some key players operating in the optical imaging systems market include PerkinElmer, Inc., St. Jude Medical Inc., Carl Zeiss Meditec AG, Topcon Corporation, Heidelberg Engineering Inc., and Optovue, Inc.

b. Key factors that are driving the market growth include the rising prevalence of ophthalmic disorders, technological advancements, increasing preference for non-invasive technology, and widening area of diagnostic applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.