- Home

- »

- Medical Devices

- »

-

Oral Care Market Size And Share, Industry Report, 2033GVR Report cover

![Oral Care Market Size, Share & Trends Report]()

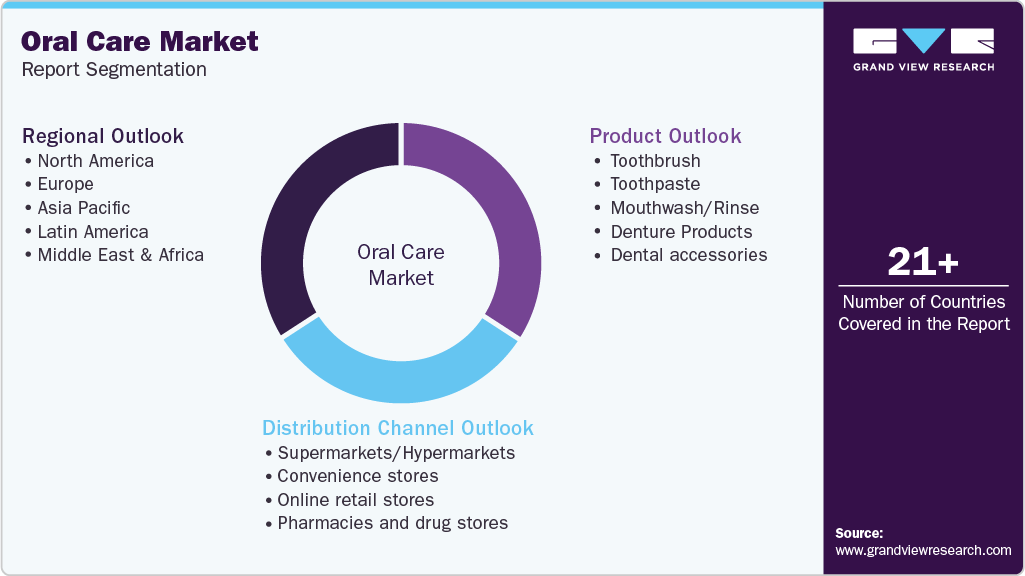

Oral Care Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Toothbrush, Toothpaste, Mouthwash/Rinse, Dental Accessories), By Distribution Channel, By Region And Segment Forecasts

- Report ID: GVR-1-68038-478-9

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Oral Care Market Summary

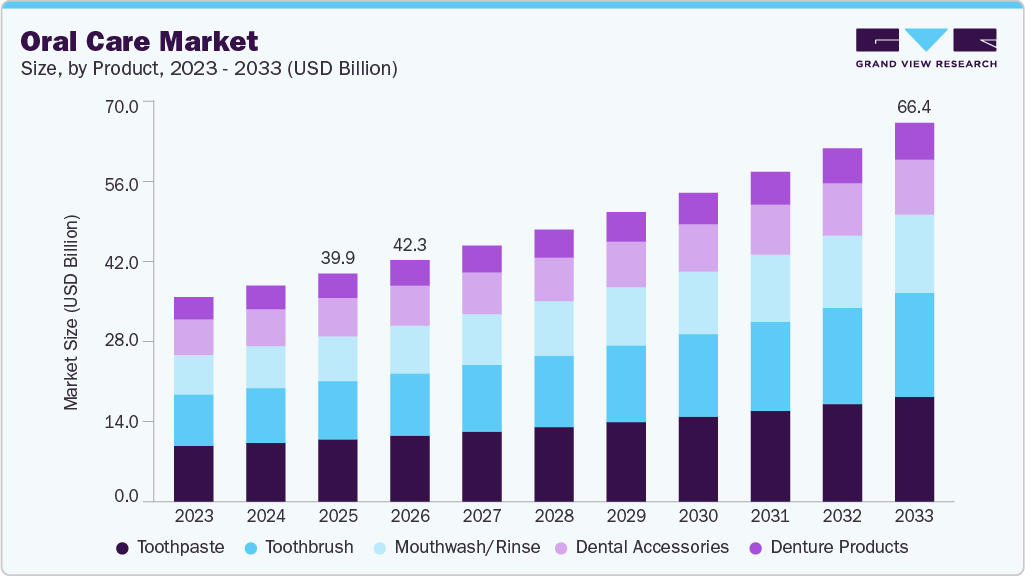

The global oral care market size was estimated at USD 39.94 billion in 2025 and is projected to reach USD 66.37 billion by 2033, growing at a CAGR of 6.65% from 2026 to 2033. The oral care market is driven by rising awareness of oral hygiene, increasing prevalence of dental diseases such as caries and periodontal disorders, and growing emphasis on preventive healthcare.

Key Market Trends & Insights

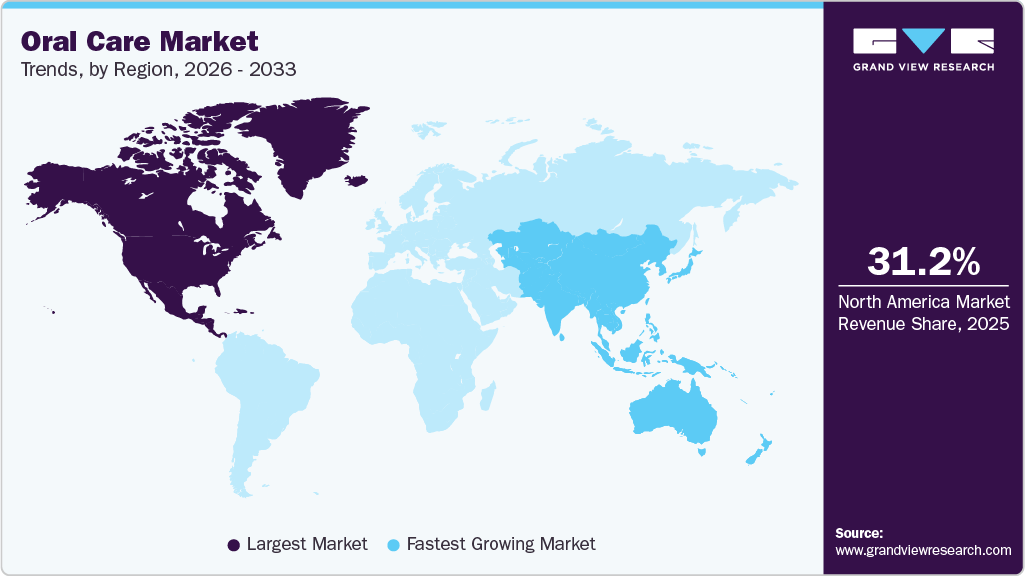

- North America dominated the oral care market with the largest revenue share of 31.20% in 2025.

- The oral care market in the U.S. accounted for the largest market revenue share in North America in 2025.

- By product, the toothpaste segment led the market with the largest revenue share in 2025.

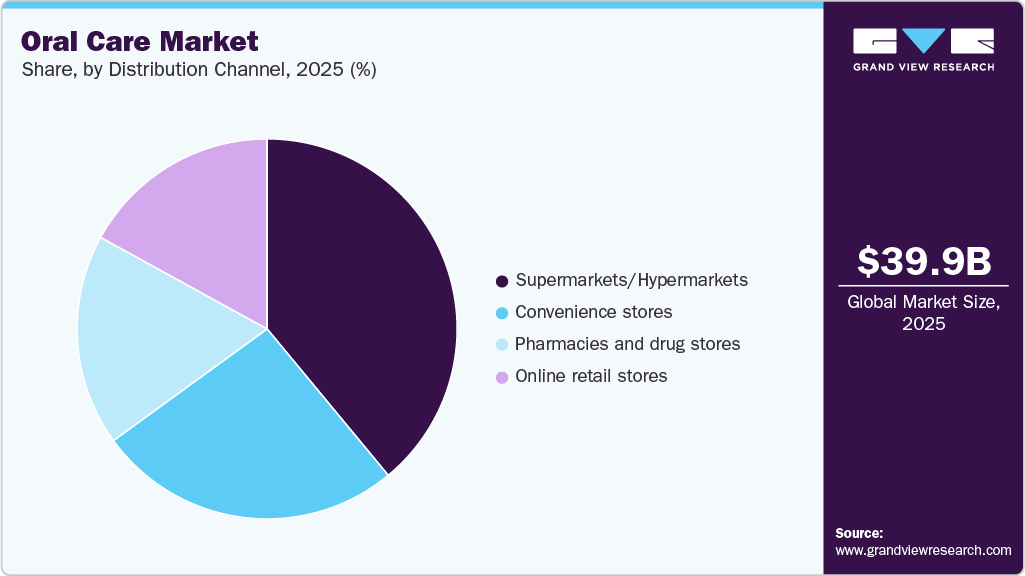

- By distribution channel, the supermarkets/hypermarkets segment led the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 39.94 Billion

- 2033 Projected Market Size: USD 66.37 Billion

- CAGR (2026-2033): 6.65%

- North America: Largest market in 2025

- Asia Pacific: Fastest Growing Market

In addition, product innovation, including advanced toothpaste formulations, electric toothbrushes, and cosmetic whitening solutions, along with the expansion of urban populations and increasing disposable incomes, continues to accelerate global market growth. According to the State of America’s Oral Health and Wellness Report, preventive dental care remained a strong focus in 2025, with most parents (95%) reporting at least one dental visit for their child in the past year, for preventive purposes (94%). The report also highlights growing recognition of oral health in prenatal care, with 50% of respondents considering it essential and over half of women who are or have been pregnant (54%) prioritizing dental visits on par with routine annual physical examinations.

The rising awareness of the importance of oral hygiene is a key driving factor for the oral care market, as consumers increasingly recognize the connection between oral health and overall well-being. A greater emphasis on preventive care, supported by public health campaigns, dental education, and regular dental check-ups, is encouraging consistent use of oral care products. This growing awareness is driving demand for advanced toothbrushes, therapeutic toothpastes, mouthwashes, and other preventive oral hygiene solutions. According to the WHO, in 2025, oral diseases affect around 3.5 billion people worldwide, with untreated dental caries being the most prevalent.

Many advancements in the global oral health agenda have been realized through the sustained efforts of organizations such as the WHO and the FDI World Dental Federation, which play a significant role in shaping policies, guidelines, and awareness initiatives worldwide.

-

The Global Oral Health Action Plan (GOHAP) places a strong emphasis on the role of primary healthcare providers in promoting oral health and preventing oral diseases. The plan recognizes that primary healthcare providers, including physicians, nurses, and community health workers, are often the first point of contact for patients seeking healthcare, and play a crucial role in delivering oral health services and promoting good oral health practice. The GOHAP also emphasizes the need to integrate oral health into WHO noncommunicable diseases (NCD) and Universal Health Coverage (UHC) agendas, as well as into the UN SDGs.

-

FDI’s Vision 2030 is a global initiative that aims to improve oral health and prevent oral diseases through advocacy, education, and partnerships. It includes efforts to promote oral health as a key component of overall health, strengthen dental education and training, and increase access to care for underserved populations.

Healthcare professionals (HCPs), including primary care physicians, nurses, pharmacists, and community health workers, play a significant role in advancing global oral health advocacy. Through their regular contact with patients and communities, they are well positioned to increase oral health awareness and support prevention and early intervention. Their involvement also helps reduce barriers to accessing dental care and promotes a more integrated, holistic approach to healthcare delivery.

Healthcare Professionals (HCPs) Can Promote Oral Health

-

Integrating oral health education into routine practice by counseling patients and families on healthy diets, reduced sugar intake, and effective oral hygiene habits such as regular brushing and flossing.

-

Collaborating closely with dental professionals to support oral health screening, early detection, and timely referrals for patients with oral health concerns.

-

Supporting and advocating for policies and programs that strengthen oral health promotion, disease prevention, and access to affordable oral healthcare services.

-

Increasing awareness of the connection between oral diseases and overall health through patient education and community outreach initiatives.

-

Participating in interprofessional collaboration to encourage a more integrated and holistic healthcare approach that recognizes oral health as a key component of general health.

-

Promoting education and capacity-building among primary care physicians, nurses, and other healthcare providers in regions with limited dental resources and advocating for training programs that enable basic oral health prevention and interventions within their scope of practice to improve access in underserved communities.

KoL’s Opinion

Sarah McDonald, VP Sustainability, GSK Consumer Healthcare said “We are fighting every day to help eradicate preventable oral health problems and to provide people with better, more sustainable oral care solutions that don’t compromise on quality. We have made the commitment that 100% of our product packaging will be recyclable or reusable, where quality and safety permits, by 2025.This is just one part of our ongoing sustainability journey, in which we are working to address the environmental and societal barriers to everyday health.”

Karl Graves, Business Director at Albéa Tubes, said “We are extremely proud to roll out our responsible Greenleaf tube packaging solution with an inspiring market leader such as GSK. Our commitment is to make 100% of our tubes recyclable by 2025 while offering innovative solutions with PCR, paper and bio-based resins. Responsible packaging is now a must-have - and it requires close collaboration between a committed brand and a daring supplier.”

Parag Chaturvedi, VP of Operations, EPL Americas said “EPL is proud to be a critical partner towards GSK’s aspirations to have a net-zero impact on the environment by 2030. We know that sustainability will dictate innovation and be the focus of our operations, today and into the future. We are committed to leading the pack in sustainable packaging - and already are ahead on this journey with Platina, the first tube-and-cap combination to be recognized by the APR as fully sustainable and completely recyclable. We at EPL feel we have a significant role in the stewardship of the environment, and are committed to conserving resources, reducing waste, and building awareness of environmental issues.”

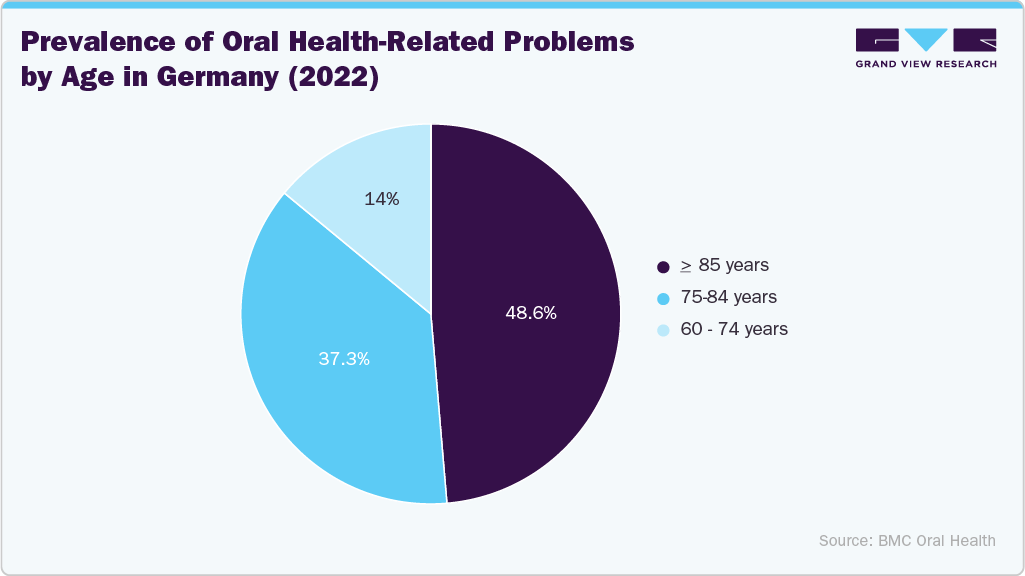

The increasing prevalence of dental diseases such as dental caries and periodontal disorders is another key driving factor for the oral care market. The rising consumption of sugar-rich diets, poor oral hygiene habits, and aging populations have contributed to a higher incidence of these conditions worldwide. The demand for preventive, therapeutic, and maintenance oral care products, including toothpastes, mouthwashes, and interdental solutions, continues to grow.

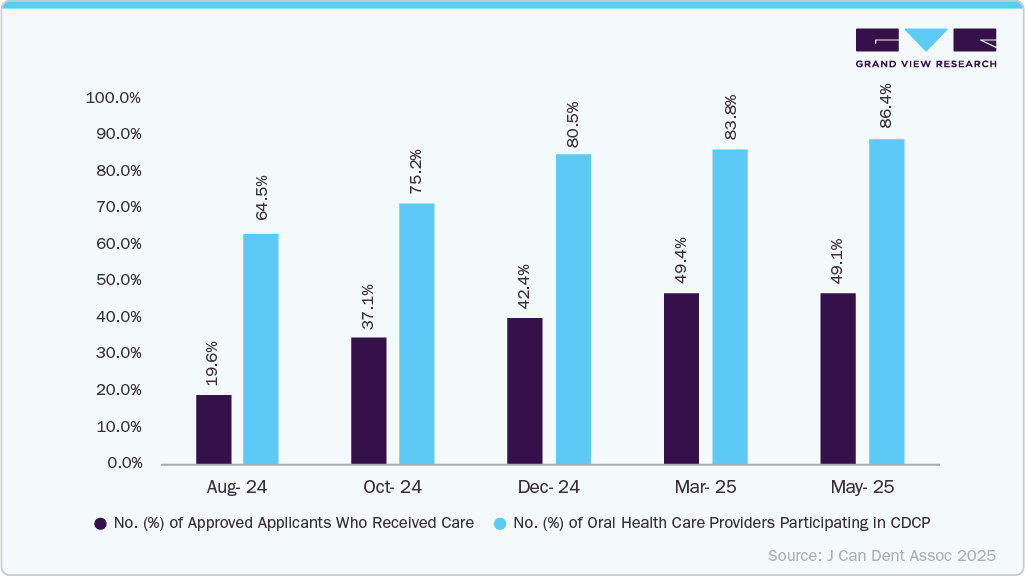

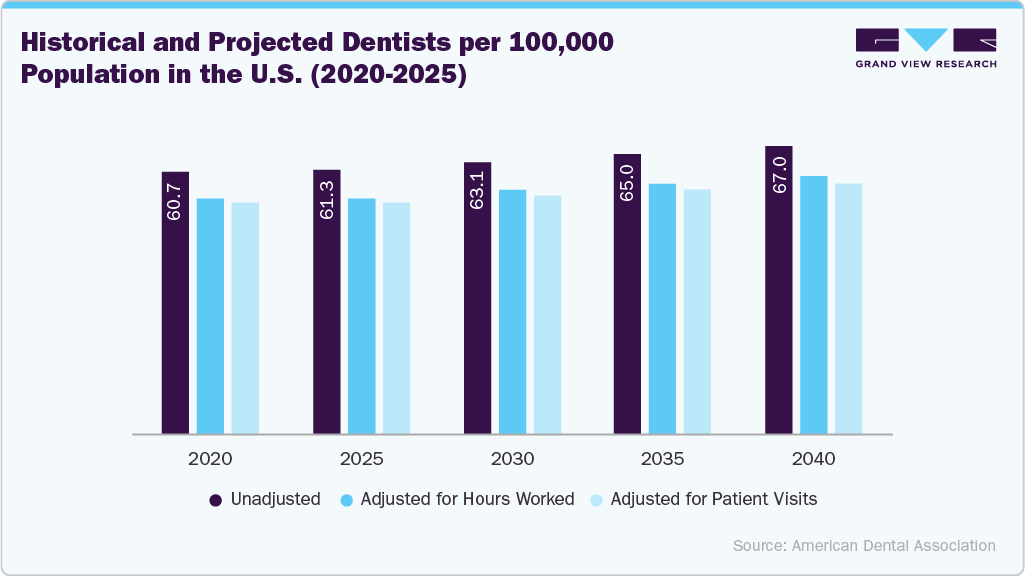

The rising number of registered dentists and their increased availability is another important driving factors for the oral care market. Growth in the dental workforce is improving access to professional oral healthcare services and increasing the frequency of dental consultations and preventive treatments. This expansion fosters higher awareness, earlier diagnosis, and increased adoption of oral care products, thereby contributing to sustained market growth.

Total number of eligible (and approved) applicants, number of those receiving care and number of oral health care providers participating in the CDCP between August 2024 and May 2025

Registration in Dental Care by Specialty (2025)

Specialty

Male

Female

Gender Unknown

Total

Dental and Maxillofacial Radiology

19

14

0

33

Dental Nurse

0

1

0

1

Dental Public Health

33

49

0

82

Endodontics

239

90

0

329

Oral and Maxillofacial Pathology

20

20

0

40

Oral Medicine

42

35

0

77

Oral Microbiology

1

4

0

5

Oral Surgery

497

266

0

763

Total

851

479

0

1,330

Source: GDC UK

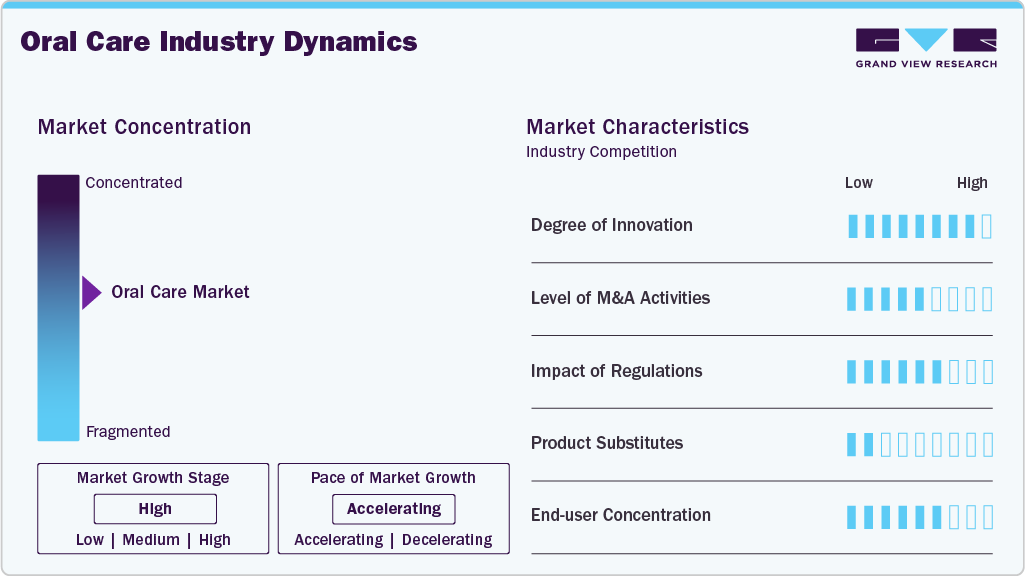

Market Concentration & Characteristics

The oral care market demonstrates a moderate to high degree of innovation, driven by advancements in smart toothbrushes, AI-enabled oral monitoring, and personalized preventive care solutions. Integration of digital technologies, eco-friendly materials, and clinically validated formulations is reshaping product differentiation and enhancing consumer engagement. The collaboration between dental professionals and manufacturers continues to accelerate innovation focused on efficacy, convenience, and long-term oral health outcomes. For instance, in September 2025, Philips announced the launch of the Philips Sonicare 6300 and Philips Sonicare 7400 electric toothbrushes, introducing Next-Generation Sonicare technology to elevate oral care. Developed with dental patients in mind, these advanced devices deliver a powerful yet gentle clean, along with real-time guidance and personalized brushing feedback, helping users achieve healthier teeth and gums with greater comfort and confidence.

“Many patients worry that power toothbrushes might be too harsh for their teeth and gums, leading them to stick with manual toothbrushes they believe are ‘good enough.’ However, manual brushing can often miss plaque in hard-to-reach areas or fail to deliver consistent pressure,” said Matina Vidalis, Senior Marketing Director, Consumer & Professional Oral Healthcare, Philips Personal Health North America. “Thoughtfully designed to ease the transition from manual to power brushing, Philips Sonicare 6300 and 7400 offer gentle yet effective care for sensitive teeth and gums. These innovations empower dental professionals not only to elevate their standard of care, but also to confidently guide patients in making the switch, helping them achieve a superior clean and healthier gums with ease.”

The oral care market has experienced a moderate to high level of mergers and acquisitions, as companies seek to strengthen their brand portfolios, expand into premium and therapeutic segments, and enhance their global reach. Strategic deals, including mergers, brand acquisitions, and technology-driven takeovers, are enabling manufacturers to sharpen focus, accelerate innovation, and improve competitive positioning in both consumer and professional oral care segments. For instance, in September 2025, Ken Paxton announced that he had secured a historic agreement with Colgate-Palmolive Company, following concerns that major toothpaste manufacturers were depicting excessive amounts of fluoride toothpaste in their marketing and packaging materials.

“This historic agreement with Colgate is an incredible example of what is possible when American companies are willing to take concrete steps to protect the health of our children and families. We commend Colgate for being the first major toothpaste manufacturer to make meaningful change in this space and hope other companies follow their lead,” said Attorney General Paxton.

Regulations have a significant impact on the oral care market by ensuring product safety, quality, and efficacy while shaping how products are developed, labeled, and marketed. Compliance with regulatory frameworks, such as medical device classifications for powered toothbrushes and ingredient controls for toothpaste and mouthwashes, can increase development costs and time to market. However, these regulations also enhance consumer trust and encourage manufacturers to invest in clinically validated, high-quality innovations. The table below shows the medical device classification of toothbrushes.

Device Name

Device Class

Toothbrush, Powered

Class 1

Toothbrush, Ionic, Battery-Powered

Class 1

Powered Radiofrequency Toothbrush

Class 2

Source: FDA

End-user concentration in the oral care market is largely centered on households and dental professionals, with demand driven by routine daily consumption and regular clinical recommendations. The ongoing acquisitions among major manufacturers are consolidating brand portfolios and distribution networks, enabling companies to better serve large consumer bases and strengthen their presence across retail, pharmacy, and professional dental channels.

Product Insights

The toothpaste segment dominates the oral care market in 2025. Due to its essential role in daily oral hygiene and widespread adoption across all age groups. High consumer awareness, frequent repeat purchases, and the availability of diverse formulations, including anticavity, sensitivity relief, whitening, and herbal variants, supported strong demand. Continuous product innovation and extensive retail penetration further reinforced toothpaste’s leading share within the overall oral care market. For instance, in January 2026, MedicalXpress reported the development of a new toothpaste formulation capable of inhibiting periodontal pathogens, highlighting ongoing innovation aimed at improving gum health and preventing periodontal disease.

The toothbrush segment is anticipated to grow at the fastest CAGR of 7.59% in the oral care market during the forecast period, supported by rising oral hygiene awareness and increasing dental issues. The rapid adoption of electric and smart toothbrushes, which offer features such as pressure sensors and timers, is further driving growth. Shifting consumer preference toward advanced and premium oral care solutions continues to accelerate demand.

For instance, in December 2025, Great Gums Inc. announced the U.S. launch of its bioelectric toothbrush, a clinically validated oral care device that uses safe microcurrents to remove plaque from hard-to-reach areas that conventional bristles often fail to clean effectively.

“Our success in Asia has demonstrated strong market demand for effective oral health solutions,” said Young Wook Kim, co-founder of Great Gums Inc. “We are confident that U.S. consumers will respond to our scientifically validated approach without relying on increased physical force.”

Distribution Channel Insights

These retail formats provide easy access to essential oral care products, including toothpaste, toothbrushes, mouthwashes, and denture care items, often supported by in-store promotions and competitive pricing. Their established distribution networks and convenience for routine household shopping continue to make them the preferred purchasing channel for a large share of consumers.

The online retail store segment is expected to grow at the fastest CAGR in the oral care market. Driven by increasing consumer preference for convenient shopping, wide product availability, and competitive pricing. The rise of e-commerce platforms, direct-to-consumer brand websites, and digital marketplaces has made it easier for customers to compare products, access detailed reviews, and receive home delivery. This shift is further supported by digital marketing, subscription models, and enhanced logistics, all of which contribute to accelerated online sales growth in the oral care sector.

Regional Insights

North America Oral Care Market Trends

The oral care market in North America held the largest share and accounted for 31.20% of global revenue in 2025. This can be attributed to growth as consumers emphasize preventive dental health and advanced oral care solutions. There is strong demand for electric and smart toothbrushes, whitening products, and specialized formulations for addressing sensitivity and gum health. Interest in natural and eco-friendly products is also rising. Widespread retail availability and online channels are supporting broader market penetration.

U.S. Oral Care Market Trends

The oral care market in the U.S. held the largest revenue share in North America's oral care market in 2025. Demand for electric and smart toothbrushes, whitening products, and specialized toothpaste for sensitivity or enamel protection is increasing. There is also growing interest in natural and sustainable oral care options. Convenience and online shopping are further boosting product accessibility and market growth.

Europe Oral Care Market Trends

The European oral care market is experiencing significant growth as consumers increasingly prioritize dental health and preventive care. There is a growing demand for innovative products, including electric toothbrushes, whitening solutions, and natural or sensitive-care formulations. Sustainability and eco-friendly packaging are becoming more important to buyers. Strong retail infrastructure and heightened health awareness are driving broader market adoption across the region.

The UK oral care market is growing as consumers increasingly prioritize preventive dental health and overall well-being. There is strong demand for innovative products, such as electric toothbrushes, interdental cleaners, and tailored toothpaste for sensitivity or whitening. The growing preference for natural and sustainable oral care options is also influencing purchasing decisions. Broad availability through high-street retail and online channels continues to support market expansion.

Projected Oral Health Trends in the UK (2020-2050)

Condition / Population Group

2020

2050 (Projected)

Change / Trend

People living with gum disease

42% of population

54% of population

Significant increase

People with signs of gum disease (gum pockets, tissue loss)

25.7 million

28 million

Increase of 2.3 million

People with gum tissue loss alone

18.7 million

~21 million

Increase of 2.3 million

Adults aged 16-59 with tooth decay

15.7 million

15.5 million

Slight decrease (-1.5%)

Adults aged 60+ with tooth decay

5 million

9.6 million

Nearly doubled (+92%)

Source: Adult Dental Health Survey (ADHS)

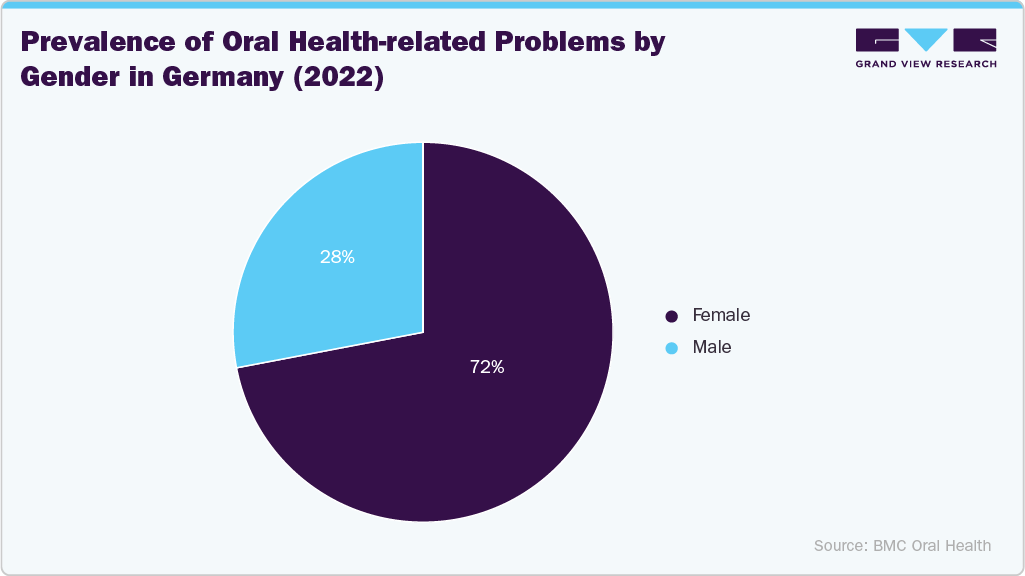

Germany’s oral care market is experiencing significant growth as consumers increasingly prioritize preventive dental health and high-quality products. There is an increasing demand for advanced solutions, such as electric toothbrushes, interdental tools, and specialized toothpaste for sensitivity or whitening. Eco-friendly and natural oral care options are also gaining popularity. Strong retail networks and health awareness continue to support market expansion.

Asia Pacific Oral Care Market Trends

The Asia Pacific oral care market is expanding significantly as consumers prioritize dental hygiene and preventive care. Demand is rising for innovative products, including electric toothbrushes, herbal and natural toothpastes, and whitening solutions. Urbanization, growing disposable incomes, and the wider distribution of products through modern retail and e-commerce are further driving market growth across the region.

Japan’s oral care market is experiencing significant growth as consumers prioritize preventive dental health and seek innovative solutions. There is a growing demand for advanced products, such as electric toothbrushes, interdental cleaners, and toothpaste specifically designed to target sensitivity and gum care. Traditional preferences for gentle, high-quality formulations coexist with interest in new technologies. Strong retail presence and health awareness support ongoing market development.

Cavity Rates Among Students in Japan (2024)

Student Group

Cavity Rate (%)

Kindergarteners

20.74

Elementary School Students

32.89

Junior High School Students

26.5

High School Students

34.7

Source: Japan Health Ministry

Latin America Oral Care Market Trends

The Latin America oral care market is witnessing consistent growth, fueled by rising consumer awareness of oral hygiene and expanding middle-class income levels. There is a growing demand for premium and innovative products such as electric toothbrushes and whitening solutions. The increasing availability through modern retail and e-commerce channels is further enhancing market penetration across the region.

MEA Oral Care Market Trends

The MEA oral care market is experiencing significant growth driven by increasing awareness of dental hygiene and a rising prevalence of oral health issues. Demand for advanced products, such as electric toothbrushes and natural oral care formulations, is gaining traction. The expanding retail channels and improved access to dental care services across the region are further supporting market development.

Key Oral Care Company Insights

Key companies in the oral care market, including major global and regional players, exert significant influence through their extensive product portfolios and distribution networks. Leading brands compete in segments like toothbrushes, toothpaste, and mouthwash, driving innovations and marketing efforts to capture market share. While established multinationals retain a large portion of the market, emerging local and niche brands are gaining traction with specialized and natural products. The competitive dynamics are shaped by product innovation, brand loyalty, and the expansion of retail and e-commerce channels.

Key Oral Care Companies:

The following are the leading companies in the oral care market. These companies collectively hold the largest market share and dictate industry trends.

- Colgate-Palmolive Company

- GSK plc

- Johnson & Johnson

- Church & Dwight Co., Inc.

- Procter & Gamble

- Unilever

- GC America Inc.

- Lion Corporation

- Sunstar Suisse S.A.

- Ivoclar Vivadent

- Solventum

- Koninklijke Philips N.V.

- FOREO

- Jordan

- Haleon Group of Companies

- BURST Oral Care

- Hismile Pty Ltd.

- Perrigo Company plc,

- Salt Oral Care

- Oracura

- STIM

- Glidewell

- Panasonic Industry

- Great Gums

- Ultradent Products Inc.

- VITA Zahnfabrik

- Avadent

- BISCO Inc.

- Kuraray America, Inc

- Prestige Consumer Healthcare Inc

- Tokuyama Dental Corporation

Recent Developments

-

In December 2025, Great Gums Inc. announced the U.S. launch of its bioelectric toothbrush, a clinically validated oral care device that uses safe microcurrents to enhance plaque removal, particularly in hard-to-reach areas where conventional bristles are less effective.

-

In September 2025, Philips unveiled the Philips Sonicare 6300 and Philips Sonicare 7400 electric toothbrushes, introducing next-generation Sonicare technology. Designed with dental patients in mind, these advanced devices deliver powerful yet gentle clean, real-time guidance, and personalized brushing insights, helping users achieve healthier teeth and gums with greater confidence.

-

In September 2025, Ken Paxton and Colgate-Palmolive announced a historic agreement to strengthen toothpaste safety standards, aimed at preventing excessive fluoride exposure and enhancing consumer protection across oral care products.

-

In August 2025, Lion Corporation announced the nationwide launch of Dent Health Medicated Toothpaste DX Premium, a formulation featuring the brand’s highest concentration and widest range of medicated ingredients. The product is designed to promote gum recovery and deliver comprehensive care for periodontitis, reinforcing Lion’s focus on advanced therapeutic oral care solutions.

-

In July 2022, Haleon plc announced the successful completion of the demerger of the Consumer Healthcare business from the GSK Group, resulting in the establishment of the independent Haleon Group. This corporate restructuring brought key oral care brands, such as Sensodyne, Aquafresh, and Polident, under Haleon’s standalone portfolio, reshaping the competitive dynamics in the global oral care market.

-

In May 2021, GSK Consumer Healthcare committed to making over one billion toothpaste tubes recyclable by 2025, reinforcing its long-term sustainability strategy and efforts to reduce plastic waste across its oral care portfolio.

Oral Care Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 42.29 billion

Revenue forecast in 2033

USD 66.37 billion

Growth rate

CAGR of 6.65% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Colgate-Palmolive Company; GSK plc; Johnson & Johnson; Church & Dwight Co., Inc.; Procter & Gamble; Unilever; GC America Inc.; Lion Corporation; Sunstar Suisse S.A.; Ivoclar Vivadent; Solventum; Koninklijke Philips N.V.; FOREO; Jordan; Haleon Group of Companies; BURST Oral Care; Hismile Pty Ltd.; Perrigo Company plc; Salt Oral Care; Oracura; STIM; Glidewell; Panasonic Industry; Great Gums; Ultradent Products Inc.; VITA Zahnfabrik; Avadent; BISCO Inc.; Kuraray America, Inc; Prestige Consumer Healthcare Inc; Tokuyama Dental Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oral Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global oral care market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Toothbrush

-

Manual

-

Electric (rechargeable)

-

Battery-powered (non-rechargeable)

-

Others

-

-

Toothpaste

-

Gel

-

Polish

-

Paste

-

Powder

-

-

Mouthwash/Rinse

-

Medicated

-

Nonmedicated

-

-

Denture Products

-

Cleaners

-

Fixatives

-

Others

-

-

Dental accessories

-

Cosmetic Whitening Products

-

Fresh Breath Dental Chewing Gum

-

Tongue Scrapers

-

Fresh Breath Strips

-

Others

-

Oral Irrigators

-

Countertop

-

Cordless

-

-

Mouth Freshener Sprays

-

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets/Hypermarkets

-

Convenience stores

-

Online retail stores

-

Pharmacies and drug stores

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oral care market size was estimated at USD 39.94 billion in 2025 and is expected to reach USD 42.29 billion in 2026.

b. The global oral care market is expected to grow at a compound annual growth rate of 6.65% from 2026 to 2033 to reach USD 66.37 billion by 2033.

b. North America dominated the oral care market, with a share of 31.20% in 2025. This can be attributed to the growing awareness of dental hygiene among people. In addition, the high prevalence of dental caries is expected to drive the market.

b. Some of the key players in the oral care market are Colgate-Palmolive Company, GSK plc., Johnson & Johnson, Church & Dwight Co., Inc., Procter & Gamble, Unilever, GC America Inc., Lion Corporation, Sunstar Suisse S.A., Ivoclar Vivadent, Solventum, Koninklijke Philips N.V., FOREO, Jordan, Haleon Group of Companies, BURST Oral Care, Hismile Pty Ltd., Perrigo Company plc, Salt Oral Care, Oracura, STIM, Glidewell, Panasonic Industry, Great Gums, Ultradent Products Inc., VITA Zahnfabrik, Avadent, BISCO Inc., Kuraray America, Inc, Prestige Consumer Healthcare Inc, and Tokuyama Dental Corporation, among others.

b. Key factors that are driving the oral care market growth include growing awareness about dental hygiene and the rising prevalence of dental caries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.