- Home

- »

- Medical Devices

- »

-

Oral Sleep Apnea Devices Market Size & Share Report, 2030GVR Report cover

![Oral Sleep Apnea Devices Market Size, Share & Trends Report]()

Oral Sleep Apnea Devices Market Size, Share & Trends Analysis Report By Product (Mandibular Advancement Device, Tongue Retaining Devices), By Sales Channel By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-194-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Oral Sleep Apnea Devices Market Trends

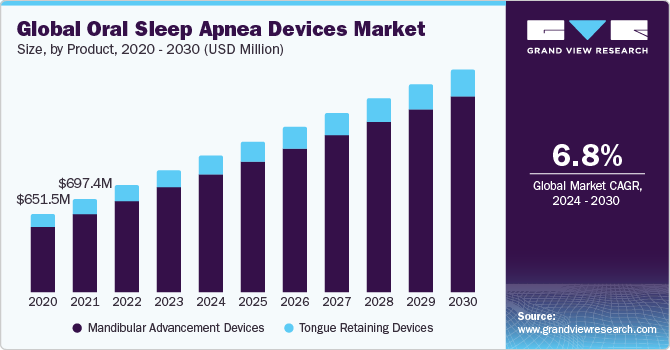

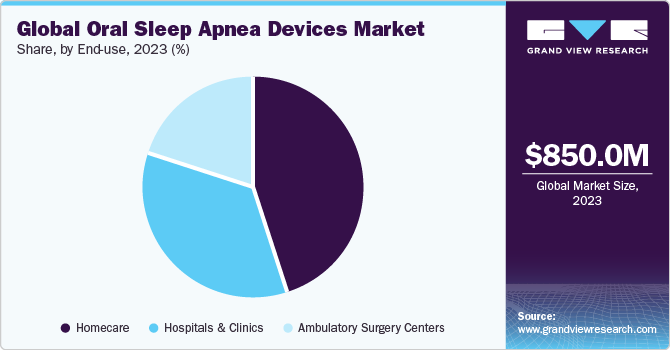

The global oral sleep apnea devices market size was valued at USD 850 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. Obesity is a significant factor in sleep apnea. The global prevalence of obesity is estimated to reach 18% in men and 21% in women by 2025. This, in turn, is estimated to drive the global sleep apnea devices market, as more than half of overweight or obese people suffer from Obstructive Sleep Apnea (OSA).

The outbreak of the COVID-19 pandemic negatively impacted the growth of diagnostic devices for sleep apnea. There was a temporary closure of physician practices, home medical equipment suppliers, and sleep clinics due to quarantine or government restrictions to control the spread of the virus. This, in turn, resulted in a decreased growth rate of diagnostic devices for sleep apnea during the COVID-19 lockdowns. However, the demand for sleep and respiratory care devices witnessed a rapid increase during the pandemic. Using PAP devices as an alternative to ventilators significantly increased the demand for PAP devices.

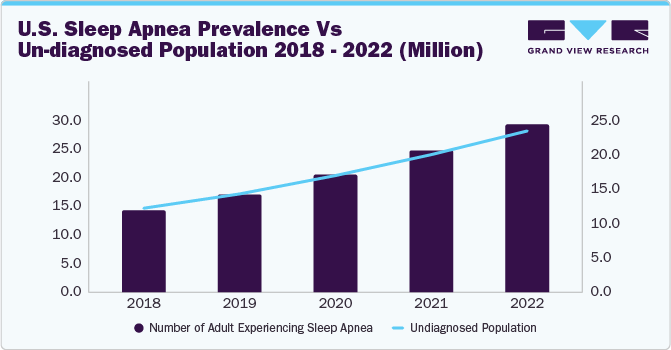

The prevalence of sleep apnea is high in the elderly population and remains underdiagnosed owing to factors such as lack of awareness among people and non-specific presentation of the disease. The growing geriatric population due to increasing life expectancy is expected to lead to a rise in the prevalence of sleep disorders. For instance, according to WHO, in 2018, the world's population of people aged 60 and above is expected to reach 2 billion by 2050. Moreover, the global elderly population (above 60 years) will double from 12% to 22%. In addition, OSA is a common disorder in the elderly population, affecting around 13% to 32% of people above 65 years of age. An increase in the geriatric population is expected to boost the adoption of sleep apnea devices, as this population group is more susceptible to sleep apnea.

Product Insights

Based on the product, the oral sleep apnea devices market is segmented into mandibular advancement devices and tongue-retaining devices. The mandibular advancement devices segment held the largest market share in 2023. These devices are trusted by healthcare professionals for their proven results and established track record. Improved patient outcomes and zero to little side-effects, and cost effectiveness of these devices are the critical factors for the segment's large market share.

Sales Channel Insights

On the basis of sales channel, the market is segmented into physician-prescribed and over-the-counter sales. Physician sales channel held the largest share in 2023. Low patient awareness of sleep apnea in developing and underdeveloped economies is a key contributing factor. Since this disease essentially goes undiagnosed in a large population base, it is only physicians who prescribe these devices.

End-use Insights

Based on end use, the oral sleep apnea devices market is segmented into hospitals & clinics, ambulatory surgical centers, and homecare. The ambulatory surgery centers segment is expected to grow fastest during the forecast period. The substantial presence of Ambulatory Surgery Centers (ASCs) drives the oral sleep apnea devices market, making ambulatory surgical centers the fastest-growing segment. It has been reported that every year, Ambulatory Surgery Centers (ASCs) carry out around 22.5 million procedures in over 5,900 Medicare-certified facilities across the U.S. Additionally, Medicare's participation in the ASC industry results in significant cost savings exceeding USD 4.2 billion per annum, primarily for the procedures that are performed in these centers.

Regional Insights

North America dominated the market in 2023. A large patient pool and the presence of established manufacturers are anticipated to strengthen market growth in this region further. The number of sleep tests conducted in the U.S. is increasing rapidly as many people are concerned about the health risks of sleep apnea. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. Rapidly developing healthcare expenditure, improving healthcare infrastructure, rising geriatric population, and increasing prevalence of lifestyle diseases are among the key factors driving the Asia Pacific oral sleep apnea devices market.

Competitive Insights

Key players operating in the market are SomnoMed, ResMed, Whole You, ProSomnus Sleep Technologies, Vivos Therapeutics, Oventus Medical, Airway Management, Apnea Sciences, and Dynafles. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In January 2023, the FDA cleared Vivos Therapeutics' daytime-nighttime oral appliance as a Class II device for mild-to-moderate obstructive sleep apnea. It opens the airway through palate expansion and can replace the need for CPAP therapy.

-

In 2021, GoPAPfree released a new oral appliance therapy device that offers a comfortable and effective alternative to CPAP therapy for obstructive sleep apnea treatment. The device can be easily customized and molded at home.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."