- Home

- »

- Medical Devices

- »

-

Organ Preservation Market Size, Industry Report, 2030GVR Report cover

![Organ Preservation Market Size, Share & Trends Report]()

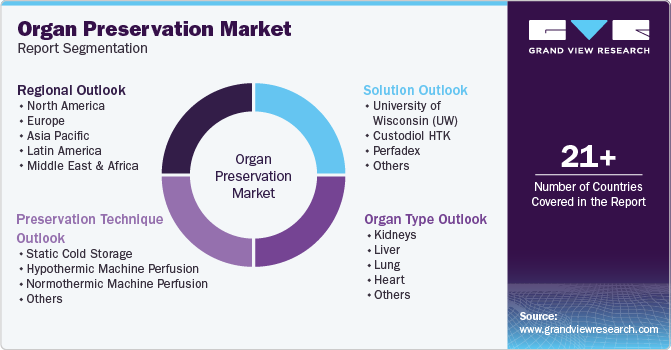

Organ Preservation Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution (University Of Wisconsin (UW), Custodiol HTK, Perfadex), By Organ Type, By Preservation Technique, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-220-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Organ Preservation Market Summary

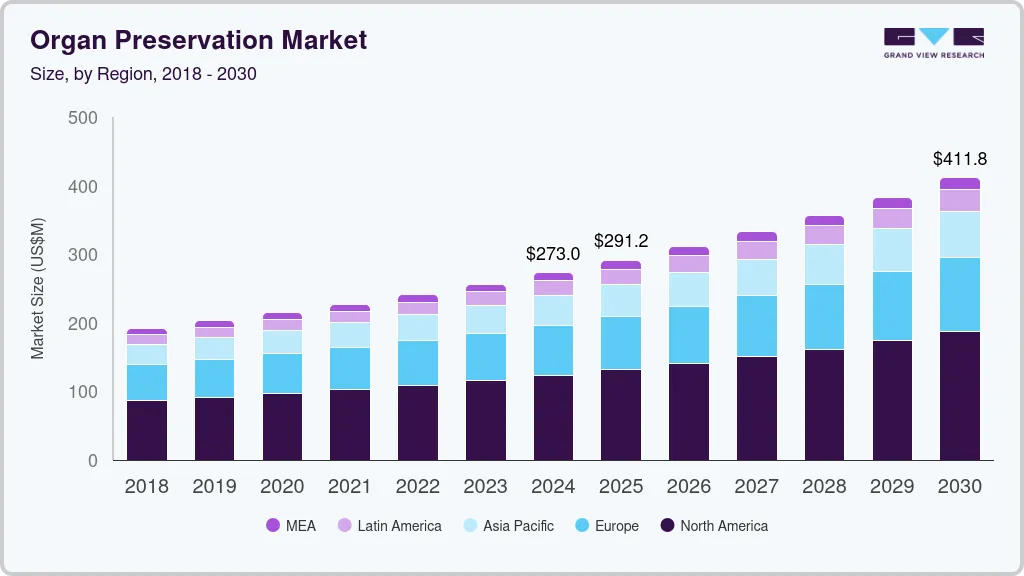

The global organ preservation market size was estimated at USD 273.0 million in 2024 and is projected to reach USD 411.8 million by 2030, growing at a CAGR of 7.2% from 2025 to 2030. Market growth is driven by key factors such as increasing demand for organ transplants, technological advancements, an aging population, and proactive government initiatives.

Key Market Trends & Insights

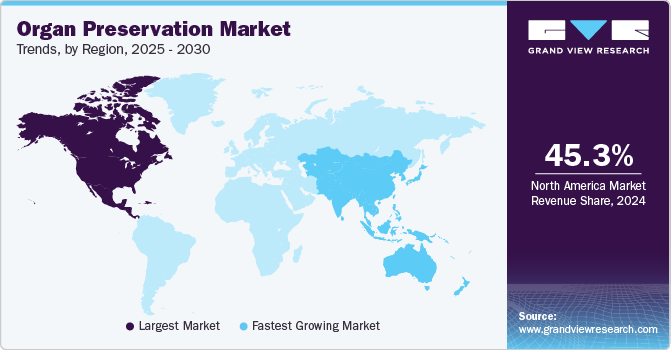

- The North America organ preservation market dominated the global market with a revenue share of 45.3% in 2024.

- The Asia Pacific organ preservation market is expected to register the fastest CAGR of 6.1% in the forecast period.

- Based on solution, the university of wisconsin (UW) dominated the market and accounted for a share of 36.0% in 2024.

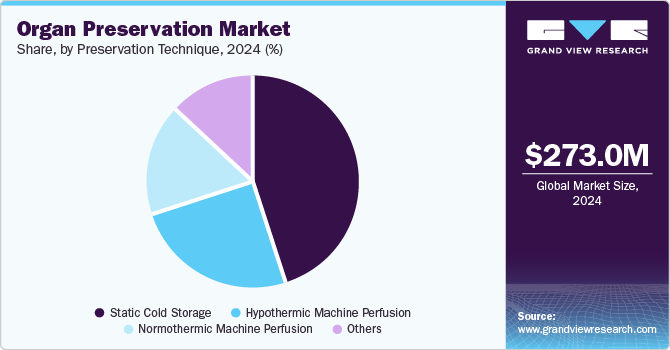

- Based on preservation technique, the static cold storage segment held the largest share of 45.1% in 2024.

- Based on organ type, the kidneys led the market with a revenue share of 34.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 273.0 Million

- 2030 Projected Market Size: USD 411.8 Million

- CAGR (2025-2030): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The United Network for Organ Sharing reported that in 2022, the U.S. performed 42,887 organ transplants, reflecting a 3.7% increase from the previous year. This upward trend is primarily attributed to rising rates of organ failure linked to chronic diseases such as diabetes and hypertension, creating an urgent need for effective preservation solutions that ensure the viability of organs during transportation and storage.

Technological innovations are also pivotal in advancing the organ preservation landscape. Improvements in machine perfusion techniques have shown promising results in increasing organ survival rates. These advancements demonstrate a commitment to innovation within the preservation methods and ensure successful transplantation outcomes, attracting investments and further igniting interest in the market.

According to the U.S. Census Bureau, it is projected that 20% of the U.S. population will be aged 65 and older by 2024, leading to a higher incidence of age-related diseases necessitating organ transplants. This significant increase in the elderly population will intensify the demand for effective preservation solutions, particularly for kidney, liver, and heart transplants, as more elderly patients require these critical procedures.

Government initiatives further bolster the organ preservation market by enhancing organ donation rates through awareness campaigns and funding. For instance, in February 2023, the Indian Express reported that the Brihanmumbai Municipal Corporation (BMC) in India allocated approximately USD 924 million to improve healthcare services and promote organ donation awareness. Such governmental support is vital in driving the need for efficient preservation methods, particularly in emerging markets such as the Asia Pacific, where healthcare expenditures are rising. This convergence of factors is preparing the organ preservation industry for substantial growth in the coming years.

Solution Insights

University of Wisconsin (UW) dominated the market and accounted for a share of 36.0% in 2024. The UW solution greatly extended preservation durations for organs such as kidneys and livers. Recent enhancements, which incorporate natural trophic factors, have further optimized its efficacy, enabling longer storage with reduced injury, thereby addressing the shortage of transplantable organs and enhancing transplant success rates.

Perfadex is expected to grow at the fastest CAGR of 7.4% over the forecast period, fueled by Perfadex’s proven effectiveness in lung preservation, which significantly lessens reperfusion injury and enhances graft viability. Designed specifically for lung transplants, Perfadex minimizes edema and improves functional performance during ischemia, resulting in superior organ quality and reduced acute graft failure rates for transplant recipients.

Preservation Technique Insights

The static cold storage segment held the largest share of 45.1% in 2024, attributed to the simplicity and effectiveness of the SCS preservation technique, which has been standard for over 50 years. This method minimizes cellular metabolism and maintains organ viability through cold preservation solutions and ice storage, ensuring successful kidney transplantation outcomes while addressing organ ischemia challenges.

Normothermic machine perfusion is projected to grow at the fastest CAGR of 7.2% over the forecast period. NMP maintains organs in a metabolically active state, enhancing viability before transplantation. This technique enables real-time assessment of organ function and rehabilitation through nutrient infusion, reducing ischemia-reperfusion injury. NMP has demonstrated promising outcomes for marginal organs, expanding the donor pool and improving transplant success rates.

Organ Type Insights

Kidneys led the market with a revenue share of 34.5% in 2024, supported by the rising incidence of ESRD and chronic conditions such as diabetes and hypertension. As kidneys remain the most frequently transplanted organs, the critical shortage of donor kidneys underscores the necessity for effective preservation methods to enhance viability during transportation and storage.

The heart segment is expected to register the fastest growth of 6.8% over the forecast period. As heart transplant rates increase with the rising prevalence of coronary artery disease and heart failure, the importance of effective preservation methods escalates. Advanced preservation techniques improve organ viability during transport, facilitating better outcomes for transplant recipients and addressing the critical shortage of donor hearts in transplantation programs.

Regional Insights

North America organ preservation market dominated the global market with a revenue share of 45.3% in 2024. The region boasts enhanced healthcare infrastructure, substantial investments in research and development, and increasing organ transplant rates. Strong governmental support for organ donation initiatives and innovative preservation techniques further improve organ viability and transplant success rates, effectively addressing the rising demand for transplantation.

U.S. Organ Preservation Market Trends

The organ preservation market in the U.S. dominated the North America organ preservation market with the largest revenue share in 2024. With around 40,000 organ transplants conducted each year, advances in preservation technologies and robust public awareness campaigns significantly boost the demand for effective preservation solutions, ultimately ensuring improved outcomes for transplant recipients and enhancing the overall efficiency of the transplantation process.

Europe Organ Preservation Market Trends

Europe organ preservation market held substantial market share in 2024. The region is supported by strong regulatory frameworks that promote organ donation and transplantation, coupled with continuous research into advanced preservation techniques. These efforts enhance organ viability and ultimately lead to improved patient outcomes in the transplantation process.

The organ preservation market in Germany is expected to grow in the forecast period. The country has experienced an increase in organ transplant procedures, bolstered by government initiatives that promote organ donation. Furthermore, advancements in preservation techniques are significantly enhancing the viability of donated organs, thereby contributing to improved success rates in transplantation outcomes.

Asia Pacific Organ Preservation Market Trends

Asia Pacific organ preservation market is expected to register the fastest CAGR of 6.1% in the forecast period. The region is witnessing heightened healthcare investments alongside a growing population affected by chronic diseases. Increased awareness of organ donation and transplantation, combined with advancements in preservation technologies, is driving demand. Furthermore, the expanding healthcare infrastructure enhances access to organ preservation solutions, addressing the urgent need for effective transplant options.

The organ preservation market in India is expected to register the fastest growth in the Asia Pacific market over the forecast period. Government initiatives aimed at enhancing healthcare services and promoting organ transplantation are pivotal in driving market growth. Moreover, improvements in preservation techniques are increasing the viability of organs during transport, effectively addressing the rising demand for successful transplant outcomes within the country.

Key Organ Preservation Company Insights

Some key companies operating in the market include XVIVO; TransMedics, Inc.; 21st Century Medicine; Bridge to Life Ltd.; Preservation Solutions, Inc.; among others. Key players are implementing strategies including mergers, acquisitions, and partnerships to strengthen market presence. Initiatives focus on innovative preservation solutions and expansion into emerging markets to enhance organ viability and transplant success rates.

-

TransMedics, Inc. specializes in advanced organ preservation technologies, particularly the Organ Care System (OCS), facilitating normothermic perfusion of donor hearts, lungs, and livers. This system enhances organ viability and enables real-time quality assessment prior to transplantation.

-

Preservation Solutions, Inc. specializes in the development and manufacturing of organ transplantation preservation solutions. Their flagship product, the University of Wisconsin (UW) solution, is extensively utilized for kidney preservation, enhancing organ viability during storage and transport.

Key Organ Preservation Companies:

The following are the leading companies in the organ preservation market. These companies collectively hold the largest market share and dictate industry trends.

- XVIVO

- TransMedics, Inc.

- 21st Century Medicine

- Bridge to Life Ltd.

- Preservation Solutions, Inc.

- Global Transplant Solutions

- Organ Recovery Systems

- CryoLife, Inc. (Artivion, Inc)

- Paragonix Technologies, Inc (Getinge)

Recent Developments

-

In November 2024, XVIVO completed enrollment for the PRESERVE clinical trial, evaluating their heart technology’s safety and effectiveness, achieving this milestone five months ahead of schedule with 141 patients transplanted.

-

In October 2024, Bridge to Life and ULS Coimbra announced a collaboration to enhance liver preservation for transplantation, launching case studies to highlight innovative procedures at ULS Coimbra’s liver transplant program.

-

In August 2024, Getinge announced the acquisition of Paragonix Technologies for approximately USD 477 million, enhancing its position in the organ preservation and transportation market while expanding its product portfolio.

Organ Preservation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 291.2 million

Revenue forecast in 2030

USD 411.7 million

Growth rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Solution, organ type, preservation technique, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

XVIVO; TransMedics, Inc.; 21st Century Medicine; Bridge to Life Ltd.; Preservation Solutions, Inc.; Global Transplant Solutions; Organ Recovery Systems; CryoLife, Inc. (Artivion, Inc); Paragonix Technologies, Inc (Getinge)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organ Preservation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organ preservation market report based on solution, organ type, preservation technique, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

University of Wisconsin (UW)

-

Custodiol HTK

-

Perfadex

-

Others

-

-

Organ Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Kidneys

-

Liver

-

Lung

-

Heart

-

Others

-

-

Preservation Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Static Cold Storage

-

Hypothermic Machine Perfusion

-

Normothermic Machine Perfusion

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.