- Home

- »

- Consumer F&B

- »

-

Organic Baby Food Market Size & Share Report, 2028GVR Report cover

![Organic Baby Food Market Size, Share & Trends Report]()

Organic Baby Food Market Size, Share & Trends Analysis Report By Product (Infant Milk Formula, Prepared Baby Food, Dried Baby Food), By Distribution Channel (Supermarket/Hypermarkets), By Region And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-931-4

- Number of Report Pages: 78

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2020 - 2028

- Industry: Consumer Goods

Report Overview

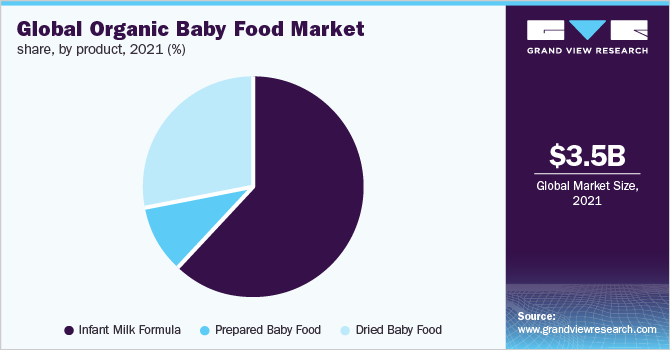

The global organic baby food market size was valued at USD 3.53 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2028. The growing organic food and beverages industry and increasing spending on baby food products are expected to promote market growth over the forecast period. The rising parental concerns over the baby’s health and nutrition in developing and developed countries are major driving factors in the market over the last few years. Moreover, the increasing awareness about the benefits of organic food products among consumers is propelling market growth.

The increasing demand for organic packaged food like ready-to-eat is anticipating the growth of the global market. In addition to this, the rising population of working women globally has projected the growth of the market over the forecast period. Furthermore, the market is driven by trends like clean labeled production and nutritious diets of baby food.

The manufacturers are providing the product with infant milk formula, prepared baby food, and dried baby food. However, stringent government rules and regulations regarding labeling of the products coupled with the high cost associated are hindering the growth of the market. Meanwhile, government guidelines in countries such as the U.S., Germany, U.K., China, and India are expected to maintain the quality of organic baby food. For instance, in the U.S., government agencies such as the U.S. Department of Agriculture (USDA) and the Food and Drug Administration (FDA) impose multiple federal regulations and guidelines for organic food product manufacturers. The published federal guidelines and rules ensure the quality of organic baby food products up to the hygienic standards for consumption.

The lockdown announced during the COVID-19 pandemic had disturbed transportation and suspended the supply of raw materials for a short duration as well as significant impacts on the demand and supply chain of the organic baby food products across the globe. The increasing demand for infant formula products after the COVID-19 pandemic will create opportunities for the market players. Thus, the market is expected to witness a healthy market growth rate in the upcoming years.

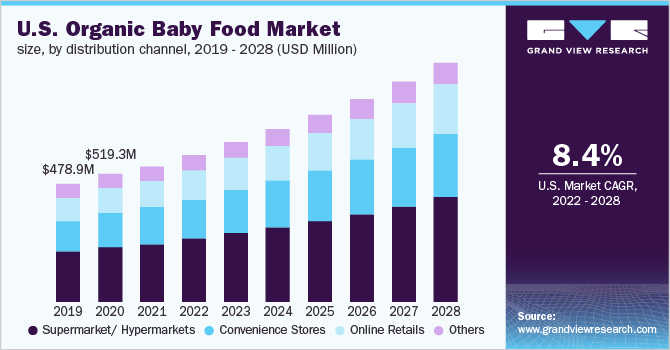

Distribution Channel Insights

Supermarkets & hypermarkets contributed a share of around 45% in the global organic baby food market in 2021. Consumers are preferring hypermarkets & supermarkets for purchasing consumer goods, grocery as well as baby care products, where they can physically verify product quality. Hypermarkets & supermarket channels are expected to remain dominant in the forecast period due to improved distribution channel networks across the globe.

The online retail segment of the market is expected to register the fastest growth with a CAGR of 9.8% from 2022 to 2028. The internet penetration rate has witnessed lucrative growth in recent years, and the growing e-commerce sector globally continues accelerating the market growth. Moreover, the use of online shopping portals and mobile apps is getting popular among the young population which in turn will drive the market demand.

Product Insights

The infant milk formula segment contributed to the largest market share of around 60% in 2021 and is expected to grow with the fastest CAGR of 8.9% from 2022 to 2028. The increasing popularity of organic packaged food products due to chemical-free healthy food has projected market growth in the forecast period. There is rising consumption of innovative organic products as these are convenient and quick sources of energy and nutrition for babies.

The dried baby food segment is expected to grow with the second-highest growth rate of 8.6%, from 2022 to 2028. Dried baby food as convenient nutritious food made available for consumers through retail channels is driving the growth of the market. Moreover, the growing popularity and demand for organic packaged food coupled with the increasing disposable income of the consumers are the significant factors of the market growth.

Regional Insights

The Asia Pacific made the largest contribution to the market with a share of around 45% in 2021. China, India, and Japan have a huge consumer base for the consumption of organic packaged food products, which will drive the regional demand. The rising number of newborns in China and India will create opportunities for manufacturers of organic packaged food products to develop organic baby food products to fulfill the consumer’s demand. Consumers concerned about baby’s health are anticipated to boost the industry growth over the upcoming years.

Europe is the fastest-growing market and is expected to witness a CAGR of 9.1% from 2022 to 2028. Rising consumption of organic packaged food products due to their environmentally friendly and high nutritious quality has projected market growth. Moreover, the development of the new blends by the manufacturers having a better combination with the organic baby food has projected the market growth over the forecast period in this region.

Key Companies & Market Share Insights

The market has a presence of various established players coupled with local manufacturers. Recently, on 18th January 2021, Hero Group acquired Baby Gourmet, a leading organic snack and meal brand for babies in Canada. With this acquisition, the Hero Group and Baby Gourmet will expand the natural & organic, and nutritious footprint of Baby Gourmet in North America. Such initiatives are expected to boost the adoption rate of the product among consumers. The manufacturers are aggressively following the organic as well as inorganic strategies to expand their footprints across the geography. Some of the key players operating in the global organic baby food market include:

-

Nestle SA

-

Abbott Laboratories

-

Danone SA

-

The Kraft Heinz Company

-

Mead Johnson & Company, LLC

-

Lactalis

-

The Hain Celestial Group Inc.

-

Hero Group

-

Sprout Organic Foods, Inc.

-

Hipp Gmbh & Co Vertrieb KG

-

Baby Gourmet Foods Inc.

-

Amara Organic Foods

Organic Baby Food Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.82 billion

Revenue forecast in 2028

USD 6.34 billion

Growth Rate

CAGR of 8.7% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Nestle SA; Abbott Laboratories; Danone SA; The Kraft Heinz Company; Mead Johnson & Company LLC; Lactalis; The Hain Celestial Group Inc.; Hero Group; Sprout Organic Foods, Inc.; Hipp Gmbh & Co Vertrieb KG; Baby Gourmet Foods Inc.; Amara Organic Foods

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the organic baby food market based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Infant Milk Formula

-

Prepared Baby Food

-

Dried Baby Food

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Supermarket/ Hypermarkets

-

Convenience Stores

-

Online Retails

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic baby food market size was estimated at USD 3.53 billion in 2021 and is expected to reach USD 3.82 billion in 2022.

b. The global organic baby food market is expected to grow at a compound annual growth rate of 8.7% from 2022 to 2028 to reach USD 6.34 billion by 2028.

b. The Asia Pacific dominated the organic baby food market with a share of 46.2% in 2021. This is attributable to the presence of a huge consumer base for the consumption of organic packaged food products in developing countries including China, India, and Japan.

b. Some key players operating in the organic baby food market include Nestle SA; Abbott Laboratories; Danone SA; The Kraft Heinz Company,; Mead Johnson & Company, LLC; Lactalis; The Hein Celestial Group Inc.; Hero Group; Sprout Organic Foods, Inc.; and Hipp Gmbh & Co Vertrieb KG

b. Key factors that are driving the organic baby food market growth include the growing organic food and beverages industry and increasing spending on baby food products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."