- Home

- »

- Beauty & Personal Care

- »

-

Organic Bar Soap Market Size & Share Report, 2030GVR Report cover

![Organic Bar Soap Market Size, Share & Trends Report]()

Organic Bar Soap Market (2022 - 2030 ) Size, Share & Trends Analysis Report By Distribution Channel (Supermarkets/Hypermarkets, General Stores, Online), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68039-963-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Bar Soap Market Summary

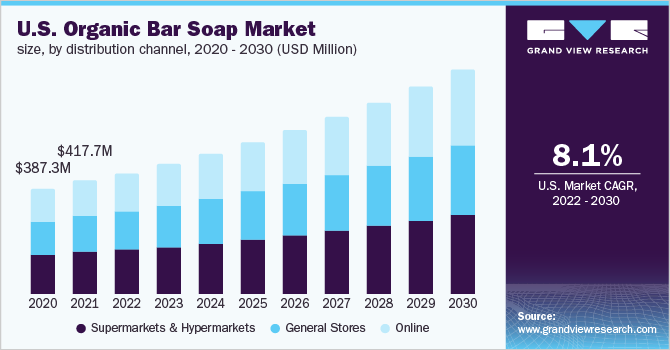

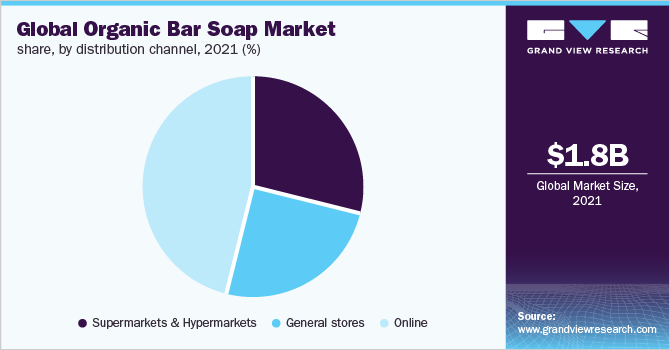

The global organic bar soap market size was estimated at USD 1.83 billion in 2021 and is projected to reach USD 3.64 billion by 2030, growing at a CAGR of 8.2% from 2022 to 2030. The market's growth is reliant upon the global consumer inclination toward well-being. Additionally, the market is driven by changing consumer behavior patterns for beauty and personal care globally.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a 33.1% share of global revenue in 2021.

- Middle East and Africa is anticipated to expand at a CAGR of 8.3% during the forecast period.

- Based on distribution channel, the online segment dominated the market and accounted for a 45.8% share of the global revenue in 2021.

Market Size & Forecast

- 2021 Market Size: USD 1.83 Billion

- 2030 Projected Market Size: USD 3.64 Billion

- CAGR (2022-2030): 8.2%

- Asia Pacific: Largest market in 2021

The global organic bar soap supply chain and distribution channel were disrupted by the Coronavirus outbreak, which resulted in the closure of convenience stores and super/hypermarkets across the world. The COVID-19 pandemic increased the demand for organic and sustainable products. Organic products are gaining immense popularity owing to the health benefits they provide, which is driving up the demand for organic and sustainable products.

The pandemic augmented the focus on public health, which influenced people to opt for natural products. This move has given merchants and manufacturers an opportunity to demonstrate their support, market their products, and keep these new customers as long-term natural product consumers.

Vegan, natural, organic, clean, reef-friendly, GMO, gluten-free, soy-free, transparency, and recyclable products are now being demanded by consumers. The manufacturers in the market are introducing innovative products that address consumer demand. For instance, Vibey Soap Co's range of eco-friendly and plant-based soaps available in a range of colors and fragrances creates a positive aura. All of the soaps, from Cucumber & Melon to Almond Mahogany, are vegan and packaged in plastic-free clamshells.

Distribution Channel Insights

The online segment dominated the market and accounted for a 45.8% share of the global revenue in 2021. People's buying habits have been significantly altered by the online distribution channel, which offers benefits such as doorstep service, simple payment options, substantial savings, and the availability of an enormous choice of items on a single platform. Due to increased internet usage and customer preference for shopping apps, major market participants are rapidly building e-commerce websites. Growing consumer inclination towards e-commerce is expected to drive segmental growth.

Online channels include several e-commerce websites like Amazon or Flipkart. The prices of products in these stores vary according to brand, and customers have the option of selecting from a variety of brands to fit their budget. The increasing consumer demand for organic personal care products including organic bar soap has resulted in a surge in portfolio expansions.

Regional Insights

Asia Pacific dominated the market and accounted for a 33.1% share of global revenue in 2021. Consumer's growing concern for skin infections and other health issues is fueling the expansion of the organic soap sector. Consumers are becoming increasingly aware of the benefits of organic soap compared to conventional chemical soap. Moreover, the emergence of organic soaps with a wide range of natural scents is projected to be one of the primary drivers driving demand growth during the forecast period. Several natural plants, including citrus fruits, oats lavender, rosemary, sandalwood, mint, and others, are used to extract the fragrances used in organic soaps. For instance, Friendly Soap produces vegan, cruelty-free luxury bars packaged in reusable and renewable cardboard boxes. They produce soaps in varied fragrances such as lemongrass, lavender, orange, aloe vera, shea butter, etc.

Middle East and Africa is anticipated to expand at a CAGR of 8.3% during the forecast period, in terms of revenue. As the demand for organic components increases, consumers across the world are leaning toward organic personal care products such as organic bar soaps, which is anticipated to boost market expansion in the upcoming years. In the United Arab Emirates, a more holistic approach to beauty is being used. This perspective is widespread among Generation Y and millennials. The expanding trend of "skin care as health" also contributes to the expansion of organic and natural goods. As a result, anti-aging, anti-pollution, and anti-stress products are gaining immense popularity.

Key Companies & Market Share Insights

The global market is characterized by the presence of numerous players. The companies are increasingly focusing on innovation to gain significant market share in the world. For instance, The Great Canadian Soap Company is a small, family-run business. Their specialty is goat milk soap, which is handcrafted on their farm using fresh goat milk, natural oils, and butter. Some of their products include All Natural Handmade Goat Milk Soap, Natural Body Care Products, Natural Skin Moisturizers, and Natural Remedies. Some of the prominent players in the global organic bar soap market include:

-

Neal’s Yard (Natural Remedies) Limited

-

Khadi Natural

-

Dr. Bronners’s Magic Soaps

-

The Body Shop International Limited

-

Forest Essentials

-

Truly’s Natural Products

-

Bali Soap

-

Beach Organics

-

Osmia

Organic Bar Soap Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.94 billion

Revenue forecast in 2030

USD 3.64 billion

Growth rate

CAGR of 8.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, China, India, South Korea, Brazil, Argentina, South Africa

Key companies profiled

Neal’s Yard (Natural Remedies) Limited; Khadi Natural; Dr. Bronners’s Magic Soaps; The Body Shop International Limited; Forest Essentials; Truly’s Natural Products; Bali Soap; Beach Organics; Osmia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Bar Soap Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global organic bar soap market based on distribution channel and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets/Hypermarkets

-

General stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global organic bar soap market size was estimated at USD 1.83 billion in 2021 and is expected to reach USD 1.94 billion in 2022

b. The organic bar soap market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.2% from 2022 to 2030 to reach USD 3.64 billion by 2030

b. The Asia Pacific dominated the organic bar soap market with a revenue share of 33.1% in 2021, on account of several factors including growing awareness regarding health among the consumers and the availability of a wide variety of organic bar soaps.

b. Some of the key players operating in the organic bar soap market include Neal’s Yard (Natural Remedies) Limited, Khadi Natural, Dr. Bronners’s Magic Soaps, The Body Shop International Limited, Forest Essentials, Truly’s Natural Products, Bali Soap, Beach Organics, Osmia.

b. The key factors that are driving the organic bar soap market include growing health and wellness trend among consumers globally, increasing millennials' interest in organic bar soap, and shifting consumer behavior patterns for beauty and personal care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.