- Home

- »

- Beauty & Personal Care

- »

-

Organic Deodorant Market Size, Share & Trends Report 2030GVR Report cover

![Organic Deodorant Market Size, Share & Trends Report]()

Organic Deodorant Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Sticks/Creams, Sprays), By Distribution Channel (Supermarkets/Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-400-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Deodorant Market Summary

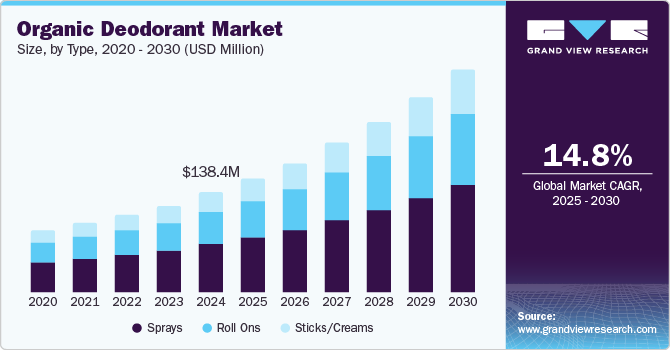

The global organic deodorant market size was valued at USD 138.4 million in 2024 and is projected to reach USD 316.1 billion by 2030, growing at a CAGR of 14.8% from 2025 to 2030. Increasing consumer awareness about the potential health risks associated with synthetic ingredients in conventional deodorants has significantly boosted demand for organic alternatives.

Key Market Trends & Insights

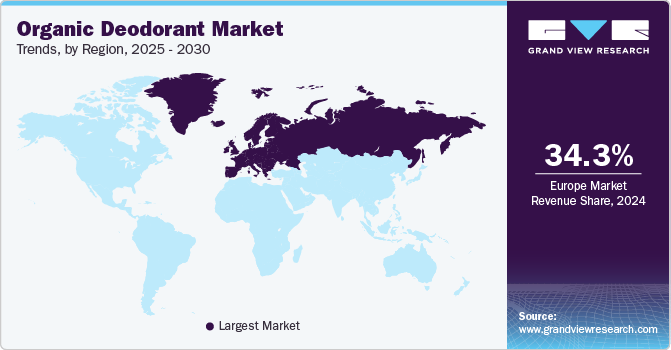

- In 2024, organic deodorant dominated the market in Europe, with a revenue share of 34.3%.

- The U.S. organic deodorant market is expected to grow significantly over the forecast period.

- By type, the sprays segment dominated the market with the largest revenue share of 48.2% in 2024.

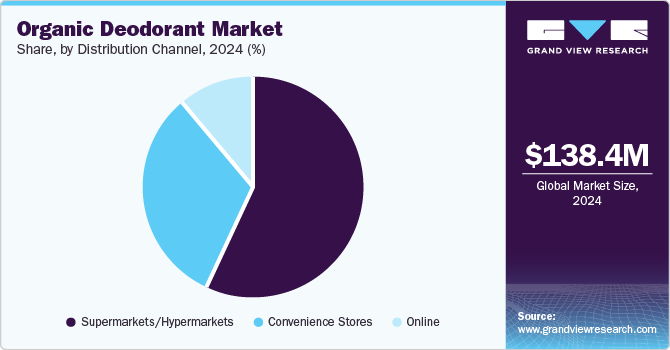

- By distribution channel, supermarkets and hypermarkets dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 138.4 Billion

- 2030 Projected Market Size: USD 316.1 Billion

- CAGR (2025-2030): 14.8%

- Europe: Largest market in 2024

As more people seek natural and chemical-free personal care products, the appeal of organic deodorants has grown. Furthermore, the rising trend of sustainable and eco-friendly lifestyles supports market expansion, as consumers prefer environmentally friendly and ethically produced products. The growing influence of social media and beauty influencers who advocate for clean and green beauty products further propels market growth.

The growing trend towards healthy lifestyles and the increased focus on holistic wellness has made consumers more conscious of the products they use on their bodies. The rising prevalence of skin sensitivities and allergies has also driven demand for gentler, natural deodorant alternatives. Furthermore, expanding online retail channels has made it easier for consumers to access various organic deodorant products. The push for transparency in product labeling and the clean beauty movement encourage manufacturers to adopt organic formulations.

Organic deodorants are proven more beneficial than scented sticks and fulfill diverse consumer needs such as odor control and skin-friendly. They are made of natural ingredients such as flowers, fruits, and vegetable extracts. Growing awareness regarding hygiene, along with the rising popularity of organic products among consumers, is expected to fuel the demand for the global market over the forecast period.

According to consumer trends, about 16% of men and 14% of women have reported skin irritation by deodorants and antiperspirants, which is expected to drive the demand for organic deodorants infused with hypoallergenic formulations. Moreover, the expansion of distribution channels, both offline and online, has widened the scope of visibility of such products. For instance, in the U.S., Credo Beauty opened six stores between 2017 and 2018. Furthermore, in October 2018, the company planned to further increase its offline stores in the next few years. Increasing the launch of organic concept stores by market players is also expected to boost the organic deodorant market growth during the forecast period.

Type Insights

The sprays segment dominated the market with the largest revenue share of 48.2% in 2024. Spray deodorants are favored for their ease of application and quick-drying properties, making them highly convenient for on-the-go consumers. Providing even coverage and a refreshing feel appeals to many users. Additionally, the growing awareness of the harmful effects of aerosol propellants in conventional sprays has shifted consumer preference towards natural and eco-friendly alternatives. The introduction of innovative formulations with organic ingredients and appealing scents has further bolstered the popularity of spray deodorants.

The sticks/creams segment is expected to grow at the fastest CAGR of 15.2% over the forecast period. Sticks and creams offer a more targeted and long-lasting application, which appeals to consumers seeking effective odor control and all-day freshness. The growing trend towards eco-friendly and zero-waste packaging also supports this segment, as many sticks and creams come in recyclable or biodegradable containers. Additionally, the increasing awareness of the potential skin benefits of natural ingredients in organic deodorants, such as essential oils and shea butter, enhances the appeal of sticks and creams.

Distribution Channel Insights

Supermarkets and hypermarkets dominated the market with the largest revenue share in 2024. These large retail outlets offer a wide variety of products, allowing consumers to compare and choose from numerous brands. The convenience of one-stop shopping, combined with frequent promotional activities and discounts, attracts a significant customer base. Additionally, physically inspecting and purchasing products before buying enhances the shopping experience.

The online channel is expected to grow at the fastest CAGR over the forecast period. The convenience of online shopping allows consumers to easily browse and purchase products from the comfort of their homes. The increasing penetration of smartphones and internet access has made e-commerce more accessible to a broader audience. Online platforms offer various products, detailed descriptions, customer reviews, and competitive pricing, enhancing the shopping experience. Additionally, the growing trend of social media and influencer marketing plays a significant role in driving online sales of organic deodorants.

Regional Insights

In 2024, organic deodorant dominated the market in Europe, with a revenue share of 34.3%. European consumers are increasingly aware of the potential health risks associated with synthetic chemicals in conventional deodorants, leading to a growing preference for natural and organic alternatives. The strong presence of brands committed to sustainability and ethical sourcing further boosts market growth. Additionally, the influence of the clean beauty movement and stringent regulations on cosmetic ingredients in Europe contribute to the demand for organic deodorants.

North America Organic Deodorant Market Trends

The North American organic deodorant market was identified as a lucrative region in 2024 owing to rising health consciousness. Consumers are increasingly aware of the harmful effects of chemicals like parabens and aluminum in traditional deodorants, which boosts demand for natural and organic alternatives. Additionally, the growing interest in personal hygiene and the availability of a wide range of natural fragrances attract more consumers. The expanding market for male grooming products also contributes to this growth.

U.S. Organic Deodorant Market Trends

The U.S. organic deodorant market is expected to grow significantly over the forecast period owing to the strong consumer preference for natural ingredients. Young consumers, in particular, are drawn to the lighter, more natural scents found in organic deodorants. The increasing popularity of health and fitness trends further encourages the use of products free from harmful chemicals. Moreover, heightened environmental awareness drives consumers towards sustainable and eco-friendly options.

Asia Pacific Organic Deodorant Market Trends

The Asia Pacific organic deodorant market is expected to grow at the fastest CAGR of 15.5% over the forecast period. The growing middle-class population in countries such as India and China drives demand for premium personal care products, including organic deodorants. Rising health and wellness awareness leads consumers to seek natural and organic options. Rapid urbanization and changing lifestyles further boost demand for safe and natural personal care products. The market's growth is also supported by the availability of a diverse range of organic deodorant products catering to various preferences.

Key Organic Deodorant Company Insights

Some key companies in the organic deodorant market include Unilever, Elsa's Organic Skinfoods, Alverde, Speick Naturkosmetik, Weleda, and others. Companies in this industry majorly focus on product launches to retain the consumer base as well as cater to their changing preferences.

-

Unilever is a major player in the organic deodorant market. The company has expanded its portfolio to include more natural and organic personal care products. Unilever's commitment to sustainability and reducing environmental impact aligns with the growing consumer demand for eco-friendly products. By leveraging its extensive distribution network and marketing expertise, Unilever has successfully introduced organic deodorant options that cater to health-conscious consumers

-

Elsa's Organic Skinfoods offers a range of organic deodorant creams, including options such as Ocean Love, Lemon Ice, and Sweet Clementine. These deodorants are made with certified organic ingredients such as coconut oil, shea butter, and essential oils, providing effective odor protection while being gentle on the skin. Elsa's Organic Skinfoods emphasizes sustainability, with products packaged in eco-friendly tins to support the zero-waste movement.

Key Organic Deodorant Companies:

The following are the leading companies in the organic deodorant market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever

- Elsa's Organic Skinfoods

- Alverde

- Speick Naturkosmetik

- Weleda

- Laverana Digital GmbH & Co. KG

- EO Products

- Buyindusvalley

- Lavanila

- Sebamed

Recent Developments

-

In August 2024, Jukebox, a women's personal care brand specializing in handcrafted soaps and natural deodorants, officially launched its products in Walmart stores nationwide and on Walmart.com. This innovative brand aims to transform personal care routines into enjoyable experiences, offering a diverse selection of 14 SKUs with various scent options. Designed with the modern woman in mind, Jukebox products feature rigorously tested, aluminum-free deodorants that promise lasting freshness, complementing the brand's nourishing soaps for a complete sensory experience.

-

In March 2024, Silab introduced Deolya, a revolutionary natural deodorant derived from Spiraea ulmaria L., that merges hygiene with skincare while alleviating underarm irritations.

-

In February 2024, Dove launched its new Dove Vitamincare+ deodorant, enhanced with Vitamin B3 to bolster the skin's natural odor defenses. This innovative product features an aluminum-free formula that guarantees 72 hours of breathable odor protection.

Organic Deodorant Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 158.5 million

Revenue forecast in 2030

USD 316.1 million

Growth Rate

CAGR of 14.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa, Saudi Arabia

Key companies profiled

Unilever; Elsa's Organic Skinfoods; Alverde; Speick Naturkosmetik; Weleda; Laverana Digital GmbH & Co. KG; EO Products; Buyindusvalley; Lavanila; Sebamed

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Deodorant Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic deodorant market report based on type, distribution channel, and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Roll Ons

-

Sticks/Creams

-

Sprays

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.