- Home

- »

- Consumer F&B

- »

-

Organic Packaged Foods Market Size, Industry Report, 2030GVR Report cover

![Organic Packaged Foods Market Size, Share & Trends Report]()

Organic Packaged Foods Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Bakery & Confectionary, R.T.E. Cereals, Dairy Products, Snacks & Nutrition Bars, Sauces, Dressings & Condiments), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-615-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Packaged Foods Market Trends

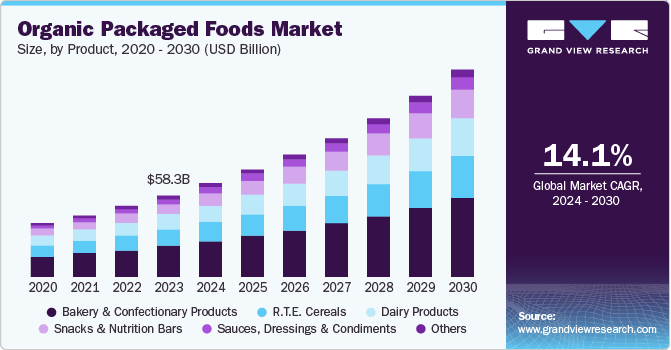

The global organic packaged foods market size was valued at USD 58.33 billion in 2023 and is projected to grow at a CAGR of 14.1% from 2024 to 2030. The market is expected to grow due to the increased dependence on packaged food driven by busy lifestyles. The rising number of women in the workforce and increasing awareness of health advantages of organic food are expected to fuel market growth further. The market focuses on sustainability, environmental consciousness, and natural methods to provide food that meets organic certification requirements. Organic packaged foods appeal to customers looking for healthier, eco-conscious options emphasizing clear sourcing and production techniques. The market is experiencing an increase in creative and delicious products. The growing accessibility of the products through various distribution channels also drives the market.

With the female workforce entering the corporate, the urban lifestyle has undergone a 360-degree change. According to World Bank Data, around 39% of the labor force across the world comprises women. The number has seen an upward trend in the last two decades, according to UN Women, because of the increasing number of working-class women. Thus, the busy modern work-life consumes a substantial part of the day, and thus leaves little or no time for the household chores, thereby enhancing the dependency on packaged food. The regular habit of eating boxed food among working-class professionals has propelled them to prefer organic packaged foods.

A shift in inclination among the urban population can be seen owing to the taste and health benefits. The urban population has been rapidly shifting from conventional food to organic packaged product forms. Various research studies have influenced the opinion of the consumers by exposing the adverse health outcomes of the consumption of products grown in chemical fertilizer.

The fact of the matter is that the millennials are ready to pay the premium price for organic packaged products in exchange for healthy food. One of the surveys has revealed that excellent taste will be the key reason behind the growing preference for organic packaged foods. Furthermore, a certain portion of urban society at the global level, which believes in maintaining an eco-friendly lifestyle by decreasing their carbon footprints, addressed that they prefer organic packaged products over conventional on account of being grown completely naturally.

Another factor propelling the growth of the market is the increasing number of organizations that offer organic packaged food products across the globe. For instance, Riverford, Amy’s Kitchen, and Eden Foods Inc. are some of them in the U.S. Similarly, Farm2Kitchen, Pride of Cows, and Mygreenkart are few among many operating in the organic packaged food market in India.

It can be noticed that growing awareness and readiness to pay a premium price for organic packaged food has presented industrialists with a vast landscape of opportunities. Operating players with a unique selling proposition of being completely organic make sure to offer quality and convenience of the highest standard. For the same purpose, they prefer selling packaged goods online as well as offline mediums.

Product Insight

The bakery & confectionary products segment dominated the market and accounted for a revenue share of 39.0% in 2023. Organic bakery and confectionery items provide convenient, pre-packaged choices to cater to consumers' hectic schedules and busy lifestyles. Moreover, growing demand for sugar-free, low-calorie, and functional products is expected to drive growth among health-conscious consumers. Product innovations relate to consumers' changing preferences, fulfilling their cravings while providing health benefits. This combination of familiarity, healthier indulgence, and convenience helps the bakery and confectionery sector dominate the market.

The snacks & nutrition bars segment is expected to register the fastest CAGR during the forecast period. Health-conscious consumers are looking for convenient, on-the-go choices that offer health benefits. Organic snack bars frequently cater to this demand by providing perceived health advantages such as additional protein, fiber, or natural components. These bars are a healthy alternative to sugary chocolate bars. The growth of this segment is being driven by increasing disposable incomes and a growing awareness of organic food choices.

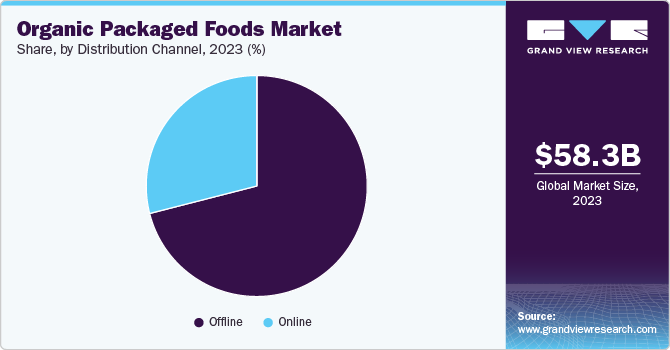

Distribution Channel Insight

The offline distribution channel dominated the market in 2023. Offline channels include physical retail outlets, wholesalers, and supermalls and marts, which allow customers to buy the product easily as and when required. These different kinds of retail layouts provide customers with a wide selection of readily available organic packaged food options, catering to customers' tastes and dietary requirements, which helps to attract a large consumer base and drive market growth.

The online distribution channel is expected to register the fastest CAGR during the forecast period. The segment growth is attributed to the expansion of e-commerce platforms offering a wide range of organic packaged food in various flavors. Additionally, the recent trends of 10-minute delivery by Blinkit, Swiggy Instamart, and Zepto are further raising the online distribution channel. Various online delivery channels provide discounts on products and free delivery options, propelling the market growth.

Regional Insights

North America organic packaged foods market dominated the global market with a revenue share of 53.4% in 2023.A strong emphasis on consumer well-being and health drives demand for organic options. Individuals' busy schedules need convenient and healthy food options, and packaged organic products meet this demand. Furthermore, well-established organic farming practices and a robust regional distribution network strengthen North America’s dominance.

U.S. Organic Packaged Foods Market Trends

The U.S. dominated the North America organic packaged market in 2023. Health-conscious consumers increasingly opt for organic choices, perceiving them as less harmful, more nutritious, and potentially healthier. The emphasis on healthy eating habits drives the need for convenient organic packaged foods for busy buyers in the U.S. Additionally, the U.S. organic packaged foods market is being driven forward due to increasing disposable incomes and a growing understanding of environmental sustainability.

Europe Organic Packaged Foods Market Trends

Europe organic packaged foods market was identified as a lucrative region in 2023. European consumers are well-known for their health consciousness and willingness to spend more money on high-quality products, including organic choices. Furthermore, the government's support for organic farming and robust organic food distribution network create a solid market expansion foundation. The convenience of organic packaged foods is highly attractive to Europe's varied population with hectic schedules and busy lifestyles, further driving the market.

The UK organic packaged foods market is expected to grow rapidly in the coming years. The growing preference for packaged food items such as R.T.E. cereals offers quick and healthy breakfast solutions to people, the organic snack options cater to health-conscious consumers seeking convenient on-the-go options. The bakery products, such as cookies and muffins, satisfy cravings with potentially better-for-you ingredients, driving the country's growth.

Asia Pacific Organic Packaged Foods Market Trends

The Asia Pacific organic packaged foods market is anticipated to witness the fastest CAGR during the forecast period. As disposable income is increasing in various Asian countries such as India, Japan, and China, people might focus more on products that provide health benefits, such as organic packaged foods. Moreover, growing environmental awareness, coupled with other factors, is leading to a rise in the popularity of organic packaged foods in the region.

China's organic packaged foods market held a substantial market share in 2023. Significant changes in eating habits, especially post COVID-19, increased emphasis on healthy food options, higher demand for less contaminated food, and higher quality standards are some of the key driving factors of market growth. Furthermore, government support for organic farming practices promotes domestic production and contributes to the overall development of China's organic packaged food market.

Key Organic Packaged Foods Company Insights

Some key companies in the organic packaged foods market include General Mills, Inc.; THE WHITEWAVE FOODS COMPANY; Hain Celestial, Sresta Natural Bioproducts Pvt. Ltd.; and Horizon Organic Dairy, LLC. Low entry barriers as a result of the presence of various brands and rapid innovation in the product line are anticipated to assert high competition among major manufacturers. Increasing demand for organic packaged products, along with attractiveness and low price provided by organizations including Walmart, is increasing competition among various players in the market. With a relatively fragmented competitive landscape, innovation and new product development are expected to remain the critical success factors over the projected period.

-

General Mills, Inc. is the largest producer of natural and organic food products. It provides a wide variety of certified organic food items, including yogurt, baking products, frozen fruits, vegetables, snacks, and meals. It also offers organic food options for gluten-free and sugar-free dietary restrictions.

Key Organic Packaged Foods Companies:

The following are the leading companies in the organic packaged foods market. These companies collectively hold the largest market share and dictate industry trends.

- THE WHITEWAVE FOODS COMPANY

- Hain Celestial

- General Mills Inc.

- Sresta Natural Bioproducts Pvt. Ltd.

- Horizon Organic Dairy, LLC

- Riverford Organic Farmers Ltd

- Amy’s Kitchen, Inc.

- Eden Foods

- Organic Valley

- Impossible Foods

Recent Developments

-

In June 2024, Amul announced the expansion in the Indian organic food market by introducing organic, jaggery, sugar and tea in the next month. It already offers 24 organic products, including rice or pulses and wheat flour.

-

In August 2023, Sresta Natural Bioproducts announced the launch of children and baby snacks, food, and frozen foods.

Organic Packaged Foods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 66.97 billion

Revenue forecast in 2030

USD 147.49 billion

Growth rate

CAGR of 14.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, Argentina, UAE, South Africa

Key companies profiled

THE WHITEWAVE FOODS COMPANY; Hain Celestial; General Mills Inc.; Sresta Natural Bioproducts Pvt. Ltd.; Horizon Organic Dairy, LLC; Riverford Organic Farmers Ltd; Amy’s Kitchen, Inc.; Eden Foods Inc.; Organic Valley; Impossible Foods

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Footwear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic packaged foods market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery & Confectionary Products

-

R.T.E. Cereals

-

Dairy Products

-

Snacks & Nutrition Bars

-

Sauces, Dressings & Condiments

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.