- Home

- »

- Healthcare IT

- »

-

Orthopedic Software Market Size And Share Report, 2030GVR Report cover

![Orthopedic Software Market Size, Share & Trends Report]()

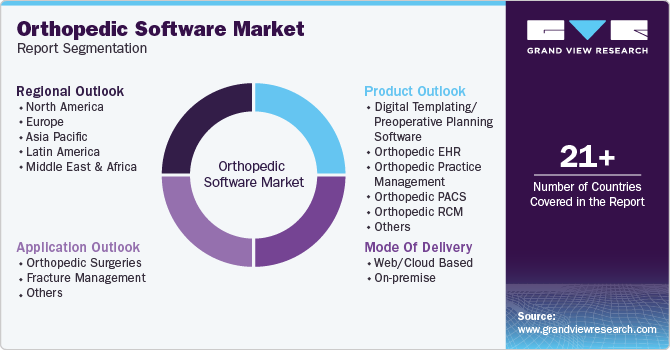

Orthopedic Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (EHR, Practice Management), By Mode of Delivery (Web/Cloud Based, On-Premise), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-101-6

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Software Market Size & Trends

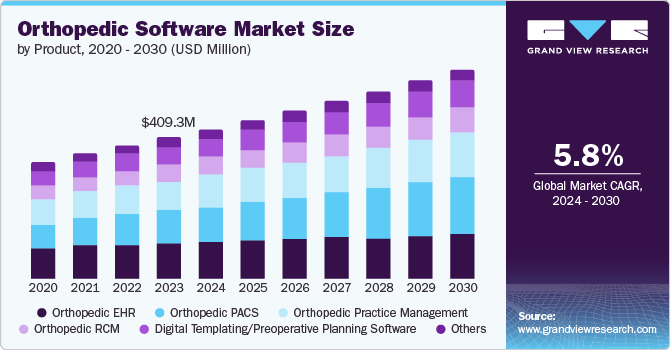

The global orthopedic software market was estimated at USD 409.3 million in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The market is driven by the increasing adoption of orthopedic software and the rise in orthopedic medical practices to meet growing demand. Moreover, several initiatives launched by government and orthopedic organizations promote innovation and technological advancements in the market. For instance, in February 2024, the American Academy of Orthopaedic Surgeons (AAOS) selected CytexOrtho as the inaugural OrthoPitch Technology Competition winner, aiming to enhance or transform current orthopedic care standards. Such initiatives encourage the development of advanced preoperative planning and digital templating solutions, thereby accelerating market growth.

The rising prevalence of injuries and health issues has increased the demand for orthopedic surgeries and medical care in orthopedics. According to a February 2022 article from the National Library of Medicine, 2,244,587 primary and revision hip and knee arthroplasty procedures were performed between 2012 and 2020. The majority of these were primary total knee arthroplasties (54.5%) and total hip arthroplasties (38.6%). Male patients accounted for 38.6% of the cases, while female patients comprised 58.5%. The average age of patients undergoing total hip arthroplasty (THA) was 66.1 years; total knee arthroplasty (TKA) was 67 years.

Furthermore, a shortage of surgeons is expected to create treatment challenges. The Association of American Medical Colleges forecasts a shortage of orthopedic physicians and surgeons in the U.S., driven by rising demand for their services due to increased sports injuries and road accidents. This surge in cases is boosting the demand for faster treatment options and outpatient services, which, in turn, is expected to increase the need for orthopedic software.

The COVID-19 pandemic significantly impacted the market. As healthcare systems worldwide were overburdened with COVID-19 cases, elective surgeries, including many orthopedic procedures, were postponed or canceled, leading to a temporary decline in demand for orthopedic solutions. However, the pandemic also accelerated the adoption of digital health technologies, including telemedicine and remote monitoring. This shift highlighted the importance of digital tools in managing patient care and optimizing workflows, driving the interest in orthopedic software for preoperative planning, virtual consultations, and remote patient management. In addition, the need for efficient healthcare delivery during the pandemic highlighted the value of integrated software systems that can streamline operations and improve patient outcomes, positioning the market for growth.

Case Study & Insights

Case Study: Coastal Orthopedics switched their EHR, practice management, and care coordination services to athenahealth

Challenges:

-

Separate EHR and practice management systems were inefficient and cumbersome

-

Staff were overwhelmed with software updates and patient phone calls.

-

Billing processes lacked transparency

-

There was no platform to support growth

-

The organization was unprepared for population health management and value-based care

Results:

-

66% same-day encounter close rate

-

31 days in accounts receivable

-

Optimized financial performance, reduced staff workload, and strengthened patient relationships

-

AthenaOne provides Coastal Orthopedics with complete visibility into billing, enhancing confidence in evolving quality programs

Market Concentration & Characteristics

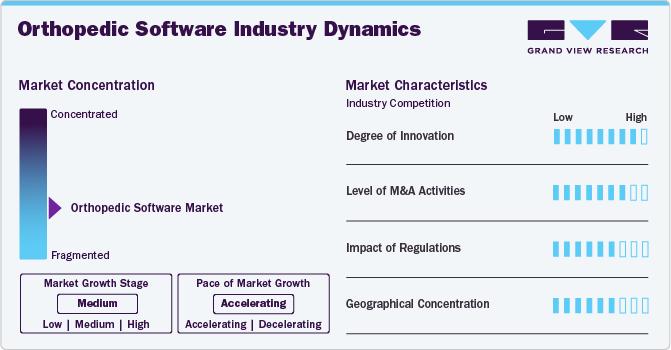

The orthopedic software industry is highly innovative, driven by advancements such as the launch of artificial intelligence (AI) and machine learning (ML) technologies that enhance diagnostic accuracy and personalized treatment. Key players are entering into technological partnerships and collaborations to integrate AI-powered orthopedic solutions. For instance, in June 2024, Zimmer Biomet partnered with RevelAi Health primarily to market their AI-powered clinical software for conditions like osteoarthritis. Zimmer Biomet aims to enhance orthopedic care by partnering with RevelAi to develop an equity-driven, whole-person approach to value-based care through integrated AI-enabled tools.

The level of M&A activities is expected to be high and enable companies to expand geographically, financially, and technologically. For instance, in October 2022, Orthofix, a global medical device company specializing in orthopedics and spine, and SeaSpine, a global medical technology company focused on surgical solutions for spinal disorders, announced a definitive agreement to merge in an all-stock transaction. The merged entity will have a complementary product portfolio that includes software planning and imaging solutions.

The regulatory impact on the orthopedic software industry is significant. The healthcare sector is vulnerable to shifting political, legislative, regulatory, and other pressures and is heavily controlled. As a result, a complex web of healthcare laws and regulations, including the Health Insurance Portability and Accountability Act (HIPAA), the Health Information Technology for Economic and Clinical Health Act, rules established by the Centers for Medicare & Medicaid Services, the Department of Health and Human Services, and laws regulating fraud and abuse like the Federal Health Care Act, regulate the services provided by companies. To establish their operations, the governments of numerous nations place additional laws on the market.

Key players in the market are pursuing geographical expansion strategies to enhance their market presence and tap into new customer bases. This includes establishing partnerships with local healthcare providers and institutions, setting up regional offices, and customizing software solutions to meet different regions' specific needs and regulatory requirements. For instance, In January 2024, MCRA announced its expansion in Europe with new offices in London (UK), Eschborn (Germany), and Winterthur (Switzerland). MCRA Europe now provides GDPR adherence, clinical studies services, Unique Device Identifier (UDI) services, and its core Clinical Research, Regulatory Affairs, and Quality Assurance offerings.

Product Insights

Orthopedic EHR dominated the market with the largest revenue share of 25.43% in 2023, owing to increased adoption in clinical settings. Orthopedic EHR software provides specialized information on patients' orthopedic conditions. The system also allows for the customization of patient education materials, prescriptions, referral letters, and other features, enabling doctors to create personalized treatment plans for specific orthopedic disorders. These features have raised EHR software adoption, driving the segment growth. For instance, in May 2024, Atlantis Orthopedics in Florida selected eClinicalWorks' cloud EHR and healow patient engagement solutions to improve operational efficiency and patient engagement. In addition, the practice will have access to the AI-powered medical scribe Sunoh.ai, integrated with eClinicalWorks.

The digital templating/preoperative planning segment is expected to grow at the fastest CAGR during the forecast period. The growth is driven by the advancements in medical imaging technology and the increasing demand for precision in surgical outcomes. These software solutions enhance surgical planning by providing accurate, customizable templates and detailed anatomical visualizations, which improve surgical accuracy and efficiency. This encourages companies to develop and advance digital templating/ preoperative planning software. For instance, in May 2023, Formus Labs received the U.S. FDA 510(k) clearance for Formus Hip, marking it the first radiological automated image processing software designed for hip replacement preoperative planning.

Mode Of Delivery Insights

Web/cloud-based software dominated the market with the largest revenue share of 86.6% in 2023 and is expected to grow rapidly during the forecast period. This growth is attributed to its advantages, such as remote access to patient health data and accurate information exchange to prevent data misuse or address issues at a crucial study stage. Other advantages include consistent uptime, cost savings, scalability, and data consolidation. In addition, another factor driving the growth of web/cloud-based software includes growing healthcare industry consolidation and increasing number of multispecialty hospitals that require one-stop solutions for all specialties, as well as data gathering & management.

On-premise software is expected to grow significantly over the forecast period. This growth is driven by the availability of affordable, locally installed orthopedic software that meets organizations' financial and clinical workflow needs. In addition, many hospitals and clinics invest heavily in advanced healthcare solutions. Companies like PeekMed offer specialized software, such as 3D planning tools for orthopedic procedures, which can be fully customized based on the size and needs of the healthcare practice.

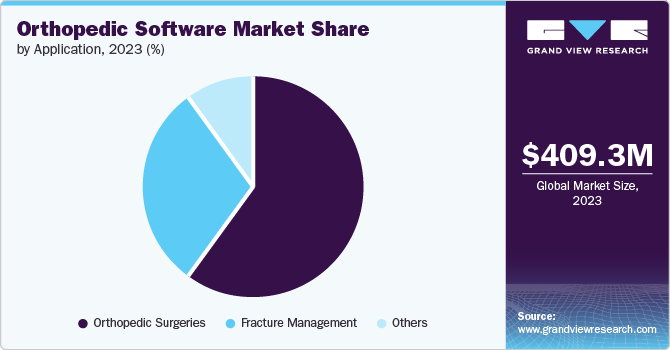

Application Insights

The orthopedic surgery segment dominated the market with the largest revenue share in 2023. One key factor driving the segment's growth is the growing number of orthopedic surgeries. For instance, according to the American College of Rheumatology's February 2024 updated article, approximately 544,000 hip replacements and 790,000 total knee replacements are performed annually in the U.S. This number is expected to grow as the population ages. Moreover, the increasing prevalence of bone issues, such as arthritis, the rising incidence of sports injuries and road accidents, and the increasing elderly population drive the market growth. According to a 2021 article by the Arthritis Society, around 6 million Canadians have arthritis, with women being more affected than men. The number of people with arthritis is projected to reach 9 million by 2040. In addition, the population aged 70-74 increased from 3,252 thousand in 2018 to 3,390 thousand in 2021. As the elderly population is more susceptible to chronic illnesses, the demand for orthopedic software in hospitals and specialized orthopedic settings is expected to rise.

Fracture management is expected to grow at the fastest CAGR during the forecast period. The orthopedic software offers a simple means of data exchange and uploads images for quick access. Several companies are developing software for fracture management for rapid, on-screen planning and templating for trauma cases. For instance, in May 2024, OrthoXel received 510(k) clearance for the Vertex Hip Fracture Nail (HFN). The Vertex HFN addresses common challenges in hip fracture treatment, such as high cutout rates, instability, persistent pain during recovery, limited post-surgery mobility, and nonunion complications. This product strives to simplify surgical procedures and improve patient outcomes by providing a stable and versatile solution for fracture fixation.

Regional Insights

North America dominated the orthopedic software market, with a revenue share of 43.01% in 2023. This is attributed to technological advancements in the region. Countries such as the U.S. and Canada have successfully implemented eHealth, mHealth, and advanced visualization systems in their healthcare systems, which can boost the market. The rising preference for minimally invasive procedures and constantly improving reimbursement scenarios can further propel the market.

U.S. Orthopedic Software Market Trends

The orthopedic software market in the U.S. accounted for the largest share in 2023. According to the American Joint Replacement Registry’s (AJRR) 2021 report, over 2.2 million knee surgeries were conducted in over 1,150 hospitals, ambulatory surgery centers, and other healthcare centers in the U.S. & the District of Columbia. These figures demonstrate the high prevalence of various orthopedic disorders. Furthermore, the increased adoption of data sharing and orthopedic Electronic Health Records (EHRs) in the country further drives the market.

Europe Orthopedic Software Market Trends

The orthopedic software market in Europe is expected to grow significantly during the forecast period. The adoption of orthopedic software in Europe has increased due to technological advancements and the growing prevalence of orthopedic conditions. Orthopedic software is becoming increasingly efficient, allowing for highly accurate diagnoses and treatments of musculoskeletal disorders and enabling medical personnel to offer personalized care plans. These factors have increased the need for such software in Europe as more healthcare providers seek digital solutions to support patient care, resulting in market growth.

The UK orthopedic software market had a substantial share in 2023, owing to the highest rate of orthopedic EHR adoption. The country's increasing number of orthopedic surgeries is the major factor driving the market. For instance, according to the NHS Data Publication Patient Reported Outcome Measure (PROMs) report, between 2020-2021, 30,937 hip replacement procedures were performed, and most patients were 50 years or older. Furthermore, technological advancements in healthcare delivery and increasing software adoption among healthcare providers are expected to drive the market over the forecast period.

The orthopedic software market in Germany is positively influenced by the trend of artificial joint replacement procedures. The German Arthroplasty Registry (EPRD) estimates that more than 400,000 hip and knee implant surgeries are performed annually in Germany, while 30,000 revisions are required annually. An anticipated surge in artificial joint replacement procedures will boost the country's market. These software are designed to reduce physician time, improve procedural accuracy, and assist with preoperative planning.

Asia Pacific Orthopedic Software Market Trends

The orthopedic software market in Asia Pacific is expected to grow at a CAGR of 6.9% during the forecast period. Governments and healthcare providers in the Asia Pacific region are increasingly focusing on reducing medical expenses and improving the overall well-being and growth of the population. This is driven by the need to improve patient experience and the growing demand for population health management. Consequently, the region's healthcare software market is experiencing rapid growth.

Japan orthopedic software market held a significant market share in the region in 2023. The large elderly population has led to a high prevalence of orthopedic diseases in the country, which is boosting the demand for faster treatment. Moreover, the government of Japan is emphasizing outpatient services to increase revenue from the segment. However, as the medical industry in the country is based more on value-based outpatient services, such software will only apply to basic treatment.

The orthopedic software market in India is expected to grow significantly during the forecast period. Government initiatives, such as Digital India Care, are anticipated to drive the healthcare IT industry in India. Large healthcare organizations, such as Tata Memorial Hospital and Max Hospitals Private Limited, have already implemented EMRs and are transitioning to EHRs. Nevertheless, the market is restrained by the lack of trained professionals and the high cost of orthopedic services.

Key Orthopedic Software Company Insights

The market is highly fragmented with the presence of many companies. Intense competition among market players can be attributed to the growing demand for technologically advanced orthopedic software/platforms. Key market players are adopting various strategies, such as partnerships and collaborations, to increase market share. For instance, in October 2022, Brainlab AG collaborated with the German Society for Orthopedics and Orthopedic Surgery (DGOOC) to advance medical research in clinics by encouraging the development of a data protection-compliant registry infrastructure for processing patient data. Such efforts can benefit the company by improving brand recognition of its product and helping gain market share.

Key Orthopedic Software Companies:

The following are the leading companies in the orthopedic software market. These companies collectively hold the largest market share and dictate industry trends.

Key Orthopedic Software Companies

AI-powered Orthopedic Software Companies

- IBM

- CureMD Healthcare

- GreenWay Health LLC

- Brainlab AG

- Medstrat

- Materialise

- NextGen Healthcare LLC

- DrChrono, Inc

- Allscripts Healthcare, LLC

- athenahealth (acquired by Hellman & Friedman and Bain Capital)

- Stryker

- Exactech, Inc.

- OPIE Software

- PEEK HEALTH S.A.

- OrthoGrid Systems, Inc.

- Smith+Nephew

- MediCodio

- eClinicalWorks

Recent Developments

-

In May 2024, Exactech introduced new ExactechGPS software designed to enhance patient-centered planning and modern alignment approaches for total knee replacement. This release upgrades the company's Newton knee balancing technique, allowing surgeons to concurrently plan tibia and femur resections using real-time ligament alignment and laxity data.

-

In November 2023, OPIE Software announced a partnership with Professional Orthopedic Products (P.O.P.). This collaboration allows Canadian facilities to streamline the ordering process for P.O.P. orthotic devices through the OPIE Inventory and Purchasing portal. Users can access P.O.P.’s digital catalog, place orders, select specialized products, and receive confirmations efficiently via the OPIE platform.

-

In May 2023, Stryker launched the Ortho Guidance Software-based Ortho Q Guidance System. This system facilitates advanced surgical guidance and planning for knee and hip procedures, allowing surgeons to control it directly from the sterile field.

-

In May 2022, Brainlab AG acquired medPhoton GmbH, an independent R&D firm specializing in the development & manufacture of robotic imaging solutions for image-guided radiation therapy & surgeries.

-

In May 2022, Morris Heights Health Center selected NextGen Management, LLC’s Nextgen Enterprises EHR and practice management solution. With this, the company expanded care services throughout New York City.

Orthopedic Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 433.3 million

Revenue forecast in 2030

USD 607.0 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of delivery, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IBM; CureMD Healthcare; GreenWay Health LLC; Brainlab AG; Medstrat; Materialise; NextGen Healthcare LLC; DrChrono, Inc; Allscripts Healthcare, LLC; eClinicalWorks; athenahealth (acquired by Hellman & Friedman and Bain Capital); Stryker; Exactech, Inc.; OPIE Software

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Software Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global orthopedic software market report based on product, mode of delivery, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Templating/Preoperative Planning Software

-

Orthopedic EHR

-

Orthopedic Practice Management

-

Orthopedic PACS

-

Orthopedic RCM

-

Others

-

-

Mode Of Delivery (Revenue, USD Million, 2018 - 2030)

-

Web/Cloud Based

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic Surgeries

-

Fracture Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the orthopedic software market, with a revenue share of 43.0% in 2023. This is attributed to technological advancements in the region, rising preference for minimally invasive procedures and constantly improving reimbursement scenarios.

b. Some key players operating in the orthopedic software market include IBM; CureMD Healthcare; GreenWay Health LLC; Brainlab AG; Medstrat; Materialise; NextGen Healthcare LLC; DrChrono, Inc; Allscripts Healthcare, LLC; eClinicalWorks; athenahealth

b. Key factors driving the market's growth include the increasing adoption of orthopedic software and the rise in orthopedic medical practices to meet growing demand.

b. The global orthopedic software market size was estimated at USD 409.3 million in 2023 and is expected to reach USD 433.3 million in 2024.

b. The global orthopedic software market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 607.0 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.