- Home

- »

- Pharmaceuticals

- »

-

Osteoporosis Drugs Market Size, Share, Growth Report 2025GVR Report cover

![Osteoporosis Drugs Market Report]()

Osteoporosis Drugs Market Analysis By Product (Branded, Bisphosphonates, Parathyroid Hormone Therapy, Calcitonin, Selective Estrogen Inhibitors Modulator (SERM), Rank Ligand Inhibitors, Generics), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-762-9

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Healthcare

Report Overview

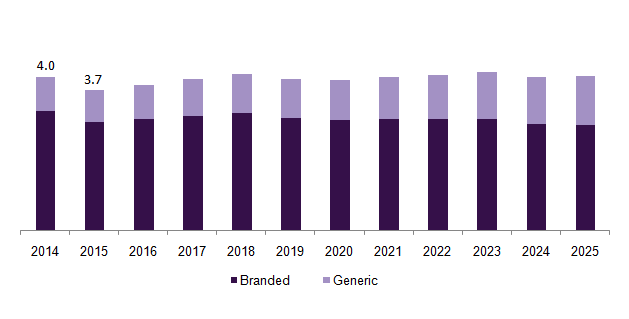

The global osteoporosis drugs market size accounted for USD 11.5 billion in 2015 and is projected to grow at a compound annual growth rate (CAGR) of 3.3% from 2018 to 2025. The market is largely driven by a significant rise in the prevalence of this disorder globally. This unprecedented rise in the prevalence resulted in the high demand for drugs in prophylaxis and treatment of osteoporosis thus widening the growth potential over the coming years. Moreover, the geriatric population possessing high susceptibility for osteoporosis is further presumed to propel the high demand.

U.S. osteoporosis drugs market, by product, 2014 - 2025 (USD Billion)

In addition, an upsurge in incidence as a result of menopause in women is anticipated to be a key growth contributing factor. As per the statistics published by International Osteoporosis Foundation, it is estimated to affect 200 million women globally. In the aforementioned statistics, osteoporosis was found in 2/3th of women aged 90, 2/5th of women aged 80, 1/5th of women aged 70 and 1/10th of women aged 60. Furthermore, 1 in 3 women over the age of 50 are found to experience osteoporotic fractures.

Moreover, according to National Institutes of Health Osteoporosis and Related Bone Diseases, lifestyle associated factors such as alcohol abuse, sedentary lifestyle, smoking is found to promote this condition in men. The aforementioned factor poses the high clinical urgency to curb osteoporosis, thus predicted to further bolster the overall growth.

The wide range of pipeline drugs possessing high probability of approval in clinical trials in the future is predicted to provide lucrative growth opportunities to osteoporosis market. Some of imperative investigational drugs include Romosozumab, Blosozumab, Abaloparatide, ZP-PTH and ZP-034.

The heightening demand is also predicted to be a consequence of new product development and collaborative research initiatives incorporated by the major healthcare organizations and companies consistently striving to improve treatment alternatives in the current market space. Also, presence of research funding by these organizations is anticipated to propel the growth further.

Product Insights

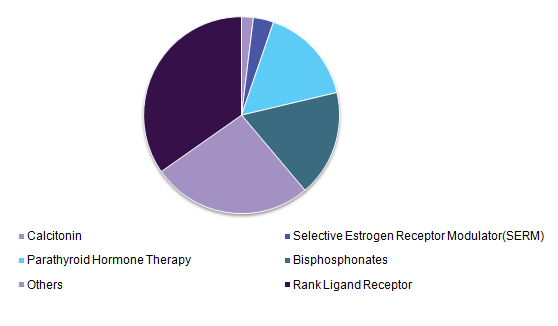

Rank ligand inhibitors are expected to grow at a lucrative CAGR during the forecast period. The high growth potential attained is a consequence of positive patient outcomes associated with rank ligand inhibitors. The positive patient outcomes can be attributed to significant improvements in bone metabolism.

Rank ligand inhibitors can also be used in conjunction with other drugs to impart a synergistic effect in overall treatment regime. The aforementioned factor is also predicted to be one of the key factors responsible to present lucrative opportunities. Other benefits pertaining to rank ligand Inhibitors such as reduced cell bone turnover and increased bone mineral density, thereby implicating high demand.

Regional Insights

In 2015, North America accounted for a dominant share of the overall market. Several collaborative efforts undertaken by major companies to enhance their R&D capabilities and ensure high medical standards are anticipated to impel the demand across this region. Moreover, the majority share can also be attributed to the high disease burden in this region.

On the other hand, Asia Pacific market space is expected to grow at a lucrative CAGR over the coming years. The high growth registered by this region is believed to be consequence of consistent R&D investments deployed by the prominent players and their efforts to commercialize branded and generic therapeutics at a relatively inexpensive price.

Global osteoporosis branded drugs market share, by drug class, 2015 (%)

In addition, the high demand to curb the high prevalence rate, increasing disposable income and continual infrastructural improvements in healthcare facilities are believed to present with high growth potential across this region. Furthermore, high growth attained by this region is also owing to the growing awareness pertaining to osteoporosis care in the emerging economies, such as India and China.

Competitive Insights

This industry is anticipated to witness intense competition during the forecast period as a consequence of rising incorporation of collaborative strategies amongst the key players to sustain in the competition position. The other strategies incorporated are high R&D investment, mergers & acquisitions, and agreements for drug development.

For instance, In October 2013, Pfizer Inc. announced the approval of DUAVEE, conjugated estrogen for the treatment and prevention of post-menopausal osteoporosis. In addition, In November 2016, Dr. Reddy’s Laboratory announced to launch Raloxifene in the U.S. for the treatment for osteoporosis. This was carried out to expand the treatment options and gain competitive advantage.

Recent Developments

- In February 2023, Sandoz (a Novartis division) announced the acceptance of its Biologics License Application (BLA) for biosimilar denosumab by the U.S. FDA. This will further increase easy access to affordable, high-quality, and disease-modifying treatment for patients suffering from osteoporosis and other related fractures.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2014 - 2015

Forecast period

2016 - 2025

Market representation

Revenue in USD Million &and CAGR from 2016 to 2025

Regional scope

North America, Europe, Asia-Pacific, Latin America & MEA

Country scope

U.S., Canada, UK, Germany, Japan, China, Brazil, Mexico, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the osteoporosis drugs market on the basis of product and region:

-

Product Outlook (Revenue, USD Million, 2014 - 2025)

-

Branded

-

Bisphosphonates

-

Parathyroid Hormone Therapy

-

Calcitonin

-

Selective Estrogen Inhibitors Modulator(SERM)

-

Rank Ligand Inhibitors

-

Others

-

-

Generic

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

U.S

-

Canada

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

The Middle East and Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."