- Home

- »

- Homecare & Decor

- »

-

Outdoor Furniture Market Size, Share & Growth Report, 2030GVR Report cover

![Outdoor Furniture Market Size, Share & Trends Report]()

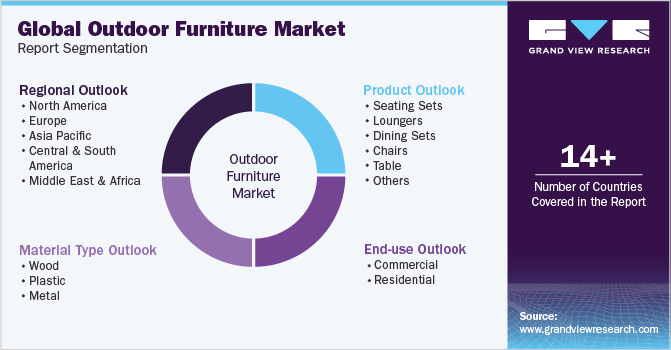

Outdoor Furniture Market Size, Share & Trends Analysis Report By Product (Seating Sets, Loungers, Dining Sets, Chairs, Tables, Others), Material Type (Wooden, Plastic, Metal), By End Use (Commercial, Residential), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-871-8

- Number of Report Pages: 83

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global outdoor furniture market size was valued at USD 46.20 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. The growth of the global industry is primarily driven by the rising need for outdoor furniture products in hotels, resorts, open spaces, and public gardens. These trends are mainly observed in seaside areas, hill stations, scenic beauty places, and historical monuments. Thus, the increasing number of hotels and restaurants may drive industry growth during the forecast period. In addition, consumer attention is changing to enhancing outside areas to provide more aesthetically pleasing and comfortable designs in balconies, gardens, and porches, supporting industry development.

Customers are eager to spend their disposable income, especially on the design and production of outdoor furniture goods, which enhance aesthetics. COVID-19 affected global industry due to the shutting down of factories, supply chain disruptions, and a downturn in the world economy. The hospitality industry was impacted by travel restrictions and closures during the pandemic as hotels and resorts stayed closed, which had an impact on outdoor furniture sales. However, because of the pandemic, people spent more time at home, which prompted both indoor and outdoor house upgrades. During the pandemic, cushions, lights, outdoor dining outdoor furniture, and gardening supplies witnessed significant growth and ever-grown consumer attention.

Consumer demand for outdoor furniture in the residential sector is growing due to rising disposable income. Several homeowners are working on improving the look of their gardens and balconies with delightful seating areas. Moreover, the selection of outdoor furniture is heavily influenced by external climatic conditions. Good weather resistance, insect resistance, superior tensile strength, and crack-proof properties are among the key factors considered when selecting outdoor furniture. In addition, restaurants and cafes across the globe are offering outdoor dining facilities. For instance, according to a survey conducted by the National Restaurant Association in September 2021, 65% of the surveyed restaurant operators across the U.S. started offering on-premises outdoor dining in areas, such as decks, sidewalks, or patios.

This, in turn, is expected to have a major impact on the global industry and boost the demand for outdoor furniture in hotels and cafes. Online distribution channels are now playing an important role in the development of the retail and outdoor furniture industries. Online channels offer a diverse variety of brands at competitive prices, drawing a larger customer base and stimulating the growth of the industry. For instance, IKEA, a major outdoor furniture manufacturer, stated that its official website saw more than 2.1 billion visits in 2016 and became an important marketing and sales platform for the company. Furthermore, with rapid digitization, rising mobile usage, and improved internet connectivity, companies are increasingly moving from brick-and-mortar transactions to e-commerce portals.

Manufacturers are showcasing their products on numerous online platforms, such as company-owned portals and third-party retailers, to increase product exposure, especially in emerging markets. Appropriate pricing, dealer margins, a strong distribution network, and brand awareness are some of the critical factors determining the success of industry players. Customers buying outdoor furniture are looking for the right combination of luxury, elegance, and versatility. They tend to prefer items that are both elegant and trendy, as well as sturdy and easy to maintain. Furthermore, outdoor fire pit sets and conversation sets are gaining popularity, especially among millennials.

Market Dynamics

The growing popularity of world tours, vacations, and trips has resulted in the expansion of tourism industry all over the world. The real estate market is booming as a result of the growth of the tourism sector. Resultant growth in the number of new hotels, resorts, public parks, and other open spaces is expected to drive outdoor furniture market growth.

According to Hospitality Net, an online resource for hospitality and hotel news, 1,017 new hotels opened in the U.S. in 2019, a 2.2% growth in new supply from the previous year, bringing the total U.S. census to 57,903 hotels. Additionally, a total of 268 hotels with 50,512 rooms were opened across North America in the year 2021, according to a blog post by TOPHOTELPROJECTS.

Consumers are increasingly opting for exclusive and aesthetically pleasing outdoor furniture and are willing to pay a higher price for soothing home décor. Furthermore, a rise in demand has been witnessed for outdoor furniture in urban areas.

According to a survey conducted for the International Casual Furnishings Association, in January 2021, people are spending more time relaxing, grilling, gardening, exercising, dining, playing with pets and children, and entertaining outside. In addition, approximately 63% of Americans will upgrade outdoor furniture or accessories in 2022. Planned purchases include outdoor lighting, lounge chairs, fire pits, dining tables/chairs, umbrellas, sofas, pillows, and rugs. These factors are estimated to drive the outdoor furniture market growth over the forecast period.

Product Insights

With the increase in commercial constructions like hotels, restaurants, and cafes, outdoor dining sets is anticipated to have potential growth over the forecast period. Consumer preferences have shifted towards outdoor experiences, with a growing demand for such dining spaces. By offering outdoor seating with comfortable and stylish dining sets, the hotel industry is able to cater to customer preferences and create memorable dining experiences.

Other outdoor furniture, including chairs and tables, among others, is anticipated to have significant growth in the years in the future. The manufacture of handcrafted bamboo-based interior décor items is being driven by growing knowledge of the benefits of long-lasting, sustainable materials that are resistant to swelling and shrinking. To diversify their product offerings, producers also place a focus on creating unique patterns and features in all bamboo or composite materials.

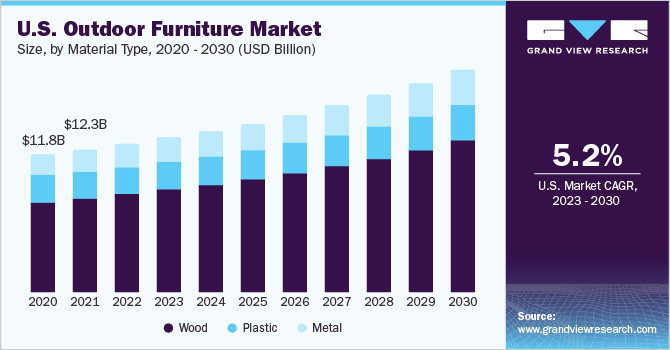

Material Type Insights

Based on material type, the global industry has been further categorized into wood, plastic, and metal. The wood material type segment dominated the global industry in 2022 and accounted for the largest share of more than 65.50% of the overall revenue. The segment is likely to remain dominant throughout the forecast period. The growing popularity of wood outdoor furniture is due to its benefits, such as robustness, improved comfort, and aesthetic appeal. Wood is among the most widely used raw materials for outdoor furniture manufacturing across the globe.

Moreover, wooden outdoor furniture is lightweight, strong, and has an aesthetic, natural appearance, making it a perfect material for making outdoor furniture. The metal segment is expected to register the fastest CAGR over the forecast period. The rapid growth can be attributed to its solid and robust material properties. Furthermore, metallic frames can be smaller and molded into more complicated shapes due to their strength, providing designers with greater style versatility. Metal is also a great choice when combined with other materials with their own aesthetic and functional benefits.

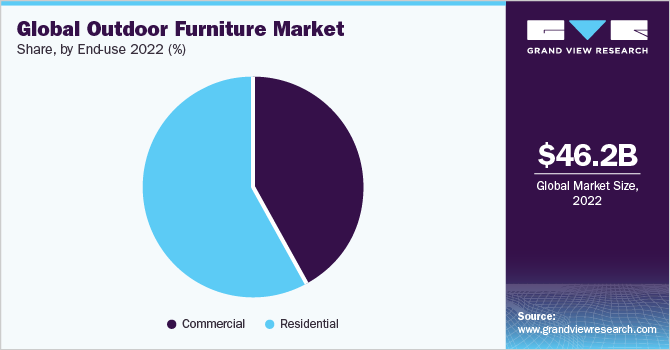

End Use Insights

In terms of revenue, the residential segment dominated the largest share of 58.04% in 2022. The key elements influencing the residential segment include population growth, rising per capita income, westernization, and shifting lifestyles. In addition, customer focus is changing to enhancing outside areas to produce more aesthetically pleasing and comfortable designs making a significant contribution to industry growth. Rising income levels are boosting product sales in both residential and non-residential environments in many nations. The overall industry will be propelled by the rising demand for outdoor seating options and other accessories.

The commercial end use segment is anticipated to have the highest CAGR around 6.4% over the forecast period. According to Travel Pulse, the U.S had the highest number of hotel projects in 2021, with almost 669,460 rooms under construction, which accounted for 41% of all projects in the world. Dallas, New York, Los Angeles, Atlanta, and Houston had the highest number of construction. These commercial establishments focus on achieving a sophisticated and elegant look.

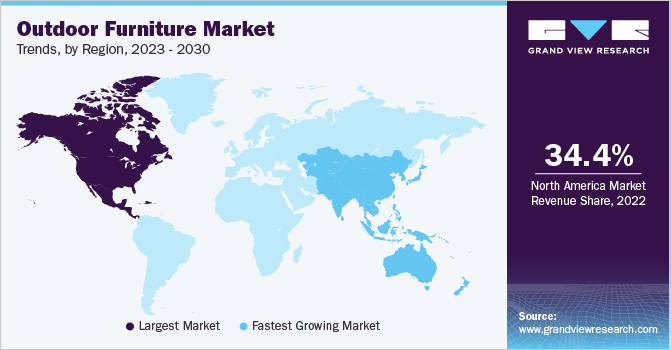

Regional Insights

Asia Pacific outdoor furniture market is expected to project the fastest CAGR of more than 7.1% over the forecast period. International tourism is gaining strong attention in countries including China, Malaysia, South Korea, Singapore, and India. With the growing tourist activity, the sales of the outdoor furniture market are rising in the region, helping in increasing the market share commercial segment of the outdoor furniture market in the region. The increase in tourism and higher disposable income indicates a surge in restaurant visits is boosting the Indian market. India outdoor furniture market is anticipated to have the fastest growth in the Asia Pacific region with a CAGR of 9.1% over the forecast period, from 2023 to 2030.

North America outdoor furniture market, accounted for the largest share of the overall revenue with a share of 34.37% in 2022, and is expected to maintain the trend throughout the forecast period. The product demand in North America has increased owing to the growing trend of family dinners and gatherings at home. This trend is further supported by the rising interest in creating and maintaining front yard and backyard gardens not only to enhance the aesthetics of the homes but also to entertain guests. Within the region, the U.S. has dominated the market with a share of 80.37% in 2022. The growth is attributable to the presence of companies such as Brown Jordan and Forever Patio as well as the availability of innovative and trendy outdoor furniture products in the U.S. is boosting the U.S. outdoor furniture market.

Europe outdoor furniture market is anticipated to have a decent growth with a CAGR of 6.4% over the forecast period of 2023 - 2030. Residential use of outdoor furniture is increasing due to an increase in the working population and disposable incomes, which is bolstering the market in the region. The U.K. outdoor furniture market for bamboo and rattan outdoor furniture is being boosted by the growing demand for eco-friendly outdoor furniture in the country. As a result, the U.K. is dominating the regional outdoor outdoor furniture market with a share of 43.93% in 2022.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of the outdoor furniture market. Players in the market are diversifying their service offering to maintain market share.

-

In June 2023, HNI Corporation announced the completion of the acquisition of Kimball International Inc. With pro forma revenue of almost $3 billion and combined EBITDA of about $305 million, the merger develops the market leader.

-

In July 2022, Andreu World, a outdoor furniture manufacturer based in U.S., opened its new showroom in Germany. The outdoor furniture pieces displayed were produced under the advice of internationally reputed designers such as Patricia Urquiola, Philippe Starck, Alfredo Häberli, Jasper.

Some of the key players operating in the outdoor furniture market include:

-

Inter IKEA Systems B.V.

-

Ashley Outdoor Furniture Industries, Inc.

-

Brown Jordan Inc.

-

Kenter

-

Agio International Company, LTD

-

Lloyd Flanders, Inc.

-

Barbeques Galore

-

Century Outdoor Furniture LLC.

-

Aura Global Outdoor Furniture

-

Kimball International Inc.

Outdoor Furniture Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 48.41 billion

Revenue forecast in 2030

USD 73.08 billion

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material type, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Spain, Italy, China, India, Japan, Australia, Brazil, Argentina, UAE, Saudi Arabia, South Africa

Key companies profiled

Inter IKEA Systems B.V., Ashley Outdoor Furniture Industries, Inc., Brown Jordan Inc., Kenter, Agio International Company, LTD, Lloyd Flanders, Inc., Barbeques Galore, Century Outdoor Furniture LLC., Aura Global Outdoor Furniture, Kimball International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Outdoor Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global outdoor furniture market on the basis of product, material type, end use and region.

-

Product Outlook (USD Million; 2017 - 2030)

-

Seating Sets

-

Loungers

-

Dining Sets

-

Chairs

-

Table

-

Others

-

-

Material Type Outlook (USD Million; 2017 - 2030)

-

Wood

-

Plastic

-

Metal

-

-

End Use Outlook (USD Million; 2017 - 2030)

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. North America dominated the outdoor furniture market with a share of around 34.4% in 2022. This is owing to the rising demand for family gatherings and the increase in the dine-out culture.

b. Some of the key players operating in the outdoor furniture market include Inter IKEA Systems B.V., Ashley Furniture Industries, Inc., Brown Jordan Inc., Kenter, Agio International Company, LTD, Lloyd Flanders, Inc., Barbeques Galore, Century Furniture LLC., Aura Global Furniture, and Kimball International Inc.

b. Key factors driving the outdoor furniture market growth include the increasing consumer spending on outdoor eating and dining and the rise in the usage of hotels, resorts, open space eateries, and public gardens.

b. The global outdoor furniture market was estimated at USD 46.20 billion in 2022 and is expected to reach USD 48.41 billion in 2023.

b. The global outdoor furniture market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 73.08 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."