- Home

- »

- Pharmaceuticals

- »

-

Ovarian Cancer Drugs Market Size And Share Report, 2030GVR Report cover

![Ovarian Cancer Drugs Market Size, Share & Trends Report]()

Ovarian Cancer Drugs Market Size, Share & Trends Analysis Report By Therapeutic Class (PARP, PD-L1, Angiogenesis Inhibitors), By Treatment, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-380-5

- Number of Report Pages: 94

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global ovarian cancer drugs market size was estimated at USD 3.37 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. The rising incidence of ovarian cancer owing to the growing unhealthy lifestyles is one of the key factors driving the growth of the market. In addition, the increasing adoption of novel drugs and the presence of a strong product pipeline are expected to positively support the growth of the market for ovarian cancer treatment.

The number of women diagnosed with ovarian cancer continues to rise, contributing to the increased demand for treatment options. According to the World Cancer Research Fund International (WCRF), ovarian cancer is the eighth most common cancer in women worldwide. It causes more deaths per year than any other gynecological cancer. In 2020, approximately 313,000 new cases and 207,252 deaths were reported worldwide. Furthermore, the risk of ovarian cancer is increased in females with conditions such as not bearing children, premature menarche (less than the age of 12), delay in natural menopause (post the age of 55), smoking, hormone therapy, and family history.

The increasing adoption of novel drugs is contributing to the growth of the ovarian cancer drug market. Healthcare providers and patients are more inclined to adopt these treatments due to their improved efficacy and reduced side effects. Furthermore, the availability of a robust development pipeline ensures a continuous influx of innovative treatment options. According to Aravive, Batiraxcept was allowed fast-track designation by the U.S. Food and Drug Administration (FDA) for platinum-resistant ovarian cancer and clear cell renal cell carcinoma.

Therapeutic Class Insights

Among the major drug classes, PARP inhibitors contributed to the majority of the market share in 2022, supported by continued uptake of approved drugs and superior efficacy. The surging uptake of checkpoint inhibitors is also projected to benefit the growth of the market. Current research in ovarian cancer is focused on using novel treatments such as immunotherapy, targeted therapy, and, most importantly, combination regimens. Immuno-oncologic agents have shown promising results with improved survival and lower toxicity.

However, a single-agent response rate of PD-1/ PD-L1 molecules such as Opdivo and Keytruda for ovarian cancer treatment is less than 20.0%. Combination therapies, specifically checkpoint inhibitors, are poised to be introduced in the first-line setting to target major unmet needs, including overcoming tumor resistance, improving progression-free survival, and maintaining the quality of life.

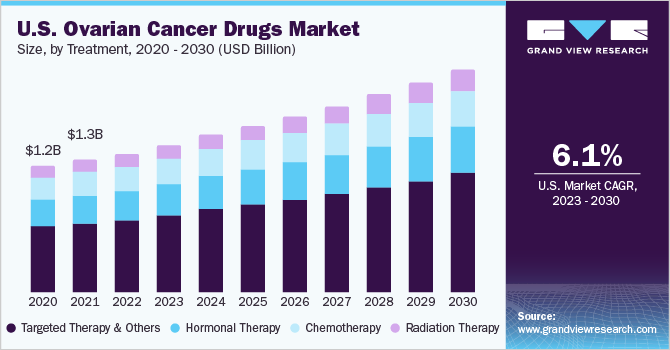

Treatment Insights

The targeted therapy segment held the largest revenue share in 2022. Targeted therapies are designed to specifically identify and attack cancer cells while sparing healthy cells, resulting in more effective treatment with fewer side effects. In ovarian cancer, targeted therapies aim to inhibit specific molecular targets that drive the growth of cancer cells. Bevacizumab, an angiogenesis inhibitor administered to patients with ovarian cancer as targeted therapy, is proven to shrink and slow the growth of advanced epithelial ovarian cancers.

The radiation therapy segment is expected to grow at the fastest CAGR over the forecast period. Radiation therapy utilizes high-energy X-rays to kill cancer cells. It is a painless procedure that only targets the area affected by the cancer. Radiation therapy is beneficial in treating areas where cancer has spread, either close to the primary tumor or in another organ, such as the spinal cord and brain. External beam radiation therapy and brachytherapy are the most common radiation therapy administered to women with ovarian cancer.

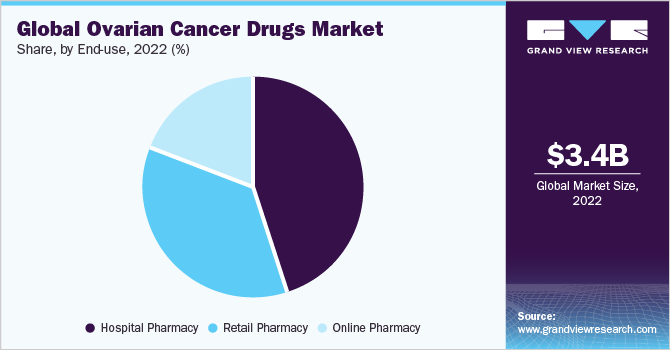

End-use Insights

The hospital pharmacy segment accounted for the largest revenue share of around 45.3% in 2022. The dominance of the segment is attributed to the fact that hospital pharmacies ensure timely access to necessary drugs for patients undergoing ovarian cancer treatment, which is essential for their care. Furthermore, patients who are diagnosed and treated for ovarian cancer in hospitals have increased trust in these hospital pharmacies contributing to the growth of the segment.

The online pharmacy material segment is estimated to register the fastest CAGR of 8.1% over the forecast period. These digital pharmacies provide convenient access to a wide range of medications, including drugs used in the treatment of ovarian cancer. Online pharmacies offer patients the convenience of ordering their prescribed medications from the comfort of their homes, eliminating the need for physical visits, therefore, attributing to the growth over the forecast period.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 43.2% in 2022. The region has a well-developed healthcare infrastructure and advanced medical facilities, which facilitate early diagnosis and treatment of ovarian cancer. The increasing awareness among patients has led to increased screening and detection rates. Additionally, North America is home to many pharmaceutical companies, research institutions, and academic centers focusing on developing innovative cancer treatments. According to the American Cancer Society, ovarian cancer ranks fifth in cancer death among women. Additionally, it is the deadliest of all gynecologic malignancies. In 2023, 19,710 women were diagnosed with ovarian cancer, and 13,270 deaths were reported in the U.S.

Asia Pacific is expected to grow at the fastest CAGR of 8.0% during the forecast period. The growth over the forecast period can be attributed to the large population and the increasing prevalence of ovarian cancer in Asian countries. This rising prevalence of ovarian cancer creates a substantial patient pool and drives the demand for effective treatment options, thus contributing to market growth. Furthermore, an increasing focus on healthcare infrastructure development in the Asia Pacific region fuels the demand for ovarian cancer drugs and drives the market growth.

Key Companies & Market Share Insights

The market comprises a large number of participants accounting for a majority of the market share. Product approval, launches, and partnerships are just a few of the important business strategies market participants use to maintain and grow their market share. In November 2022, ImmunoGen Inc. announced that the Food and Drug Association (FDA) had allowed accelerated approval for ELAHERE for the treatment of platinum-resistant ovarian cancer. In March 2020, Vivesto AB and Elevar Therapeutics Inc. signed a global strategic partnership to commercialize Vivesto AB’s ovarian cancer drug Apealea. Some prominent players in the global ovarian cancer drugs market include:

-

AbbVie Inc.

-

Pfizer, Inc.

-

AstraZeneca

-

F. Hoffmann-La Roche AG

-

Johnson & Johnson Services, Inc.

-

Boehringer Ingelheim International GmbH

-

Clovis Oncology

-

ImmunoGen, Inc.

-

Vivesto AB

Ovarian Cancer Drugs Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.61 billion

Revenue forecast in 2030

USD 5.65 billion

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutic class, treatment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Pfizer, Inc., AstraZeneca; F. Hoffmann-La Roche AG; Johnson & Johnson Services, Inc.; Boehringer Ingelheim International GmbH; Clovis Oncology; ImmunoGen, Inc.; Vivesto AB

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ovarian Cancer Drugs Market Report Segmentation

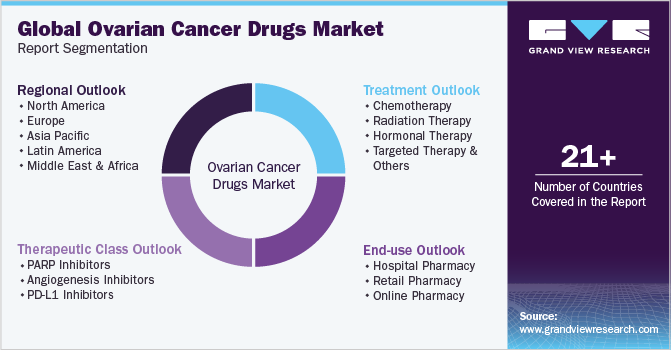

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ovarian cancer drugsmarket report based on therapeutic class, treatment, end-use, and region:

-

Therapeutic Class Outlook (Revenue, USD Million, 2018 - 2030)

-

PARP Inhibitors

-

Angiogenesis Inhibitors

-

PD-L1 Inhibitors

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Radiation Therapy

-

Hormonal Therapy

-

Targeted Therapy & Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ovarian cancer drugs market size was estimated at USD 3.37 billion in 2022 and is expected to reach USD 3.61 billion in 2023.

b. The global ovarian cancer drugs market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 5.65 billion by 2030.

b. Ovarian cancer treatment landscape has changed dramatically in the last few years with upswing in the uptake of PARP inhibitors and angiogenesis inhibitors.

b. Some of the key players operating in the market are AstraZeneca, Roche, Tesaro, and Clovis Oncology.

b. Rising incidence of ovarian cancer, owing to growing geriatric population and unhealthy lifestyles, is one of the key trends escalating market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."