- Home

- »

- Medical Devices

- »

-

Over-the-Counter (OTC) Hearing Aids Market Report, 2030GVR Report cover

![Over-The-Counter (OTC) Hearing Aids Market Size, Share & Trends Report]()

Over-The-Counter (OTC) Hearing Aids Market Size, Share & Trends Analysis Report By Product, By Technology (Digital Hearing Aids, Analog Hearing Aids), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-008-2

- Number of Report Pages: 190

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

OTC Hearing Aids Market Size & Trends

The global over-the-counter (OTC) hearing aids market size was valued at USD 1.06 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.60% from 2023 to 2030. OTC hearing aids have lower prices when compared to prescription ones and hence are more affordable. This is one of the important factors responsible for their growing demand. The average price of prescription hearing aids is around USD 4,600, while OTC cost around USD 1,600. Furthermore, Medicare and many insurance companies do not cover the cost of hearing aids. Some insurance providers offer coverage as add-on services, but the patients are required to pay extra premiums.

Hearing loss or impairment is common among patients, especially in industrialized countries. As per WHO, over 1.5 billion people across the globe live with some level of hearing loss. This figure is expected to reach 2.5 billion by 2050. Furthermore, over 460 million people across the globe, representing around 5% of the global population, are living with disabling hearing loss. This is expected to increase to over 700 million or 1 in every 10 people by 2050. This is mainly due to increasing life expectancy and rising noise pollution, which is leading to a high incidence of age-related auditory impairment.

With the increasing demand for OTC hearing products, many companies are entering the market by launching technologically advanced products. Many manufacturers offer products that can be embedded deep in the ear, thereby hiding them from view. The latest Behind-the-Ear (BTE) and Invisible-in-Canal (IIC) are available in small sizes, which are not easily visible. These aids fit very close to the eardrum, hence requiring less power while delivering natural and clear sound. Many manufacturers launching canal hearing aids that are discreet. For instance, in October 2022, Lexie (hearX IP (Pty) Ltd.) announced the release of the Lexie B2, a receiver-in-canal OTC hearing aid in the U.S.

The COVID-19 pandemic had a positive impact on the market, with an increase in consumer awareness about OTC hearing aids and its benefits that led to high adoption. Lockdowns imposed across nations and increased restrictions on in-person activities, particularly among the geriatric population that need audiology devices the most, are factors driving the market. OTC hearing aids do not require any visits to audiologists or ENT specialists and can be easily purchased online, which favored sales during the pandemic. For instance, Eargo, Inc.’s revenue in the year 2020 increased by 111%, due to high demand during the COVID-19 pandemic.

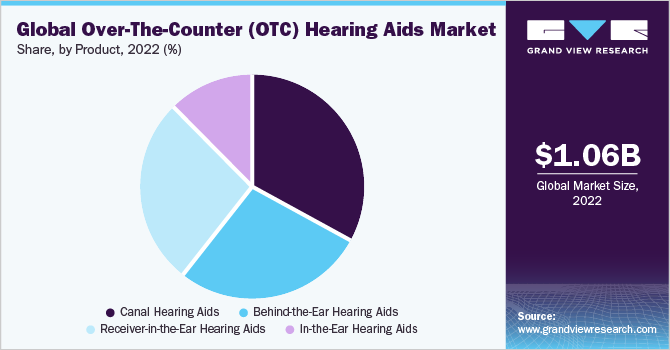

Product Insights

The canal hearing aids segment held the largest market share of 32.9% in 2022. Technological advancements, new product approvals, and advantages, such as compact design, are factors driving segment growth. Moreover, increasing R&D initiatives undertaken by the key players in order to improve their performance and rising demand for invisible devices by the younger population are some of the key factors, which are expected to boost their acceptance.

The behind-the-ear segment is anticipated to witness lucrative growth during the forecast period owing to the advantages offered by these devices such as feedback management, noise reduction, and multiple listening environments which is expected to drive demand for these devices. Moreover, the devices can be modified by connecting with external sound sources and are Bluetooth compatible which enables wireless connectivity. Further, the devices offer higher amplification and feature larger battery life, which is expected to further contribute to the demand for behind-the-ear devices.

Receiver-in-the-Ear (RITE) devices feature receivers that can be placed inside the ear, thus allowing the device to be smaller than BTE. RITE devices have several advantages including availability in mini and micro sizes, efficient sound transmission directly into the ear canal, invisible when worn due to their small size. In addition, these devices are available with the option of standard domes or custom earmolds.

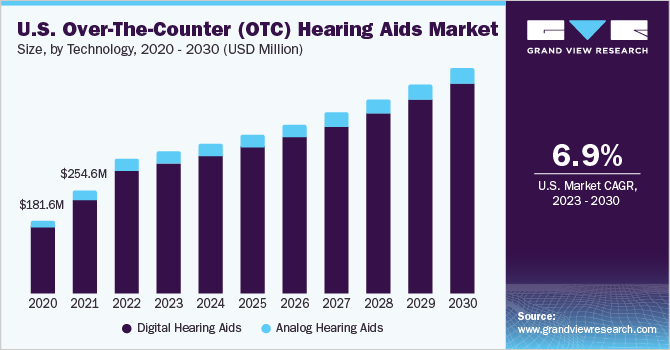

Technology Insights

The digital segment accounted for the largest revenue share of 93.3% in 2022. Technological advancements and increased preference for digital audiology devices compared with analog ones are boosting the segment growth. These devices offer enhanced flexibility in programming for matching the transmitted sound to the needs of a specific pattern of hearing loss. In addition, they provide multiple program memories. They have several advantages over traditional analog devices, which include directional microphones, feedback reduction, signal processing, speech enhancement, and noise reduction.

In addition, companies are developing a new generation of digital audiology devices along with innovative technology, improving compatibility, and incorporation along with IT devices, thus favoring segment growth. Furthermore, increased awareness about digital devices and their usage also resulted in market growth in both developed and emerging countries.

The analog segment is expected to have moderate market growth. These devices work by increasing the intensity of continuous sound waves. All sounds, including speech & noise, are uniformly amplified by them. Due to low cost and a small number of resistant customers, manufacturers have been making and selling analog audiology devices.

Distribution Channel Insights

The retail stores segment accounted for a major market share of 39.7% in 2022. This can be attributed to factors such as a rise in the number of manufacturing companies partnering with retail store owners, a large number of retail stores across various locations, and high retail sales margins. The FDA's rule permits stores to sell hearing aids over the counter to millions of customers at lower prices. Retailers can make the most of this exceptional opportunity.

The online segment is anticipated to witness lucrative growth during the forecast period. Cost efficiency, ease of use, and availability are driving the segment growth. Manufacturers are adopting online platforms as the products reach directly to customers eliminating the players in between increasing their profits.

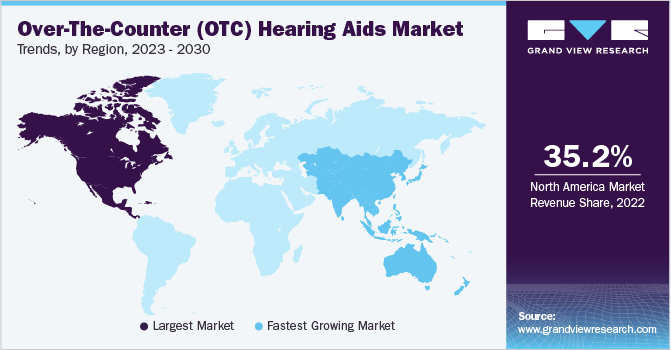

Regional Insights

North America dominated the market in 2022, accounting for the largest market share of 35.2%, and is anticipated to maintain its position throughout the forecast period. The availability of favorable government policies and the high prevalence of mild auditory impairment is expected to be the key factors driving the market in North America. For instance, according to the National Institute on Deafness and Other Communicable Disorders, about 18% of the population between the ages of 20 and 69 suffer from audio-frequency hearing loss in one or both ears in the U.S. About 28 million American adults can benefit from hearing aids, which is expected to contribute to market growth.

Asia Pacific is expected to register remarkable growth during the forecast period The market in Asia Pacific is primarily driven by high demand in China and Japan. This is due to the local presence of major market players and the large geriatric population. China is anticipated to be the fastest-growing market during the forecast period in Asia Pacific, with South Korea and India as some of the key emerging economies.

Asia has the highest population density in the world and most likely the largest number of individuals with hearing loss. In 2021, WHO predicted that 401 million people in the WHO Southeastern Asia have some degree of hearing loss, and 109.4 million individuals, or 5.5% of the population, have a moderate or severe loss. Furthermore, this figure is expected to reach 666 million by 2050 in Southeastern Asia.

Key Companies & Market Share Insights

The market is fairly competitive due to the presence of a large number of multinational as well as local market players. Companies operating in the market are adopting various strategies, such as new product launches, regional expansion, and partnerships & collaborations, to gain higher market shares. For instance, in October 2022, Jabra announced the availability of Jabra Enhance Plus, which will be available online as well as in stores. Jabra Enhance Plus is an in-ear device that improves hearing while allowing users to answer calls and listen to music. Some of the prominent players in the global over-the-counter hearing aids market include:

-

Eargo Inc.

-

Jabra (GN Store Nord A/S)

-

MDHearing

-

Audicus

-

Sony Corporation

-

Start Hearing

-

Lexie (hearX IP (Pty) Ltd.)

Over-The-Counter (OTC) Hearing Aids Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.11 billion

Revenue forecast in 2030

USD 1.74 billion

Growth Rate

CAGR of 6.60% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Eargo, Inc.; Jabra; MD Hearing; Audicus; Sony Corporation; Start Hearing; and Lexie (hearX IP (Pty) Ltd.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Over-the-Counter (OTC) Hearing Aids Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global over-the-counter (OTC) hearing aids market report based on product, technology, distribution channel, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-the-Ear Hearing Aids

-

Receiver-in-the-Ear Hearing Aids

-

Behind-the-Ear Hearing Aids

-

Canal Hearing Aids

-

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Hearing Aids

-

Analog Hearing Aids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Stores

-

Online

-

Audiology Offices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global over-the-counter (OTC) hearing aids market size is estimated at USD 1.06 billion in 2022 and is expected to reach USD 1.11 billion in 2023.

b. The global over-the-counter (OTC) hearing aids market is expected to grow at a compound annual growth rate of 6.60% from 2023 to reach USD 1.7 billion by 2030.

b. Canal hearing aids dominated the hearing amplifiers market with a share of 32.9% in 2022. This is attributable to high connectivity, comfort, highly efficient, easy to use coupled with the growing demand for aesthetically appealing products.

b. Some key players operating in the OTC hearing aids market include Eargo, Inc.; Jabra; MD Hearing; Audicus; Sony Corporation; Start Hearing; and Lexie (hearX IP (Pty) Ltd.)

b. Growing prevalence of mild and moderate hearing loss among the adults globally and recent approval of the OTC hearing aids by the FDA for adults use without the need for prescriptions are factors anticipated to contribute to the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."