- Home

- »

- Pharmaceuticals

- »

-

Overactive Bladder Treatment Market Size Report, 2030GVR Report cover

![Overactive Bladder Treatment Market Size, Share & Trends Report]()

Overactive Bladder Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report, By Type (Anticholinergics, Mirabegron, Neuromodulation, Botox), By Disease Type (Idiopathic, Neurogenic), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-168-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Overactive Bladder Treatment Market Summary

The Global Overactive Bladder Treatment Market size was estimated at USD 3.79 billion in 2023 and is projected to reach USD 5.25 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030.The market for overactive bladder (OAB) treatment growth can be attributed to increasing incidences of overactive bladder conditions and other diseases causing frequent urination & incontinence.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

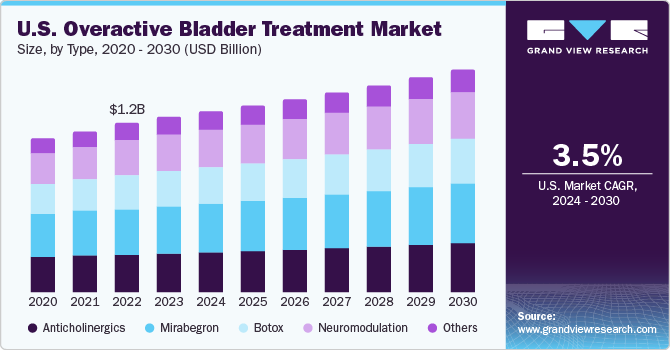

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- On the basis of type, the mirabegron drug held the largest market share of 27.6% in 2023.

- On the basis of disease type, the idiopathic OAB segment dominated in 2023 with a market share of 78.5%.

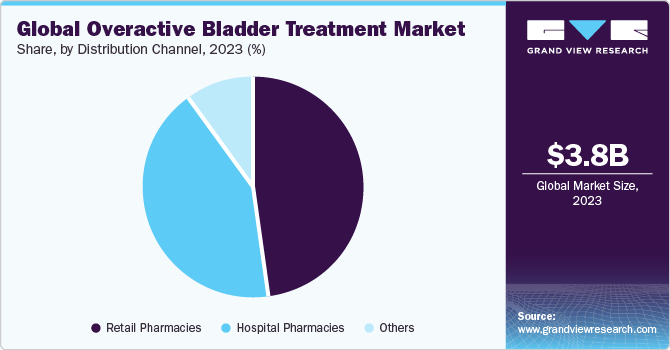

- Based on distribution channel, the retail pharmacies segment captured the largest market share of 47.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.79 Billion

- 2030 Projected Market Size: USD 5.25 Billion

- CAGR (2024-2030): 4.8%

- North America: Largest market in 2023

Moreover, rising development of therapeutics targeting overactive bladder conditions by key industry participants is another factor influencing the market growth.

Rising overactive bladder and urinary incontinence incidences are expected to provide significant growth opportunities for the industry. According to the article published by the American Urogynecology Society., in April 2022, over 60% of community-dwelling adult women in the U.S. experience urinary incontinence. This article states that the increasing prevalence of urinary incontinence can be due to rising obesity prevalence and an increasing aging population.

Moreover, increasing prevalence of numerous disorders that cause OAB, such as bladder cancer, diabetes, and urinary tract infections (UTI), is expected to propel the demand for space. The symptoms associated with bladder cancer include painful and frequent urination. Moreover, urinary incontinence is a common symptom of urinary tract infections. In addition, according to the report published by the National Healthcare Safety Network, CDC, in January 2023, UTIs were the fifth most common type of healthcare-associated infection. Thus, the rising prevalence of such conditions are anticipated to increase the demand for OAB treatment.

Furthermore, increasing development and launches of medications targeting overactive bladder are anticipated to fuel the market expansion. Several notable companies, including AbbVie Inc., Velicept Therapeutics,Medytox, Sumitovant Biopharma,Inc., Lipella Pharmaceuticals,Imbrium Therapeutics, Aetas Pharma, and more, are actively engaged in developing potential drug candidates. This collective effort reflects a competitive landscape where companies are striving to improve and expand options available to those with overactive bladder.

These companies are at a forefront of research and development, aiming to address the evolving needs of patients suffering from overactive bladder. Their contributions to the market bring promise and innovation, as they work on potential treatments that may enhance the quality of life for individuals dealing with this condition. Similarly, other key players are introducing novel drugs and focusing on obtaining regulatory approvals. For instance, in December 2020, a biopharmaceutical company, Urovant Sciences, received approval for the New Drug Application for the GEMTESA from the U.S. Food and Drug Administration. GEMTESA treats OAB symptoms, including frequent urination, urgency, and urinary incontinence. Such increasing developments and approvals are expected to improve the demand for overactive bladder treatments.

Type Insights

On the basis of type, the market is segmented into anticholinergics, mirabegron, Botox, neuromodulation, and others. Mirabegron drug held the largest market share of 27.6% in 2023. This drug comes as an extended -release oral tablet to treat symptoms of overactive bladder. Factors such as wide use of mirabegron for treating urge urinary incontinence, urgency, frequent urination, and rising regulatory approvals for this drug are projected to drive the drug demand. Furthermore, according to the article published by the National Library of Medicine in September 2022, adverse drug effects of mirabegron are typically mild and tolerable. Generally, mirabegron is considered a safe and effective drug.

In addition, regulatory authorities are supporting this drug for OAB and other bladder diseases. For instance, in March 2021, the U.S. FDA approved a new indication for mirabegron tablets (Myrbetriq) and mirabegron oral suspension (Myrbetriq Granules) for treating a bladder dysfunction, neurogenic detrusor overactivity (NDO) in children ages three years and older. Such approvals are anticipated to drive the segment growth over the forecast period.

Neuromodulation segment is anticipated to grow at a significant CAGR over the forecast period. The growth of the segment can be attributed to rising adoption of sacral and other neuromodulation devices. Sacral neuromodulation (SNM) is a minimally invasive, fully reversible therapy. In addition, various neuromodulation techniques are being explored to treat OAB. For instance, according to the study published by the National Library of Medicine in October 2023, peroneal neuromodulation and parasacral transcutaneous neuromodulation are among the most studied investigative techniques. Furthermore, these techniques were demonstrated to yield promising results in treating OAB symptoms.

Disease Type Insights

On the basis of disease type, the market is segmented into the neurogenic overactive bladder and the idiopathic overactive bladder. The idiopathic OAB segment dominated in 2023 with a market share of 78.5%. The higher revenue share of the segment is attributed to its high prevalence. Idiopathic or non-neurogenic OAB is a condition where the person does not have a defined or identifiable neurological abnormality, but the bladder nerve pathways are not working properly. Moreover, government authorities are also focusing on idiopathic OAB, which is expected to boost segment growth in the coming years. For instance, according to the article published by the American Urological Association in September 2019, guideline for the non-neurogenic overactive bladder was amended to provide a clinical framework for the diagnosis and treatment of the disease.

Neurogenic OAB segment is projected to register a lucrative CAGR from 2024 to 2030. A rising focus of public and private players on developing innovative solutions for neurogenic OAB is anticipated to drive market growth. Companies are offering novel drugs for treating overactive bladder associated with neurogenic conditions. For instance, in February 2021, Allergan, an AbbVie company, received U.S. FDA authorization for Botox, a neurotoxin to treat detrusor over activity associated with a neurologic disorder in pediatric patients.

Distribution Channel Insights

Based on distribution channel, the market is categorized into retail pharmacies, hospital pharmacies, and others. Retail pharmacies segment captured the largest market share of 47.9% in 2023. The presence of established pharmacy chains such as Walgreens, Walmart, Rite Aid, CVS Pharmacy, and Kroger significantly contribute to the segment expansion. In addition, shopping from pharmacies such as retail pharma stores offers personalized guidance from pharmacists, and it also offers a wide variety of products to choose from for the customers. Such benefits associated with retail pharmacies are anticipated to drive the segment growth over the forecast period.

On the contrary, the other segment comprises distributing drugs via e-commerce platforms or online distribution channel, is projected to register the fastest CAGR of from 2024 to 2030. An increase in the number of players providing online drugs is one of the important factors driving segment growth. For instance, Amazon offers products such as Ultimate Bladder Control capsules and MASON NATURAL Daily Bladder Comfort for controlling overactive bladder and urgency. E-commerce platforms provide various advantages such as convenient shopping, saving time, and offering various discounts. These advantages associated with other segments are anticipated to boost the segment growth over the forecast period.

Regional Insights

North America dominated the OAB treatment market with a share of 36.5% in 2023. High presence of key industry participants such as Pfizer, Inc., AbbVie, Inc., and Viatris, Inc. is likely to contribute a higher revenue share of the region. In addition, various companies operating in the region are focusing on clinical trials and product pipelines. For instance, according to the JP Morgan Healthcare Conference in January 2023, Onabotulinumtoxin A ( Botox) is an under-development product by Viatris Inc. for treating OAB and cervical dystonia. This product is expected to be launched by 2026. Such developments are anticipated to boost the regional growth over the forecast period.

Overactive bladder treatment market for Asia Pacific is expected to grow at a significant CAGR from 2024 to 2030. Significant demand for OAB medications and treatments owing to the rising prevalence of the condition across the region is expected to support the regional market. Moreover, rising product launches and presence of large numbers of industry participants further facilitate regional market. For instance, in November 2021, Taiho Pharmaceutical Co., Ltd. introduced BUP-4 LADY, an OTC medication for urinary urgency, in Japan. This medicine was launched at non-dispensing pharmacies, drug stores, and dispensing pharmacies in Japan.

Key Companies & Market Share Insights

The key players in the industry are undertaking various strategic initiatives to maintain their market presence. In addition, various strategic initiatives help market players to bolster their business avenues.

-

In March 2023, MSN Labs introduced Fesobig, a generic version of the Fesoterodine Fumarate tablet, to treat OAB and urinary incontinence.

-

In May 2023, following the agreement with Urovant Sciences GmbH, Pierre Fabre commenced the EU marketing authorization application process for Vibegron, a medication targeting OAB symptoms.

Key Overactive Bladder Treatment Companies:

- Pfizer, Inc

- AbbVie Inc.

- Astellas Pharma Inc.

- Medtronic

- Sumitomo Pharma America, Inc.(Urovant Sciences.)

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Hisamitsu Pharmaceutical Co. Inc.

- Macleods Pharmaceuticals Ltd.

- Endo International plc

Overactive Bladder Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.96 billion

Revenue forecast in 2030

USD 5.25 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, disease type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Pfizer, Inc.; AbbVie Inc.; Astellas Pharma Inc.; Medtronic; Sumitomo Pharma America, Inc.( Urovant Sciences.); Viatris Inc.; Teva Pharmaceutical Industries Ltd.; Hisamitsu Pharmaceutical Co., Inc; Macleods Pharmaceuticals Ltd.; Endo International plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

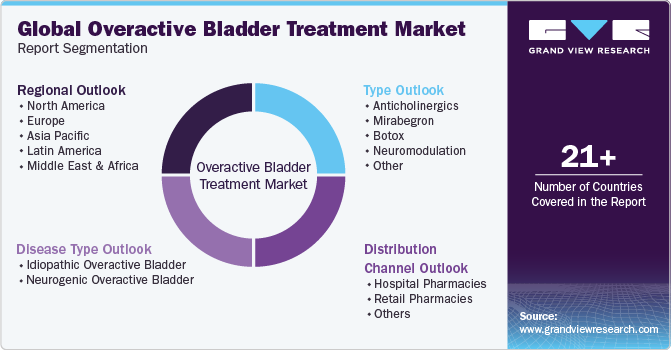

Global Overactive Bladder Treatment Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global overactive bladder treatment market report based on type, disease type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Anticholinergics

-

Mirabegron

-

Botox

-

Neuromodulation

-

Other

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Idiopathic Overactive Bladder

-

Neurogenic Overactive Bladder

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.