- Home

- »

- Pharmaceuticals

- »

-

Pancreatic Cancer Treatment Market Size Report, 2030GVR Report cover

![Pancreatic Cancer Treatment Market Size, Share & Trends Report]()

Pancreatic Cancer Treatment Market Size, Share & Trends Analysis Report By Type (Exocrine, Endocrine), By Treatment (Chemotherapy, Radiation Therapy, Others), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-774-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pancreatic Cancer Treatment Market Trends

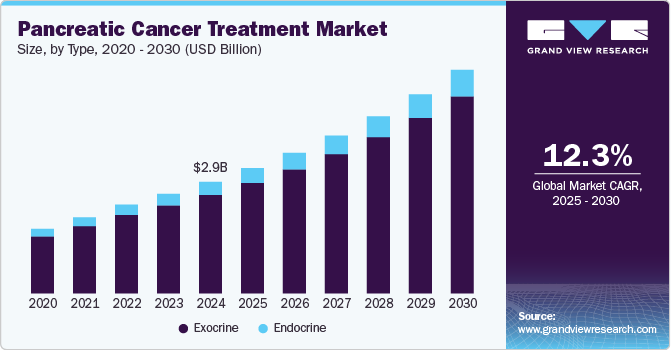

The global pancreatic cancer treatment market was valued at USD 2.87 billion in 2023 and is projected to grow at a CAGR of 13.9% from 2024 to 2030. Factors such as unhealthy lifestyles, alcohol consumption, and obesity have been the primary cause of pancreatic cancer in patients. The growing prevalence of pancreatic cancer in the population and developments in molecular biology, drugs, and technology play a vital role in driving market growth. Hence, the research and development activities encourage the launch of new products and facilitate in driving the market growth.

The incidence of pancreatic cancer increases as the repair mechanism becomes less effective as the person grows old. Medical research is primarily focused on treatment because of the high mortality rate and limited treatment options. The market encompasses pharmaceutical and healthcare players who aim to address diagnosis and treatment challenges and ensure patient-centric care. The factors that are constraining the growth of the pancreatic cancer treatment market are the high cost attributed to the treatment of pancreatic cancer, lack of healthcare infrastructure, and lack of skilled professionals. In developing countries, governments are improving the healthcare infrastructure for patients and have initiated to optimize treatment and make them cost-friendly.

As the demand for pancreatic cancer is increasing, major biopharmaceutical players are investing in the development of better drugs, devices, and treatments. The increase in awareness has led to the opening of new market opportunities. Due to growth in government funding, the healthcare infrastructure for the public has improved, which has resulted in better treatment opportunities for patients. Major pharmaceutical players collaborate and partner to develop advanced technology to treat patients better.

Type Insights

Based on type, the pancreatic cancer treatment market has been categorized into exocrine and endocrine segments. The exocrine segment dominated with a share of 84.2% in 2023. The exocrine pancreatic affected by cancer occurs when the pancreas loses the ability to produce and supply digestive enzymes to the small intestine, resulting in indigestion. This condition arises because of several factors, such as diabetes, gastrointestinal surgeries, and cystic fibrosis. The majorly increasing prevalence of chronic pancreatitis and an increase in the consumption of sugar and alcohol induce the treatment for the exocrine pancreatic segment.

The endocrine segment is expected to grow at the fastest CAGR of 15.0% during the forecast period. The factors driving the market include an increase in the global diabetic population due to poor diet and lifestyle and a rise in the geriatric and obese population. The technological developments have resulted in equipment such as easy-to-operate test kits and home-based diagnosis encouraging its adoption.

Treatment Insights

Based on treatment, the pancreatic cancer treatment market has been categorized into chemotherapy, radiation therapy, and others. Chemotherapy is the dominant segment, with a global share of 57.9% in 2023. Chemotherapy is the most widely used cancer treatment for its efficacy and significance. Chemotherapy targets the cancer cells and reduces the size of the tumor, which can lead to pancreatic tumors to prevent their growth.

Radiation therapy is anticipated to witness a significant CAGR over the forecast period. In radiation therapy, high-energy X-rays kill cancer cells. It is used to shrink the tumor and prevent its recurrence after surgery. Furthermore, it can alleviate the symptoms that proliferate in the body. Physicians recommend radiation therapy to patients in whom cancer has reached an early stage and the cancerous cells can be eliminated from spreading in the body.

End-use Insights

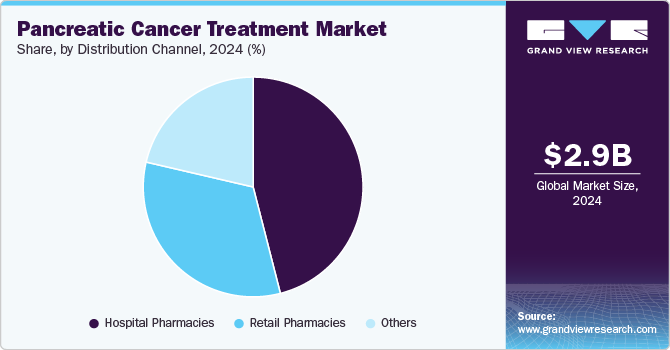

The hospital pharmacies segment dominated with a share of 52.9% in 2023. Most pancreatic cancer patients are treated in hospitals because of the availability of advanced equipment, devices, and skilled professionals. Hospitals have thus become a common point for all types of cancer treatments. This has enabled hospitals to serve better in mild to moderate cancer cases.

Retail pharmacies are expected to be the fastest-growing segment, with a CAGR of 14.9% during the forecast period. Factors influencing the growth include the rising number of retail pharmacies and the number of patients. Retail pharmaceuticals are easily accessible for any patient due to the easy availability of medicines and drugs. Besides, cost-effectiveness has played a significant role in the growth of retail pharmacies.

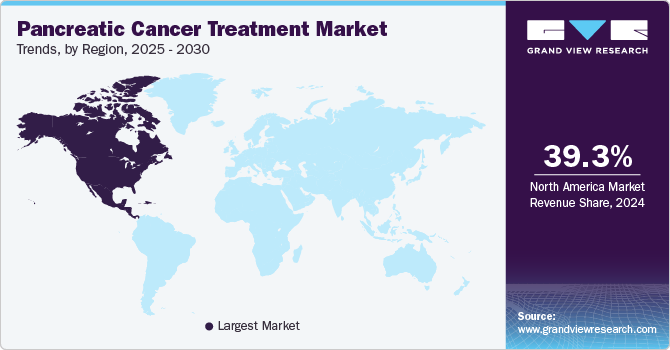

Regional Insights

North America dominated the pancreatic cancer treatment market, with a global share of 37.7% in 2023, due to high healthcare spending, favorable policies, an increase in pancreatic cancer incidences, and major pharmaceutical players. The consumption of sugar, fats, and fast food products has increased rapidly due to the population's changing trends and preferences for junk foods.

U.S Pancreatic Cancer Treatment Market Trends

The U.S. accounted as the dominant region in North America registering a share of 89.3% in 2023. Increasing patient numbers, the presence of major pharmaceutical players, and supportive government policies are expected to drive market growth. The rate of obesity is highest in the U.S. as compared to the globe, due to which the occurrence of diabetes is witnessed due to which the chances of pancreatic cancer are always high.

Europe Pancreatic Cancer Treatment Market Trends

Europe was the second most dominant player in 2023. The increase in sugar consumption, poor diet, and lifestyle have been the driving factors for the growth of regional markets. Heavy industrialization has led to an increase in chemical exposure in the population. Pesticides and chemicals have been traced in raw and processed foods in the past. These factors account for the growth of cancer cases across Europe.

The UK has been the most important region in Europe due to the presence of one-third of the geriatric population in the region. Increasing sugar and processed foods are driving the cases of pancreatic cancer in the population of the UK. Besides, the growing dependency on alcohol and tobacco has resulted in the rise of patients with high blood pressure and a lack of medical attention at the latter stages. These factors constitute a need for clinical support for such patients.

Asia Pacific Pancreatic Cancer Treatment Market Trends

Asia Pacific accounted for a significant share of the pancreatic cancer treatment market in 2023. The major driving forces for the Asia Pacific market include an increase in demand for cancer tests and treatments, governments, and non-profit organizations taking the initiative to spread awareness. Technological advancements in diagnostics and treatment have led to more cost-effective solutions and are also driving forces for the market.

China is one of the most important markets for Asia Pacific. The country's population is dense, and a high number of cases have been reported in several regions. Factors such as an increase in pollution, high sugar consumption, government initiatives, and improved healthcare infrastructure influence the market.

Key Pancreatic Cancer Treatment Company Insights

Some key companies in the pancreatic cancer treatment market are AstraZeneca, Novartis AG, Pfizer Inc., etc. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, the key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

AstraZeneca is a global biopharmaceutical company that focuses on delivering new medicines that can treat most diseases, particularly chronic conditions like cancer. Its portfolio of drugs, vaccines, and other supplements all aim to improve patient health.

-

Novartis AG offers a wide range of medicines for various therapeutic areas. It is well known for its innovative drugs, cancer treatments to improve health and well-being of patients.

Key Pancreatic Cancer Treatment Companies:

The following are the leading companies in the pancreatic cancer treatment market. These companies collectively hold the largest market share and dictate industry trends.

- AstraZeneca

- Novartis AG

- Pfizer Inc

- Genentech, Inc

- Bristol-Myers Squibb Company

- Ipsen Pharma Oncolytics Biotech Inc

- TME Pharma

- Phaxiam

Recent Developments

-

In July 2024, Astra Zeneca announced the launch of Imfinzi which has been recommended for approval in the European Union and will be used in treatment for certain patients of endothermal cancer.

-

In February 2024 the U.S. Food and Drug Administration announced the approval of Ipsen’s new drug application for Onivyde (irinotecan liposome injection) combination regimen (NALRIFOX) as the primary treatment for metastatic pancreatic adenocarcinoma in adults.

Pancreatic Cancer Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.20 billion

Revenue forecast in 2030

USD 6.98 billion

Growth rate

CAGR of 13.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, treatment end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Mexico, Canada, Germany, UK, France, Spain, Italy, Denmark, Norway, Sweden, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, Kuwait, South Africa

Key companies profiled

AstraZeneca; Novartis AG; Pfizer Inc.; Genentech, Inc; Bristol-Myers Squibb Company; Ipsen Pharma; Oncolytics Biotech Inc; TME Pharma; Phaxiam

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pancreatic Cancer Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pancreatic cancer treatment market report based on type, treatment, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Exocrine

-

Endocrine

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Radiation Therapy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."