- Home

- »

- Advanced Interior Materials

- »

-

Para-aramid Fibers Market Size, Industry Report, 2033GVR Report cover

![Para-aramid Fibers Market Size, Share & Trends Report]()

Para-aramid Fibers Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Security & Protection, Optical Fibers, Friction Material, Rubber Reinforcement, Tire Reinforcement), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-784-1

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Para-aramid Fibers Market Summary

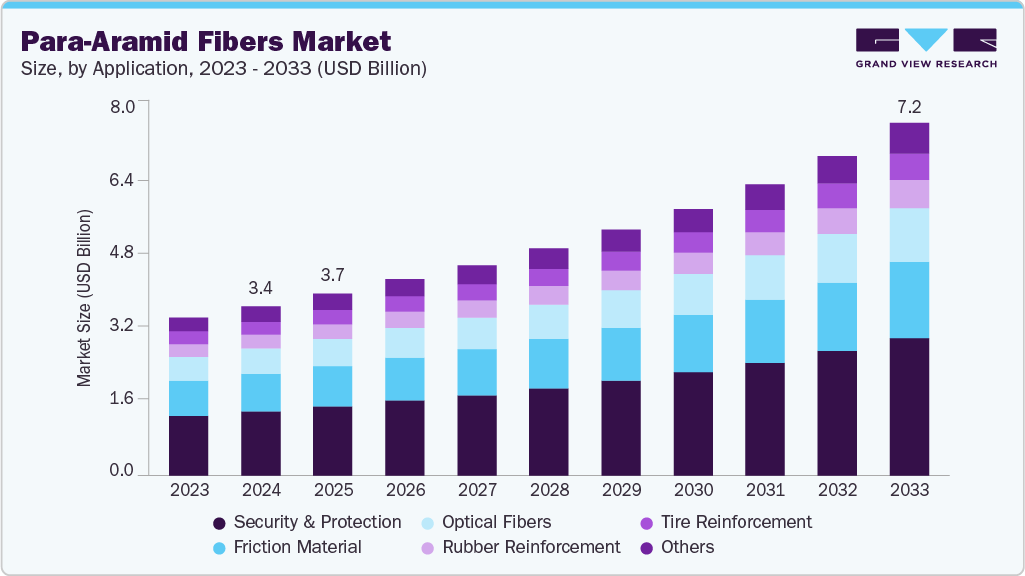

The global para-aramid fibers market size was estimated at USD 3.43 billion in 2024 and is projected to reach USD 7.15 billion by 2033, growing at a CAGR of 8.6% from 2025 to 2033. This market is expected to witness substantial growth owing to its superior properties, including high strength and rigid molecular structure, which drives product use in security and protection applications.

Key Market Trends & Insights

- The para-aramid fiber market in North America is anticipated to grow at the fastest CAGR during the forecast period.

- The para-aramid fiber market in the U.S. is projected to witness at a significant CAGR during the forecast period.

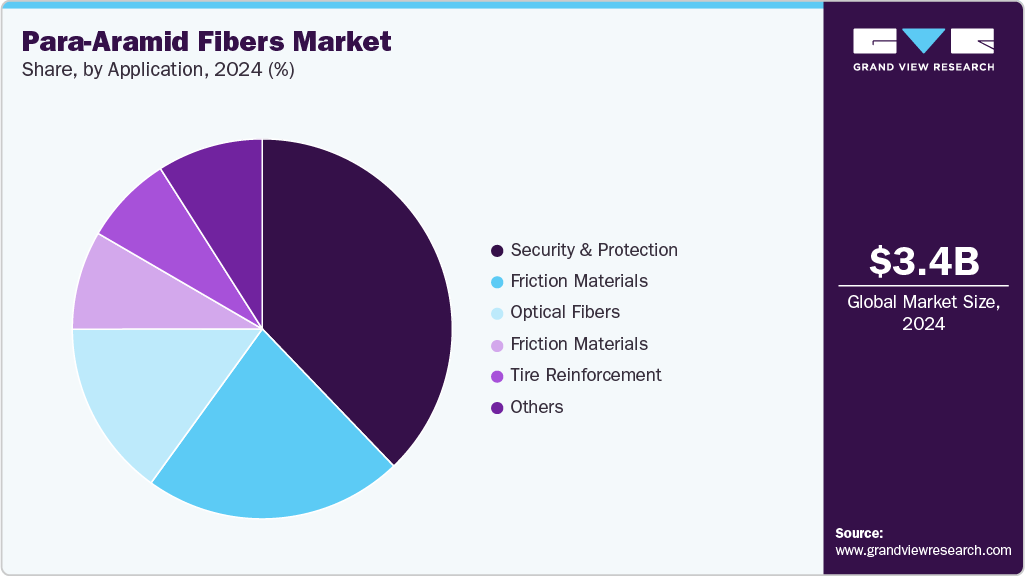

- Based on application, the security & protection segment led the market with the largest revenue share of 37.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.43 Billion

- 2033 Projected Market Size: USD 7.15 Billion

- CAGR (2025-2033): 8.6%

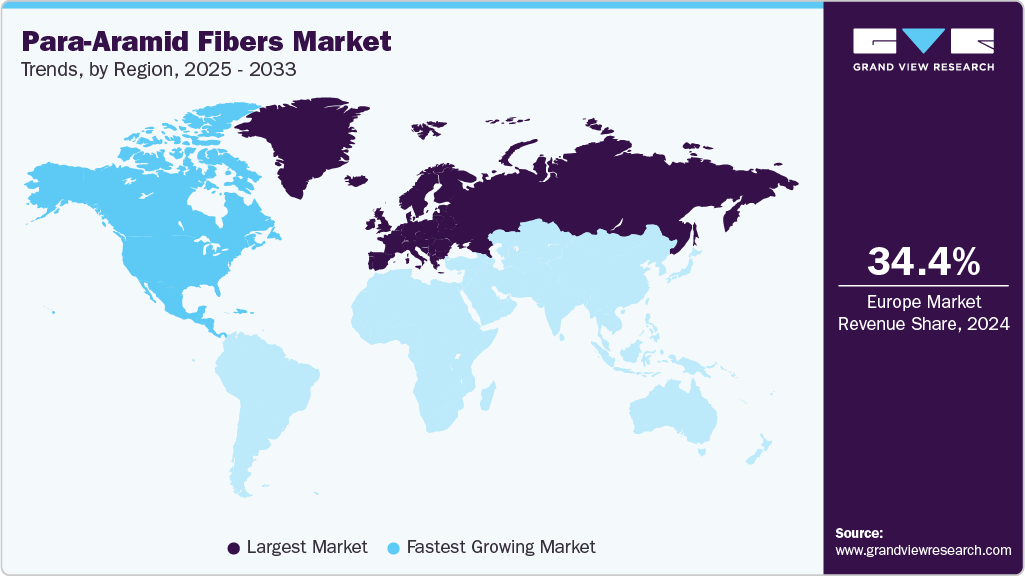

- Europe: Largest market in 2024

Increasing demand for protective headgear, eye protection equipment, and safety harnesses is anticipated to propel product demand over the coming years. The product is supplied through wholesalers, retailers, direct agreements between players and distributors, or through third-party supply agreements. E. I. du Pont de Nemours Company and Teijin Ltd. are major product manufacturers and suppliers across the globe that are forward-integrated across the value chain.Various companies are involved in the development of low-cost and technologically advanced aramid fiber products. Hand lay-up, vacuum bagging, vacuum infusion, RTM, RTM light, press molding, filament winding, and pultrusion are some of the methods adopted for product manufacturing.

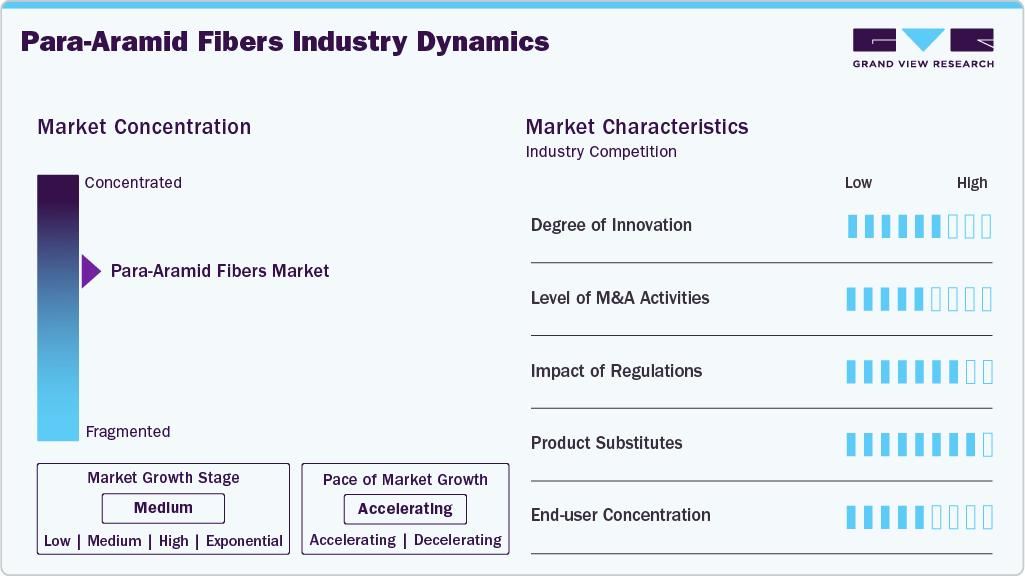

The threat of substitutes is anticipated to remain medium over the forecast period. Carbon and glass fibers can be used as alternatives to aramid fibers, depending on the requirements of various application segments. In addition, most end users prefer aramid-based products over other synthetic fibers on account of their excellent chemical, mechanical, and thermal properties.

Product manufacturers face numerous challenges, elevated manufacturing costs, and low production efficiency, deterring growth. Factors, including high production cost, high initial investment, and inconsistent raw material supply, are also expected to hamper market growth, thereby discouraging the entry of new players in this market.

Market Concentration & Characteristics

The global para-aramid fiber industry is fragmented and is characterized by the presence of a large number of global and regional players. Various initiatives by prominent participants in the form of technology innovations and research and development activities are projected to increase the competition in this market over the forecast period. However, the high production costs involved in the manufacturing of para-aramid fibers are posing a challenge to the entry of new players in this market at the global level.

The threat of new entrants is expected to be moderate over the next few years owing to the high initial investments and manufacturing costs. However, this market is moving toward fragmentation as it comprises numerous global and regional players. Several key market players are conducting research and development of cost-effective para-aramid fibers to meet this market's needs. This is expected to attract new players to this market.

Some of the manufacturers are forward integrated, i.e., they manufacture the products and distribute them to end users via offline or online channels. This market player establishes sales and distribution networks across various regions to cater to the demand from end-user markets. The companies also enter into direct contracts as well as establish partnerships with end-user companies to get a competitive edge over other manufacturers.

The end-users in the para-aramid fibers industry include automotive, aerospace, construction, and military. They use para-aramid fibers for manufacturing various products, including ballistic vests, aircraft, helmets, ropes, automotive parts, and aircraft components.

The para-aramid fiber industry is governed by several regulations and standards on its use and production. Several agencies, such as the Department of Defense and the American Society for Testing and Materials, have levied regulations on para-aramid fibers. The regulations have also been implemented on the requirements and test methods for para-aramid fiber production.

The growth of various end-use industries, such as automotive, aerospace, construction, electronics, and telecommunication, is expected to support the demand for para-aramid fibers globally. The abovementioned industries are experiencing significant demand on account of industrialization, rising income of the population, technological advancements such as 5G in the communication field, and government support to boost infrastructure construction.

Application Insights

Based on application, the security & protection segment led the market with the largest revenue share of 37.8% in 2024 and is forecasted to grow at the fastest CAGR of 9.1% from 2025 to 2033. Para-aramid fibers are highly preferred in security & protection applications owing to growing concerns over the protection of personnel in the military and industrial sectors. Applications leveraging para-aramid fibers include bullet-resistant and protective clothing and stab-resistant products, such as helmets and protective gloves, among others. Furthermore, growing defense expenditure among the major countries across the globe is expected to drive the demand for protective wear, which is further expected to result in rising consumption of para-aramid fibers in the coming years.

Optical fiber applications of para-aramid fiber include aerial dielectric self-supporting cables, premise cables, water-blocking yarns, fiber to the home (FTTH), ballistic tapes, and ripcords. Para-aramid fibers are used as the strength member in the designing and manufacturing of fiber optic cables owing to their advantageous properties, such as low weight, flexibility, dielectricity, high-tensile strength, and handling requirements in an optical fiber cable. Furthermore, they are used as a reinforcing material to support optical cables and fibers on account of their cost-performance advantage.

The optical cable and fiber segment is anticipated to witness at a significant CAGR during the forecast period, owing to technological advancements in terms of innovation of 5G communication. With the growing adoption of 5G communication, metal wires will be replaced by optical fibers as the medium for information transmission. Para-aramid fiber is considered an ideal reinforcing material for optical fibers and cables. Therefore, the installation of 5G communication networks is expected to accelerate the demand for optical fibers and cables, which, in turn, is expected to boost the market growth over the forecast period.

Regional Insights

The para-aramid fiber market in North America is anticipated to grow at the fastest CAGR during the forecast period. Stringent regulations laid down by various regulatory bodies, such as HSE, ANSI, and state bodies, pertaining to the security and protection measures of workers in various industries have been driving this market for the past few years. For instance, American National Standards Institute (ANSI) has laid down protection standards for a broad range of personnel protective equipment, such as protective gloves, to ensure protection at the workplace in various industries.

U.S. Para-Aramid Fibers Market Trends

The para-aramid fiber market in the U.S. is projected to witness at a significant CAGR during the forecast period, on account of increasing demand from application segments owing to its rigid molecular structure. Increasing onshore and offshore drilling activities coupled with growing shale oil & gas industry are expected to further drive the para-aramid fiber demand in the U.S. over the forecast period.

Europe Para-Aramid Fibers Market Trends

Europe dominated global para-aramid market with the largest revenue share of 34.4% in 2024. This is owing to the increasing demand from various application segments such as security & protection, optical fibers, electrical insulation, rubber reinforcement, and tire reinforcement. Robust growth in these applications is expected to fuel the demand for para-aramid fibers over the forecast period. The demand for high bandwidth fiber optic cables for data services and communication is anticipated to influence the para-aramid fiber market positively in the optical fibers segment over the coming years.

European countries are among the world’s biggest manufacturers of automobiles. The tire market is largely dependent on the automotive sector, which has a direct influence on para-aramid fibers. Para-aramid fibers are extensively used in tire reinforcement for improved performance, increased safety, higher comfort, less fuel consumption, and protection of tires.

The para-aramid market in Germany accounted for the largest market revenue share in Europe in 2024. Stringent regulations laid by the EU Commission for protective equipment to ensure the safety and protection of the workforce in various end-use industries are anticipated to fuel the demand for para-aramid fibers in Germany over the forecast period. Regulations in the country mandate the use of protective clothing by military personnel, as well as by the workforce of industries such as construction and chemicals. Moreover, the increasing usage of para-aramid fibers as an alternative to asbestos and steel in various applications is further contributing to their demand in Germany.

Asia Pacific Para-Aramid Fibers Market Trends

The para-aramid fiber market in Asia Pacific is expected to grow at a significant CAGR of 8.9% from 2025 to 2033. Growing need for security & protection measures in various end-use industries and increasing usage of para-aramid fibers as an alternative to asbestos and steel are some of the main factors projected to contribute significantly to the market growth over the forecast period. Security & protection measures in various industries, such as healthcare/medical, mining, oil & gas, manufacturing, building & construction, and military, are fueling the consumption of the product in major economies, such as China and India, which, in turn, is likely to provide significant opportunities for this market to grow in the coming years.

The China para-aramid fiber accounted for the largest market revenue share in Asia Pacific in 2024. Growing product demand from the military and industrial sectors for the security & protection of personnel is propelling the growth of the para-aramid fiber market in the country. Furthermore, the growth of the personal protective equipment and automotive industries is expected to fuel the demand for para-aramid fibers in the country over the forecast period.

Middle East & Africa Para-Aramid Fibers Market Trends

The para-aramid fiber market in the Middle East & Africa is expected to grow at a moderate CAGR during the forecast period. The growing oil & gas industry in the Middle East is expected to drive the demand for PPE over the forecast period. Moreover, growing concerns regarding occupational injury and illness cases, coupled with stringent industry regulations, are expected to drive the demand for PPE in various industries including construction, fire services, and industrial manufacturing.

The Saudi Arabia para-aramid fiber market accounted for the largest market revenue share in MEA in 2024, as per the International Trade Administration. Telecommunications companies largely use optical fibers to transmit telephone, internet communication, and cable television signals to their end users. Para-aramid fibers widely find application in indoor and outdoor optical fiber and power cables, outdoor ADSS (All-dielectric Self-supporting) optical cables, indoor optical cables, and jumpers. Hence, the growth of the ICT industry in Saudi Arabia is expected to promote the demand for optical fibers over the coming years.

Central & South America Para-Aramid Fibers Market Trends

The para-aramid fiber market in the Central & South America is growing rapidly. As there are several developing countries in the Central & South American region, including Brazil, Argentina, Peru, and Colombia. Economic growth and urbanization have led to an increase in investment in several industries such as aerospace and automotive. Para-aramid fibers are strong and durable, and they find applications in automotive components. Increasing investments in automotive manufacturing are likely to support the demand for para-aramid fibers.

The Brazil para-aramid fiber market is a major economy in Central & South America. According to the World Bank, Brazil’s real GDP rose by 2.9% in 2022 compared to 2021. According to Trading Economics, the country’s GDP was projected to reach USD 1,722 billion and USD 1,790 billion by 2023 and 2024, respectively. Therefore, investments in the industrial sector are expected to benefit the demand for para-aramid fibers in the country over the forecast period.

Key Para-Aramid Fiber Company Insights

Some of the key players operating in this market include Teijin Limited and DuPont:

-

Teijin Limited sells its products through seven business segments, namely, high-performance materials, composites, fiber & product converting, healthcare, IT, and others.

-

DuPont operates through three business segments: water solutions, safety solutions, and shelter solutions. It has a presence in North America, Asia Pacific, Europe, the Middle East, South America, and Africa.

Kolon Industries, Inc. and TAEKWANG Industrial Co., Ltd. are some of the emerging market participants in the global market.

-

Kolon Industries, Inc. has four major divisions, namely industrial materials, chemical, films/electronic materials, and fashion.

-

TAEKWANG Industrial Co., ltd. operates through four business segments, namely, fiber, petrochemical, advanced materials, and textile. The company started the production of para-aramid fibers and para-aramid filament yarn with an annual production capacity of 1,000 tons in 2015.

Key Para-Aramid Fiber Companies:

The following are the leading companies in the para-aramid fibers market. These companies collectively hold the largest market share and dictate industry trends.

- Teijin Limited

- Yantai Tayho Advanced Materials Co., Ltd.

- DuPont

- Kolon Industries, Inc.

- HYOSUNG ADVANCED MATERIALS

- TAEKWANG Industrial Co., Ltd.

- Davy Textiles Ltd.

- AFCHINA

- Artec

- Guangzhou Green New Materials Co., Ltd.

Recent Developments

-

In June 2023, Teijin Limited started the first industrial production plant for manufacturing Twaron using recycled feedstock materials. The fiber produced with recycled materials delivers the same characteristics as the original Twaron fiber. Furthermore, this innovation marks the company's first step of including a high percentage of recycled material in the production of Twaron.

-

In April 2023, DuPont launched Kevlar EXO aramid fiber, featuring first-in-class ballistic and thermal resistance of up to 500 degrees C, which is lightweight and flexible. Kevlar EXO is stated to have a life of five years.

Para-Aramid Fibers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.68 billion

Revenue forecast in 2033

USD 7.15 billion

Growth rate

CAGR of 8.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in Tons, Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Teijin Limited; Yantai Tayho Advanced Materials Co. Ltd.; DuPont; Kolon Industries, Inc.; HYOSUNG ADVANCED MATERIALS; TAEKWANG Industrial Co., Ltd.; Davy Textiles Ltd.; AFCHINA; Artec; Guangzhou Green New Materials Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Para-Aramid Fibers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global para-aramid fibers market report based on application, and region.

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Security & Protection

-

Optical Fibers

-

Friction Material

-

Rubber Reinforcement

-

Tire Reinforcement

-

Other Application

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

South Korea

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global para-aramid fibers market size was estimated at USD 3.43 billion in 2024 and is expected to reach USD 3.68 billion in 2025.

b. The global para-aramid fibers market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2033 to reach USD 7.15 billion by 2033.

b. Security & protection application accounted for the largest revenue share of 37.8% in 2024 and is expected to dominate the market over the forecast period, owing to the growing defense expenditure among the major countries which drives the demand for protective wear, which is further expected to result in rising consumption of para-aramid fibers in the coming years

b. The key players operating in the global para-aramid fibers market include Teijin Limited, Yantai Tayho Advanced Materials Co.,Ltd., DuPont, Kolon Industries, Inc. , HYOSUNG ADVANCED MATERIALS, TAEKWANG Industrial Co., Ltd., Davy Textiles Ltd., AFCHINA , Artec, and Guangzhou Green New Materials Co., Ltd.

b. Increase in demand for security & protective equipment in various Application industries such as military and construction is anticipated to surge the demand for para-aramid fibers worldwide over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.