- Home

- »

- Petrochemicals

- »

-

Paraffin Wax Market Size And Share, Industry Report, 2033GVR Report cover

![Paraffin Wax Market Size, Share & Trends Report]()

Paraffin Wax Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Candles, Packaging, Cosmetics, Hotmelts, Board Sizing, Rubber), By Region (North America, Asia Pacific, Europe, Middle East and Asia, Latin America), And Segment Forecasts

- Report ID: 978-1-68038-520-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Paraffin Wax Market Summary

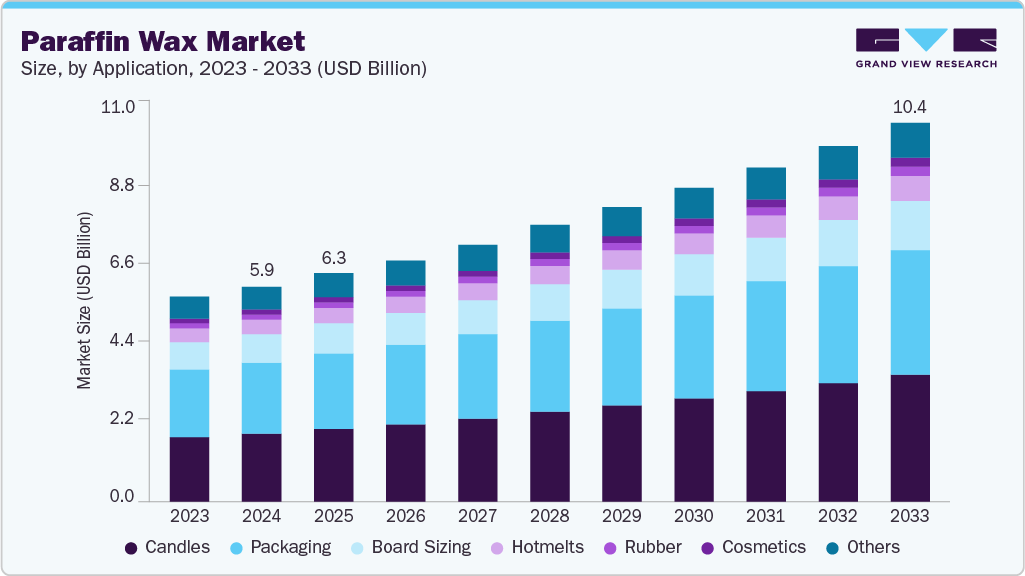

The global paraffin wax market size was estimated at USD 5,929.2 million in 2024 and is projected to reach USD 10,459.3 million by 2033, growing at a CAGR of 6.5% from 2025 to 2033. The market is primarily driven by strong demand from the candle, packaging, and personal care industries.

Key Market Trends & Insights

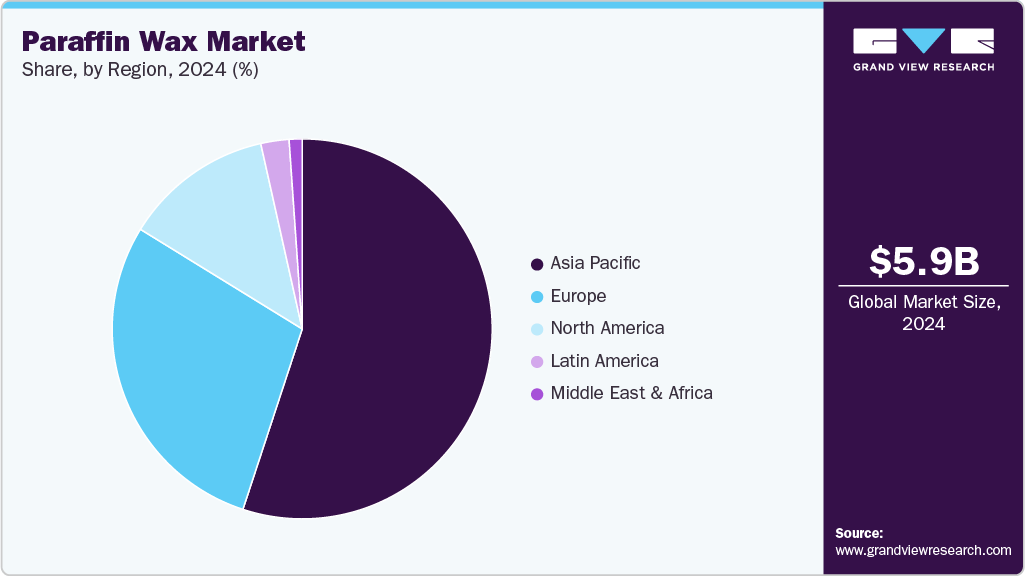

- Asia Pacific dominated the paraffin wax market with the largest revenue share of 55.0% in 2024.

- The U.S. paraffin wax market remains the primary consumer within North America, with robust demand for paraffin wax in household candles, cosmetics, and packaging materials.

- By application, the candles segment is expected to grow at the highest CAGR of 7.2% from 2025 to 2033.

- By application, the packaging segment held the largest revenue share of 33.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,929.2 Million

- 2033 Projected Market Size: USD 10,459.3 Million

- CAGR (2025-2033): 6.5%

- Asia Pacific: Largest market in 2024

Candles remain a key revenue generator, especially in developed economies, where scented and decorative variants are growing in popularity. The expansion of the packaging sector, particularly in Asia Pacific, due to e-commerce growth and increasing food exports, further supports market growth. Additionally, rising disposable incomes and heightened focus on personal grooming in emerging markets are fueling paraffin wax demand in cosmetics and skincare formulations. The market faces significant challenges due to increasing environmental concerns and regulatory restrictions on petroleum-derived products.

The growing consumer preference for bio-based and sustainable alternatives poses a threat to market stability, especially in regions with strict environmental mandates. Additionally, the market is exposed to crude oil price fluctuations, which can adversely affect production costs and profitability. Intensifying competition from synthetic and plant-based waxes also adds pricing pressure on traditional paraffin wax producers.

Despite environmental challenges, the market presents opportunities through innovation and diversification. The development of eco-friendly wax blends and hybrid formulations is gaining traction among manufacturers looking to align with sustainability goals. Emerging applications such as phase change materials (PCMs) for thermal energy storage and industrial uses in construction and rubber industries offer new avenues for revenue generation. Furthermore, increasing demand for premium candles and cosmetic products in Asia Pacific and the Middle East is expected to create lucrative growth prospects for market players.

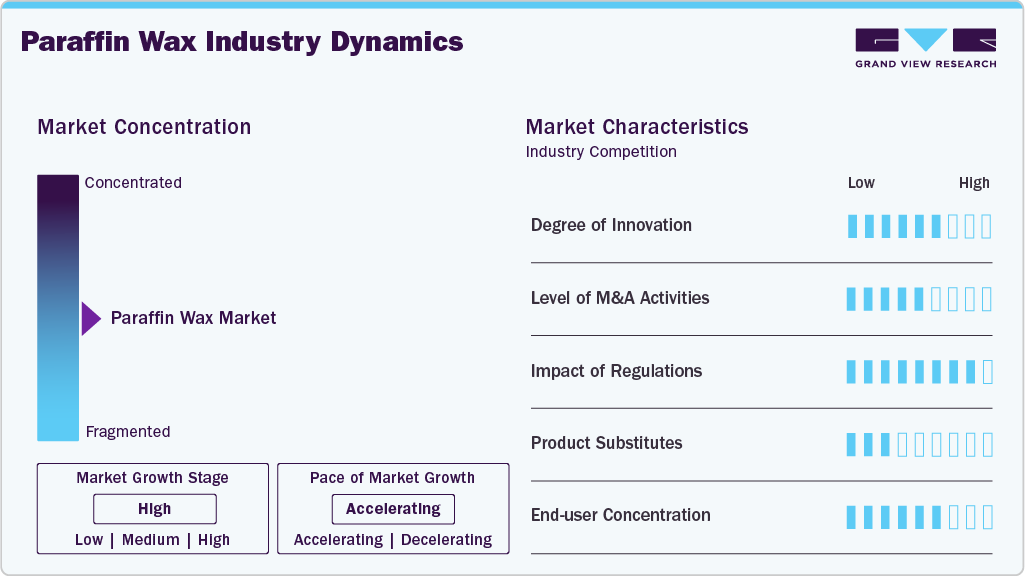

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Petro China Company Limited, China Petrochemical Corporation (Sinopec), Sasol Limited, and Exxon Mobil Corporation, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the global paraffin wax market are adopting a combination of capacity expansion, product innovation, strategic partnerships, and sustainability initiatives to strengthen their market position. Companies such as ExxonMobil, Sasol, and PetroChina are investing in advanced refining technologies to enhance product purity and performance for high-end applications like cosmetics and phase change materials. To cater to rising demand in Asia Pacific and the Middle East, several players are expanding their production and distribution networks in these regions.

Application Insights

The global paraffin wax market is segmented across diverse applications such as candles, packaging, cosmetics, hot melts, board sizing, rubber, and others, each with distinct end-user demand drivers. Among these, packaging emerged as the dominant segment with a revenue share of 33.1% of the total market in 2024. This is driven by its widespread usage as a coating and moisture barrier in corrugated boxes, food packaging, and industrial wrapping materials. The robust growth of e-commerce, food exports, and retail sectors, particularly in emerging economies such as China and India, has significantly boosted demand for paraffin wax in protective and flexible packaging solutions. Compared to other applications, packaging offers consistent, high-volume demand, is less sensitive to seasonal consumption patterns (as seen in candles), and benefits from recurring industrial usage.

While candles continue to be a major segment, especially in North America and Europe, due to demand for scented, decorative, and religious products, the packaging sector surpassed it due to its integration across multiple industrial supply chains and growing need for sustainable packaging upgrades. Cosmetics and hot melts are fast-growing segments with rising adoption in premium personal care products and industrial adhesives, but remain niche compared to packaging in terms of volume. Applications like board sizing and rubber processing leverage paraffin wax for functional enhancements (e.g., water resistance, anti-ozonant properties) but contribute a smaller share. The "Others" segment includes niche uses such as fire starters, Polishes, and crayons, offering stable but limited growth potential. In essence, packaging led the market in 2024 due to its broad applicability, industrial scale, and alignment with growth sectors such as logistics, food delivery, and consumer goods.

Regional Insights

The Asia Pacific paraffin wax market dominated the market with a revenue share of 55.0% in 2024. This is driven by strong industrial manufacturing, packaging, and personal care product demand. The region benefits from high paraffin wax consumption in food packaging, rubber processing, and cosmetics, particularly in emerging economies like India, Indonesia, and Vietnam. Rapid urbanization, expansion of the middle-class population, and growing exports of consumer goods have bolstered downstream applications. Additionally, the region hosts several large-scale refineries, ensuring cost-effective supply and strong export capabilities.

China paraffin wax market remained the single largest contributor to the Asia Pacific market, underpinned by its vast refining capacity and integrated supply chain for candles, cosmetics, and packaging materials. The country leads global paraffin wax production, with state-owned enterprises like Sinopec and PetroChina operating large-scale refineries. China's booming e-commerce sector and strong demand for domestic packaging have further strengthened its position. Moreover, the country’s export-driven candle and personal care manufacturing industries continue to support steady domestic consumption and international sales.

Europe Paraffin Wax Market Trends

Europe paraffin wax market held the second-largest revenue share of 28.7% of the global market in 2024, supported by high demand in candles, cosmetics, and premium packaging segments. The region has a mature market characterized by rising demand for high-quality, refined wax products, particularly in Western Europe. Environmental regulations are pushing refiners and manufacturers to innovate with sustainable or hybrid paraffin wax formulations. Furthermore, Europe’s long-standing tradition of candle consumption, especially in cultural and religious contexts, sustains stable demand throughout the year.

Germany paraffin wax market represents a key market within Europe, driven by its strong presence in candle manufacturing, cosmetics production, and specialty packaging. The country’s focus on sustainability has led to increased investments in R&D for cleaner-burning waxes and hybrid blends, making it a frontrunner in innovation. German manufacturers are also highly export-oriented, supplying value-added paraffin-based products across the continent. Additionally, its advanced industrial infrastructure supports consistent wax usage in rubber and hot melt applications.

North America Paraffin Wax Market Trends

North America paraffin wax market captured a 12.7% share of the global market in 2024, primarily driven by steady demand from the U.S. candle and personal care sectors. The region is characterized by high per capita consumption of decorative and scented candles, supported by seasonal and lifestyle-driven trends. Industrial applications in packaging and adhesives also contribute to paraffin wax consumption. However, growing environmental awareness and the shift toward bio-based alternatives have created a push for sustainable product development across the region.

U.S. Paraffin Wax Market Trends

The U.S. paraffin wax market remains the primary consumer within North America, with robust demand for paraffin wax in household candles, cosmetics, and packaging materials. Consumer preference for aromatherapy and wellness-related products continues to drive candle sales, while a mature beauty and personal care market supports cosmetic wax use. The country also imports significant volumes of refined waxes due to limited local production, making trade dynamics and supply chain efficiency critical for market players.

Latin America Paraffin Wax Market Trends

Latin America paraffin wax market accounted for a modest 2.4% share in 2024, with Brazil and Mexico leading regional demand. Growth is supported by expanding FMCG packaging needs, rising disposable incomes, and increased candle usage during religious and cultural events. However, the market remains price-sensitive and largely dependent on imports, particularly for high-grade or specialty waxes. Limited domestic refining capacity restricts scalability, but rising demand in cosmetics and packaging presents long-term potential.

Middle East & Africa Paraffin Wax Market Trends

The Middle East & Africa paraffin wax market held a significant share of the global market in 2024, driven by industrial packaging, candles, and construction materials. The region's market is nascent but slowly expanding due to economic diversification efforts and infrastructural development in the Gulf Cooperation Council (GCC) countries. Limited local production capabilities result in high reliance on imports, but strategic investments in downstream sectors and increased urban consumption may open new opportunities in the coming years.

Key Paraffin Wax Company Insights

Key players, such as Petro China Company Limited, China Petrochemical Corporation (Sinopec), Sasol Limited, and Exxon Mobil Corporation, are dominating the market.

China Petrochemical Corporation (Sinopec)

-

China Petrochemical Corporation (Sinopec) is a major contributor to the global paraffin wax market. It is recognized for its large-scale refining infrastructure, diversified product portfolio, and strong domestic and international distribution networks. As one of the world’s leading integrated energy and chemical companies, Sinopec produces high-quality fully refined and semi-refined paraffin waxes that cater to key applications such as packaging, candles, cosmetics, and hot melts. The company operates multiple advanced refining units across China, ensuring consistent supply and cost efficiency. Sinopec’s strategic emphasis on technological innovation, product standardization, and environmental compliance has strengthened its position in both developed and emerging markets.

Key Paraffin Wax Companies:

The following are the leading companies in the paraffin wax market. These companies collectively hold the largest market share and dictate industry trends.

- Petro China Company Limited

- China Petrochemical Corporation (Sinopec)

- Sasol Limited

- Exxon Mobil Corporation

- The International Group, Inc.

- Petro bras

- NIPPON SEIRO CO., LTD.

- Repsol

- Holly Frontier Corporation

- H&R GROUP

- Honeywell International Inc.

- Ergon, Inc.

- Cepsa

- Calumet Specialty Products Partners, L.P.

- Eni SpA.

Global Paraffin Wax Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,303.5 million

Revenue forecast in 2033

USD 10,459.3 million

Growth rate

CAGR of 6.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Poland; Netherlands; Russia; China; India; Japan; South Korea; Indonesia; Vietnam; Saudi Arabia; South Africa; UAE; Brazil; Argentina; Chile

Key companies profiled

Petro China Company Limited; China Petrochemical Corporation (Sinopec); Sasol Limited; Exxon Mobil Corporation; The International Group, Inc.; Petro bras; NIPPON SEIRO CO., LTD.; Repsol; Holly Frontier Corporation; H&R GROUP; Honeywell International Inc.; Ergon, Inc.; Cepsa; Calumet Specialty Products Partners, L.P.; Eni SpA

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Paraffin Wax Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global paraffin wax market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Candles

-

Packaging

-

Cosmetics

-

Hot melts

-

Board Sizing

-

Rubber

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Vietnam

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Frequently Asked Questions About This Report

b. The global paraffin wax market size was estimated at USD 5,929.2 million in 2024 and is expected to reach USD 6,303.5 million in 2025.

b. The paraffin wax market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2033 to reach USD 10,459.3 million by 2033.

b. The packaging segment held the largest revenue share in 2024 due to its extensive use of paraffin wax as a moisture barrier and coating agent in food-grade and industrial packaging. Rapid growth in e-commerce, food exports, and retail logistics, particularly in Asia Pacific, fueled consistent, high-volume demand.

b. Some of the key players operating in the paraffin wax market include Petro China Company Limited, China Petrochemical Corporation (Sinopec), Sasol Limited, Exxon Mobil Corporation, The International Group, Inc., Petro bras, NIPPON SEIRO CO., LTD., Repsol, Holly Frontier Corporation, H&R GROUP, Honeywell International Inc., Ergon, Inc., Cepsa, Calumet Specialty Products Partners, L.P., and Eni SpA.

b. The global paraffin wax market is driven by rising demand from the packaging, candle, and personal care industries, supported by expanding e-commerce and consumer goods sectors. Additionally, growing industrial applications and increasing disposable incomes in emerging economies are fueling consistent market growth.

b. Paraffin wax is used in candles, packaging, cosmetics, hotmelts, and rubber manufacturing industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.