- Home

- »

- Medical Devices

- »

-

Patient-controlled Analgesic Pumps Market Size Report 2030GVR Report cover

![Patient-controlled Analgesic Pumps Market Size, Share & Trends Report]()

Patient-controlled Analgesic Pumps Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Electronic, Mechanical), By Application (Diabetes, Oncology, Gastroenterology, Hematology), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-346-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global patient-controlled analgesic pumps market size was valued at USD 417.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The rise in the geriatric population and increasing preference for surgical procedures with technological advancements that enable procedures at the office and home care settings are the major factors driving the market. The patient-controlled pumps promote better patient management and care, thus offering several advantages in comparison to the conventional modules. In addition, rise in trends of home healthcare settings due to COVID-19 are expected to boost the demand for patient-controlled analgesic (PCA) pumps in the forecast period.

The prevalence of chronic disorders such as cancer, arthritis, and pain witnessed a steep rise across the globe. The growing number of individuals suffering from chronic pain will enhance the overall market growth. For instance, as per the Centers for Disease Control and Prevention (CDC) in the U.S., the percentage of adults experiencing chronic and high-impact chronic pain in 2021 was about 20.9% and 6.9 % respectively. In addition, the occurrence of chronic pain will increase in the upcoming years owing to a surge in cancer survival rates and rise in diabetes cases. According to the World Health Organization (WHO), the age-standardized death rate due to diabetes has increased by 3% from 2000 to 2019. This chronic pain condition requires analgesic pumps for timely pain relief, leading to an increase in demand for patient-controlled analgesic pumps.

Furthermore, rising cancer cases throughout the globe are anticipated to escalate market progression. For instance, according to the National Cancer Institute, about 18,06,590 new cancer cases were diagnosed in the U.S. in 2020. Thus, the surging prevalence of cancer creates demand for patient-controlled analgesic pumps, as they are effective and safe for relieving cancer-associated pain. In addition, accidental injuries are also expected to propel the market growth for PCA pumps as they provide administrative surveillance to accident survivors. Thus, with rising accidents, the demand for patient-controlled analgesic pumps is expected to rise. According to WHO in June 2022, every year around 20 to 50 million people have to suffer from non-fatal injuries due to road accidents globally, with many of them incurring some kind of disability as a result of the injury.

Patient-controlled analgesic pumps are widely used during post-surgical recovery as they provide consistent methods of pain management as compared to frequent analgesic injections. In addition, the PCA pump offers patients to self-administer significant doses of narcotics directly into the vein by just pressing the push button. It also aids in managing pain after undergoing surgery for faster recovery. Similarly, these pumps help in reducing or eliminating the need for intramuscular injections. It also offers decreased patient anxiety, better analgesic effects, and has substantial improvements in pulmonary complications as compared to other forms of analgesic. Thus, several advantages associated with PCA pumps include greater patient satisfaction, improved pain relief, and fewer postoperative complications, accelerating market growth.

Various patient-controlled analgesic pumps are suitable for pain management in a homecare environment, especially during the pandemic when hospital stays are reduced to the minimum. For instance, CME Medical’s TPCA Patient Controlled Analgesia Syringe Pump is useful in home care services as well as hospitals based on the patient’s needs. These pumps are compact, lightweight and are suitable for ambulatory and bedside use. Hence, increasing demand for PCA pumps in home care settings will boost market progression.

Patient-controlled analgesic pumps are useful for a variety of painful conditions and are majorly useful in acute postoperative pain management. Novel patient-controlled analgesic techniques such as Patient Controlled Regional Analgesia (PCRA), Patient Controlled Epidural Analgesia (PCEA), and noninvasive forms of PCA have expanded the options for pain treatment. Additionally, advances in PCA technology including variable-rate infusions that are calculated based on patient needs for analgesia and enhanced patient monitoring will boost the use of these techniques during the forecast timeframe.

Incorporation of the newest technology in PCA pumps helps in faster pain recovery and leads to increased patient preference, thereby accelerating market growth. For instance, Acromed Chroma infusion pumps integrate the latest technology in pain control that allows patients to self-administer bolus analgesic medicine. This aids patients to control pain and allows them to feel comfortable while minimizing the need for on-site support from hospital members.

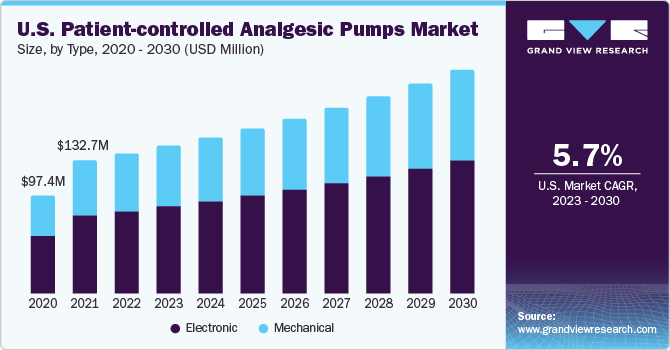

Type Insights

The electronic pumps segment dominated the market for patient-controlled analgesic pumps and accounted for the largest revenue share of over 55% in 2022 and it is expected to grow at the fastest CAGR of 6.2% over the forecast period. An electronically patient-controlled analgesic pump uses a high-performance single-chip microcomputer and control circuit to effectively control the infusion flow rate. Electronic analgesic pumps are effective and safe for Patient-controlled Epidural Analgesia (PCEA) for childbirth as well as postoperative pain management, augmenting the segment demand. Additionally, studies have shown that electronic PCA pumps are suitable for a large population base, as they can be regulated based on patients’ needs. However, there are chances that several PCA treatment errors may occur in electronic PCA pumps. Human and equipment errors may occur during the dosing phase that may hamper the segmental growth over the analysis timeframe.

Mechanical is the second-largest type segment with promising growth opportunities. Mechanical patient-controlled analgesic pumps have several advantages, leading to increasing preference among healthcare professionals and patients. Advantages of mechanical PCA pumps include small size, easy portability, low price, and no programming errors. Also, several studies have shown that mechanical analgesic pumps have fewer failures and high patient satisfaction, increasing their adoption rate.

End-use Insights

The hospitals segment dominated the market for patient-controlled analgesic pumps and accounted for the largest revenue share of over 30% in 2022. Patient-controlled analgesic therapy is most commonly used in hospital settings as they are effective in lessening the post-operative pain of the patients. Availability of most of the smart and advanced patient-controlled analgesic pumps in hospitals along with increasing demand for advanced PCA pumps in newly set up hospitals especially in developing countries is anticipated to fuel the growth of the market.

The home care settings segment is anticipated to grow at the fastest CAGR of 7.1% over the forecast period. Pain-related hospitalization can be prevented, if opting for homecare settings, securing its market growth. Patient-controlled analgesic with Computerized Ambulatory Drug Delivery Device (CADD) can be used to manage pain in the home care setting. Individuals who are in hospice or have moderate to severe pain caused by cancer can use PCA pumps at home, augmenting the growth of the segment. Moreover, the rising hospitalization cost globally is shifting the preference of patients towards home care setting for affordable pain management and thus is expected to propel segmental growth.

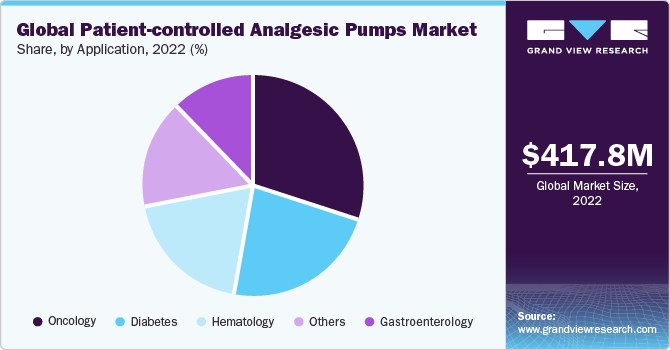

Application Insights

The oncology segment dominated the patient-controlled analgesic pumps market and accounted for the largest revenue share of 30.15% in 2022. PCA pumps control cancer pain by self-administration of intravenous opioids with the use of a programmable pump. Patient-controlled analgesic pumps are used at home by individuals that are suffering from moderate to severe pain from cancer. Thus, the prevalence of cancer cases has been a major factor driving the segment growth. For instance, according to World Health Organization (WHO), in 2020, cancer was responsible for around 10 million deaths globally, which accounts for nearly 1 in every 6 deaths. Thus, increasing the usage of PCA pumps at home care settings for the treatment of cancer is projected to enhance segmental growth.

In addition, several centers such as specialty clinics, hospitals, and ambulatory surgical centers are routinely offering patient-controlled analgesic pumps for cancer suffering individuals to manage chronic pain. Thus, the increasing number of hospitals, ambulatory surgical centers, and specialty centers in developed as well as developing economies providing pain management solutions among cancer patients is estimated to boost the market growth.

The diabetes segment is expected to grow at the fastest CAGR of 6.8% from 2023 to 2030. PCA pumps are useful in reducing pain among diabetic patients. The increasing prevalence of diabetes across the globe is expected to surge the demand for PCA pumps, fostering the growth of the segment. For instance, as per the American Diabetes Association, around 37.2 million Americans were suffering from diabetes in 2019 which accounted for 11.3% of the total population. Similarly, according to the International Diabetes Federation 2021 report, around 537 million adult populations, aged between 20 to 79 years, is living with diabetes and this number is estimated to reach 643 million by the year 2030. Patient-controlled analgesic pumps are increasingly being preferred in the management of type-1 diabetes for pain control.

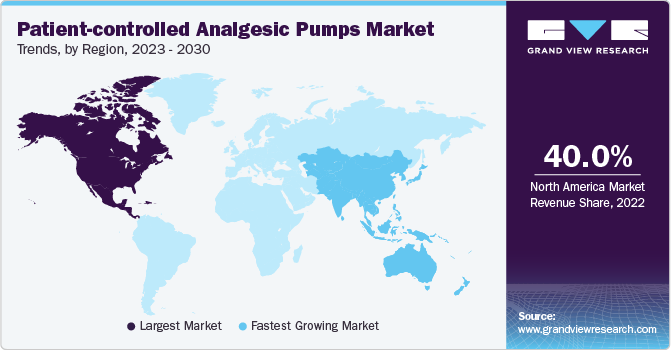

Regional Insights

North America dominated the market for patient-controlled analgesic pumps and accounted for the largest revenue share of around 40% in 2022. The region is expected to continue its dominance over the forecast period. Regionally, the market is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East and Africa. Increasing cases of diabetes, cancer, accidental injuries, and other diseases related to pain management are expected to secure the growth of the market for patient-controlled analgesic pumps. The growing geriatric population base coupled with the rising benefits of patient-controlled analgesic pumps is also contributing to the region’s development. According to the U.S. Census Bureau, the older population, aged 65 or above in the U.S. accounted for 16.8% of the total population in the year 2020 which accounts for 1 in every 6 people.

Asia Pacific is expected to grow at the fastest CAGR of 6.3% over the forecast period. The increasing incidence of chronic diseases along with rising awareness about new technologies especially in India and China is expected to boost market expansion in the coming years. For instance, according to the Department of Biotechnology of the Government of India (GOI) in Feb 2023, non-communicable diseases are responsible for around 53% of deaths in India. Moreover, the growing geriatric population, increasing awareness about pain management, and improving healthcare facilities and infrastructure are the factors propelling the market growth.

Key Companies & Market Share Insights

Product launch, strategic acquisitions, and innovation are major strategies adopted by the key players to retain their market share. For instance, in August 2022, Baxter International Inc. announced the approval of the U.S. Food and Drug Administration (FDA) 510(k) for its Novum IQ infusion pump which has Dose IQ safety software. And IQ Enterprise connectivity suite. In March 2022, Shanghai MicroPort Lifesciences Co., Ltd. received approval for marketing their AutoEx chemotherapy infusion pump from the National Medical Products Administration (NMPA) of China. This pump is expected to provide precise drug delivery control and improve patient comfort. In January 2022, ICU Medical Inc. announced their complete acquisition of Smith Medical from Smiths Group plc which included syringe and ambulatory infusion devices. This acquisition is expected to provide a competitive advantage to ICU Medical Inc.

Key Patient-controlled Analgesic Pumps Companies:

- Baxter.

- B. Braun SE

- Smiths Group plc

- Fresenius SE & Co. KGaA

- BD

- ICU Medical, Inc.

Patient-controlled Analgesic Pumps Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 439.6 million

Revenue forecast in 2030

USD 656.5 million

Growth Rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Colombia; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Baxter.; B. Braun SE; Smiths Group plc; Fresenius SE & Co. KGaA; BD; ICU Medical, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

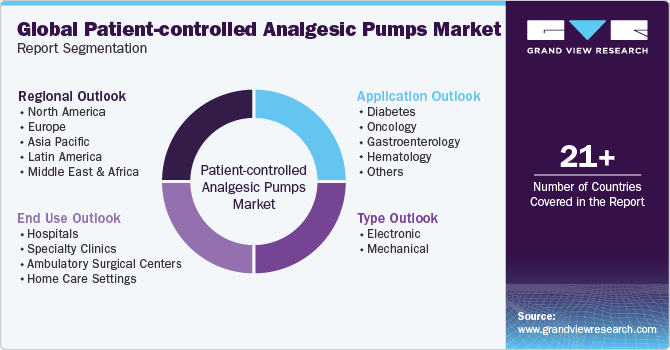

Global Patient-controlled Analgesic Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global patient-controlled analgesic pumps market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic

-

Mechanical

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetes

-

Oncology

-

Gastroenterology

-

Hematology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers

-

Home Care Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient-controlled analgesic pumps market size was estimated at USD 417.8 million in 2022 and is expected to reach USD 439.6 million in 2023.

b. The global PCA pumps market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 656.5 million by 2030.

b. The electronic pumps segment dominated the global patient-controlled analgesic pumps market and accounted for the largest revenue share of 57.2% in 2022.

b. The hospitals segment dominated the global patient-controlled analgesic pump market and accounted for the largest revenue share of 31.2% in 2022.

b. The oncology segment dominated the global patient-controlled analgesic pumps market and accounted for the largest revenue share of 30.1% in 2022.

b. North America dominated the PCA pumps market with a share of 40.0% in 2022. This is attributable to the growing geriatric population, increasing awareness about pain management, and improving healthcare facilities and infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.