- Home

- »

- Medical Devices

- »

-

Patient-derived Xenograft Model Market Size Report, 2030GVR Report cover

![Patient-derived Xenograft Model Market Size, Share & Trends Report]()

Patient-derived Xenograft Model Market Size, Share & Trends Analysis Report By Tumor Type (Lung Cancer, Breast Cancer), By Model Type (Mice Model, Rat Model), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-002-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

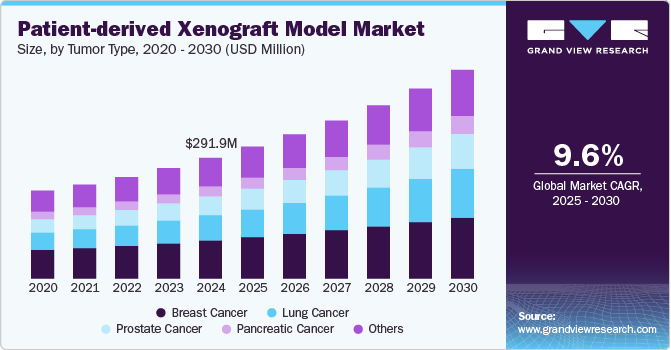

The global patient-derived xenograft model market size was estimated at USD 291.9 million in 2024 and is projected to grow at a CAGR of 9.64% from 2025 to 2030. The market growth is mainly due to increasing cases of cancer, growing research and development activities by the pharmaceutical industry, and advancements in cancer research and personalized medicines. Traditional cell line-based models often fail to mimic the complex biology of tumors in patients, leading to a higher rate of clinical trial failures. PDX models, which involve implanting human patient-derived tumors into immunodeficient mice, offer a closer approximation of human cancer biology, making them essential tools for preclinical drug development. This shift toward personalized treatments, where therapies are tailored to the genetic profile of individual patients, is contributing to the market growth.

Furthermore, the increasing complexity and cost of drug development is also one of the factors contributing to the patient-derived xenograft model industry growth. Pharmaceutical companies are constantly working towards shortening the time and reducing the costs associated with bringing new drugs to market. PDX models have become critical in early-stage drug discovery because they provide more reliable predictions of a drug’s efficacy and toxicity in humans compared to traditional in vitro methods. These models enable researchers to test a wide range of therapies, including targeted therapies, immunotherapies, and combination treatments. Thus, PDX models are being integrated into preclinical testing pipelines to help identify the most promising drug candidates and optimize clinical trial design.

In addition, growing support from regulatory bodies such as the FDA and EMA towards incorporating more human-like models in drug development is also driving the patient-derived xenograft model industry growth. PDX models have the potential to support regulatory submissions, especially in areas such as oncology, where conventional animal models often fail to reflect human tumor heterogeneity. The growing regulatory support for more sophisticated and representative preclinical testing tools has increased investment in PDX technologies, further stimulating their adoption across the pharmaceutical and biotechnology sectors.

Tumor Type Insights

The breast cancer segment dominated with 31.7% of the revenue share in 2024 owing to increasing cases of breast cancer globally. According to the data published by the American Cancer Society in 2024, there would be 310,720 new cases of invasive breast cancer and 56,500 new cases of ductal carcinoma in situ (DCIS) will be diagnosed in women. Moreover, approximately 42,250 women are projected to die from breast cancer in 2024. Increasing prevalence of cancer cases would lead to significant investment in breast cancer research and drug development, driving demand for more reliable preclinical models such as PDX models. Thus, as the need for new therapies grows, particularly for metastatic and drug-resistant forms of breast cancer, the demand for PDX models will also grow significantly to study tumor biology and test novel treatment strategies.

Lung cancer is projected to witness the fastest growth from 2025 to 2030 owing to the growing demand for more accurate preclinical models to test novel therapies. Lung cancer remains one of the leading causes of cancer-related deaths, and despite advances in treatment, survival rates remain relatively low, particularly for advanced stages. PDX models offer a valuable tool for researchers to study the genetic and molecular characteristics of lung cancer, assess patient-specific responses to treatment, and develop targeted therapies, especially for hard-to-treat forms like non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC). Thus, PDX models will play a key role in accelerating drug development, leading to a faster growth rate in this segment of the market.

Model Type Insights

The mice model segment dominated the market in 2024. Mice are the most commonly used species for xenograft studies due to their well-established immunodeficient strains, cost-effectiveness, and ease of handling. These models provide a reliable and reproducible platform for studying human tumor growth, metastasis, and response to therapies. In addition, the availability of genetically modified mice, such as those with specific mutations or immune deficiencies, enables the creation of more precise models that better reflect human cancer biology. The relatively short lifespan and fast reproduction rates of mice further accelerate research timelines, making them the preferred choice for preclinical studies.

The rat model segment is projected to witness fastest growth from 2025 to 2030. Rats offer significant advantages for certain types of research, such as studying larger tumor volumes and long-term therapeutic responses. Their larger size compared to mice allows for more extensive tumor implantation, which can more closely mimic human cancer progression and metastasis. Moreover, rats are increasingly being used to study complex diseases like liver, pancreatic, and brain cancers, where the tumor microenvironment and organ-specific interactions play a critical role in treatment outcomes. As researchers seek more accurate preclinical models that can better represent human tumor biology, particularly for drug discovery in complex cancer types, the rat model segment is expected to grow rapidly.

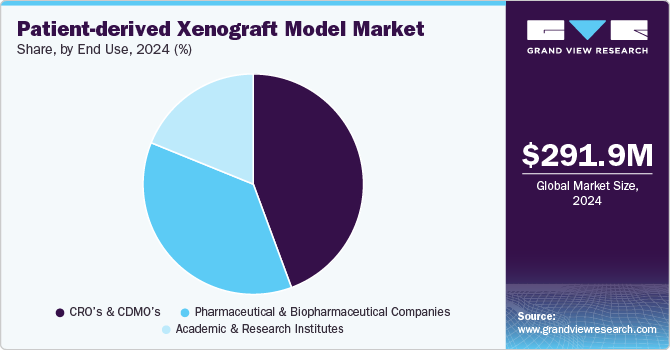

End Use Insights

The CRO and CDMO segment dominated the market in 2024 owing to increasing outsourcing activities by pharmaceutical and biotechnology companies for research and development activities. CROs and CDMOs play a pivotal role in streamlining the drug discovery and development process, offering specialized expertise, infrastructure, and resources that many companies may not have in-house. PDX models, which are critical for preclinical testing and drug validation, are often outsourced to these organizations, as they provide efficient and cost-effective solutions for generating and testing PDX models at scale.

Pharmaceutical and biopharmaceutical companies are projected to witness considerable growth from 2025 to 2030 owing to the increasing demand for more accurate and reliable preclinical models to advance drug discovery and development. These companies are heavily investing in PDX models as they seek to improve the success rates of clinical trials and accelerate the development of novel therapies, particularly in oncology. PDX models offer a more realistic representation of human tumors compared to traditional cell line models which allows for the testing of new drug candidates in a setting that closely mirrors patient-specific responses. As personalized medicine continues to gain traction, pharmaceutical and biopharmaceutical companies are turning to PDX models to better understand tumor heterogeneity, resistance mechanisms, and the potential effectiveness of targeted therapies.

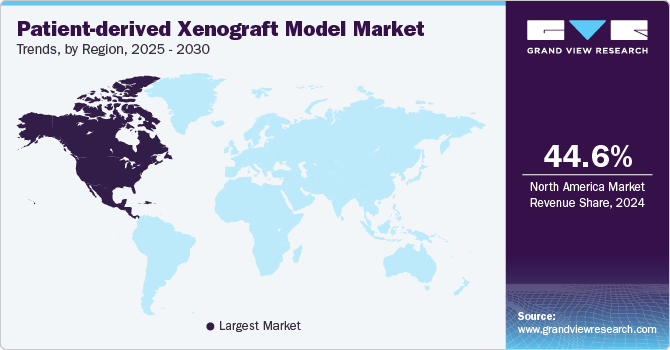

Regional Insights

North America patient-derived xenograft model market dominated the global market and accounted for a 44.6% share in 2024. The growth in the region is attributed to the high prevalence of cancer coupled with the growing aging population which has increased the demand for more effective cancer therapies, thus driving the investments into cancer research. Moreover, the FDA’s increasing focus on accelerating the approval of innovative cancer treatments is also contributing to the growth of PDX models in the region, as they provide a more accurate way to predict therapeutic outcomes in human patients.

U.S. Patient-derived Xenograft Model Market Trends

The patient-derived xenograft model market in the U.S. is projected to be driven by to country’s well-established healthcare infrastructure and advanced research facilities. Moreover, increasing technological advancements such as CRISPR gene editing, next-generation sequencing, and advanced imaging techniques are allowing researchers to create more complex and accurate PDX models. These models offer tailored solutions which includes specific genetic mutations, immune responses, and tumor microenvironment characteristics that are unique to individual patients or cancer subtypes. The ability to generate highly personalized and sophisticated models is enabling researchers to study cancer more comprehensively and develop therapies that are better suited to target specific patient populations. This trend is contributing to the increasing use of PDX models in preclinical research and drug development in the U.S.

Europe Patient-derived Xenograft Model Market Trends

The Europe patient-derived xenograft model market is anticipated to witness lucrative growth over the projected period. The growth of the market is mainly due to a significant shift towards prioritizing personalized or precision medicine, particularly in oncology. Moreover, European countries, particularly in Western and Northern Europe, increasingly adopting precision medicine approaches, utilizing PDX models to identify novel biomarkers, develop targeted therapies, and better predict clinical outcomes. This trend is accelerating as researchers seek to develop more effective treatments with fewer side effects, driving demand for PDX models in the region.

The patient-derived xenograft model market in the UK is anticipated to experience considerable growth over the forecast period. The growth of the market is mainly due to the stringent regulatory landscape and the presence of major pharmaceutical & biopharmaceutical companies. In addition, increasing government support in the country is also contributing to the country’s market growth. The National Institute for Health Research (NIHR), Cancer Research UK, and various other funding bodies provide significant investment toward cancer research projects that utilize advanced preclinical models, including PDX models. In October 2024, NIHR and the Office for Life Sciences (OLS) announced of funding six projects of USD 14.01 million through NIHR's Invention for Innovation (i4i) and the OLS Cancer Programme. The UK’s cancer research community is increasingly focused on collaboration among academic institutions, hospitals, and private companies, which is enhancing the utilization of PDX models.

Germany patient-derived xenograft model market is expected to grow at a considerable rate over the forecast period owing to the presence of a strong pharmaceutical industry and research institutions. Moreover, growing partnerships in the country with pharmaceutical companies and Contract Research Organizations (CROs) to accelerate drug discovery and development using PDX models are also contributing to the country's market growth. Large pharmaceutical companies are also increasingly using PDX models in their R&D pipelines to better predict how new therapies will perform in human patients.

Asia Pacific Patient-derived Xenograft Model Market Trends

Asia Pacific patient-derived xenograft model market is expected to grow at the highest CAGR over the forecast period.The growth can be attributed to the increasing prevalence of cancer in the region, particularly in countries like China, India, and Japan, due to aging populations, lifestyle changes, and environmental factors. According to the data published by the American Cancer Society in April 2024, nearly half of all cancer cases (49.2%) and the majority of cancer-related deaths (56.1%) worldwide were estimated to occur in Asia in 2022. Thus, increasing cases of cancer has led to the growing need for innovative research models like PDX to help identify better therapies and improve clinical outcomes. Moreover, with the advancing healthcare infrastructure, there is a greater focus on tackling the growing cancer burden.

The patient-derived xenograft model market in China is projected to witness significant growth in the coming years owing to increasing investment in research and development activities in the country by several public and private institutes. China invests heavily in the development of immuno-oncology therapies, such as immune checkpoint inhibitors, CAR-T cell therapies, and cancer vaccines, to improve treatment outcomes for a variety of cancer types. PDX models are a critical tool in this research, as they allow scientists to study the tumor microenvironment and the interactions between cancer cells and immune cells in a way that more closely resembles human conditions.

Japanpatient-derived xenograft model market is expected to witness lucrative growth over the forecast period due to strong government support and advanced healthcare infrastructure. The country’s government has invested significantly in medical research through programs such as the NEXT-Ganken Program, the Japanese Foundation for Cancer Research which support efforts to advance cancer treatment and drug development. These initiatives are driving the growth of the PDX model market, as these models are recognized as essential tools for preclinical research in oncology. The government’s support towards the development of advanced cancer therapies, coupled with its funding for cutting-edge research projects, supports the widespread adoption of PDX models for drug testing, biomarker discovery, and therapeutic validation.

The patient-derived xenograft model market in India is poised to grow in the coming years owing to the lower cost of conducting research compared to Western countries. This affordability is attracting both domestic and international pharmaceutical and biotech companies to conduct preclinical studies in India. CROs in India are providing high-quality PDX models at competitive prices, making it easier for companies, especially small and medium-sized biotech firms, to conduct drug discovery and early-stage development. The cost-effectiveness of conducting PDX-based research in India is expected to drive the country’s market growth, as companies seek to minimize the costs of preclinical testing while still benefiting from the accuracy and human relevance that PDX models offer.

MEA Patient-derived Xenograft Model Market Trends

The MEA patient-derived xenograft model market is projected to grow at a lucrative rate. Countries in the MEA region such as Saudi Arabia, the UAE, and Qatar, are increasingly investing in healthcare infrastructure and biotechnology research. The establishment of advanced research centers, cancer hospitals, and biotechnology incubators is providing the infrastructure necessary to support cutting-edge cancer research. For instance, in March 2023, the UAE government announced the launch of the National Genome Strategy to prioritize Emirati health care. Thus, growing research capabilities are driving the adoption of advanced preclinical models like PDX, which are essential for understanding tumor biology, exploring new therapies, and identifying genetic biomarkers specific to the region’s populations.

The patient-derived xenograft model market in Saudi Arabia is projected to witness a considerable growth rate due to an increasing burden of cancer in the country. According to the data published by the American Society of Clinical Oncology in January 2024, cancer incidence in the country is projected to increase from 27,885 in 2020 to 60,429 by 2040 (+116.7%). Thus, increasing cases of cancer have led the government to invest heavily in research and development activities to develop effective treatment options. Thus, increasing focus on cancer care is fueling the demand for advanced research models like Patient-Derived Xenograft (PDX) models, which allow researchers to test new drugs and personalize treatments based on individual tumor characteristics.

Key Patient-derived Xenograft Model Company Insights

Key players operating in the industry are Charles River Laboratories, The Jackson Laboratory, and Crown Bioscience among others are undertaking various strategic initiatives, the signing of a new partnership agreement, collaborations, mergers & acquisitions, and geographic expansions, to strengthen their services and gain a competitive advantage. For instance, in November 2023, Charles River Laboratories entered into a partnership agreement with Aitia to co-develop patient-derived xenograft (PDX) digital twins for in vivo oncology research.

Key Patient-derived Xenograft Model Companies:

The following are the leading companies in the patient-derived xenograft model market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories

- The Jackson Laboratory

- Crown Bioscience

- Altogen Labs

- Envigo

- WuXi AppTec

- Oncodesign

- Hera Biolabs

- XenTech

- Abnova Corp.

View a comprehensive list of companies in the Patient-derived Xenograft Model Market

Recent Developments

-

In August 2024, Altogen Labs, a preclinical contract research organization (CRO) announced the validation of a set of 10 lung cancer xenograft models. These models are crucial for evaluating the in vivo efficacy of novel therapeutics targeting lung cancer, driving progress in the diagnosis, understanding, and treatment of primary lung carcinoma.

-

In May 2024, BioAtla, Inc., a clinical-stage biotechnology company, announced of receiving FDA authorization for its novel antibody-drug conjugate (ADC) BA3361, targeting multiple tumor types. The company demonstrated BA3361's superior efficacy in both cell line-derived xenograft models and patient-derived xenograft (PDX) models, including pancreatic cancer, showing complete tumor regression and reduced toxicity due to CAB selectivity.

-

In March 2024, Crown Bioscience, a global contract research organization (CRO) announced to present its groundbreaking research at the AACR 2024 meeting, including data from its Patient-Derived Xenograft (PDX) models. These PDX models play a key role in advancing preclinical oncology studies, helping to drive more effective and personalized cancer therapies.

Patient-derived Xenograft Model Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 319.0 million

Revenue forecast in 2030

USD 505.3 million

Growth rate

CAGR 9.64% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Tumor type, model type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China, India, South Korea, Thailand, Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Charles River Laboratories; The Jackson Laboratory; Crown Bioscience; Altogen Labs; Envigo; WuXi AppTec; Oncodesign; Hera Biolabs; XenTech; Abnova Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

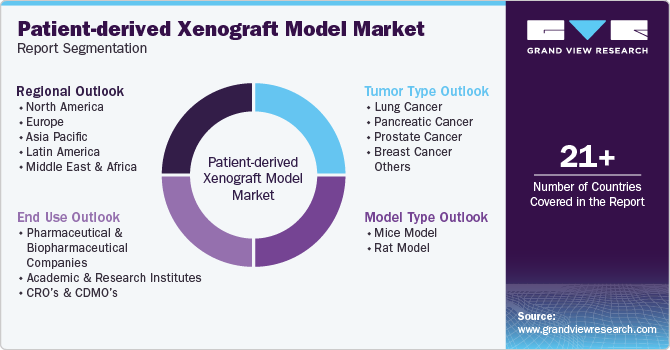

Global Patient-derived Xenograft Model Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global patient-derived xenograft model market report based on tumor type, model type, end use, and region.

-

Tumor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lung Cancer

-

Pancreatic Cancer

-

Prostate Cancer

-

Breast Cancer

-

Others

-

-

Model Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mice Model

-

Rat Model

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Academic and Research Institutes

-

CRO’s and CDMO’s

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient-derived xenograft model market size was estimated at USD 291.9 million in 2024 and is expected to reach USD 319.0 million in 2025.

b. The global patient-derived xenograft model market is expected to grow at a compound annual growth rate of 9.64% from 2025 to 2030 to reach USD 505.3 million by 2030.

b. By tumor type, the breast cancer segment dominated the patient-derived xenograft model market with a share of 31.7% in 2024 as the majority of the PDX model were developed for breast cancer.

b. Some key players operating in the patient-derived xenograft model market include Charles River Laboratories, The Jackson Laboratory, Crown Bioscience, Altogen Labs.

b. The global patient-derived xenograft model market is projected to expand rapidly due to the rising number of cancer cases across the globe, increasing R&D investment for cancer research, and an increasing number of Contract Research Organizations (CROs).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."