- Home

- »

- Medical Devices

- »

-

Patient Monitoring Devices Market, Industry Report, 2033GVR Report cover

![Patient Monitoring Devices Market Size, Share & Trends Report]()

Patient Monitoring Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Blood Glucose Monitoring Systems, Cardiac Monitoring Devices), By End-use (Hospitals, Ambulatory Surgery Centers, Home Care Settings), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-444-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Patient Monitoring Devices Market Summary

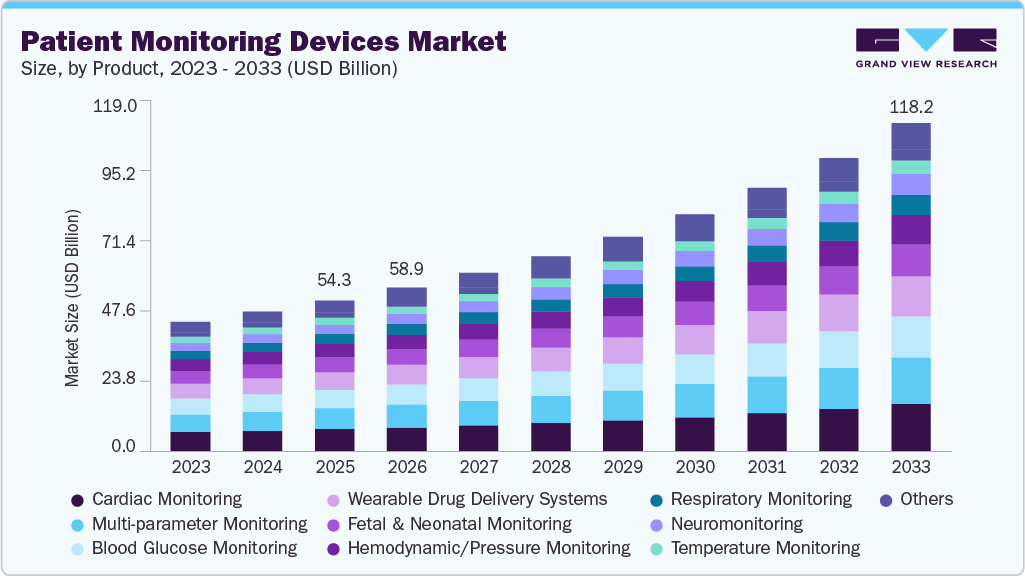

The global patient monitoring devices market size was estimated at USD 54.33 billion in 2025 and is expected to reach USD 118.21 billion by 2033, growing at a CAGR of 10.5% from 2026 to 2033. The expansion of industry can be attributed to the increasing demand for monitoring devices that measure, record, and display various biometric data, including blood pressure, temperature, and blood oxygen saturation levels.

Key Market Trends & Insights

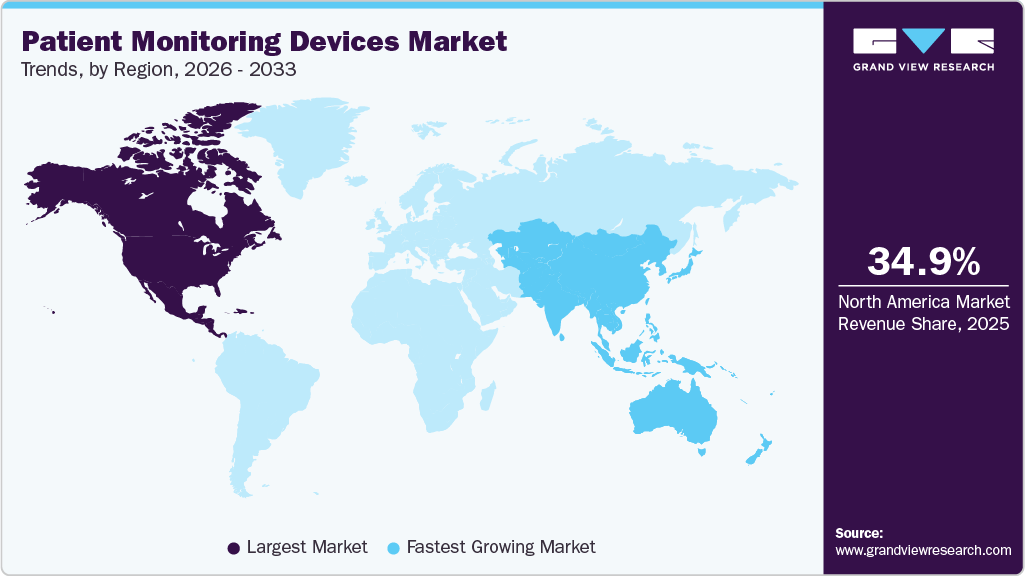

- North America dominated the market and accounted for a 34.99% share in 2025.

- The patient monitoring devices market in the U.S. has seen significant growth over the forecast period owing to the adoption of integrated solution.

- By product, the cardiac monitoring devices segment dominated the market with a share of 14.80% in 2025.

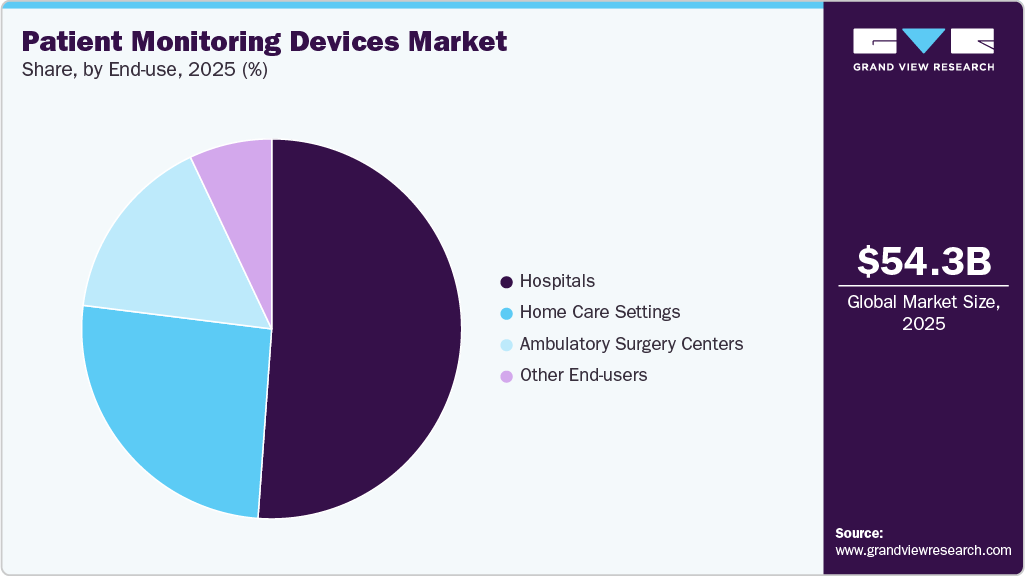

- By end use, the hospitals segment accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 54.33 Billion

- 2033 Projected Market Size: USD 118.21 Billion

- CAGR (2026-2033): 10.5%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The growing geriatric population, rising prevalence of chronic conditions such as cardiovascular diseases, diabetes, and respiratory disorders, and the increasing need for continuous monitoring are key drivers supporting market growth. For instance, the World Health Organization estimates that by 2030, one in six people globally will be 60 years or older, amplifying the demand for technologies that enable timely intervention and remote care. Rising adoption of telehealth and remote patient monitoring programs driven by healthcare cost pressures and staffing shortages. For instance, the AMA Digital Health Care 2022 study highlighted that 93% of physicians find digital tools beneficial, with remote patient monitoring (RPM) usage more than doubling to 30% since 2016. This growing adoption reflects strong clinician confidence in connected monitoring devices for managing chronic diseases, post-acute recovery, and preventive care.

Technological developments in miniaturization, battery life, and wireless connectivity are further driving the market. For instance, in The FDA has cleared Dexcom’s G7 15-Day Continuous Glucose Monitoring (CGM) system for adults with diabetes. This next-generation device offers up to 15.5 days of wear time, improved accuracy with an 8.0% MARD, and a 12-hour grace period, making it the longest-lasting and most precise CGM currently available in the U.S. market. Similarly, in September 2022, Medtronic announced the FDA clearance of its LINQ II insertable cardiac monitor with Bluetooth connectivity, offering real-time arrhythmia data transmission to physicians and facilitating earlier intervention. These innovations highlight how continuous improvements in device design and connectivity are enhancing remote monitoring capabilities and supporting proactive chronic disease management.

Despite the positive outlook, challenges remain, such as data security concerns and reimbursement gaps for certain remote monitoring services. However, with continuous innovation, growing acceptance by clinicians, and value-based care models emphasizing preventive health management, the patient monitoring devices market is poised to witness robust growth over the forecast period.

AI Integration in Patient Monitoring Devices: Key Applications and Examples

AI Application

Function

Example

Impact

Continuous Vital Signs Monitoring

AI analyzes heart rate, respiratory rate, posture, and activity trends

Philips Healthdot + smartQare - Healthdot is a wearable biosensor that continuously monitors vitals such as HR and RR and transmits data to clinicians via the smartQare platform.

Enhances patient safety, enables seamless in-hospital to home care transition

ECG Analysis & Arrhythmia Detection

AI interprets ECG waveforms from ambulatory monitors to detect arrhythmias

iRhythm Zio Patch + ZEUS AI - a wearable ECG monitor analyzed by ZEUS AI to detect arrhythmias with high accuracy for outpatient cardiac monitoring.

Improves diagnostic yield, reduces cardiologist reading time

Predictive Glucose Monitoring

AI predicts hypoglycemia events and analyzes glucose trends up to 2 hours ahead

Roche Accu-Chek SmartGuide CGM - a continuous glucose monitor using AI to forecast hypo events and glucose trends, supporting proactive diabetes management.

Enables proactive diabetes management, reduces hypoglycemia risks

Case Study: MAC VU360 Resting ECG: Operational Efficiency Study

Objective

Compare operational efficiency, usability, and performance of the new MAC VU360 ECG workstation (“Product X”) against three existing ECG systems: GE MAC 5500 HD, Philips Pagewriter TC70, and Mortara ELI 380 ERGO/ELI 350

Methodology

A double-blind observational study involving 20 nurses and ECG technicians, using a timed series of routine ECG tasks. Metrics included time-to-complete, assistance needed, usability scores, mobility, cleaning, and overall preference

Key Findings

-

Participants completed routine ECG tasks significantly faster using the MAC VU360 compared to other systems tested.

-

Users required less assistance or supervision, indicating improved usability and intuitive workflow design.

-

MAC VU360 scored the highest on:

-

Tasks were completed with fewer errors, supporting improved data accuracy and patient safety.

Conclusion

MAC VU360 demonstrated meaningful efficiency gains and enhanced user satisfaction, making it a compelling choice for high-volume hospital settings aiming to streamline ECG operations.

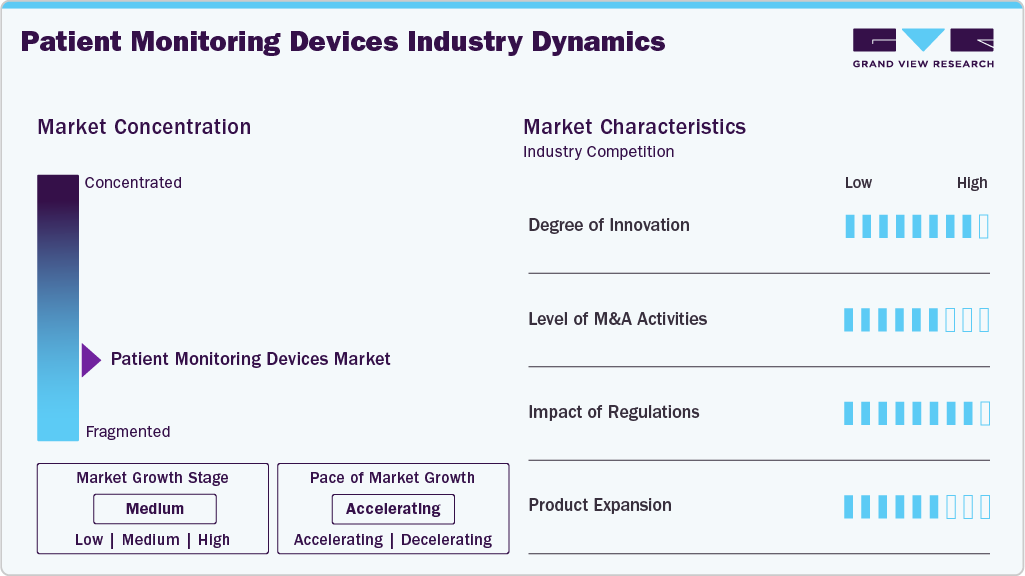

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the remote patient monitoring devices market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry is high. However, the regional expansion observes moderate growth.

The level of innovation in the remote patient monitoring (RPM) systems market is moderate to high, driven by rapid technological advancements in AI-enabled analytics, cellular connectivity, and device interoperability. Companies are increasingly focusing on developing smart, patient-friendly monitoring solutions that enable continuous, reliable data transmission and predictive insights to support proactive care models. For instance, in July 2024, Roche received CE mark approval for its Accu-Chek SmartGuide CGM, a next-generation continuous glucose monitoring system integrating predictive AI algorithms to forecast hypoglycemia up to 30 minutes in advance, marking a significant leap in proactive chronic disease management through patient monitoring solutions.

The level of partnerships & collaboration activities by key players in the industry is high with major players joining forces to enhance technological capabilities, broaden product offerings, and streamline global access to advanced monitoring solutions. In July 2025, Medtronic and Philips signed a multi-year strategic partnership, integrating Medtronic’s Nellcor pulse oximetry, Microstream capnography, BIS brain monitoring, and other consumables into Philips’ patient monitoring platforms. This alliance aims to provide healthcare systems with validated, cyber-secure, end-to-end monitoring ecosystems bundled with essential supplies and backed by joint training programs to improve clinician efficiency and patient care outcomes.

The impact of regulations on the market is high as they ensure the safety, accuracy, and data security of patient monitoring devices. Recent FDA guidelines, such as the Cybersecurity in Medical Devices (2023), require robust protections for connected monitors, while the EU Medical Device Regulation (MDR) enforces strict clinical evaluation and post-market surveillance standards. while the EU Medical Device Regulation (MDR) enforces strict clinical evaluation, risk classification, and post-market surveillance requirements. Although these regulations support patient safety and quality, they also increase development costs and extend approval timelines for manufacturers.

The industry's level of regional expansion is moderate. Regional expansion has become a key growth strategy for patient monitoring device companies to enhance market presence, broaden patient access to advanced monitoring technologies, drive revenue growth, and diversify their global portfolios. Companies are focusing on entering emerging markets and expanding distribution networks to meet the growing demand for continuous and connected patient care solutions.

Product Insights

The cardiac monitoring devices segment led the market with a revenue share of 14.80% in 2025. The segment's large share is due to cardiovascular diseases remaining the leading cause of death worldwide, which drives high demand for continuous cardiac monitoring across various care settings. Technological advancements such as AI-enabled arrhythmia detection, wireless ECG patches, and integrated monitoring systems have further increased adoption. For instance, in June 2025, Cardinal Health introduced its Kendall DL Multi System. This single-use device continuously monitors cardiac activity, blood oxygen saturation, and temperature in one system, enhancing workflow efficiency and patient safety while maintaining a strong market presence for cardiac monitoring solutions.

Wearable drug delivery systems segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by increasing demand for patient-centric and self-administered therapies, particularly for chronic conditions such as diabetes, oncology, and autoimmune diseases. These systems offer enhanced convenience, improved adherence, and better pharmacokinetic control compared to traditional delivery methods, making them an attractive option for both patients and healthcare providers.

End-use Insights

The hospital segment held the largest revenue share in 2025. This is due to the growing need for accurate and timely disease detection in hospitals, along with the rising number of procedures performed there. The segment's expansion is driven by more patients being admitted to hospitals because of injuries, chronic illnesses, and other conditions. In general wards and intensive care units, multiparameter patient monitors are often used to continuously track patients' vital signs, including oxygen saturation, respiration rate, blood pressure, and heart rate.

The home care segment is anticipated to witness rapid growth over the forecast period. The development of next-generation therapeutic, display, diagnostic, and monitoring devices design, which are more adaptable, precise, and compact, is accelerating due to the trend toward portability and the delivery of treatment at home or at the bedside.

Regional Insights

The North America patient monitoring devices market remains strong in 2025, driven by increasing chronic disease rates, aging populations, and the rapid shift toward remote care models. For instance, according to the CDC, over 805,000 people in the U.S. have a heart attack every year, increasing demand for continuous cardiac monitoring devices. The region is also experiencing high adoption of advanced technologies; for instance, in July 2022, Mindray introduced its VS9 Vital Signs Monitor, which features a true-to-life display for enhanced visual clarity, quick temperature measurement, and an intuitive workflow designed to boost clinician efficiency and patient care in both acute and general ward settings. This highlights the market’s focus on integrating user-friendly, innovative monitoring solutions to support proactive and efficient healthcare delivery.

U.S. Patient Monitoring Devices Market Trends

The patient monitoring devices market in U.S. is driven by rising chronic disease prevalence, an aging population, and the explosion of remotely delivered care. According to IQVIA, by 2030 over 142 million Americans (nearly 40% of the population) are expected to be using remote patient monitoring technology. This surge reflects a meaningful shift toward data-driven, patient-centric care.

Europe Patient Monitoring Devices Market Trends

The patient monitoring devices market in Europe is growing steadily, driven by its aging population and rising chronic disease burden. Countries such as Germany, France, and the UK are seeing increased adoption of advanced multi-parameter monitors and remote patient monitoring solutions to improve care efficiency and reduce hospital readmission. Strict EU MDR regulations ensure high safety and quality standards, influencing innovation and market entry strategies across the region.

UK patient monitoring devices market is growing steadily, supported by NHS digital initiatives and rising chronic disease burdens. In July 2024, NICE approved HeartLogic (Boston Scientific) and TriageHF (Medtronic) remote monitoring tools for heart failure, enabling earlier detection of deterioration and reducing hospitalizations by up to 72%. This highlights the country’s focus on integrating advanced remote monitoring solutions to improve patient outcomes and reduce healthcare system strain.

Patient monitoring devices market in Germany is evolving through increased adoption of digital and AI-enabled solutions, particularly in chronic and oncology care. For instance, in November 2021, Kaiku Health and MSD Germany partnered to develop an AI-powered digital monitoring tool for lung cancer patients, enabling timely symptom tracking and alerts to care teams to improve patient management.

Asia Pacific Patient Monitoring Devices Market Trends

Patient monitoring devices market in APAC is growing due to the adoption of a sedentary lifestyle in the region, including poor diet, physical inactivity, and high sugar intake, which led to many chronic illnesses such as obesity, diabetes, and others, the Asia Pacific region is predicted to have profitable growth throughout the projection period. The greatest diabetic populations are in China and India, and this number is projected to rise during the prediction period. This causes a rise in diabetes prevention awareness, which further boosts market expansion.

Patient monitoring devices market in Chinaiswitnessinga significant growth due to country’s rising burden of respiratory diseases. For instance, according to world health organization as of November 2023, around 100 million people in china are living with chronic obstructive pulmonary disease which accounts for almost 25% of all global COPD cases. Remote patient monitoring is expanding swiftly, with vital sign monitors being the fastest-growing segment, supported by initiatives like rural telehealth pilots and AI-integrated wearables.

Japan patient monitoring devices market is growing steadily, driven by its aging population and high prevalence of chronic diseases like diabetes and heart conditions. The market features strong presence of key players such as Nihon Kohden and remote monitoring technologies to support, OMRON, and Terumo, who are advancing wearable home-based care and hospital efficiency, aligning with Japan’s push toward digital health integration.

Latin America Patient Monitoring Devices Market Trends

The Latin America patient monitoring devices market is growing steadily, driven by the rising burden of chronic diseases and expanding telehealth initiatives. Countries like Brazil are increasingly adopting remote and wearable monitoring solutions to enhance healthcare access in underserved regions, supporting a gradual shift toward more connected and preventive care models.

Middle East & Africa Patient Monitoring Devices Market Trends

The MEA market growth is attributed to the region’s rising COPD and asthma therapeutics market. In addition, growing urbanization and increasing pollution levels also contributing to the market’s growth. Further, Countries such as Saudi Arabia are expected to register the highest growth rates. However, challenges such as limited access to healthcare services and affordability issues persist, particularly in low-income regions.

Key Patient Monitoring Devices Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Patient Monitoring Devices Companies:

The following are the leading companies in the patient monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- Bosch

- Biotronik

- Welch Allyn

- Koninklijke Philips N.V.

- GE Healthcare

- Medtronic

- MASIMO CORPORATION

- Smith’s Medical

- OMRON Corporation

- Mindray Medical India Pvt. Ltd.

- F. Hoffmann-La Roche Ltd

- Drägerwerk AG & Co. KGaA

- NIHON KOHDEN CORPORATION

- Natus Medical

Recent Developments

-

In April 2025, BD launched the HemoSphere Alta, an advanced hemodynamic monitoring platform featuring AI-driven predictive algorithms like the Cerebral Autoregulation Index (CAI) and Hypotension Prediction Index (HPI) along with a 15″ touchscreen and hands-free voice/gesture controls to help clinicians proactively manage blood pressure and blood flow in critical care settings.

“The availability of the novel Cerebral Autoregulation Index provides clinicians with a tool to detect conditions of impaired autoregulation and can help identify a patient's lower limit of autoregulation. This, in combination with Hypotension Prediction Index technology and other advanced software and algorithms on the HemoSphere Alta platform allows us to both customize and predict patients' low blood pressure.”

-Dr. Charles Hogue, chairman of the Department of Anesthesiology at Northwestern University Feinberg School of Medicine in Chicago

-

In May 2024, Omron Healthcare India has partnered with AliveCor to introduce AI-driven portable ECG devices including the first FDA-cleared device combining blood pressure and ECG in India. These home-use tools enable early detection of arrhythmias such as AFib and support remote cardiovascular health monitoring.

-

In April 2024, Philips and smartQare have formed a partnership to integrate smartQare’s viQtor and Philips’ Healthdot biosensors into Philips’ clinical monitoring platforms. The collaboration creates an open, continuous patient monitoring ecosystem-across hospital and home settings-to streamline data flow, reduce clinician workload, and improve patient safety

“By opening our world-class monitoring platform to other companies like smartQare, we can create a patient-monitoring ecosystem that helps to give time back to the provider to work on what matters and care for their patients confidently.”

- Christoph Pedain, Business Leader, Hospital Patient Monitoring at Philips.

-

In Januray 2024, Pylo Health launched two cellular-connected, clinically validated RPM devices the Pylo 900 LTE blood pressure monitor and Pylo 200 LTE weight scale featuring roaming 4G/5G connectivity, no-setup ease, and AHA-aligned triple-measure mode for reliable remote monitoring across U.S. programs.

“Ongoing remote blood pressure and weight monitoring are low-barrier and highly effective additions to primary care, cardiology, gastroenterology, bariatric, and other remote care programs,"

- Daniel Tashnek, founder and CEO of Pylo and Prevounce.

Patient Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 58.90 billion

Revenue forecast in 2033

USD 118.21 billion

Growth rate

CAGR of 10.5% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Bosch; Biotronik; Welch Allyn; Koninklijke Philips N.V.; GE Healthcare; Medtronic; MASIMO CORPORATION; Smiths Medical; OMRON Corporation; Mindray Medical India Pvt. Ltd.; F. Hoffmann-La Roche Ltd; Drägerwerk AG & Co. KGaA; NIHON KOHDEN CORPORATION; Natus Medical.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global patient monitoring devices market report based on product, end-use, and regions.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood Glucose Monitoring Systems

-

Self-monitoring Blood Glucose Systems

-

Continuous Glucose Monitoring Systems

-

-

Cardiac Monitoring Devices

-

ECG Devices

-

Implantable Loop Recorders

-

Event Monitors

-

Mobile Cardiac Telemetry Monitors

-

Smart/Wearable ECG Monitors

-

-

Multi-parameter Monitoring Devices.

-

Low-acuity Monitoring Devices

-

Mid-acuity Monitoring Devices

-

High-acuity Monitoring Devices

-

-

Respiratory Monitoring Devices

-

Pulse Oximeters

-

Spirometers

-

Capnographs

-

Peak Flow Meters

-

-

Temperature Monitoring Devices

-

Handheld Temperature Monitoring Devices

-

Table-top Temperature Monitoring Devices

-

Wearable Continuous Monitoring Devices

-

Invasive Temperature Monitoring Devices

-

Smart Temperature Monitoring Devices

-

-

Hemodynamic/Pressure Monitoring Devices

-

Hemodynamic Monitors

-

Blood Pressure Monitors

-

Disposables

-

-

Fetal & Neonatal Monitoring Devices

-

Fetal Monitoring Devices

-

Neonatal Monitoring Devices

-

-

Neuromonitoring Devices

-

Electroencephalograph Machines

-

Electromyography Machines

-

Cerebral Oximeters

-

Intracranial Pressure Monitors

-

Magnetoencephalograph Machines

-

Transcranial Doppler Machines

-

-

Weight Monitoring Devices

-

Digital

-

Analog

-

-

Wearable Drug Delivery Systems

-

Other Patient Monitoring Devices

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgery Centers

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The cardiac monitoring devices segment led the market with a revenue share of 14.80% in 2025.

b. The hospital segment dominated the patient monitoring devices market and accounted for the largest revenue share in 2024.

b. The global patient monitoring devices market size was estimated at USD 54.33 billion in 2025 and is expected to reach USD 58.90 billion in 2026.

b. The global patient monitoring devices market is expected to grow at a compound annual growth rate of 10.5% from 2026 to 2033 to reach USD 118.21 billion by 2033.

b. North America dominated the patient monitoring devices market and accounted for the largest revenue share in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.