- Home

- »

- Healthcare IT

- »

-

Patient Safety And Risk Management Software Market Report, 2030GVR Report cover

![Patient Safety And Risk Management Software Market Size, Share & Trends Report]()

Patient Safety And Risk Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Deployment Type (Cloud, On-premise), By End-use (Hospitals, Ambulatory Care Centers, Long-term Care Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-158-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global patient safety and risk management software market size was valued at USD 2.22 billion in 2024 and is anticipated to grow at a CAGR of 12.12% from 2025 to 2030. The growing number of medical errors and the need for patient safety and care are the factors driving the market growth. Moreover, government initiatives to promote the healthcare software sector and the increased adoption of digitization are further accelerating market growth. The WHO organized a World Patient Safety Day 2023 campaign with the slogan “Elevate the voice of patients!” to assure that all stakeholders are involved in policy formulation, designing safety strategies, and being active partners. Such activities contribute to the development of a platform that is patient-centered.

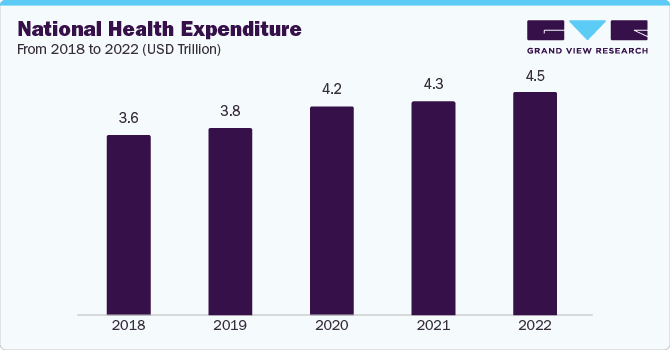

Rising healthcare expenditure in both developed and developing regions is driving the adoption of patient safety and risk management software in the healthcare industry. The sector is shifting from a fee-for-service framework to a value-based approach, where reimbursements are aligned with treatment outcomes. This shift is driving the demand for patient safety and risk management solutions. For instance, data published by the U.S. Centers for Medicare & Medicaid Services in December 2023 showcased that National Health Expenditure (NHE) was USD 13,493 per capita in 2022. The below-mentioned bar chart showcases the growth in NHE from 2018 to 2022.

Furthermore, increasing government initiatives for better patient safety and outcomes drive the adoption of patient safety and risk management software in the healthcare industry. For instance, the WHO has formulated a Global Patient Safety Action Plan 2021-2030. The action plan aims to offer a strategic framework for stakeholders to eliminate avoidable harm in healthcare and enhance patient safety across various practice areas. This is achieved through policy actions focused on the safety & quality of health services and implementing recommendations at the point of care. Furthermore, the plan guides countries to formulate national patient safety action plans and aligns with existing strategies to improve patient safety in clinical & health-related programs.

Patient safety has become a top priority for healthcare organizations and regulatory bodies worldwide. The importance of preventing adverse events, medical errors, and enhancing patient outcomes is growing. This focus on patient safety is fueling the demand for software solutions capable of rapidly identifying and addressing hazards. According to The Joint Commission (TJC), a nonprofit organization accrediting numerous healthcare organizations and programs in the U.S., there has been a concerning rise in adverse patient safety events. Its 2023 annual report revealed a significant increase in sentinel events, which are significant breaches in patient safety that can lead to serious harm or fatalities.

From 2020 to 2021, these events surged by 78.1%, and from 2021 to 2022, they rose by 19.3%. Furthermore, as per the findings published in the Journal of Patient Safety, approximately 210,000 lives are lost annually due to preventable medical errors. However, when considering errors of omission and diagnostic inaccuracies, this figure escalates to 440,000 lives lost each year. Moreover, medical errors cost USD 1 trillion each year. This has raised the adoption of various software to reduce medical errors and adverse events in healthcare settings, thereby driving the market.

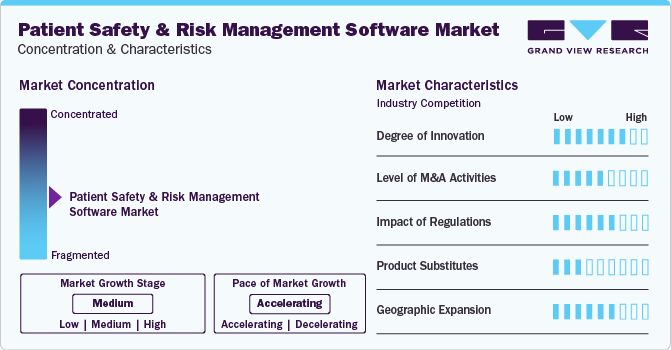

Market Concentration & Characteristics

Technological advancements in patient safety and risk management software are revolutionizing healthcare. These advancements include AI and machine learning for predictive analytics, real-time monitoring through IoT devices, cloud computing for scalability and data security, advanced data analytics for insights, mobile apps for communication, blockchain for data integrity, and predictive analytics for risk prevention. For instance, in June 2023, Pharmapod deployed OMNI Care Homes (OMNI) to enhance medication management and facilitate the provision of superior resident care. This platform efficiently integrates data from residential facilities and pharmacies, enabling OMNI to conduct thorough analyses and identify and mitigate risks effectively.

The activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in July 2022, RLDatix announced the acquisition of Galen Healthcare Solutions. This strategic acquisition enabled organizations to satisfy regulatory conditions for data retention while ensuring patient care continuity throughout their healthcare journey.

The regulation sets standards for software development, marketing, and use. Software used for patient safety and risk management must comply with these regulations' safety, performance, and data protection requirements. Regulatory bodies like the European Medicines Agency and national competent authorities oversee the approval and monitoring of such software to ensure patient safety and effectiveness. Moreover, compliance with HIPAA and the Health Information Technology for Economic and Clinical Health (HITECH) Act is essential in the North American healthcare sector. These standards focus on safeguarding patient health information and ensuring secure electronic data transfer. Healthcare providers must adhere to these regulations to protect patient privacy and avoid penalties.

Companies in the patient safety and risk management software industry adopt geographic expansion strategies to maintain their position in emerging markets and customer base from these regions. For instance, in October 2020, Health Catalyst marked its entry into the Middle East healthcare market by partnering with the Middle East Healthcare Company to offer its services to six Saudi Arabian hospitals. These hospitals would implement Health Catalyst’s DOS technology platform.

Type Insights

The risk management & safety solutions segment dominated the market with the largest revenue share of 67.05% in 2024. This large share is attributed to the development of patient safety software, which allows healthcare managers to access patient data from a single system, resulting in easy accessibility and data protection. These solutions provide effective and high-quality care for patients. In May 2023, DOSIsoft announced the launch of ThinkQA Secondary Dose Check, a new software application that calculates and verifies patients' secondary doses. It is designed to help Radiation Therapy (RT) departments with patient-specific safety and quality assurance (QA) procedures and meet the QA standards of the most recent adaptive radiotherapy tools and procedures.

The governance, risk & compliance solutions segment is expected to grow at the fastest CAGR from 2025 to 2030. The growth is attributed to the rising number of adverse health-related events worldwide. According to a report by the Institute of Medicine (IOM), around 98,000 people die annually due to medical errors when they are admitted to the hospital. Hence, the WHO and several governments are directing several patient safety programs to raise awareness in this area. Moreover, some key players are adopting various strategies, such as mergers & acquisitions, to strengthen their market presence and cater to the growing demand.

For instance, in July 2022, RLDatix, specializing in healthcare Governance, Risk, & Compliance (GRC) solutions, acquired Galen Healthcare Solutions (Galen), specializing in optimization, data migration, implementation, & archival solutions for HIT systems. This acquisition facilitated organizations in complying with regulatory mandates related to data retention while assuring patient continuity care throughout their healthcare trajectory. By leveraging RLDatix’s premier GRC solutions, organizations can be prepared to archive, administer, and preserve legacy data essential for safer healthcare services.

Deployment Type Insights

The cloud segment dominated the market with the largest revenue share of around 58.07% in 2024. Cloud-based patient safety & risk management software is a digital platform that runs on cloud servers and can be accessed through web browsers. It is specifically created to assist healthcare providers & organizations to manage and enhance patient safety while minimizing risks. This software utilizes advanced cloud computing and/or web technologies to deliver a secure, scalable, & adaptable framework for storing, analyzing, & addressing patient safety data, incidents, and risk evaluations.

The on-premise segment is expected to grow at a significant CAGR from 2025 to 2030. On-premise patient safety & risk management software gives healthcare organizations greater control over data security and compliance. It offers customization & integration options, reliable performance in areas with limited internet access, and adherence to regulatory requirements. In addition, the software enables offline access, strong data backup, potential cost savings, and local maintenance support. These advantages make it a preferred choice for many healthcare institutions seeking secure and efficient patient safety & risk management systems.

End-use Insights

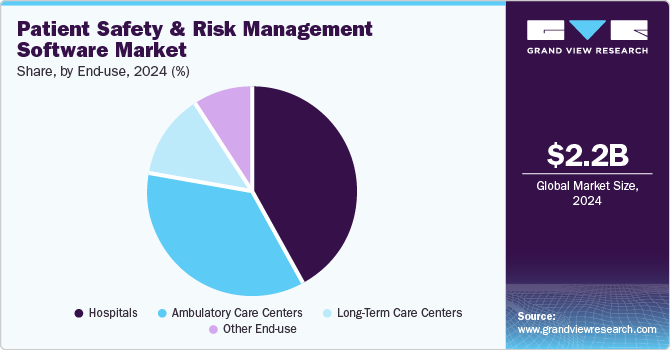

The hospital segment dominated the market with the largest share of 41.75% in 2024. Growth in the segment can be attributed to the growing need to reduce medical errors. The adoption of IT in healthcare is increasing due to its numerous advantages, such as a simplified & consistent data collection process and single point of data entry, which reduces the risk of errors.

Market players are undertaking several strategic initiatives to promote patient safety software in hospitals. For instance, in December 2023, ObservSMART collaborated with Mount Sinai Medical Center to enhance behavioral health patients’ safety across its three emergency centers in Miami-Dade County. The innovative portable rounding technology developed by ObservSMART, which employs Bluetooth proximity and patient wearable devices, facilitates the monitoring of patients with higher acuity levels.

The ambulatory care centers segment is expected to grow at the fastest CAGR from 2025 to 2030. Ambulatory care encompasses medical services provided on an outpatient basis without needing admission to a hospital or similar facility. It comprises services offered by physicians' offices and other healthcare professionals, hospital outpatient departments, specialty clinics or centers for dialysis or infusion, urgent care clinics, and ambulatory surgical centers (ASCs), among others. Hence, market players are introducing several offerings to cater to this segment. For instance, in March 2024, Surglogs announced that it was chosen as the compliance management software provider by one of the largest ASC companies in the U.S. This collaboration sets Surglogs to enhance and streamline regulatory compliance operations throughout over 300 ASCs within its portfolio.

Regional Insights

North America dominated the market with a revenue share of 48.08% in 2024. The growth is attributed to the high adoption of healthcare IT services to organize & streamline workflows at healthcare institutions in the U.S. and Canada. Moreover, the presence of technologically advanced healthcare infrastructure and the shift from on-premise solutions to cloud-based solutions are driving the market growth. In addition, the rise in the usage of data analytics to enhance patient safety and the presence of numerous key market participants in the U.S. are some of the key factors boosting market growth in this region.

U.S. Patient Safety And Risk Management Software Market Trends

The U.S. patient safety and risk management software held the largest share in 2024 due to government initiatives that support improvements in treatment, diagnosis, and patient care. During a hospital stay, approximately 25% of Medicare patients experience adverse events, with over 40% of these incidents being preventable errors. There is a continuous effort within hospitals and health systems to improve patient safety standards. In 2023, the American Hospital Association (AHA) initiated a new Patient Safety Initiative to promote ongoing efforts in this country. This initiative aims at reinforcing and advancing patient safety measures across hospitals & health systems.

Europe Patient Safety And Risk Management Software Market Trends

Europe followed North America in terms of revenue share in 2024 and is expected to maintain its position from 2025 to 2030. The healthcare industry in Europe is focused on developing solutions capable of mitigating the rising costs, increasing prevalence of chronic conditions, rising frequency of medical errors, rapidly aging population, growing demand for treatments, and declining healthcare workforce. A shift toward value-based healthcare is expected to strengthen the demand for better patient outcomes at a reasonable cost.

The Germany patient safety and risk management software market dominated in the European region in 2024. Increasing adoption of innovative healthcare IT solutions due to the need for efficient utilization of resources and increased patient-centric approach significantly contributes to the adoption of patient safety & risk management software solutions in healthcare systems.

The patient safety and risk management software market in the UK is expected to grow significantly from 2025 to 2030. The market growth in the country is attributed to the increasing incidence of medical errors and hospital-acquired infections. Medical errors present a challenge in healthcare, often leading to preventable patient harm, extended hospital stays, and elevated costs. According to a study by the Policy Research Unit in Economic Evaluation of Health and Care Interventions, about 237 million medication errors occurrence estimated annually in England, with approximately 66 million potentially having clinical significance.

Asia Pacific Patient Safety And Risk Management Software Market Trends

Asia Pacific is anticipated to register the fastest CAGR from 2025 to 2030. An increase in the patient pool, a rise in investments to improve healthcare infrastructure and advancements related to AI/ML are factors propelling the demand for patient safety & risk management software. Furthermore, the growing need for managing efficient workflows and increasing demand for personalized and customized information in emerging economies like India and China are driving the market growth in the region.

The China patient safety and risk management software market held a significant market share in 2024. An increase in medical errors resulting in high demand for patient safety and care is driving the market growth in the country. Moreover, growing concerns regarding hospital-acquired infections and high healthcare costs are further propelling the growth of the market. For instance, according to a study published by NCBI in January 2023, the median total medical costs and length of hospital stay for in-patients with Hospital-Acquired Infections (HAI) in China exceed those without HAI by approximately USD 4000 and 13.89 days, respectively.

The patient safety and risk management software market in India is expected to grow significantly from 2025 to 2030. Digitalization in the healthcare sector in India is being rapidly adopted. Tech giants have started focusing on implementing healthcare IT solutions in the country. These solutions help overcome barriers by solving the problem through early detection, diagnostics, decision-making, & treatment, supporting the shortage of personnel and catering to the country's large population. This, in turn, is driving the adoption of patient safety and risk management software to promote care, reduce risks associated with hospital-acquired infections, and maintain compliance with industry standards & regulations.

Key Patient Safety And Risk Management Software Company Insights

The market is fairly competitive, and some notable participants in the market are symplr; BD; Origami Risk LLC; and Riskonnect, Inc. These players are involved in new product launches, partnerships, and acquisitions to gain a competitive edge over each other.

Key Patient Safety And Risk Management Software Companies:

The following are the leading companies in the patient safety and risk management software market. These companies collectively hold the largest market share and dictate industry trends.

- Riskonnect, Inc.

- Origami Risk LLC

- RLDatix

- Health Catalyst

- Conduent, Inc.

- symplr

- Clarity Group, Inc.

- Becton, Dickinson and Company (BD)

- RiskQual Technologies, Inc.

- Prista Corporation

Recent Developments

-

In January 2024, Origami Risk LLC launched a new mobile application, Origami Mobile, designed to significantly improve the user experience in facilitating Environmental, Health, & Safety (EHS) and risk management processes. This app enables professionals in safety and risk management, performs audits & inspections, record observations, and report incidents from any location in the field through a mobile phone or tablet, even without Wi-Fi or mobile data connectivity.

-

In June 2023, Prista Corporation partnered with the Idaho Hospital Association and implemented its ActionCue Clinical Intelligence within the facility. This initiative supported enhancing patient care and safety by offering real-time, actionable insights to healthcare executives and their teams.

-

In July 2023, Neighbourly Pharmacy chose Pharmapod’s medication incident management solution to manage medication safety across approximately 300 locations throughout Canada.

-

In July 2022, RLDatix announced the acquisition of Galen Healthcare Solutions. This acquisition helped organizations satisfy regulatory requirements for data retention while ensuring patient care continuity throughout their healthcare journey.

-

In June 2022, BD partnered with Mayo Clinic Platform to gain access to anonymized patient data through Mayo Clinic Platform_Discover. This collaboration was undertaken to conduct comprehensive postmarket surveillance of its products. This initiative aimed to stimulate innovation and facilitate a quicker, more streamlined pathway to market, ultimately enhancing the quality of patient care.

Patient Safety And Risk Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.46 billion

Revenue forecast in 2030

USD 4.36 billion

Growth rate

CAGR of 12.12% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Riskonnect, Inc.; Origami Risk LLC; RLDatix; Health Catalyst; Conduent, Inc.; symplr; Clarity Group, Inc.; Becton, Dickinson and Company (BD); RiskQual Technologies, Inc.; Prista Corporation; Pharmapod (Think Research Corporation)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Safety And Risk Management Software Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global patient safety and risk management software market report based on type, deployment type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Risk Management & Safety Solutions

-

Claims Management Solutions

-

Governance, Risk & Compliance Solutions

-

-

Deployment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-Premise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers

-

Long-Term Care Centers

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient safety and risk management software market size was estimated at USD 2.22 billion in 204 and is expected to reach USD 2.46 billion in 2025.

b. The global patient safety and risk management software market is expected to grow at a compound annual growth rate of 12.12% from 2025 to 2030 to reach USD 4.36 billion by 2030.

b. Risk management and safety solutions dominated the patient safety & risk management software market with a share of 67.05% in 2024. This is attributable to the development of patient safety software devices, which provides an advantage to the healthcare managers to access patient data from a single system, resulting in easy accessibility and protection of data.

b. Some key players operating in the patient safety and risk management software market include Riskonnect Inc.; Health Catalyst (U.S.), LLC; Conduent Inc.; Origami Risk; Symplr.; RLDatix; Clarity Group Inc; Verge Health; RiskQual Technologies; Quantros Inc.; and The Patient Safety Company.

b. Key factors driving patient safety & risk management software market growth include an increase in the number of medical errors coupled with an increased necessity to provide patient safety and care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.