- Home

- »

- Medical Devices

- »

-

Patient Temperature Management Market Size Report, 2033GVR Report cover

![Patient Temperature Management Market Size, Share & Trends Report]()

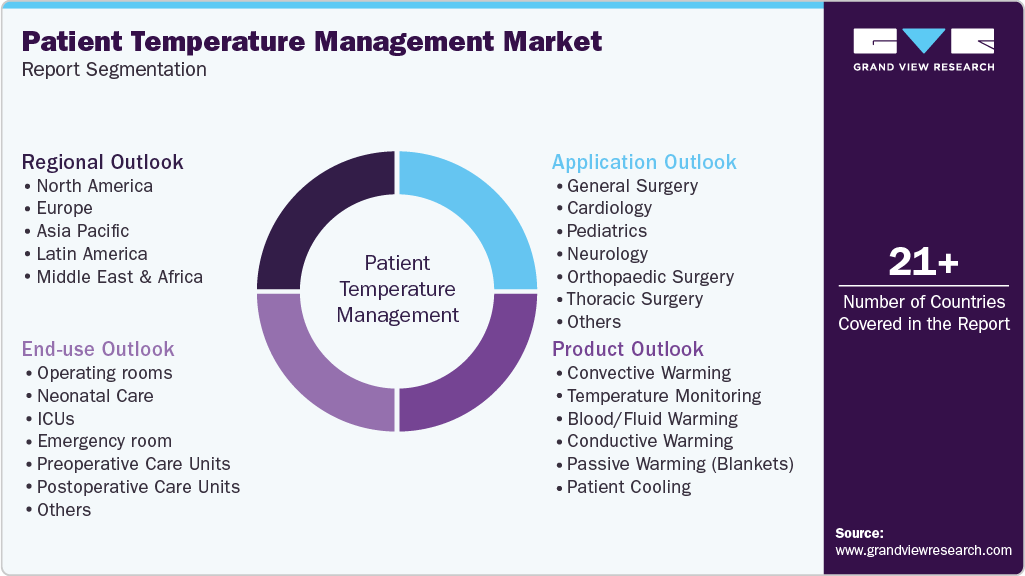

Patient Temperature Management Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Patient Warming Systems, Patient Cooling Systems), By Application (General Surgery, Cardiology, Pediatrics, Neurology), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-738-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Patient Temperature Management Market Summary

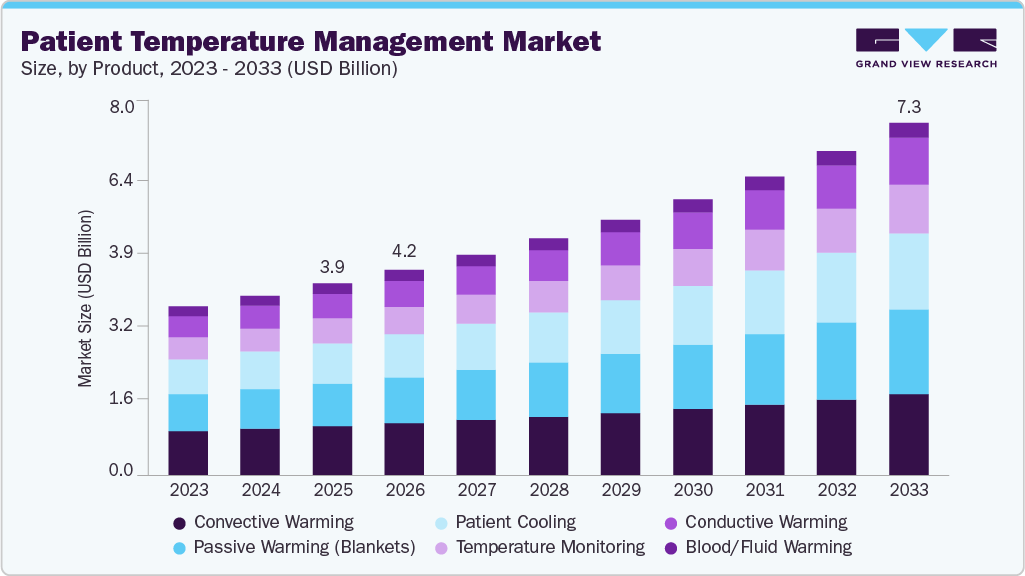

The global patient temperature management market size was valued at USD 3.95 billion in 2025 and is expected to reach USD 7.25 billion by 2033, growing at a CAGR of 8.03% from 2026 to 2033. This growth is driven by the increasing volume of surgical procedures, largely due to the rising global prevalence of cardiovascular diseases and cancer.

Key Market Trends & Insights

- The North America patient temperature management market dominated the global market with the largest revenue share of 45.3% in 2025.

- The U.S. is expected to grow at the fastest CAGR over the forecast period.

- Based on product, the convective warming segment led the market with the largest revenue share of 25.7% in 2025.

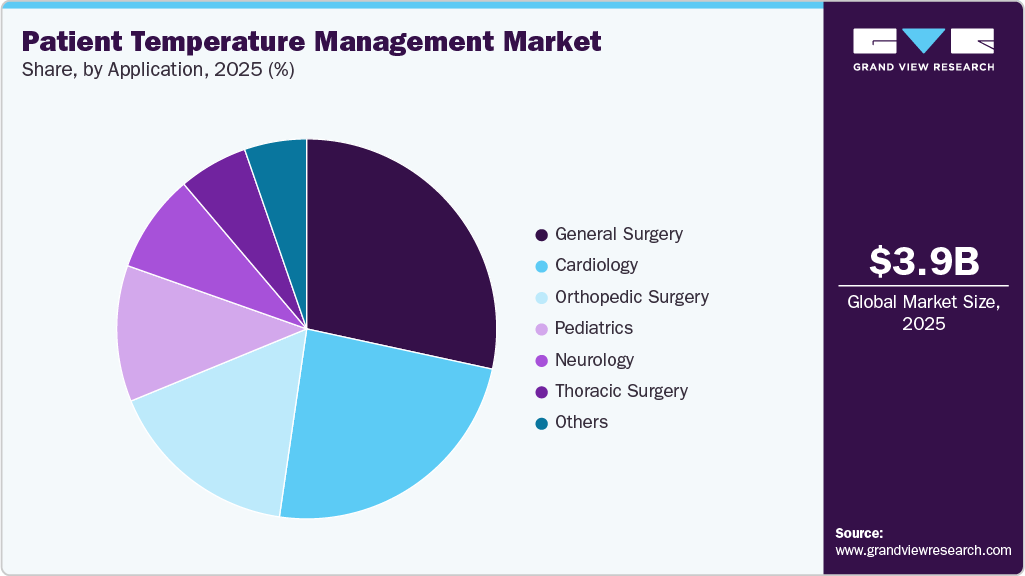

- Based on application, the general surgery segment led the market with the largest revenue share of 28.4% in 2025.

- Based on end use, the operating room segment led the market with the largest revenue share of 20.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.95 Billion

- 2033 Projected Market Size: USD 7.25 Billion

- CAGR (2026-2033): 8.03%

- North America: Largest market in 2025

The demand for warming and cooling devices is significant, as they are essential for maintaining optimal body temperature during surgeries. In addition, increasing incidences of heart attack and stroke are also considered a significant driver impacting the market's growth. For instance, as per an article published by the American College of Cardiology Foundation in August 2022, the incidence of stroke is estimated to grow by 33.8% or 15 million between 2025 - 2060 in the U.S. The industry is growing substantially due to an increase in the number of surgical procedures. This surge can be attributed to advancements in medical technology, a rapidly aging population, an increasing number of hypothermia cases, and a rising prevalence of chronic diseases requiring surgical intervention. For instance, according to the Population Reference Bureau (PRB), in January 2024, Americans aged 65 and above are expected to grow from 58 million in 2022 to 82 million by 2050, marking a 47% increase. In addition, the proportion of this age group (65 and older) in the total population is projected to rise from 17% to 23%.

Technological advancements are also projected to increase the market demand due to the introduction of new temperature management systems, such as surface pads, blankets, and head caps. Moreover, key strategic initiatives such as collaboration and partnership propel market growth. For instance, in April 2023, Augustina Surgical Inc. partnered with Baxter to launch the Baxter Patient Warning system. The growing need for modern temperature management systems has led to the introduction of a wide range of surface warming and cooling systems, accelerating market growth.

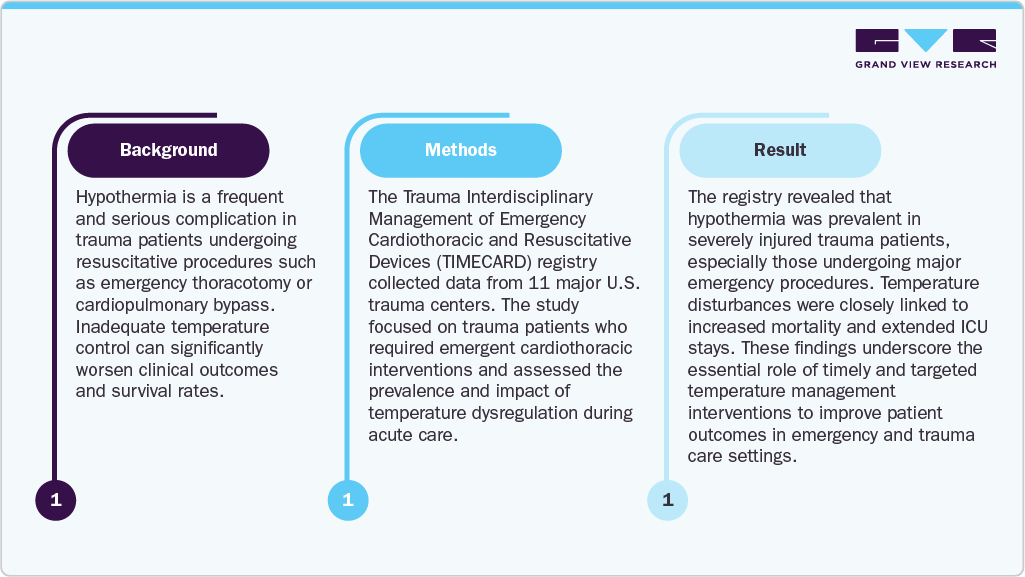

Growth in Emergency and Trauma Care Infrastructure

The rapid expansion of emergency and trauma care infrastructure globally is a significant driver for the patient temperature management market. With increasing investments in trauma centers, emergency departments, and critical care units, the demand for advanced thermal management solutions has surged. These facilities frequently manage patients suffering from severe injuries, cardiac events, sepsis, and shock conditions, where maintaining normothermia is crucial to survival. For example, hypothermia is recognized as a component of the "lethal triad" in trauma, alongside acidosis and coagulopathy, making temperature regulation a vital part of trauma protocols.

The TIMECARD Registry study highlights the critical importance of temperature regulation in trauma environments:

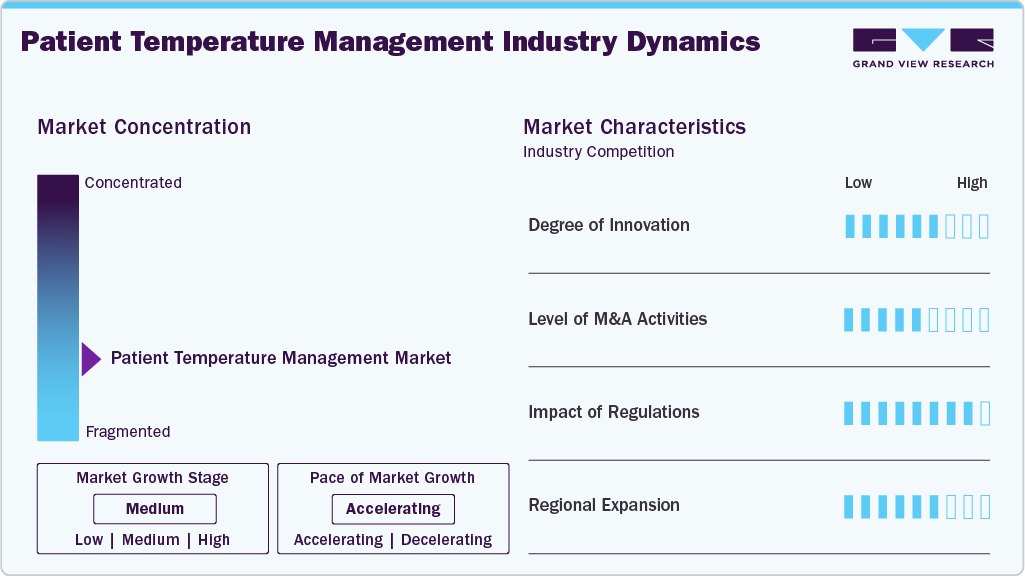

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the patient temperature management market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation in the market is moderate to high, driven by active participation from leading players such as 3M, Gentherm, Stryker, and ICU Medical, Inc. These companies are focusing on developing efficient warming and cooling systems, disposable blankets, and fluid management solutions tailored to diverse clinical settings. For instance, in June 2023, ICU Medical announced the availability of the Level 1H-1200 Fast Flow Fluid Warmer, designed to rapidly and safely warm blood and fluids for patients in critical care settings.

“Our teams have worked very hard to make the Level 1 H-1200 device available globally in countries where market authorization exists. We look forward to serving and supporting current and new customers and their patients.”

- Chad Jansen, ICU Medical Corporate Vice President of Specialty Products.

The level of partnerships and collaboration activities among key players in the market is moderate, as most manufacturers primarily focus on independent product development and regional distribution expansion. Companies tend to operate through localized subsidiaries or distributors rather than forming strategic alliances. While occasional collaborations occur for clinical validation or regulatory approvals, large-scale joint ventures or technology partnerships remain limited across the region.

Regulations shape the market by enforcing strict safety, performance, and compliance standards (FDA 510(k)/PMA, EU MDR, ISO norms), which increase development costs but ensure device reliability and clinical accuracy. They also heighten requirements for risk management, post-market surveillance, and infection-control measures, slowing entry for smaller players while driving established manufacturers to innovate and maintain high-quality, compliant systems.

The level of regional expansion in the market is moderate, supported by rising healthcare investments, hospital infrastructure development, and increasing awareness of perioperative temperature regulation. Global players such as 3M, Gentherm, Stryker, and ICU Medical are expanding their presence through local manufacturing, and distribution networks. For instance, in June 2025, Gentherm expanded its partnership with DUOMED. Through this partnership DUOMED will offer a patient temperature management portfolio in France and Benelux.

Product Insights

Convective warming held the largest revenue share of 25.4% in 2025, driven by its widespread use in perioperative care, critical care units, and recovery rooms for maintaining normothermia. The segment benefits from the high efficiency, ease of use, and continuous innovation in airflow design and temperature control precision by leading players such as 3M, Stryker, and ICU Medical.

Patient cooling systems are expected to show growth during the forecast period. This is due to the rising number of cardiac surgeries and the requirement for low temperatures for eliminating adverse neurologic outcomes and related brain trauma injuries. Patients with traumatic brain injury furthermore require cold temperatures to minimize the risk of adverse neurologic outcomes and enhance survival rate, along with the significant products launched. For instance, in September 2022, Emanuel Cancer Center launched a cooling system, DigniCap, which can be managed through a touch screen display and an attached cooling cap.

End Use Insights

Operating rooms held the largest revenue share in 2025 and are expected to witness the fastest CAGR growth of 9.7% during the forecast period. During different stages of surgery, patients require a specific temperature within the operating room to reduce the surgical complications. For example, patients undergoing cardiac surgeries often require cooling therapies, however, patients who are given anesthesia before surgery need warming therapies. Thus, with the surge in surgeries, the demand for these products is expected to remain high.

Moreover, the neonatal care segment is estimated to offer lucrative opportunities due to the rising number of childbirths and premature deliveries, requiring huge support with temperature management devices in neonatal care. Moreover, there is a risk of hypothermia in premature infants as they are exposed to cold temperatures in neonatal care. Hence, they are kept warm using patient warming systems in neonatal care.

Application Insights

The general surgery segment held the largest market share in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. The patient warning systems factors supporting this growth include the rising number of cardiac and gynecology surgeries. For instance, as per the National Institute of Health’s article, an estimated 2 million open heart surgeries are performed around the world. Temperature management systems are also largely used in pre-, post-, and perioperative surgical procedures. In addition, these devices help address surgical site complications.

The cardiology segment is expected to witness significant growth during the forecast period due to the increasing prevalence of cardiovascular diseases. According to The Heart Foundation, in the U.S., every year, around 805,000 people suffer from heart attacks. Cardiac diseases, such as stroke and heart attack, need cold temperatures to eliminate any risk of traumatic brain injuries, thereby generating high demand for cooling devices in the country.

Regional Insights

North America patient temperature management market dominated the market and accounted for 45.3% share in 2025. This high share is attributable to the rising number of cardiac surgeries and increasing healthcare expenditure in the U.S. The country also has a favorable reimbursement scenario for patients, requiring temperature management devices. Thus, there is a high penetration of patient temperature management products in this region. In addition, the market is significantly driven by an increase in the geriatric population, which is more susceptible to chronic diseases that result in various disorders, such as gastrointestinal disorders, metabolic disorders, and neurological disorders. For instance, according to the U.S. Census Bureau, in 2022, about 17.3% of the population in the U.S. was aged 65 and above.

U.S. Patient Temperature Management Market Trends

The patient temperature management market in the U.S. is expected to grow over the forecast period due to the increasing prevalence of various chronic diseases, including neurological conditions, which is also anticipated to expand the applications of patient temperature management devices during the forecast period. According to The Alzheimer's Association's 2022 Report, about 6.5 million individuals were living with Alzheimer’s disease in the U.S. in 2022.

Europe Patient Temperature Management Market Trends

The patient temperature management market in Europe was identified as a lucrative region. The market remained unaffected by the economic downturn in European countries, mainly due to the presence of sophisticated healthcare infrastructure, high awareness among patients & practitioners, the growing geriatric population, especially in the Western European region, the rising prevalence of preterm births, and the introduction of industry-friendly regulations.

The UK patient temperature management market is expected to grow over the forecast period due to several compelling factors that have fueled the demand for these medical devices across diverse healthcare settings. The UK has a sizable healthcare system, creating a consistent demand for medical products and a receptive attitude toward innovative technologies.

The market in France is expected to grow over the forecast period. Rising orthopedic traumatology procedures in France drive the growth of the market. According to an Elsevier B.V. article published in April 2024, between 2013 and 2021, France recorded a total of 5,216,567 orthopedic traumatology procedures, averaging approximately 579,618 procedures annually. This steady volume of surgeries underscores the significant demand for specialized patient management systems, including temperature management solutions.

Germany patient temperature management market is expected to grow over the forecast period due to the Germany's well-regulated reimbursement scheme plays a crucial role in driving market growth. Approximately 80.0% of the German population is covered by statutory health insurance policies, and the reimbursement system for medical devices is classified into inpatient and outpatient policies.

Asia Pacific Patient Temperature Management Market Trends

The patient temperature management market in Asia Pacific is anticipated to witness significant growth over the forecast period. This growth owes to the presence of high growth opportunities to cater to the unmet needs of the target population in this region. Moreover, a growing number of surgeries, as well as road accidents in India and other Asian countries, are also driving the growth in the market. Japan and China have a large elderly population, which is at a high risk of chronic conditions. Chronic illness is more common in the geriatric population, and it is expected to boost the demand for patient temperature management devices in the Asia Pacific. According to the World Hunger Education Service, around 70% of all malnourished children live in Asia. This represents high growth potential in the market.

Japan patient temperature management market is primarily driven by a growing geriatric population, increasing prevalence of chronic diseases, and the rise in surgeries. Japan has a relatively high healthcare expenditure per capita. For instance, according to the OECD 2023 report, Japan spends USD 5,251 per capita on health. As the government and private sector continue to invest in healthcare infrastructure and technology, advanced medical treatments, including patient temperature management devices, are more accessible.

The patient temperature management market in India is driven by an increasing volume of surgical procedures and the rising prevalence of chronic diseases such as cardiovascular disorders and cancers. For instance, according to the Medijourney article published in March 2024, India witnessed more than 5.6 million orthopedic procedures in 2022, highlighting the country's significant demand for medical interventions. This surge in orthopedic surgeries underscores the growing need for effective patient temperature management during these procedures, as maintaining optimal body temperature is critical for preventing complications such as hypothermia and ensuring better patient outcomes.

Latin America Patient Temperature Management Market Trends

The patient temperature management market in Latin America is growing due to the rising incidence of CVD disorders, increasing cancer incidence, and technological advancements. A study published in the NCBI in August 2022 provided insights into the incidence and mortality rates of CVD across various countries in Latin America. The study revealed variations in the incidence and mortality rates, with countries experiencing different levels of CVD burden. Brazil had the highest incidence of CVD (3.86 per 1,000 person-years), indicating a significant disease prevalence. On the other hand, Argentina had the lowest incidence (3.07 per 1,000 person-years). Regarding mortality rates, Argentina had the highest rate (5.98 per 1,000 person-years).

Middle East & Africa Patient Temperature Management Market Trends

The patient temperature management market in the Middle East and Africa is witnessing steady growth, driven by an increasing prevalence of chronic diseases, surgical procedures, and advancements in healthcare infrastructure. The region’s diverse healthcare needs and rising hospital admissions for critical conditions such as cardiovascular diseases, cancer, and neurological disorders have significantly contributed to the demand for patient temperature management (PTM) devices.

Key Patient Temperature Management Company Insights

Key players operating in the patient temperature management market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Patient Temperature Management Companies:

The following are the leading companies in the patient temperature management market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Stryker Corporation

- Medtronic

- Zoll Medical Corporation (Acquired by ASAHI KASEI)

- BD

- Atom Medical Corp

- Terumo Corporation

- GE Healthcare

- Nihon Kohden Corporation

- Care Essentials (Cocoon)

- ICU Medical, Inc.

- Gentherm/Gentherm Incorporated

Recent Developments

-

In July 2025, Medline launched a new ComfortTemp Patient Warming System, a 510(k)-cleared, Class-II warming solution featuring disposable blankets and gowns. It uses a lock-in hose mechanism and rotating elbow connector for a secure, flexible setup, aiming to maintain core body temperature peri-operatively and reduce risks of hypothermia and related complications.

“We designed the ComfortTemp system to address specific challenges our customers were experiencing with patient warming systems,” Perioperative departments and surgery centers looking for advanced technology that improves this important facet of the surgical process will find ComfortTemp easy to use and a great way to enhance the surgery experience for both patients and clinical team members.”

- Charlie Ling, Medline product manager for the operating room division.

-

In June 2025, 3T Medical Systems, Inc. acquired the Altrix Precision Temperature Management System from Stryker. This acquisition helped 3T to expand its portfolio and global healthcare reach.

“The acquisition of AltrixTM will support 3T Medical’s mission to provide efficient, cost-effective, and unique recovery solutions to hospitals and patients globally. It’s critical that healthcare organizations deliver simple, safe and efficient care, and we expect this transaction will continue in enabling 3T Medical to deliver a high-quality, high-performing temperature management solution, assisting clinicians and hospitals achieve our shared mission.”

- 3T Medical’s Chief Executive Officer, Dr. Jack J. Kelley.

-

In September 2024, BD completed the acquisition of the Critical Care business from Edwards Lifesciences, expanding its capabilities in advanced monitoring technologies used in intensive care settings.

“The health care industry is being redefined by AI, robotics, and autonomous solutions, and our team continues to accelerate the application of these new technologies to improve the quality and cost of patient care around the world.”

- Tom Polen, chairman, chief executive officer and president of BD.

-

In August 2024, ZOLL acquired the ventilator business of Vyaire Medical, aiming to expand its portfolio in acute critical care and respiratory support technologies.

Patient Temperature Management Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.22 billion

Revenue forecast in 2033

USD 7.25 billion

Growth rate

CAGR of 8.03% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

3M Company; Stryker Corporation; Medtronic; Zoll Medical Corporation (Acquired by ASAHI KASEI); BD; Atom Medical Corp; Terumo Corporation; GE Healthcare; Nihon Kohden Corporation; Care Essentials (Cocoon); ICU Medical, Inc.; Gentherm/Gentherm Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Patient Temperature Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global patient temperature management market report on the basis of product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Convective Warming

-

Temperature Monitoring

-

Blood/Fluid Warming

-

Conductive Warming

-

Passive Warming (Blankets)

-

Patient Cooling

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Cardiology

-

Pediatrics

-

Neurology

-

Orthopaedic Surgery

-

Thoracic Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Operating rooms

-

Neonatal Care

-

ICUs

-

Emergency room

-

Preoperative Care Units

-

Postoperative Care Units

-

Acute Care

-

Burn Centres

-

Cath Labs

-

Neurological Care Units

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global patient temperature management market size was estimated at USD 3.95 billion in 2025 and is expected to reach USD 4.22 billion in 2025.

b. The global patient temperature management market is expected to grow at a compound annual growth rate of 8.03% from 2026 to 2033 to reach USD 7.25 billion by 2033.

b. North America dominated the patient temperature management market with a share of 45.3% in 2025. This is attributable to the rising number of cardiac surgeries, favorable reimbursement scenarios, and increasing healthcare expenditure in the U.S.

b. Some key players operating in the patient temperature management market include Stryker Corporation; Medtronic; ZOLL Medical Corporation; BD.; Cincinnati Sub-Zero Products, Llc/Gentherm; 3M Company; TSC Life; ICU Medical; Atom Medical Corporation; BrainCool AB.

b. Key factors that are driving the patient temperature management market growth include an increasing number of surgical procedures, a rise in the number of road accidents & other trauma, presence of extreme environmental conditions in remote places.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.