- Home

- »

- Next Generation Technologies

- »

-

Payday Loans Market Size, Growth & Trends Report, 2030GVR Report cover

![Payday Loans Market Size, Share & Trends Report]()

Payday Loans Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Storefront Payday, Online Payday), By Marital Status (Married, Single), By Customer Age, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-990-5

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Payday Loans Market Summary

The global payday loans market size was estimated at USD 4.8 billion in 2021 and is projected to reach USD 6.8 billion by 2030, growing at a CAGR of 3.8% from 2022 to 2030. Factors such as rising awareness about payday loans among the younger generation are driving the growth of the market.

Key Market Trends & Insights

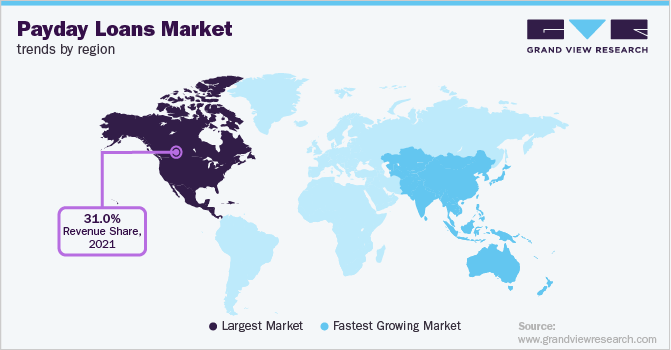

- North America dominated the global data center generator market with the largest revenue share of 31.0% in 2021.

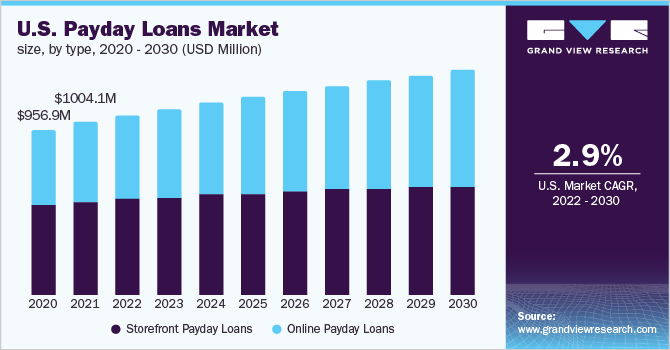

- By type, the storefront payday loans segment led the market, holding the largest revenue share of 53.7% in 2021.

- By marital status, the single segment is projected to expand at the fastest CAGR of 4.0% from 2022 to 2030.

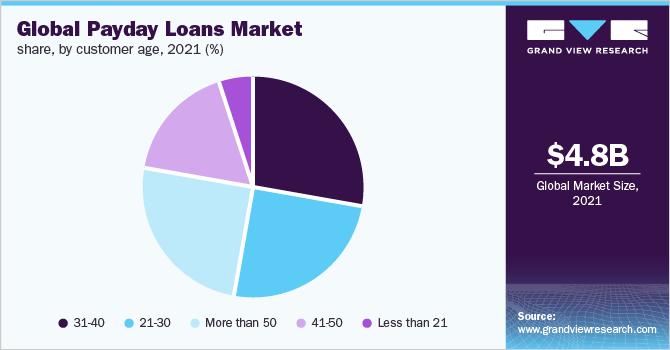

- By customer age, the 31-40 segment led the market, holding the largest revenue share in 2021.

Market Size & Forecast

- 2021 Market Size: USD 4.8 Billion

- 2030 Projected Market Size: USD 6.8 Billion

- CAGR (2022-2030): 3.8%

- North America: Largest market in 2021

Additionally, the increasing adoption of advanced technologies among payday lenders is boosting the growth of the market. The COVID-19 pandemic had a negative impact on the market. In 2020, many people lost their jobs as the world economy slowed down. The general requirement for the market is having a stable source of income, and the borrowers need to provide proof of income to the payday lenders while applying for the loan. Hence, many people became ineligible to apply for a payday loan.

Moreover, people became cautious about spending money owing to uncertain economic conditions. Numerous governments across several regions extended financial aid during COVID-19, reducing demand for payday loans. For instance, in March 2020, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was introduced by the U.S. government to provide unemployment insurance for COVID-19 impacted workers.

A payday loan is an unsecured personal loan provided by payday lenders for the short term. The loan amount is less compared to secured personal loans. The loan is characterized by the high-interest rates, which makes it risky for the borrowers. Payday lenders provide loans both online and in-store modes. Online loan application is experiencing growth owing to rapid digitization across the Banking, Financial Services, and Insurance (BFSI) sector.

The payday loans market is extremely regulated, owing to high-interest rates. This is further restraining the payday loans industry as borrowers are likely to avoid it owing to the high risk involved. According to the U.S.-based In Charge Debt Solutions, a financial services company offering credit counseling, the average Annual Percentage Rate (APR) in the U.S. is 391.0% and is likely to be more than 600.0%. Hence, the industry is getting increasingly regulated to protect borrowers from predatory lending. In September 2019, California, U.S. senate passed a consumer protection law to limit the interest rates charged by payday lenders.

Developing countries are likely to offer significant growth opportunities for the market. There are many payday lenders in developing countries, such as South Africa-based mi payday loans & Boodle (Pty) Ltd. and India-based Rupee lend. Moreover, these countries have a huge population, and there is a large share of the population entering the working age. Hence, the market is likely to grow in these countries.

Type Insights

Based on type the market is segmented into storefront payday loans and online payday loans. The storefront payday loans segment held the maximum revenue share in 2021 with a share of 53.7% and is expected to register a CAGR of 1.6% during the forecast period. The growth of the segment can be attributed to the presence of numerous payday lending stores. Moreover, a payday loan is likely to get approval in lesser time when a borrower visits in-store compared to an online payday loan application.

Furthermore, the online payday loans segment is projected to grow at the highest CAGR of 4.2 % during the forecast period. The segment growth can be attributed to the convenience of the online loan application and seamless digital experience for payday loan borrowers. Moreover, the borrowers get to choose from multiple payday loan options online.

Marital Status Insights

Based on marital status, the market is segmented into married and single. The single segment accounted for the largest revenue share of 63.7%in 2021 and is expected to develop by the highest CAGR of 4.0% during the forecast period. The growth of this segment can be attributed to a single source of income for singles compared to the married segment, which is likely to have more than one source of income if both members are working.

The median age at first marriage is also rising. For instance, according to the U.S. Census Bureau, the median age at first marriage in the U.S. was around 28 years in 2010 and has risen to over 30 years in 2021. Moreover, single, separated, or divorced parents are likely to manage the expenses of their children by themselves. The married segment held a revenue share of 36.3%in 2021 and is expected to develop by a CAGR of 3.5% during the forecast period.

Customer Age Insights

Based on customer age, the market is segmented into less than 21, 21-30, 31-40, 41-50, and more than 50. The 31-40 segments accounted for the largest revenue of USD 1,356.3 million in 2021 and are expected to expand at a CAGR of 3.9% during the forecast period. The market growth in this segment is attributed to a greater number of financial commitments handled by the customers in this age group.

The 21-30 segments are likely to develop by a CAGR of 4.8%, the highest for the segment during the forecast period. Increasing awareness among the younger generation and financial commitments such as repaying student loans are the factors likely to contribute to the expansion of the segment. Moreover, a rising number of people entering the working age group are likely to drive the segment growth.

Regional Insights

North America dominated the global market with a share of 31.0% in 2021 and is anticipated to expand at a CAGR of more than 3.3% during the forecast period. Factors such as the presence of numerous direct payday lenders and advanced technological infrastructure are the factors driving the market growth within the region. According to The Washington State Department of Financial Institutions’ 2020 payday lending report, there were 62 payday lending locations in Washington, the U.S. in 2020.

Asia-Pacific is expected to expand at the highest CAGR of 5.0% during the forecast period. The market growth across the region can be attributed to the growing presence of payday lenders and improving technological infrastructure in the region. Moreover, the large population and young demographics are the factors likely to drive market growth in the region.

Key Companies & Market Share Insights

The competitive landscape of the market is fragmented in nature, with numerous local and global payday lenders. The key participants are adopting advanced technologies to offer better solutions to their customers. Moreover, market players are using technologies such as analytics, Artificial Intelligence (AI), and Machine Learning (ML) to reduce compliance costs and survive in a highly competitive market.

In April 2021, GAIN Credit announced the establishment of Synapi, a SaaS (Software as a Service) business that provides companies with the technology and insights for extending credit to their clients. The client businesses will include merchants offering finance for their clients and lenders that want to efficiently serve their customers while maintaining regulatory compliance. Some of the prominent players in the global payday loans Market include:

-

Title Max

-

Cash Money

-

Check City Online

-

Mr. Lender

-

Fast Loan UK

-

Speedy Cash

-

GAIN Credit

-

Cash float

-

Credit star Group

-

Mr. Payday

Payday Loans Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 5061.3 million

Revenue forecast in 2030

USD 6.8 billion

Growth rate

CAGR of 3.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, marital status, customer age, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Australia; Brazil; Mexico; Chile; Argentina; UAE; Saudi Arabia and South Africa

Key companies profiled

Title Max; Cash Money; Check City Online; Mr. Lender; Fast Loan UK; Speedy Cash; GAIN Credit; Cash float; Credit star Group; Mr. Payday

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Payday Loans Market Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global payday loans Market report based on, type, marital status, customer age, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Storefront Payday Loans

-

Online Payday Loans

-

-

Marital Status Outlook (Revenue, USD Million, 2017 - 2030)

-

Married

-

Single

-

-

Customer Age Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 21

-

21-30

-

31-40

-

41-50

-

More than 50

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global payday loans market size was estimated at USD 4.8 billion in 2021 and is expected to reach USD 5061.3 million in 2022.

b. The global payday loans market is expected to grow at a compound annual growth rate of 3.8% from 2022 to 2030 to reach USD 6.8 billion by 2030.

b. North America dominated the payday loans market with a share of 31.0% in 2021. This is attributable to the presence of numerous payday lenders in the region.

b. Some key players operating in the payday loans market include TitleMax, Cash Money, Check City Online, Mr Lender, Fast Loan UK, Speedy Cash, GAIN Credit, Cashfloat, Creditstar Group, and Mr. Payday.

b. Key factors driving the market growth include the growing awareness of payday loans among the youth and the increasing adoption of technologies by payday lenders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.