- Home

- »

- Next Generation Technologies

- »

-

Payment Processing Solutions Market Size Report, 2030GVR Report cover

![Payment Processing Solutions Market Size, Share & Trends Report]()

Payment Processing Solutions Market Size, Share & Trends Analysis Report By Payment Method (Credit Card, Debit Card, E-wallet), By End-use (Hospitality, Retail), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-240-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

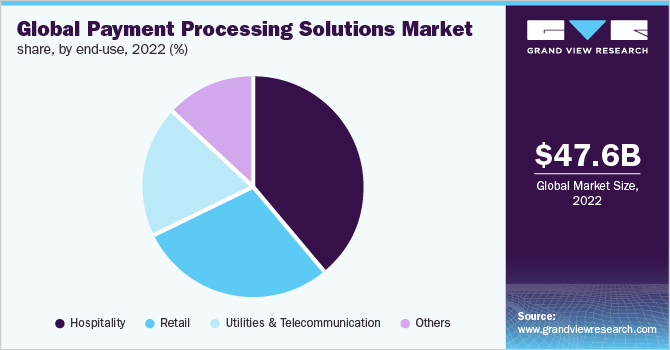

The global payment processing solutions market size was valued at USD 47.61 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.5% from 2023 to 2030. The growth can be attributed to the increasing penetration of the internet coupled with smartphones across the globe. For instance, according to the Digital 2022 October Global Statshot Report by DataReportal, over 63% of the world’s population has used the internet at some point in time. Thus, such easy access to the internet has led to the rise in the adoption of digital payment processing resulting in the growth of the payment processing solutions industry.

Several factors, including technological advancements, evolving customer expectations, and robust infrastructure have the potential to fuel market growth. In addition, the increasing technological advancements in APIs have enabled businesses to adapt to payment needs through a single API integration, thereby rising the demand for payment processing solutions across the globe.

Furthermore, the introduction of Near-field Communication (NFC) and QR code payment technology for contactless payments also have boosted the adoption of e-wallets worldwide. The increasing adoption of debit and credit cards for processing online and in-store payments is further anticipated to fuel the market’s growth over the forecast period.

The benefits offered by payment processing solutions include payment processing through multiple payment methods, allowing merchants to minimize the total cost for payment operation, and offering a seamless customer experience. With such benefits, the demand for payment processing solutions is expected to witness growth. Furthermore, the rising online shopping trends across the globe are also anticipated to fuel the market’s growth. The smartphone-based e-wallet applications offer customers alternative billing options to process faster and more secure payments, thereby further driving growth.

The increasing investments by venture capital firms across have offered new growth opportunities to the market. For instance, in March 2021, Stripe Inc., a digital payment company, announced that it raised USD 600 million through a series H funding round. The primary investors who led the round, include Allianz X, Baillie Gifford, Axa, and Fidelity Management & Research Company, among others. The company utilized funds for expanding its operation across Europe and Dublin headquarters.

While the payment processing solution market is projected to grow over the forecast period, some of the factors such as cyber-attacks and unawareness about digital payments are expected to restrain the growth of the market. The seamless integration between the software or existing operations and the payment processing solution is much needed to introduce operational business efficiency.

Furthermore, the security risks and increasing payment frauds are also resulting in restraining the growth of the market. In addition, for some of the companies, it’s not feasible to offer 24/7 support to its customer which might create delays in payments and generate friction for customers.

COVID-19 Impact Analysis

The COVID-19 pandemic positively impacted the payment processing solutions market. Social distancing during the pandemic resulted in a rise in digital and contactless payments to avoid physical contact and lower chances of getting infected. Furthermore, the rising digitalization and home delivery model in the pandemic resulted in a rise in demand for online payment processing solutions worldwide.

Additionally, the prominent market players were involved in launching new payment processing solutions to increase its adoption globally. For instance, in June 2021, GoDaddy, a web hosting company, introduced a payments processing solution for Medium-Sized Businesses (SMBs). The newly launched solution called GoDaddy Payments enabled its e-commerce customers to manage transactions and orders over its business platform with ease.

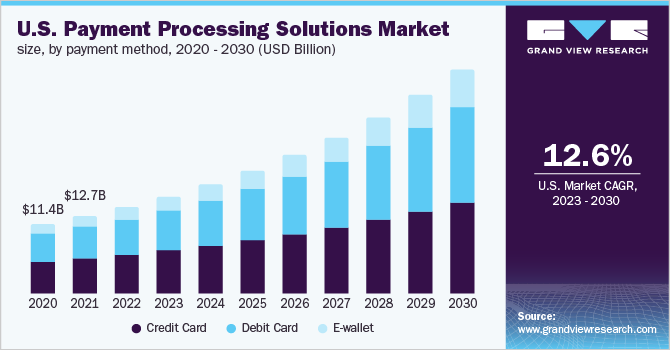

Payment Method Insights

The credit card segment dominated the market in 2022 and accounted for more than 44.0% share of the global revenue. Credit card processing tools are widely used by businesses, as these tools allow businesses to align the essential data of their businesses, i.e., business orders, shipping & invoicing, and inventory level within the business ERP system so that the businesses would function efficiently. Manually entering data at the time of the payment process is time-consuming and prone to human error. With an integrated credit card payment processing solution, there’s a continuous flow of data to ERP systems that eliminates entry errors and avoids data redundancy.

The e-wallet segment is anticipated to witness the fastest growth over the forecast period. The increasing penetration of smartphones and laptops across the globe are functional in fueling the adoption of e-wallets. The high payment process speed and convenience of these e-wallets are expected to create growth opportunities for the segment growth over the forecast period. The rise of numerous e-commerce platforms across the globe is also propelling the e-wallet segment growth.

End-use Insights

The hospitality segment dominated the market in 2022 and accounted for more than 39.0% share of the global revenue. The hospitality industry is a wide category of fields within the service industry, which includes food & beverages, event planning, transportation, lodging, and traveling, among others. A hospitality unit, such as a hotel, or restaurant, consists of multiple groups, including direct operations and facility maintenance that are focusing on adopting payment processing solutions. Also, travelers across the globe are becoming increasingly reliant on their smartphones and preferring to pay for their goods and services online.

The retail end-use segment is anticipated to witness the fastest growth over the forecast period. Vendors are focusing on providing customized retail payment processing solutions that allow merchants to provide flexible payment methods at the point of sale. This helps retailers to enhance customer service with safe, quick, and efficient checkouts. Furthermore, retailers are widely adopting these solutions to gain complete visibility in payment transactions.

Regional Insights

North America dominated the payment processing solutions market in 2022 and accounted for over 34.0% share of the global revenue. The high adoption of digital payment solutions across North American countries is expected to contribute to the growth. Moreover, the growing adoption of mobile wallets in the region is also expected to fuel the growth. Furthermore, in North American countries, a credit card is the most preferred mode of payment by customers in both point-of-sale (POS) and online methods.

The Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The growing adoption of smartphones, coupled with internet services, is expected to accelerate the growth. Over the past few years, the region is witnessing an increased adoption of alternative payment methods, such as bank transfers and e-wallets. Moreover, the rising retail market in the region is further expected to create growth opportunities for the regional industry.

Key Companies & Market Share Insights

Key vendors in the market include Adyen N.V.; Amazon Payments Inc.; Authorize.Net; PayPal Holdings Inc.; and Global Payments, Inc. The market is highly consolidated by players, such as Amazon Payments Inc.; PayPal Holdings, Inc.; and Authorize.Net. The vendors are leveraging the partnership activities to expand their product portfolio and gain a competitive edge over other vendors.

For instance, in August 2022, Agoda partnered with Alipay+ to leverage Alipay+ solutions on the Agoda platform for bettering customer benefits and rewards. With this partnership, Agoda enhanced its transaction conversion rate by offering travelers rewards using Alipay+ rewards and in-cashier marketing services to distribute rewards and redemption on Agoda. Vendors are focusing on innovations to differentiate and personalize their solution offerings for potential customers. Also, vendors are largely investing in R&D activities for innovating and updating their products and solutions.

Mergers & acquisitions and new product launches are some of the key strategies adopted by these vendors to strengthen their foothold in the market. For instance, in September 2018, Global Payments Inc. partnered with Ingenico Group to offer advanced payment terminal services to enhance the consumer payment experience. This partnership aimed at increasing its small & medium enterprises’ customer base. Some prominent players in the global payment processing solutions market include:

-

Adyen

-

Alipay

-

Amazon Payments, Inc.

-

Authorize.Net

-

PayPal Holdings Inc.

-

PayU

-

SecurePay

-

Stripe, Inc.

-

Apple Inc. (Apple Pay)

-

Alphabet (Google Pay)

Recent Developments

-

In June 2023, Adyen announced the launch of Payout services to enable faster processing of payments. The service enables customers to payout acquired funds faster and as per their preferred method.

-

In June 2023, Amazon Web Services announced a new service, AWS Payment Cryptography, to help simplify the implementation of cryptography operations to secure data in payment processing applications. It also streamlines payment key management by generating keys and automating key management.

-

In June 2023, Stripe announced a partnership with Google Workspace to help businesses make paid appointment bookings with Google Calendar. The new feature allows customers to pay directly while making a booking on a Google Calendar booking page.

-

In April 2023, PayPal Holdings, Inc. announced the addition of new features to its complete payments solution for small businesses. The solution will allow customers a variety of choices for payment, including PayPal, PayPal Pay Later, and Venmo.

-

In October 2022, Adyen launched its next-generation open banking solution in partnership with Tink. The technology will enable users to pay directly from their preferred banking environment.

-

In February 2022, Apple announced its plan to introduce Tap to Pay on iPhone to empower merchants and retailers to seamlessly and securely accept Apple Pay. Tap to Pay on iPhone will provide businesses to accept contactless payments using the convenience and security of the iPhone.

Payment Processing Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 54.23 billion

Revenue forecast in 2030

USD 139.90 billion

Growth rate

CAGR of 14.5% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Payment method, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Adyen; Alipay; Amazon Payments, Inc.; Authorize.Net; PayPal Holdings Inc.; PayU; SecurePay; Stripe, Inc.; Apple Inc. (Apple Pay); Alphabet (Google Pay)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Payment Processing Solutions Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global payment processing solutions market report based on payment method, end-use, and region:

-

Payment Method Outlook (Revenue, USD Billion, 2017 - 2030)

-

Credit Card

-

Debit Card

-

E-wallet

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hospitality

-

Retail

-

Utilities & Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global payment processing solutions market size was estimated at USD 47.61 billion in 2022 and is expected to reach USD 54.23 billion in 2023.

b. The global payment processing solutions market is expected to grow at a compound annual growth rate of 14.5% from 2023 to 2030 to reach USD 139.90 billion by 2030.

b. North America dominated the payment processing solutions market with a share of 34.75% in 2022. This is attributable to the high adoption of digital payment solutions across the North American countries.

b. Some key players operating in the payment processing solutions market include Adyen N.V., Amazon Payments Inc., Authorize.Net, and PayPal Holdings Inc.

b. Key factors that are driving the market growth include the high proliferation of smartphones and worldwide initiatives for the promotion of online and digital payments.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."