- Home

- »

- Pharmaceuticals

- »

-

Peanut Allergy Treatment Market Size & Share Report, 2023GVR Report cover

![Peanut Allergy Treatment Market Size, Share & Trends Report]()

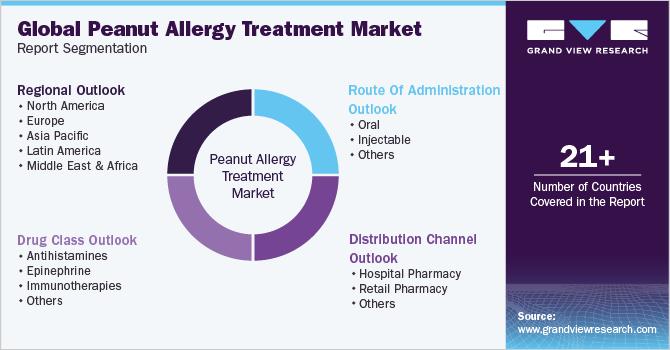

Peanut Allergy Treatment Market Size, Share & Trends Analysis Report By Drug Class (Antihistamines, Epinephrine), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-097-6

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Peanut Allergy Treatment Market Trends

The global peanut allergy treatment market size was estimated at USD 477.96 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.82% from 2024 to 2030. Key factors propelling market include, rising prevalence of peanut allergies worldwide and increasing R&D activities for novel drugs. Moreover, growing adoption of new biological agents to treat allergies and an increase in clinic visits by patients seeking therapy for this allergy are likely to drive market over forecast period.

Growing prevalence of allergies is driving development of innovative treatments that enhance management and potentially reduce severity of allergic reactions. With peanut allergy affecting about 1% to 2% of the U.S. population, need for effective treatments is more crucial than ever. Over past 10 years, incidence has gradually increased. For instance, according to the Food Allergy Research & Education in 2022, around 32 million individuals in America have an illness, and 6.1 million of those have a peanut allergy. In addition, it ranks among most prevalent food allergies, impacting a staggering 17 million individuals across Europe.

Increasing funding for peanut allergy treatment market is driving advancements in research, development, and accessibility of innovative therapies, addressing growing demand for more effective treatments & management strategies. Moreover, in September 2022, COUR Pharmaceuticals, a clinical-stage biotechnology company, successfully completed a USD 30 million financing round, with Alpha Wave Ventures as lead investor. This funding will support expansion of COUR's innovative immune-modifying nanoparticles (COUR NanoParticles or CNPs) technology platform. This heightened financial support is propelling growth of allergy treatment market, fostering development of safer and more accessible solutions for those affected by this condition.

Furthermore, peanut allergy treatment market is experiencing a positive impact owing to increasing approvals of products for treatment. For instance, in January 2020, the U.S. FDA granted authorization for PALFORZIA as reported by Aimmune Therapeutics, Inc. PALFORZIA represents first immunotherapy medication approved for individuals with a peanut allergy. It is an oral immune therapy designed to reduce allergic responses, including anaphylaxis resulting from unintended ingestion. PALFORZIA is intended for use by individuals with a confirmed indication, and initial dose escalation is suitable for children aged four to 17.

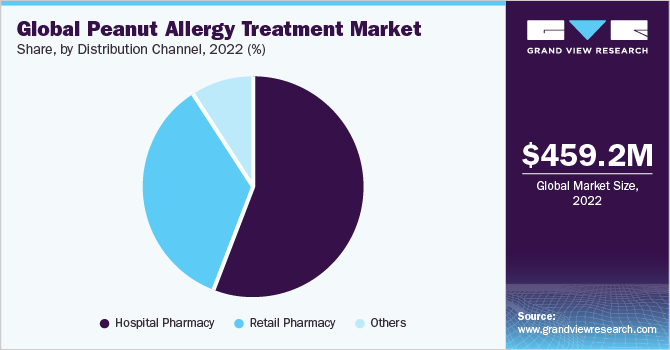

Distribution Channel Insights

Hospital pharmacy segment dominated peanut allergy treatment market in 2023 with a share of 54.85%. Hospital pharmacies serve as a critical distribution channel in market, facilitating availability and efficient dispensation of medications and treatments essential for managing allergies within a hospital environment. Several prominent market drivers deeply influence this role. Increasing prevalence of peanut allergies has led to a growing demand for treatments, making it crucial for hospital pharmacies to meet this demand effectively. Additionally, stringent allergen labeling regulations have underscored need for prompt access to peanut allergy treatments in hospital settings.

The retail pharmacy segment is estimated to witness fastest CAGR over forecast years. The significance of retail pharmacies lies in their accessibility, as they are often conveniently located for patients, allowing them to promptly obtain prescription medications and over-the-counter products, thereby enhancing the overall quality of care and improving the well-being of those dealing with peanut allergies. Retail pharmacies are crucial in making these essential treatments widely available to those in need.

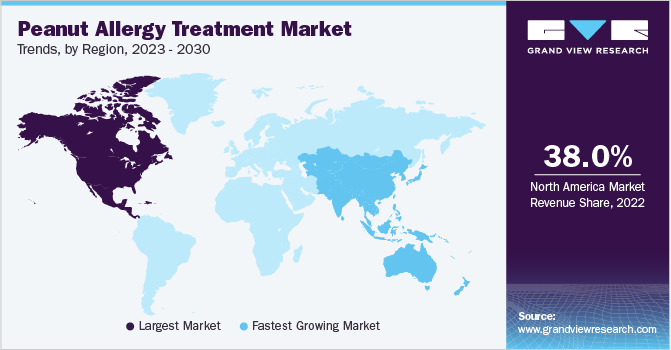

Regional Insights

North America accounted largest share of 39.52% of peanut allergy treatment market in 2023. In the U.S., a significant number of adults and children struggle with peanut allergy, with adults developing allergies in adulthood facing lower diagnosis rates. Moreover, in Canada, a notable number of children contend with peanut allergy, emphasizing importance of understanding and managing these allergies. As a significant development in the market, Nestlé divested its Palforzia business in September 2023 to Stallergenes Greer. Stallergenes Greer is a biopharmaceutical company focusing on allergy diagnosis and treatment. This strategic move followed Nestlé's earlier announcement of a review of Palforzia, with Nestlé set to receive milestone payments and ongoing royalties as part of the agreement.

Asia Pacific is estimated to grow at fastest CAGR during forecast period. In recent years, peanut allergy treatment market in this region has experienced significant growth. Peanut allergy, a prevalent food allergy, has been on rise globally, particularly in Asia Pacific region. This has led to an escalating demand for effective therapies and treatments to manage and treat these allergies. Additionally, adoption of Oral Immunotherapy (OIT) and other related therapies has increased in Asia Pacific region, with countries such as Australia, South Korea, and Japan taking lead in development and application of these treatments. Asia Pacific’s substantial population, particularly in countries like China and India, presents a considerable market opportunity for peanut allergy therapies.

Market Dynamics

The development of non-injectable treatments for type I allergic reactions, including anaphylaxis, is a significant advancement in the peanut allergy treatment market. This aligns with the technology trend of creating innovative oral formulations and noninvasive solutions to manage severe allergic reactions. If approved, Neffy by ARS Pharmaceuticals, Inc. will mark a milestone in providing a safer and more accessible emergency treatment option, demonstrating how technology is enhancing patient care and making life-saving interventions more widely available for individuals with allergies.

Peanut allergy, a prevalent and challenging childhood condition, often persists into adulthood without available treatments. Peanut Oral Immunotherapy (POIT) is gaining traction, using FDA-approved PTAH (formerly AR101; Palforzia) and store-bought peanut products. POIT in preschoolers is increasingly accepted as a safe and advantageous approach. Numerous innovative therapeutic interventions are under study with diverse methods and mechanisms. Although other immunotherapies are not yet approved, the epicutaneous method is well-researched, and sublingual, subcutaneous, and intralymphatic approaches are actively explored. Biologics, particularly Omalizumab, show promise as adjunctive or standalone treatments. Future allergists must evaluate patient goals and weigh risks, benefits, and alternatives when considering these evolving therapies. In addition, epicutaneous immunotherapy, the peanut patch, has recently shown promising results.

Moreover, there are various awareness programs and initiatives aimed at educating public and supporting individuals and families dealing with peanut allergies. For instance, Food Allergy Research & Education (FARE) is a leading advocacy and education organization dedicated to raising awareness and funding research on all types of food allergies. They organize events and campaigns throughout the year. These programs and organizations contribute to ongoing efforts to raise awareness, educate public, and support individuals with peanut allergies in the U.S. They often collaborate, share resources, and work toward common goals of improving safety and quality of life for those affected by allergies. Such initiatives are driving market growth.

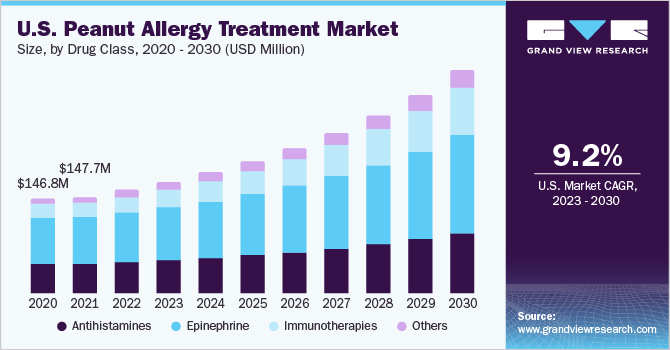

Drug Class Insights

Epinephrine segment held major share of peanut allergy treatment market in 2023 with 47.15% in terms of global revenue. Growth is attributed to increased demand for peanut allergy treatment due to rising prevalence of allergy, stricter allergen labeling laws, and greater awareness of anaphylaxis risks. This has led to innovations in auto-injector design and increased accessibility to epinephrine, ensuring timely and effective treatment for individuals with peanut allergies. In addition, in October 2022, The U.S. FDA accepted ARS Pharmaceuticals, Inc.'s New Drug Application (NDA) for neffy. Neffy is intended for emergency treatment of type I allergic reactions, including anaphylaxis, in adults and children weighing at least 30 kg (66 lbs.). The FDA had previously set a target action date for the Prescription Drug User Fee Act (PDUFA) review, which was expected by mid-2023.

Immunotherapies segment is expected to grow at fastest CAGR over forecast period. Oral Immunotherapy (OIT) and Sublingual Immunotherapy (SLIT) are two notable approaches. OIT involves gradual exposure to small, controlled amounts of peanut protein, increasing tolerance over time. SLIT employs a similar principle but administers treatment under the tongue. In March 2023, SLIT, as demonstrated in a study published in The Journal of Allergy and Clinical Immunology, has been shown to induce clinically significant desensitization in children with peanut allergies, offering a favorable safety profile. Nearly 70% of participants achieved clinically significant desensitization, and 36% achieved full desensitization.

Route of Administration Insights

Injectable segment held largest share of 55.49% in peanut allergy treatment market in 2023 and is estimated to be the fastest growing segment over the forecast period. Epinephrine stands as primary medication for treating anaphylaxis, with preferred route being Intramuscular (IM) injection into lateral thigh. While Intravenous (IV) administration is a viable choice, it is mainly confined to inpatient settings due to need for careful monitoring. Supportive therapies such as and bronchodilators, corticosteroids, and antihistamines, can be employed, but they do not directly address underlying condition. Administration of IV fluids is essential for preventing and managing tissue hypoperfusion.

Oral route of administration is expected to witness significant growth over forecast period. Oral Immunotherapy (OIT), involving gradual consumption of controlled amounts of peanut protein. OIT offers several distinct advantages for individuals with peanut allergies. OIT also serves as a safety net, mitigating risks associated with unintended contact which can be especially vital in emergencies. Furthermore, successful OIT can improve overall quality of life, allowing individuals to dine with less anxiety and potentially reintroduce peanuts into their diet, broadening their food choices. The aforementioned capabilities of oral route of administration are projected to fuel market during review period.

Key Companies & Market Share Insights

Companies engage in strategic initiatives such as collaborations, acquisitions, mergers, clinical studies, and strategic agreements for product portfolio expansion to maximize their market share. To sustain their presence in market, industry players are also concentrating on geographic expansion and product launches.

-

In June 2023, Alladapt Immunotherapeutics, Inc. has unveiled topline results of Phase 1/2 Harmony study assessing effectiveness & safety of ADP101 for treating food allergies. Outcomes indicate dose-dependent, clinically significant responses, and a favorable safety profile in pediatric patients with single or multiple food allergies. These promising findings suggest ADP101's potential as a safe and effective treatment for children with common food allergies.

-

In May 2023, DBV Technologies has made an announcement that the results of its Phase 3 EPITOPE trial involving EPIT using Viaskin Peanut in children aged 1 to 3 years have been published in the New England Journal of Medicine. This publication underscores the potential of a new food allergy treatment option for this specific age group, offering hope for the management of food allergies in young children.

Key Peanut Allergy Treatment Companies:

- Aimmune Therapeutics Inc.

- Aravax Pty Ltd

- Sanofi

- DBV Technologies

- Alladapt Immunotherapeutics, Inc.

- Vedanta Biosciences, Inc.

- Regeneron Pharmaceuticals Inc.

- Teva Pharmaceuticals Industries Ltd.

- Prota Therapeutics

Peanut Allergy Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 515.43 million

Revenue forecast in 2030

USD 1.01 billion

Growth rate

CAGR of 11.82% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Sanofi; Aimmune Therapeutics Inc.; DBV Technologies; Vedanta Biosciences, Inc.; Alladapt Immunotherapeutics, Inc.; Regeneron Pharmaceuticals Inc.; Aravax Pty Ltd.; Prota Therapeutics; Teva Pharmaceuticals Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peanut Allergy Treatment Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the peanut allergy treatment market report based on route of administration, drug class, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Antihistamines

-

Epinephrine

-

Immunotherapies

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global peanut allergy treatment market size was estimated at USD 477.96 million in 2023 and is expected to reach USD 515.43 million in 2024.

b. The global peanut allergy treatment market is expected to grow at a compound annual growth rate of 11.82% from 2024 to 2030 to reach USD 1.01 billion by 2030.

b. North America dominated the market for peanut allergy treatment and accounted for the largest revenue share of 39.52% in 2023, attributable to increasing cases of peanut allergy, high demand for effective therapies, and presence of key players focusing on initiatives expected to gain market share.

b. Some of the key market players include Sanofi, Aimmune Therapeutics Inc., DBV Technologies, Vedanta Biosciences, Inc., Alladapt Immunotherapeutics, Inc., Regeneron Pharmaceuticals Inc., Aravax Pty Ltd, Prota Therapeutics, Teva Pharmaceuticals Industries Ltd.

b. Key factors driving the peanut allergy treatment market growth include high disease prevalence, robust product pipeline, advancement in drug delivery system, and strategic initiatives by key market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."