- Home

- »

- Consumer F&B

- »

-

Peanut Butter Market Size & Share Report, 2022 - 2028GVR Report cover

![Peanut Butter Market Size, Share & Trends Report]()

Peanut Butter Market (2022 - 2028) Size, Share & Trends Analysis Report By Type (Crunchy, Creamy), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-931-5

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Peanut Butter Market Summary

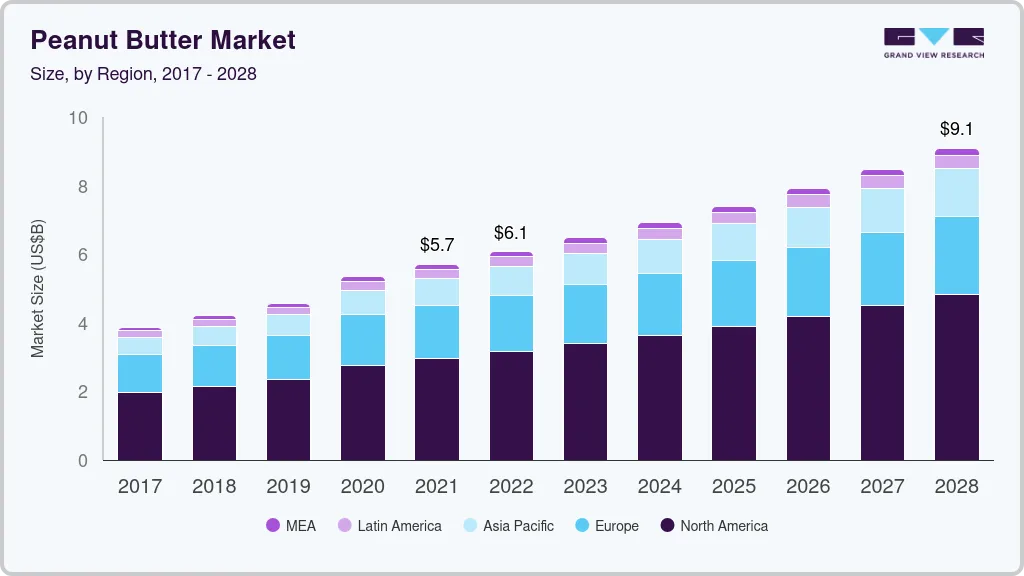

The global peanut butter market size was estimated at USD 5.70 billion in 2021 and is projected to reach USD 9.09 billion by 2028, growing at a CAGR of 6.9% from 2022 to 2028. The market growth is significantly bolstered by the increasing health awareness across the globe.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2021.

- Country-wise, Brazil is expected to register the highest CAGR from 2022 to 2028.

- By type, the crunchy segment captured over 45% of the market revenue share in 2021.

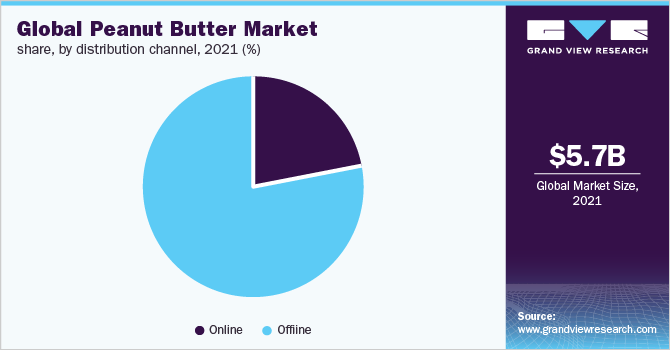

- By distribution channel, the offline segment accounted for the largest revenue share in 2021.

Market Size & Forecast

- 2021 Market Size: USD 5.70 Billion

- 2030 Projected Market Size: USD 9.09 Billion

- CAGR (2022-2028): 6.9%

- North America: Largest market in 2021

On the other hand, as consumers become more worried about their health as a result of rising chronic conditions such as high blood pressure and heart disease, new opportunities for the peanut butter business will emerge. Changing lifestyles with an increased preference for convenient food is also facilitating the growth of the global market.

Rising disposable income in developing countries coupled with the increasing awareness around the world is anticipated to drive the growth of the market over the forecast period. Moreover, increasing expansion of the key players and heightened product launches is expected to create new business opportunities for industry participants to advance their product portfolio. The key restraint of the market is the lack of awareness about the product in the Asia Pacific affecting the penetration of the market. Inconsistent peanut production and fluctuating peanut prices also affect the market growth. Import and export tariffs implemented by the key countries are again hampering the market growth. For instance, in 2018, European Union had indicated imposing higher import duties on peanut butter from the U.S.

The COVID-19 pandemic had a positive impact on the market. With the spread of infection, consumers turned towards healthy and nutritious food products to stay healthy and safe. Peanut butter experienced an increase in demand due to the high nutritious, low calorie, and high protein content it offers. Also, due to the pandemic consumer’s inclination toward stockpiling comfort food including peanut butter increased significantly. Over the forecast period, the market is expected to witness a strong growth scenario, owing to the change in lifestyle and food consumption habits.

Type Insights

The crunchy segment captured over 45% of the market revenue share in 2021. The higher consumption of crunchy peanut butter and higher preference for the product contributes to the higher market share. Crunchy peanut butter tends to be slightly healthier as it has less saturated fats and more fiber compared to the creamy. Over the forecast period, crunchy types of peanut butter are expected to witness a robust growth rate owing to the rising popularity among kids and youth.

The other segment is expected to register the highest growth rate of over 7.3% during the forecast period. The others segment includes peanut butter fortified with other fruits, nuts, and seeds. This segment of the peanut butter type is relatively new and at an emerging stage. Various companies are introducing products fortified with other ingredients to increase nutritious value. For instance, on 23rd July 2022, Ambrosia Organic Farms introduced the world’s first Mango Peanut Butter in the Indian market. Also, for instance, in September 2021, Chobani introduced Chocolate peanut butter spread in the U.S. market. Such initiatives by key players are expected to attract prospective consumers and open up new revenue streams.

Distribution Channel Insights

By distribution channel, the offline segment accounted for the largest revenue share in 2021. The offline segment of the distribution channel includes hypermarkets, department stores, supermarkets, convenience stores, specialty stores, etc. The higher market share of the offline segment is credited to the long-established nature and widespread availability across the world. Moreover, the majority of the consumers still prefer shopping at offline distribution channels as it presents product verification, authenticity, and surety.

The online distribution channel is anticipated to witness the highest growth rate in the global market. The increasing penetration of online retailers and the launching of online retailers across the world, facilitate the accessibility and availability of the online channels and drive the segmental growth. Moreover, increasing internet penetration and the use of smartphones are anticipated to drive the growth of the online segment. Characteristics such as comfort, convenience, and easy payment are likely to drive online growth, which was also significantly catapulted by the COVID-19 pandemic.

Regional Insights

North America accounted for the highest market share of over 50% on revenue basis in 2021. The higher market share of the region is mainly due to the higher peanut butter consumption in the U.S. According to the National Peanut Board, 90% of the household in the U.S. consume peanut butter regularly which is one of the most popular flavors in America. Higher peanut production and producing companies coupled with higher awareness about the product in North America are attributable to higher market share. Moreover, easy accessibility, higher disposable income, and well developed retail sector facilitate the higher demand and consumption of peanut butter in the region.

The Asia Pacific is anticipated to witness a significant growth rate over the forecast years. The higher growth rate of the region is mainly anticipated due to the increasing product awareness in countries like India, China, Japan, South Korea, etc. Increasing disposable income and changing lifestyles in the region are significantly driving the demand for processed foods. Key players are introducing peanut butter products and are taking key initiatives to recognize the regional market potential. New product launches and emerging players in the region coupled with the development in the retail sector are anticipated to propel the market growth over the forecast period. For instance, Hormel Foods Corporation launched the Skippy Squeeze Pouch of peanut butter in Malaysia in May 2019.

Key Companies & Market Share Insights

The global peanut butter market is consolidated in nature. The market is characterized by the presence of prominent global players and a few small/medium local players. Key global players have significant influence over the global market. New players are emerging in the market across the world as product awareness is gradually increasing. Key players are focused on penetration in a new geography, production expansion, product innovation, and product launch. New product variation by fortifying with the other nutritious ingredients is also been carried out by the market players to enable product offerings to wider consumers. With the increasing consumer reach and accessibility, the key players aim to increase their market share in the global market. For instance, in November 2021, American Peanut Growers Group, a farmer-owned processor based in Georgia, U.S., announced expansion plans amounting to USD 85 million, to make peanut butter and other products. Some prominent players in the global peanut butter market include:

-

J.M. Smucker Company

-

Kellogg Company

-

Conagra Brands, Inc.

-

Hormel Foods Corporation

-

Kraft Foods

-

Mars, Inc.

-

Oetker Group

-

The Hershey Company

-

Unilever Plc

-

Associated British Foods plc

Peanut Butter Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 6.08 billion

Revenue forecast in 2028

USD 9.09 billion

Growth Rate, Value

CAGR of 6.9% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

J.M. Smucker Company; Kellogg Company; Conagra Brands, Inc.; Hormel Foods Corporation; Kraft Foods; Mars, Inc.; Oetker Group; The Hershey Company; Unilever Plc; Associated British Foods plc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global peanut butter market report based on type, distribution channel, and region:

-

Type Outlook (Revenue USD Million, 2017 - 2028)

-

Crunchy

-

Creamy

-

Other

-

-

Distribution Channel Outlook (Revenue USD Million, 2017 - 2028)

-

Online

-

Offline

-

-

Regional Outlook (Revenue USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global peanut butter market size was estimated at USD 5.70 billion in 2021 and is expected to reach USD 6.08 billion in 2022.

b. The global peanut butter market is expected to grow at a compound annual growth rate of 6.9% from 2022 to 2028 to reach USD 9.09 billion by 2028.

b. North America dominated the peanut butter market with a share of 51.8% in 2021. This is attributable to the higher peanut butter consumption in the U.S. and higher peanut production along with the higher presence of peanut butter producing companies in the region.

b. Some key players operating in the peanut butter market include J.M. Smucker Company; Kellogg Company; Conagra Brands, Inc.; Hormel Foods Corporation; Kraft Foods; Mars, Inc.; Oetker Group; The Hershey Company; Unilever Plc; and Associated British Foods plc.

b. Key factors that are driving the peanut butter market growth include increasing health awareness across the globe, rising trend of health consciousness, and increasing demand for high protein food products among youth and millennials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.