- Home

- »

- Medical Devices

- »

-

Pediatric Clinical Trials Market Size And Share Report, 2030GVR Report cover

![Pediatric Clinical Trials Market Size, Share & Trends Report]()

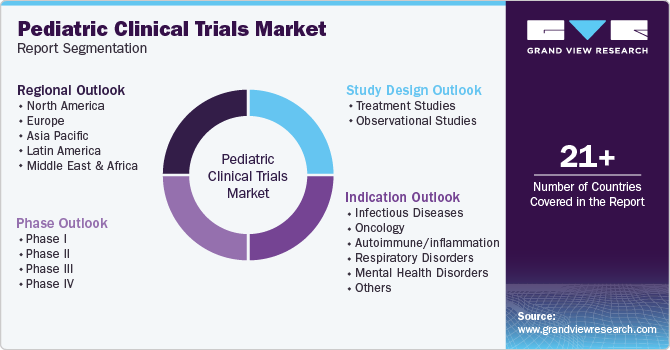

Pediatric Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase III), By Study Design (Treatment Studies, Observational Studies), By Indication, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-940-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Pediatric Clinical Trials Market Size & Trends

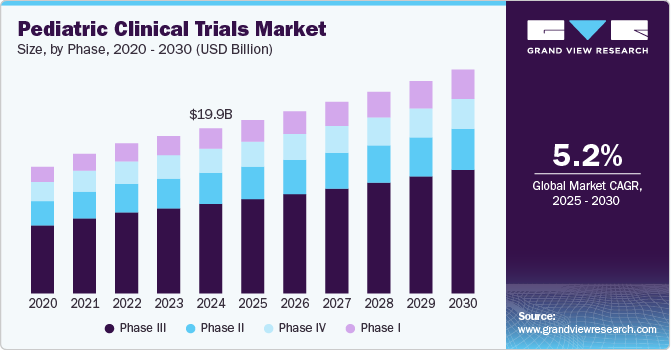

The global pediatric clinical trials market size was estimated at USD 19.9 billion in 2024 and is projected to grow at a CAGR of 5.25% from 2025 to 2030. The market growth is mainly due to increasing research and development investments by the market players coupled with growing government support for conducting pediatric clinical trials. Moreover, with growing awareness about the importance of conducting clinical research specifically for children, pharmaceutical companies are increasingly focusing on developing therapies that cater to pediatric populations.

Furthermore, the increasing prevalence of pediatric diseases coupled with the growing need for tailored treatment options also contributes to the market growth. According to the data published by UNICEF in November 2023, Pneumonia is the leading cause of mortality among children, accounting for over 700,000 deaths of those under the age of five each year. Globally, there are over 1,400 cases of pneumonia per 100,000 children annually, which accounts to one case for every 71 children. The highest incidence rates are found in South Asia, with 2,500 cases per 100,000 children, and in West and Central Africa, the rate is 1,620 cases per 100,000 children. Thus, increasing cases have led pharmaceutical companies to conduct and accelerate clinical trials among pediatric patients to meet the growing need for effective treatment options.

Moreover, advancements in technology and data analytics are also enhancing the design and execution of pediatric clinical trials. The integration of digital health technologies, such as wearable devices and telemedicine, has enhanced patient recruitment and monitoring, making it easier to collect data from pediatric participants. For instance, in June 2024, Medidata announced the launch of a new AI-powered platform for clinical trials, which aims to revolutionize the clinical research data experience and streamline the trial process. These technological innovations would further improve the quality of data collected, leading to more reliable outcomes.

Phase Insights

The phase III segment dominated the market with a revenue share of 54.2% in 2024. In this phase large populations of pediatric patients are involved, allowing for comprehensive data collection that provides proper outcomes. This is particularly important for conditions affecting children, where dosing, side effects, and overall effectiveness can differ significantly from adult populations. In addition, the growing focus on developing targeted therapies for pediatric diseases has led to an increase in Phase III trials as pharmaceutical companies seek to validate their findings on larger scales. Thus, ensuring safe and effective treatments for pediatric patients further contributes to the segment’s market growth.

Phase I is projected to witness the fastest growth from 2025 to 2030 owing to increasing focus towards early-stage trials in pediatric research, as they provide essential data on safety, tolerability, and pharmacokinetics in younger populations. This has led to heightened interest from researchers and sponsors to initiate more Phase I studies tailored for children. Moreover, advancements in technology and innovative trial designs, such as adaptive trials, are making it easier to conduct these studies in pediatric populations, thereby accelerating their implementation.

Study Design Insights

The treatment studies segment dominated the market in 2024 owing to its focus on evaluating the efficacy and safety of new therapies specifically designed for pediatric populations. Treatment studies address the growing need for targeted treatments for various pediatric diseases. By concentrating on treatment outcomes, these studies generate vital data that informs clinical practice and regulatory approval processes. Moreover, regulatory bodies are increasingly advocating for the inclusion of pediatric-specific studies in drug development, which has further fueled the growth of this segment. The emphasis on developing effective and safe medications for children has led to a surge in treatment trials, as researchers aim to fill the significant gap in available therapies.

The observational studies segment is projected to witness considerable growth from 2025 to 2030. These studies often require fewer resources compared to traditional interventional trials, making them a more cost-effective option for researchers and sponsors. This can facilitate broader participation and faster study completion. Moreover, growing awareness of ethical issues in pediatric research, observational studies present an alternative that minimizes risk to participants while providing valuable data to conduct the study.

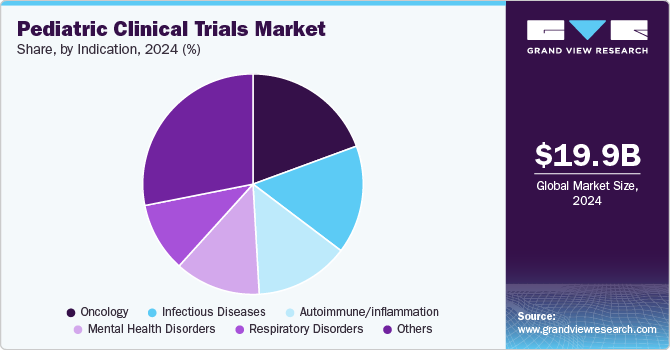

Indication Insights

The oncology segment dominated the market in 2024 owing to increasing prevalence of cancer globally coupled with growing need for more effective treatment strategies. According to an article published by American Cancer Society in May 2024, approximately 9,620 children under the age of 15 in the U.S. are expected to be diagnosed with cancer and approximately 1,040 children under the age of 15 are anticipated to die from cancer. Thus, increasing cases of cancer has led several pharmaceutical companies and researchers to develop targeted therapies specifically designed for younger patients. This growing demand for effective treatments will lead to more clinical trials aimed at addressing the unique biological and therapeutic needs of children with cancer.

Infectious Diseases segment is projected to witness considerable growth from 2025 to 2030 owing.to rising prevalence of infectious diseases among children leading to increasing focus on developing effective vaccines and treatment options. Moreover, ongoing global health challenges, such as outbreaks of diseases such as respiratory infections, gastrointestinal illnesses, and emerging pathogens has heightened the urgency to conduct pediatric clinical trials that address these growing health issues.

Regional Insights

North America pediatric clinical trials market dominated the global market with a revenue share of a 42.6% in 2024. The growth in the region is attributed to the presence of established market players and an increasing number of clinical trials are anticipated to drive market growth. Moreover, robust healthcare infrastructure, including advanced research facilities and a strong network of hospitals and clinics that are well-equipped to conduct clinical trials are also contributing to the region’s market growth. This infrastructure facilitates the recruitment of pediatric participants and enhances the overall efficiency of trial processes.

U.S. Pediatric Clinical Trials Market Trends

The U.S. pediatric clinical trials market is projected to be driven owing to growing investment in research and development by both government entities and private companies, driving innovation in pediatric therapies. Moreover, increasing government support in the country to conduct pediatric clinical trials has led several pharmaceutical companies to invest in the country’s market.

Europe Pediatric Clinical Trials Market Trends

The pediatric clinical trials market in Europe is anticipated to witness lucrative growth over the projected period. The growth is due to the expansion of outsourcing activities among pharmaceutical companies. Several companies are entering into a partnership and collaboration agreement to advance their service offerings and accelerate its clinical trial process. This trend is contributing to the growth of the market across the region.

The UK pediatric clinical trials market is anticipated to experience considerable growth over the forecast period. Increasing government support from agencies such as MHRA has increased investment and collaboration between academia, industry, and healthcare providers. Moreover, there is a growing emphasis on investment in pediatric research from both public and private sectors. The UK is increasingly seen as a hub for innovative research, with collaborations between universities, pharmaceutical companies, and research organizations driving advancements in pediatric therapies.

The pediatric clinical trials market in Germany is expected to grow at a considerable rate over the forecast period. Several government initiatives for clinical research activities have accelerated the clinical trials market in the country. Furthermore, advancements in technology and availability of high-quality clinical resources are some of the main factors responsible for the country’s market growth.

Asia Pacific Pediatric Clinical Trials Market

Asia Pacific Pediatric clinical trials market is expected to grow at the highest CAGR over the forecast period.The growth of the market can be attributed to ongoing advancements in clinical research, along with lower patient costs in Asia-Pacific countries and the availability of a diverse patient population that is relatively easy to recruit. According to the data published by Clinical Trials Arena in January 2023, Asia Pacific has emerged as one of the reliant and most promising markets for clinical trials. In addition, more than 27,000 clinical trials were initiated in 2021, and nearly half were conducted in the APAC region. Thus, constant advancements and developments in clinical trials are expected to further contribute to the market growth.

China pediatric clinical trials market is projected to witness significant growth in the coming years owing to the increasing demand for biopharmaceuticals. In addition, the country’s large and diverse patient population facilitates the recruitment process for clinical trials. The vast number of potential participants allows for quicker enrollment and the ability to conduct studies across various demographics, which is crucial for obtaining comprehensive data on treatment efficacy and safety.

The pediatric clinical trials market in Japan is expected to witness lucrative growth over the forecast period. The growth of the market is mainly due to growing investment in pediatric research from both public and private sectors in Japan. The government in collaboration with several pharmaceutical companies and academic institutions has initiated several funding programs aimed at promoting pediatric drug development. This investment is crucial for fostering innovation and ensuring that new therapies are available for children.

India pediatric clinical trials market is poised to grow in the coming years. Low labor costs, improvements in healthcare infrastructure, and easy availability of technical expertise are expected to be some of the major factors propelling market growth over the forecast period. Moreover, increasing number of clinical trials in India, owing to growing demand for treatment options for several diseases is also one of the factors driving the market growth.

MEA Pediatric Clinical Trials Market Trends

The pediatric clinical trials market in MEA is projected to grow at a lucrative rate. The growth in the region is driven by the increasing incidence of chronic diseases like respiratory infections, malaria, and genetic disorders among children. This surge in health issues has created a significant demand for effective therapeutic options, prompting a stronger focus on clinical trials aimed at developing targeted therapies and vaccines for young patients. These factors would further enhance the health outcomes in areas where these diseases are very prevalent.

Saudi Arabia pediatric clinical trials market is projected to witness the fastest growth. There is a growing investment in pediatric research from both public and private sectors. The Saudi government has initiated various programs to promote healthcare innovation and support research initiatives that target pediatric populations. This investment is crucial for developing new therapies and improving existing treatment options for children.

Key Pediatric Clinical Trials Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their services. Companies such as ICON plc, Syneos Health, Medpace, and Thermo Fisher Scientific Inc. are continuously involved in expanding their facilities, collaborating, and engaging in partnerships, mergers, and acquisitions of companies. These are key strategic initiatives that are influencing the industry dynamics. For instance, in September 2024, Ther mo Fisher Scientific Inc. announced the launch of the international CorEvitas clinical registry focused on adolescent atopic dermatitis, a chronic skin condition. This would further facilitate the comprehensive data collection on this chronic skin condition.

Key Pediatric Clinical Trials Companies:

The following are the leading companies in the pediatric clinical trials market. These companies collectively hold the largest market share and dictate industry trends.

- ICON plc

- Syneos Health

- Medpace

- Thermo Fisher Scientific Inc.

- Premier Research

- Laboratory Corporation of America

- QPS Holdings.

- Pfizer Inc.

- The Emmes Company, LLC

- IQVIA Inc.

View a comprehensive list of companies in the Pediatric Clinical Trials Market

Recent Developments

-

In July 2024, Labcorp entered into a collaboration agreement with Naples Comprehensive Healthcare (NCH) in Southwest Florida. The collaboration aims to merge key capabilities, expertise, and technologies from both organizations to improve access to laboratory services and advance the delivery of high-quality care.

-

In March 2024, Pfizer Inc. announced that the European Commission (EC) has granted marketing authorization for its 20-valent pneumococcal conjugate vaccine, known in the European Union as PREVENAR 20®. This vaccine is approved for active immunization to prevent invasive disease, pneumonia, and acute otitis media caused by Streptococcus pneumoniae in infants, children, and adolescents aged 6 weeks to under 18 years.

-

In December 2023, Pfizer Inc. and Valneva SE announced the completion of participant recruitment for the Phase 3 trial, Vaccine Against Lyme for Outdoor Recreationists focused on the Lyme disease vaccine candidate VLA15. Building on positive results from earlier Phase 1 and 2 trials, this study includes both adult and pediatric participants and aims to confirm the efficacy, safety, lot consistency, and immunogenicity of VLA15.

Pediatric Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.90 billion

Revenue forecast in 2030

USD 26.99 billion

Growth rate

CAGR 5.25% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, study design, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China, India, South Korea, Thailand, Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

ICON plc; Syneos Health; Medpace; Thermo Fisher Scientific Inc.; Premier Research; Laboratory Corporation of America; QPS Holdings.; Pfizer Inc.; The Emmes Company, LLC; IQVIA Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pediatric Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pediatric clinical trials market report based on phase, study design, indication, and region.

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Treatment Studies

-

Observational Studies

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Oncology

-

Autoimmune/inflammation

-

Respiratory Disorders

-

Mental Health Disorders

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pediatric clinical trials market size was estimated at USD 19.90 billion in 2024 and is expected to reach USD 20.90 billion in 2025.

b. The global pediatric clinical trials market witnessed a moderate growth rate of 5.25% from 2025 to 2030 to reach USD 26.99 billion by 2030.

b. The treatment studies segment dominated the pediatric clinical trials market with a share of 65.9% in 2024. This is attributable to the increasing rate of treatment-based clinical studies across the globe.

b. Some key players operating in the pediatric clinical trials market include ICON plc, Syneos Health, Medpace, Thermo Fisher Scientific Inc., and a few others.

b. Increasing focus on pediatric research due to the high burden of pediatric diseases is one of the major factors supporting the growth of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."