- Home

- »

- Medical Devices

- »

-

Pediatric ENT Market Size, Share And Trends Report, 2030GVR Report cover

![Pediatric ENT Market Size, Share & Trends Report]()

Pediatric ENT Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Hearing Aids, Hearing Implants, Diagnostic ENT Devices, Surgical ENT Devices, Nasal Splints), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-395-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pediatric ENT Market Size & Trends

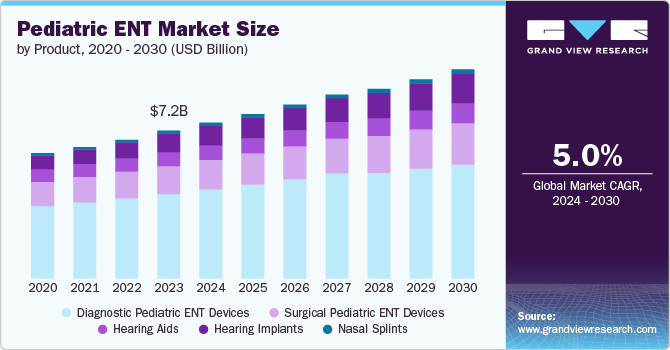

The global pediatric ENT market size was estimated at USD 7.19 billion in 2023 and is projected to grow at a CAGR of 5.02% from 2024 to 2030. The market growth is expected to be driven by several key factors such as technological advancement, increasing demand for procedures, and accessible pediatric ENT solutions. In addition, the incorporation of AI into ENT procedures enhances diagnostic accuracy and surgical planning, making procedures safer and more efficient, which is expected to fuel further growth and innovation in the sector.

Development of more advanced surgical tools and diagnostic equipment developed specifically for the anatomical and physiological needs of children is driving the market growth. For instance, the Hummingbird TTS is an advanced device that enables ear, nose and throat surgeons to place ear tubes in children as young as six months old in the office, without the need for general anesthesia. This eliminates the risks and stress associated with subjecting children to this common procedure. The device was developed in partnership with leading pediatric ENTs such as Preceptis Medical, Resolution Medical and has received clearance for in-office use from the FDA 510(k).

Furthermore, the increasing prevalence of hearing loss and use of cochlear implants is expected to decrease the need for traditional hearing aids. For instance, according to the National Institute on Deafness and Other Communication Disorders (NIDCD) about 2 out of every 1,000 children in the U.S. are born with hearing loss in one or both ears. Furthermore, over 90% of children with hearing impairment are born to parents with no hearing impairment. This shift in the demographic is expected to lead to a higher demand for cochlear implants as families opt for effective solutions to their children's hearing problems.

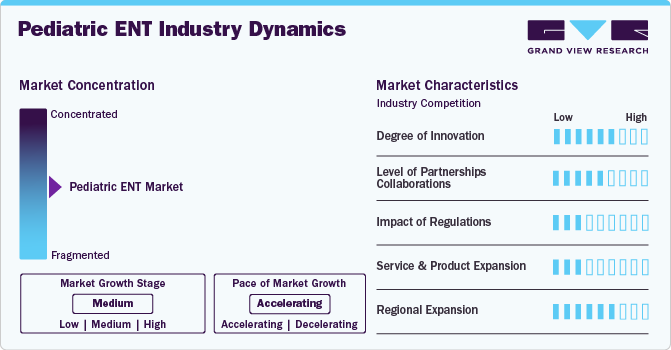

Industry Dynamics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The x-axis shows the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, such as degree of innovation, impact of regulations, industry competition, product expansion, level of partnerships and collaboration activities, and regional expansion. For instance, the industry is consolidated with a few major players dominating the market. There is a high degree of innovation, high level of partnerships and collaboration activities, high impact of regulations, high product expansion, and moderate regional expansion of the industry.

The market is currently experiencing significant innovation, particularly driven by recent advancements in technology and the challenges faced due to the COVID-19 pandemic. The integration of AI into diagnostic tools has improved the accuracy and accessibility of ear disease diagnoses. For instance, in March 2020, the HearX Group released a beta version of their hearScope digital otoscope system, which includes an AI image classification feature. The hearScope is a smartphone-based video otoscope designed to provide affordable access to ear care, making it easier for healthcare providers to assess conditions in pediatric patients.

Manufacturers of ENT devices establish partnerships with medical equipment distributors to enhance their market presence. This facilitates the efficient distribution of devices to healthcare facilities, ensuring better access to services. For instance, in April 2023, Elevate ENT Partners, a provider of ear, nose and throat care and a prominent otorhinolaryngology physician practice management organization in U.S., collaborated with Otolaryngology Consultants, PA. This collaboration includes the Center for Advanced Sinus and Nasal Care, the Center for Pediatric ENT, Neck and Head Surgery, and the Center for Advanced Hearing Care. This partnership is expected to provide Elevate the support of skilled physicians as they continue to expand their presence in the Florida market.

The impact of regulations on the market is moderate. Pediatric devices are subject to stricter regulatory standards by agencies such as the FDA. Under the Federal Food, Drug, and Cosmetic Act (FD&C Act), pediatric ENT devices are subject to specific regulations aimed at ensuring their safety and effectiveness for children. For instance, from 2016-2021, 84% of pediatric devices were approved by U.S. FDA, through Premarket Approval (PMA) compared to 33% of adult devices.

The level of product expansion in the industry is high, owing to the launch of new products to meet the growing pediatric ENT devices demand. For instance, in June 2024,the KARL STORZ company; AventaMed launched new Solo+, an advanced, single-use ear tube device that provides physicians and patients with a quicker and simpler option for this frequently performed pediatric ENT surgery. Solo+ has received certification for fulfilling the requirements of the European Medical Device Regulation (MDR). Additionally, the US FDA has granted 510(k) clearance for the product for patients aged 6 months to 24 months old. This advancement is expected to improve the patient experience and streamline the treatment process for otitis media, reducing recovery time and costs compared to traditional operating room procedures.

The market is expected to have significant growth, driven by various factors across different regions. For instance, in November 2022, Cochlear Ltd. It has expanded Malaysia by opening its manufacturing plant in Kuala Lumpur, Malaysia. The expansion facilitated an investment of more than USD 6.28 million to meet the increasing demand for acoustic and cochlear hearing implants.

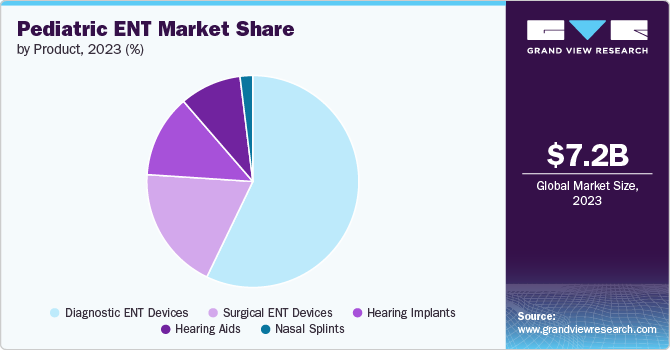

Product Insights

The diagnostic ENT devices segment led the market with the largest revenue share of 57.15% in 2023. Growing awareness among parents and healthcare professionals regarding pediatric ear, nose and throat disorders has led to an increased demand for effective diagnostic tools. This is further supported by educational initiatives and public health campaigns aimed at early detection and treatment of ENT diseases in children. Furthermore, there is a trend towards minimally invasive diagnostic procedures, which are particularly beneficial in pediatric care due to the reduced risk and discomfort for young patients. Devices that facilitate such approaches are becoming more prevalent in clinical settings. These factors are expected to drive the segment growth during the forecast period.

In addition, recent advancements in pediatric otolaryngology have introduced innovative diagnostic devices aimed at improving the management of ear, nose, and throat conditions in children. One notable device is the Tomi Scope developed by PhotoniCare Inc. in January 2020. This device utilizes optical coherence tomography to provide detailed imaging of the tympanic membrane and middle ear, addressing the unmet need for non-invasive diagnostics in pediatric patients.

The hearing implant segment is expected to grow at the fastest CAGR during the forecast period. This can be attributed to the increasing preference for cochlear implants as non-invasive methods, increasing the adoption of hearing implants, and the development of new products by key companies. In April 2024, Cochlear Limited, a worldwide manufacturer of implantable hearing solutions, has been granted clearance from the U.S. FDA to reduce the age range from 12 to 5 years old for the Cochlear Osia System. This clearance applies to children with mixed hearing loss, conductive hearing loss, and single-sided sensorineural deafness (SSD).

Regional Insights

North America dominated the pediatric ENT market with the largest revenue share of 34.14% in 2023. The increasing incidence of hearing disorders, sinusitis, and other conditions among children is a major driver for the market growth. Furthermore,the presence of major ENT device manufacturers in North America, such as Medtronic, Stryker, and Johnson & Johnson, contributes to the easy availability and adoption of these devices for pediatric patients.

U.S. Pediatric ENT Market Trends

The pediatric ENT market in U.S. held the largest share in North America in 2023, Companies are involved in strategic activities to gain access to new markets, capabilities and technologies, which can enable them to increase their business and increase their profitability. For instance, in May 2022, Medtronic, a healthcare technology company, finalized the acquisition of Intersect ENT, further enhancing the company's extensive ear, nose, and throat portfolio. This acquisition brings innovative products for sinus procedures to enhance post-operative results and address nasal polyps.

Asia Pacific Pediatric ENT Market Trends

The pediatric ENT market in Asia Pacific expected to witness at the fastest CAGR over the forecast period, driven by various factors including rising healthcare expenditures, increasing awareness of early diagnosis, and advancements in technology. Increased government and private sector investments in healthcare infrastructure are facilitating better access to ENT services and devices. This is particularly important in countries like China and India, where healthcare systems are rapidly evolving.

The China pediatric ENT market held significant largest share in Asia Pacific in 2023.The Pediatric Group of the Chinese Society of Otorhinolaryngology Head and Neck Surgery (OHNS) was officially established by the Chinese Medical Association in early 2003. By 2019, there were over 228 children's hospitals and maternal and child health centers across China with a combined staff of more than 500 otorhinolaryngologists. In addition, recent advancements in pediatric ENT devices in China underscore significant progress and collaborations aimed at improving medical technology in this field. For instance, in September 2023, Nanos Medical has collaborated with Zhuhai Vision Medical Technology to jointly develop electronic flexible endoscopes for ENT applications. This partnership aims to accelerate the domestic production of these devices, which are expected to be safer and more cost-effective for clinical use. Nanos Medical, a leader in ENT medical devices, plans to leverage its expertise alongside Zhuhai Mindsion’s technological foundation to improve the availability of advanced ear, nose and throat diagnostic and treatment solutions in China.

The pediatric ENT market in India is driven by factors such as increased government initiatives to improving pediatric ENT care in India through innovative technologies and accessible healthcare programs. For instance, under the Indian government's Assistance to Disabled Persons (ADIP) scheme, MAA ENT Hospitals has launched a free cochlear implantation program for children up to five years of age from families below the poverty line. This program addresses the critical issue of hearing loss, which affects approximately 63 million people in India, including many children.

Europe Pediatric ENT Market Trends

The pediatric ENT market in Europe is a significant market for ENT devices and treatments, with countries such as Germany, France, and the UK leading in terms of market share. The region benefits from advanced healthcare infrastructure and favorable regulatory environments, which support the adoption of new technologies.

The UK pediatric ENT market is expected to grow at a significant CAGR over the forecast period,this growth, driven by increasing technological innovations in the market.The ENT UK Foundation is developing a virtual reality (VR) training program designed to improve access to emergency medical algorithm training for pediatric ENT devices. This initiative aims to enhance the skills of healthcare professionals in managing pediatric emergencies and focusing on better surgical practices, innovative training, and community engagement to ensure children receive timely and effective care.

The pediatric ENT market in Germany held the largest share in Europe in 2023. Major hospitals in Germany, such as the University Medical Center Freiburg and Heidelberg University Hospital, are expanding their pediatric ENT devices services. These facilities are recognized for their multidisciplinary approach, integrating various specialties to provide comprehensive care for children with ENT disorders. This includes collaboration with experts in neonatology, audiology, and speech therapy to address complex cases effectively. This development expected to enhance pediatric ENT devices care in Germany, ensuring that children receive timely and effective treatment for their ENT-related health issues.

Latin America Pediatric ENT Market Trends

The pediatric ENT market in Latin America is anticipated to grow at a significant CAGR during the forecast period, due to the major players in the market, such as Stryker, Olympus, and Smith & Nephew, increasingly focusing on collaborations and partnerships to enhance their offerings in Latin America.

The Brazil pediatric ENT market is expected to grow at a substantial CAGR during the forecast period. Common diagnoses among children include conditions such as mouth breathing and otitis media, which often necessitate surgical interventions such as adenotonsillectomy. The high prevalence of these conditions drives the demand for ENT services in pediatric populations. This expected to drive the market growth in the country.

Middle East & Africa Pediatric ENT Devices Market Trends

The pediatric ENT market in the Middle East and Africa is anticipated to grow at a significant CAGR during the forecast period, due to increased awareness and diagnosis of ear, nose and throat conditions, particularly in pediatric populations, are contributing to higher demand for specialized devices.

The UAE pediatric ENT market is anticipated to witness at a significant CAGR during the forecast period, due to advancements in technology, particularly in minimally invasive surgical procedures. Innovations such as electromagnetic image-guided surgery systems and robotic surgical devices are enhancing the precision and outcomes of ear, nose and throat surgeries. These technologies are particularly beneficial in treating common pediatric ENT devices conditions like tonsillitis and ear infections.

Key Pediatric ENT Company Insights

The market is dominated by established players like Medtronic, Stryker, and Smith & Nephew, but there are also some emerging players focused on pediatric ENT devices such as Preceptis Medical, Interacoustics, and Oticon Medical.

Key Pediatric ENT Companies:

The following are the leading companies in the pediatric ENT market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Karl Storz

- Stryker Corporation

- Smith & Nephew plc

- Olympus Corporation

- Cochlear Ltd.

- Demant A/S

- GN Store Nord A/S

- Ambu A/S

- Pentax Medical

- FUJIFILM Holdings

- Acclarent

- Preceptis Medical

Recent Developments

-

In September 2023, Zepp Health launched the Zepp Clarity Pixie, a premium hearing aid designed for patients with mild-to-moderate hearing loss. The Pixie is nearly invisible when worn, has a 17-hour battery life, and easily connects to wireless devices.

-

In September 2021, Johnson & Johnson Medical Devices Company & Acclarent, Inc. has launched their first AI-powered ENT devices in the U.S. The new software uses a machine learning algorithm to simplify surgical planning and provide real-time response during ENT navigation procedures, such as endoscopic sinus surgery. It aims to offer efficient and reliable image-guided preoperative planning and navigation for ENT procedures

Pediatric ENT Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.58 billion

Revenue forecast in 2030

USD 10.17 billion

Growth rate

CAGR of 5.02% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden;China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait.

Key companies profiled

Medtronic; Karl Storz; Stryker Corporation; Smith & Nephew plc; Olympus Corporation; Cochlear Ltd.; Demant A/S; GN Store Nord A/S; Ambu A/S; Pentax Medical; FUJIFILM Holdings; Acclarent; Preceptis Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pediatric ENT Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pediatric ENT market report based on product, and regions.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic ENT Devices

-

Surgical ENT Devices

-

Hearing Aids

-

Hearing Implants

-

Nasal Splints

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pediatric ENT market is expected to grow at a compound annual growth rate of 5.02% from 2024 to 2030 to reach USD 10.17 billion by 2030.

b. The global pediatric ENT market size was estimated at USD 7.19 billion in 2023 and is expected to reach USD 7.58 billion in 2024.

b. North America dominated the pediatric ENT market with a share of over 34.14% in 2023. This is attributable to the region's increasing incidence of hearing disorders, sinusitis, and other conditions among children is a major driver for the market growth.

b. Key factors that are driving the pediatric ENT market growth include high prevalence of hearing loss, increasing penetration of minimally invasive pediatric ENT procedures and technological advancements in pediatric ENT devices

b. Some key players operating in the pediatric ENT market include Medtronic, Karl Storz, Stryker Corporation, Smith & Nephew plc, Olympus Corporation, Cochlear Ltd., Demant A/S, GN Store Nord A/S, Ambu A/S, Pentax Medical, FUJIFILM Holdings, Acclarent, and Preceptis Medical

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.