- Home

- »

- Next Generation Technologies

- »

-

Peer-to-Peer Lending Market Size And Share Report, 2030GVR Report cover

![Peer-to-Peer Lending Market Size, Share & Trends Report]()

Peer-to-Peer Lending Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Consumer Lending, Business Lending), By Loan Type (Secured, Unsecured), By End-user, By Purpose Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-105-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peer-to-Peer Lending Market Summary

The global peer-to-peer lending market size was estimated at USD 5.07 billion in 2022 and is projected to reach USD 21.42 billion by 2030, growing at a CAGR of 7.2% from 2023 to 2030. The demand for alternative financing options is among the primary drivers of peer to peer (P2P) lending market.

Key Market Trends & Insights

- North America dominated the peer-to-peer lending market in 2022 with a revenue share of more than 30.0%.

- The Asia Pacific regional market is anticipated to register the fastest CAGR of 23.0% over the forecast period.

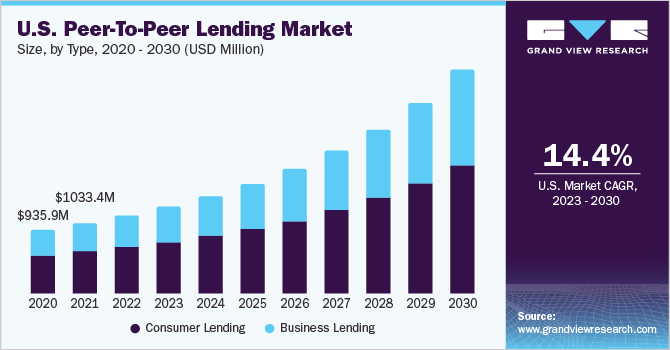

- By type, the consumer lending segment dominated the market in 2022 with a revenue share of more than 59.0%.

- By loan type, the unsecured segment dominated the market in 2022 with a revenue share of more than 65.0%.

- By end-user, the non business loans segment dominated the market in 2022 with a revenue share of over 75.0%.

Market Size & Forecast

- 2022 Market Size: USD 5.07 Billion

- 2030 Projected Market Size: USD 21.42 Billion

- CAGR (2023-2030): 20.2%

- North America: Largest market in 2022

Traditional lending channels, such as banks may not always be accessible or attractive to individuals and small businesses. P2P lending platforms offer a convenient and streamlined process for borrowers to access loans, even if they have limited credit history or are considered high-risk by traditional lenders.

Technological advancements have played a crucial role in driving the growth of P2P lending. Online platforms and digital infrastructure have made it easier for borrowers and lenders to connect directly, eliminating the need for intermediaries. Advanced algorithms and data analytics have also enabled efficient credit risk assessment, enhancing the overall efficiency and speed of the lending process. The P2P lending market’s growth is driven by the potential for higher returns for lenders compared to that of traditional investment options. P2P lending allows individuals to directly invest in loans and earn interest income, potentially generating higher returns than traditional savings accounts or other investment vehicles.

P2P lending platforms have emerged as a popular choice due to their increased transparency and simplified loan application process. These platforms allow borrowers to compare loan terms, interest rates, and fees across different providers, empowering them to make informed decisions. By providing clear and accessible information, P2P lending platforms enable borrowers to evaluate and select the most suitable loan options for their needs. In addition, the streamlined application process offered is conducted entirely online, eliminating the need for extensive paperwork and time-consuming procedures.

The growing adoption of P2P lending by small businesses is driving market growth. Traditional lenders often have stringent criteria and lengthy approval processes for small business loans, making it challenging for these businesses to access capital. P2P lending platforms provide a viable alternative, offering quick and flexible financing options tailored to the needs of small businesses. Moreover, changing consumer preferences and attitudes toward borrowing and investing have contributed to the growth of the P2P lending market. Many individuals now prefer borrowing directly from peers or investing in loans that align with their values and interests.

However, the market is restrained by the potential risk of loan defaults and borrower fraud. As with any lending activity, there is always uncertainty and risk associated with lending money to individuals or businesses. Default rates and fraudulent activities can negatively impact investors' returns and erode trust in the P2P lending platform. To overcome this restraint, P2P lending platforms implement various risk assessment mechanisms to evaluate the creditworthiness of borrowers. In addition, they may enforce strict verification processes, and background checks, and employ advanced fraud detection algorithms to mitigate the risk of fraud.

COVID-19 Impact Analysis

The COVID-19 pandemic has highlighted the importance of alternative lending platforms as traditional financial institutions faced challenges and tightened lending criteria. P2P lending platforms stepped in to fill the gap, providing much-needed access to credit for individuals and small businesses. In addition, the low-interest-rate environment caused by the pandemic has made P2P lending more attractive to investors seeking higher returns on their investments. Furthermore, the shift toward digitalization and remote work during the pandemic has increased the acceptance and adoption of online lending platforms.

Type Insights

The consumer lending segment dominated the market in 2022 with a revenue share of more than 59.0%. One of the significant benefits of P2P lending is the ability for borrowers to secure loans at lower interest rates compared to traditional banks or credit unions. This advantage stems from the fact that P2P lenders operate with lower overhead costs, enabling them to offer loans at more competitive rates. Moreover, P2P lending platforms typically have a more efficient underwriting process, contributing to lower lending costs and making P2P lending an attractive option for consumers seeking affordable borrowing opportunities.

The business lending segment is anticipated to register the fastest CAGR of 22.5% over the forecast period. P2P lending for businesses is becoming prevalent as this form of lending is exempt from prolonged checking procedures and other complicated processes that pester conventional bank loans. The digital nature of this form of loan results in an easy and swift application process that small businesses tend to appreciate. In addition, P2P loans are most popular among startups and small businesses as they typically have lower limits on the available funding amount.

Loan Type Insights

The unsecured segment dominated the market in 2022 with a revenue share of more than 65.0%. Unsecured loans do not require borrowers to provide collateral, simplifying the application process and making it more accessible for a larger pool of borrowers. This eliminates the need for time-consuming and cumbersome asset evaluation procedures. In addition, the absence of collateral requirements makes unsecured P2P lending attractive to borrowers who may not have significant assets to pledge as security.

The secured segment is anticipated to register the fastest CAGR of 22.1% during the forecast period. Secured loans offer lenders a higher level of protection by requiring borrowers to provide collateral, such as real estate, vehicles, or other valuable assets. This collateral acts as security for the loan and reduces the risk of default. Therefore, lenders are more willing to provide larger loan amounts and offer lower interest rates, attracting borrowers seeking larger funds or better loan terms.

End-user Insights

The non business loans segment dominated the market in 2022 with a revenue share of over 75.0%. Personal loans cater to a wide range of individual financial needs, such as debt consolidation, home improvement, medical expenses, education, and other personal expenses. This broad applicability attracts a large pool of borrowers, contributing to the dominance of non-business loans. Moreover, P2P lending platforms offer flexibility in loan amounts and repayment terms, which are attractive to individuals seeking smaller loan amounts with shorter repayment periods.

The business loans segment is anticipated to register the fastest CAGR of 22.3% over the forecast period. Small and medium-sized enterprises often encounter challenges accessing traditional bank loans, particularly in the early stages of their business or periods of financial instability. P2P lending platforms provide an alternative financing option that caters specifically to the needs of these businesses, enabling them to obtain the necessary capital for growth and expansion. Moreover, P2P lending offers faster and more streamlined loan application processes compared to traditional financial institutions. This appeals to businesses that require quick access to funding to seize opportunities or address urgent financial needs.

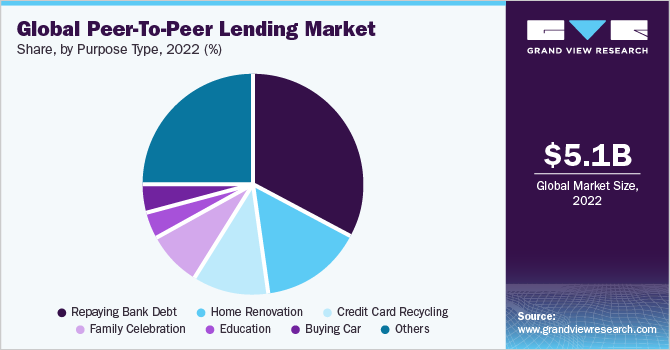

Purpose Type Insights

The repaying bank debt segment dominated the market in 2022 with a global revenue share of over 33.0%. Many borrowers use P2P lending to consolidate and refinance their bank debt. By taking out a P2P loan, borrowers can potentially secure more favorable terms, such as lower interest rates or longer repayment periods, compared to their existing bank loans. This enables them to manage their debt better and reduce their overall financial burden.

The home renovation segment is anticipated to register the fastest CAGR of 22.3% over the forecast period. Banks generally prioritize home loans over smaller home improvement loans due to the larger ticket size and potential for higher returns. This preference creates an opportunity for P2P lending platforms to cater to borrowers seeking funds for home renovation projects. P2P lending platforms offer streamlined processes, competitive rates, and flexibility, enabling borrowers to access smaller loans tailored for home improvements.

Regional Insights

North America dominated the peer-to-peer lending market in 2022 with a revenue share of more than 30.0%. The North America region has a highly developed financial ecosystem with a strong emphasis on innovation and technological advancements. This environment has nurtured the growth of P2P lending platforms and attracted both borrowers and investors. In addition, North America has a large population of tech-savvy individuals who are comfortable with online transactions and digital platforms, making them more receptive to P2P lending. Furthermore, the regulatory framework in North America has been relatively supportive of P2P lending, providing a conducive environment for platform growth.

The Asia Pacific regional market is anticipated to register the fastest CAGR of 23.0% over the forecast period. The Asia Pacific region has a large population, including many unbanked or underbanked individuals with limited access to traditional financial services. P2P lending platforms provide an alternative source of funding for these individuals, driving the demand for P2P lending in the region. In addition, Asia Pacific is experiencing rapid economic growth, leading to increased entrepreneurial activities and small business development. P2P lending platforms serve as a vital source of capital for these businesses, fueling the growth of the region.

Key Companies & Market Share Insights

The key players in the peer-to-peer lending market focus on factors such as loan interest rates, borrower experience, investor returns, and risk management. They leverage technology to streamline the lending process, utilizing algorithms and data analytics to assess creditworthiness and mitigate risk. In addition, partnerships and collaborations with financial institutions and other market players help enhance their market position. As the market evolves, new entrants and innovative platforms are emerging, introducing novel lending models and technologies. This intensifies competition and encourages established players to innovate and improve their offerings continually.

In June 2023, PeerBerry investors provided financing of USD 71.08 million for loans and received USD 8,94,252.9 in interest. The total amount of loans funded on the PeerBerry platform increased by 3% compared to the previous month. As of the end of June, PeerBerry's portfolio has reached a value of USD 125.7 million. Some prominent players in the global peer-to-peer lending market include:

-

LendingClub Bank

-

Lendermarket

-

Prosper Funding LLC

-

Proplend

-

PeerBerry

-

Upstart Network, Inc.

-

RateSetter

-

StreetShares, Inc.

-

Bondora Capital OÜ

-

AS Mintos Marketplace

-

Landbay Partners Limited

Peer-to-Peer Lending Market Report Scope

Attribute

Details

Market size value in 2023

USD 5.91 billion

Revenue forecast in 2030

USD 21.42 billion

Growth rate

CAGR of 20.2% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, loan type, end-user, purpose type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Indonesia; India; Japan; South Korea; Australia; Brazil; Mexico; Israel; South Africa; UAE

Key companies profiled

LendingClub Bank; Lendermarket; Prosper Funding LLC; Proplend; PeerBerry; Upstart Network, Inc.; RateSetter; StreetShares, Inc.; Bondora Capital OÜ; AS Mintos Marketplace; Landbay Partners Limited

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peer-to-Peer Lending Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global peer-to-peer lending market report based on type, loan type, end-user, purpose type, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consumer Lending

-

Business Lending

-

-

Loan Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Secured

-

Unsecured

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Non Business Loans

-

Business Loans

-

-

Purpose Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Repaying Bank Debt

-

Credit Card Recycling

-

Education

-

Home Renovation

-

Buying Car

-

Family Celebration

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

- Asia Pacific

-

Indonesia

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Israel

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global peer-to-peer lending market size was estimated at USD 5.07 billion in 2022 and is expected to reach USD 5.91 billion in 2023.

b. The global peer-to-peer lending market is expected to grow at a compound annual growth rate of 20.2% from 2023 to 2030 to reach USD 21.42 billion by 2030.

b. North America dominated the peer-to-peer lending market with a share of over 33.0% in 2022. The North America region has a highly developed financial ecosystem with a strong emphasis on innovation and technological advancements. This environment has nurtured the growth of P2P lending platforms and attracted both borrowers and investors.

b. Some key players operating in the peer-to-peer lending market include LendingClub Bank; Lendermarket; Prosper Funding LLC; Proplend; PeerBerry; Upstart Network, Inc.; RateSetter; StreetShares, Inc.; Bondora Capital OÜ; AS Mintos Marketplace; Landbay Partners Limited.

b. Key factors that are driving the peer-to-peer lending market growth include the rising demand for alternative financing options and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.