- Home

- »

- Next Generation Technologies

- »

-

People Counting System Market Size, Industry Report, 2030GVR Report cover

![People Counting System Market Size, Share & Trends Report]()

People Counting System Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Offering, By Hardware, By Technology, by Mounting Platform, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-996-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

People Counting System Market Summary

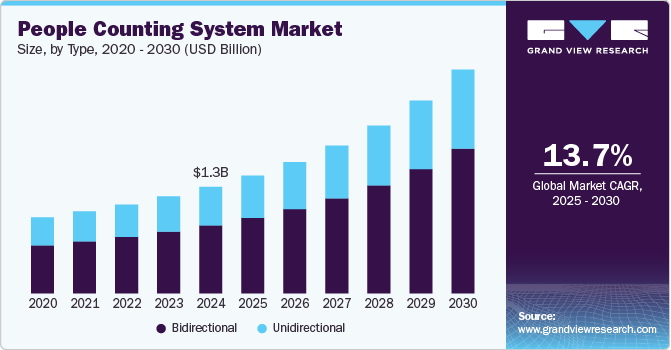

The global people counting system market size was estimated at USD 1.26 billion in 2024 and is projected to reach USD 2.65 billion by 2030, growing at a CAGR of 13.7% from 2025 to 2030. The increasing demand for real-time data analytics is driving growth in various sectors, especially in retail.

Key Market Trends & Insights

- The people counting system market in North America held a share of over 33.0% in 2024 owing to the widespread adoption of advanced people counting systems.

- The people counting system market in the U.S. is expected to grow significantly at a CAGR of 11.9% from 2025 to 2030

- Based on technology, the infrared beam segment accounted for the largest revenue share of over 33.0% in 2024.

- Based on mounting platform, the ceiling segment accounted for the largest revenue share of over 39.0% in 2024.

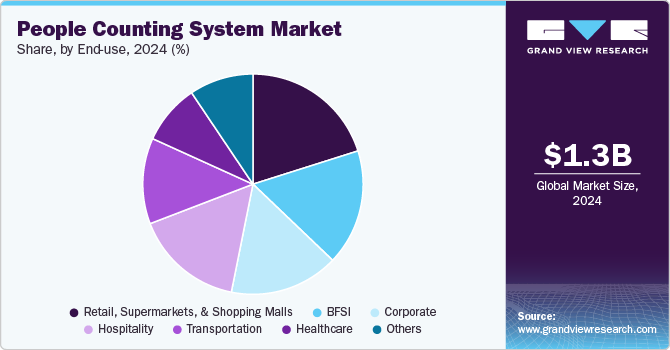

- Based on end use, the retail, supermarkets, and shopping malls segment accounted for the largest revenue share of over 20.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.26 Billion

- 2030 Projected Market USD 2.65 Billion

- CAGR (2025-2030): 13.7%

- North America: Largest market in 2024

Businesses place significant value on accurate foot traffic data to enhance decision-making. By analyzing how people move and behave in different spaces, companies can optimize staffing levels, manage inventory more efficiently, and refine their marketing strategies. This real-time data is particularly crucial in large public areas and retail environments, where understanding peak times and customer preferences can greatly influence revenue. The rise of IoT and cloud-based solutions has streamlined data collection, prompting more organizations to adopt people counting systems.

As smart building concepts become more popular, especially in developed regions, the integration of people counting systems has become essential. These systems optimize energy use by adjusting heating and lighting based on occupancy, leading to improved overall building management. The Internet of Things (IoT) plays a crucial role by enabling connected devices and sensors to collect and transmit data about building occupancy. Additionally, people counting technologies are increasingly integrated with other smart building solutions, creating a more comprehensive and intelligent environment.

With a growing emphasis on security in both public and private spaces, people counting systems are increasingly being used to enhance surveillance and manage crowd control. Airports, shopping malls, and stadiums rely on these systems to monitor occupancy levels, ensure public safety, and comply with regulations regarding maximum capacity. By analyzing crowd movement patterns, security teams can proactively address bottlenecks and high-density situations, ultimately reducing the risks associated with overcrowding.

The rise of e-commerce has significantly affected physical retail spaces, prompting many stores to reassess how they attract foot traffic. With fewer customers visiting in person, brick-and-mortar stores are focusing on maximizing the impact of each visitor. People counting technology enables retailers to measure the effectiveness of promotions, optimize store layouts, and refine staffing schedules. As physical stores continue to adapt to the challenges posed by e-commerce, they are increasingly investing in people-counting systems to enhance the shopping experience and improve operational efficiency.

Type Insights

The bidirectional segment accounted for the largest revenue share of over 63.0% in 2024 due to the growing demand for highly accurate data on occupancy and customer movement. By distinguishing between inbound and outbound foot traffic, these systems provide businesses with a clear picture of actual occupancy rates, peak times, and conversion ratios. Retailers, for instance, can precisely calculate how many unique visitors convert to customers or leave without making purchases. The high accuracy of bidirectional systems makes them invaluable for optimizing staffing, improving marketing strategies, and fine-tuning the customer experience.

The unidirectional segment is expected to grow at a CAGR of 17.0% over the forecast period. Advancements in sensor technology have improved the accuracy and reliability of unidirectional systems, drivers their adoption. Infrared and thermal sensors can accurately detect and count individuals as they move through an entry or exit point, even in challenging lighting or weather conditions. These advancements help minimize errors such as double counting or missing individuals, which is critical for locations where precise occupancy data is necessary. This improved accuracy expands the range of environments in which unidirectional systems can be used effectively, enhancing their appeal.

Offering Insights

The hardware segment accounted for the largest revenue share of over 62.0% in 2024. As sustainability initiatives become more prominent, there is a growing focus on energy-efficient hardware in the market. Many organizations are prioritizing hardware that consumes minimal power, operates efficiently, and has a long operational life. Manufacturers are responding by designing energy-efficient people-counting devices that comply with green building standards, appealing to organizations focused on reducing their environmental footprint. This demand for sustainable hardware is particularly high in smart building projects, which aim to reduce energy usage through automated lighting and HVAC systems based on occupancy data.

The software segment is expected to grow at a significant CAGR over the forecast period. AI and machine learning technologies are transforming people counting systems by making them more accurate. Advances in facial recognition, image processing, and sensor technology allow these systems to identify and count individuals with high accuracy in challenging environments. Modern systems can distinguish between individuals based on attributes such as height or walking patterns, providing specific data that can be used to analyze customer demographics and behavior.

Hardware Insights

The thermal cameras segment accounted for the largest revenue share of over 61.0% in 2024. The cost of thermal camera technology has decreased significantly due to advancements in manufacturing processes and increased competition among suppliers. This drop in price, along with the improved affordability of related hardware and software, has made thermal cameras more accessible to a wider range of businesses and organizations. Additionally, the lower total cost of ownership associated with thermal cameras such as reduced maintenance requirements and longer lifespans makes them an attractive option for budget-conscious buyers.

The fixed cameras segment is expected to grow at a significant CAGR over the forecast period owing to the significant advancements in imaging technology, such as high-definition (HD) and 4K video capabilities. These improvements enhance the accuracy and reliability of people counting, as high-resolution images can capture clearer details of individuals in diverse lighting conditions and environments. In addition, features like wide-angle lenses and low-light performance expand the usability of fixed cameras, making them suitable for various mounting platforms in retail stores, public transport systems, and large venues.

Technology Insights

The infrared beam segment accounted for the largest revenue share of over 33.0% in 2024 Infrared beam people counting systems are often more cost-effective compared to more advanced technologies, such as 3D or thermal imaging systems. Their relatively simple installation and low maintenance needs make them an attractive choice for businesses looking to implement people counting solutions without a significant financial burden. This cost advantage is particularly appealing for small to medium-sized enterprises and public spaces that need efficient monitoring without extensive investment.

The video-based technology segment is expected to grow at a significant CAGR over the forecast period. As businesses strive to enhance customer experience and optimize operations, video-based people counting systems provide valuable insights. By understanding customer behavior, businesses create more engaging environments and improve service delivery.

Mounting Platform Insights

The ceiling segment accounted for the largest revenue share of over 39.0% in 2024. The rise of smart building solutions is a major growth driver for the ceiling mounting platform segment. Many organizations are now incorporating people counting systems into broader smart building frameworks that utilize IoT technology to manage various building operations. Ceiling-mounted systems can seamlessly integrate with other smart devices, such as HVAC systems, lighting controls, and security systems, to optimize energy use and enhance occupant comfort.

The wall segment is expected to grow at a significant CAGR over the forecast period. The flexibility of wall-mounted people counting systems allows them to be used across a wide range of industries beyond traditional retail and hospitality. For example, educational institutions are increasingly adopting these systems to monitor classroom occupancy, optimize space usage, and enhance safety protocols. Healthcare facilities utilize wall-mounted people counting for patient flow analysis and to ensure compliance with safety regulations. As more sectors recognize the benefits of people counting technology, the growth potential for wall-mounted platforms expands.

End Use Insights

The retail, supermarkets, and shopping malls segment accounted for the largest revenue share of over 20.0% in 2024. With the retail industry becoming more data-centric, the demand for advanced analytics tools is on the rise. People counting systems contribute significantly to retail analytics by offering insights that help retailers understand customer behavior, preferences, and trends. Retailers can use this data to refine marketing strategies, optimize promotional activities, and enhance the overall shopping experience. The growing emphasis on analytics as a competitive differentiator drives further investment in people counting technologies.

The hospitality segment is expected to grow at a significant CAGR over the forecast period in the people counting system industry. The hospitality industry is increasingly adopting smart technologies to enhance operational capabilities and guest experiences. People counting systems are being integrated with other smart solutions such as automated lighting, HVAC systems, and security features. For example, occupancy data can trigger energy-efficient adjustments to heating and cooling systems, leading to cost savings and a reduced environmental footprint.

Regional Insights

The people counting system market in North America held a share of over 33.0% in 2024 owing to the widespread adoption of advanced people counting systems. The integration of artificial intelligence (AI), machine learning, and computer vision is enhancing the accuracy and functionality of these systems. These technologies enable real-time data analytics, allowing businesses to gain deeper insights into customer behavior and occupancy patterns.

U.S. People Counting System Industry Trends

The people counting system market in the U.S. is expected to grow significantly at a CAGR of 11.9% from 2025 to 2030 driven by the integration of artificial intelligence (AI) and machine. These technologies enhance the accuracy and functionality of counting solutions, enabling businesses to gather richer data insights. For instance, AI algorithms can analyze patterns in foot traffic, allowing organizations to forecast trends, optimize layouts, and improve customer engagement strategies.

Europe People Counting System Industry Trends

The people counting system market in Europe is growing with a significant CAGR from 2025 to 2030. European cities are increasingly implementing people counting technologies in buses, trains, and metro systems to monitor passenger flows and optimize schedules. This trend is complemented by the rise of smart mobility solutions, where data collected from people counting systems informs transportation planning and enhances the efficiency of public transport services.

The UK people counting system market is expected to grow rapidly in the coming years. As companies focus on employee well-being and safety, the need for people counting systems to monitor employee occupancy and social distancing is on the rise. These systems help businesses track employee attendance in offices, warehouses, and manufacturing plants, ensuring a safe working environment and compliance with health guidelines.

The people counting system industry in Germany held a substantial market share in 2024. Businesses in Germany are seeking customizable and flexible people counting solutions that can adapt to their unique operational needs. This trend is leading to the development of modular systems that can be tailored to fit different environments, such as retail stores, transportation hubs, and corporate offices. Vendors are focusing on providing solutions that allow organizations to implement and scale systems based on their specific requirements.

Asia Pacific People Counting System Market Trends

Asia Pacific is growing significantly at a CAGR of 15.6% from 2025 to 2030 due to the growing urbanization, with large populations migrating to urban centers. This trend has led to increased foot traffic in various sectors, including retail, transportation, and hospitality. People counting systems are being adopted to manage and analyze this foot traffic effectively, enabling businesses to optimize operations, enhance customer experiences, and improve safety measures in densely populated areas.

The Japan people counting system industry is expected to grow rapidly in the coming years. People counting systems in Japan are increasingly being integrated with other technologies, such as customer relationship management (CRM) systems, marketing automation tools, and building management systems. This integration enables businesses to utilize foot traffic data more effectively, enhancing customer engagement strategies and improving operational efficiencies.

The people counting system market in China held a substantial market share in 2024.The Chinese government is actively promoting smart city initiatives, which include the technology of people counting systems. These systems are used to gather data on pedestrian traffic, assisting urban planners and policymakers in making informed decisions regarding infrastructure development, public transport, and community services. The integration of people counting solutions into smart city frameworks is fostering a data-driven approach to urban management, enhancing the quality of life in urban areas.

Key People Counting System Company Insights

Key players operating in the people counting system industry are Axis Communications AB, Hikvision Digital Technology Co., Ltd., InfraRed Integrated Systems Ltd (IRISYS),Sensormatic Solutions, and RetailNext Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Sensormatic Solutions partnered with Thruvision Ltd, a UK-based security screening technology provider, to make advanced people screening more accessible to retailers worldwide. Thruvision Ltd’s passive terahertz camera technology and scanning software will complement Sensormatic’s loss prevention solutions, offering retailers a fast, respectful, and effective option for people screening in distribution centers and logistics facilities, aimed at reducing internal shrink.

-

In March 2024, Axis Communications AB launched a thermographic camera that is explosion-proof and specifically engineered for use in Zone and Division 2 hazardous environments. The camera allows for remote temperature monitoring, improving operational efficiency and extending its detection capabilities into Zone and Division 1 areas. With its automated alert functionality, the camera can provide early warnings about equipment overheating, enabling faster and more effective responses compared to traditional handheld devices that require manual location checks.

Key People Counting System Companies:

The following are the leading companies in the people counting system market. These companies collectively hold the largest market share and dictate industry trends.

- Axis Communications AB

- DILAX Intelcom GmbH

- HELLA Aglaia Mobile Vision GmbH

- Hikvision Digital Technology Co., Ltd.

- RetailNext Inc.

- Sensormatic Solutions

- ShopperTrak

- Teledyne FLIR LLC

- V-Count

- Xovis AG

People Counting System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.39 billion

Revenue forecast in 2030

USD 2.65 billion

Growth rate

CAGR of 13.7% from 2025 to 2030

Actual data

2018 - 2023

Base year for estimation

20244

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report type

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, offering, technology, mounting platform, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Axis Communications AB; DILAX Intelcom GmbH; HELLA Aglaia Mobile Vision GmbH; Hikvision Digital Technology Co., Ltd.; InfraRed Integrated Systems Ltd (IRISYS); RetailNext Inc.; Sensormatic Solutions; ShopperTrak; V-Count; Xovis AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global People Counting System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the people counting system market report based on type, offering, technology, mounting platform, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Unidirectional

-

Bidirectional

-

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Thermal Cameras

-

Infrared Sensors

-

Fixed Cameras

-

Fixed Dome Cameras

-

Pan-Tilt-Zoom Cameras

-

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrared beam

-

Thermal Imaging

-

Video- based Technology

-

Others

-

-

Mounting Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceiling

-

Wall

-

Floor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail, Supermarkets, and Shopping malls

-

Transportation

-

Hospitality

-

Corporate

-

BFSI

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global people counting system market was valued at USD 1.26 billion in 2024 and is expected to reach USD 2.32 billion in 2025.

b. The global people counting system market is expected to grow at a compound annual growth rate of 13.7% from 2025 to 2030 to reach USD 3.53 billion by 2030.

b. The people counting system market in North America held a share of over 33.0% in 2024 owing to the widespread adoption of advanced people counting systems. The integration of artificial intelligence (AI), machine learning, and computer vision is enhancing the accuracy and functionality of these systems.

b. Some key players operating in the people counting system market include Axis Communications AB, DILAX Intelcom GmbH, HELLA Aglaia Mobile Vision GmbH, Hikvision Digital Technology Co., Ltd., InfraRed Integrated Systems Ltd (IRISYS), RetailNext Inc., Sensormatic Solutions, ShopperTrak, V-Count, and Xovis AG.

b. The increasing demand for real-time data analytics is driving growth in various sectors, especially in retail. Businesses place significant value on accurate foot traffic data to enhance decision-making. By analyzing how people move and behave in different spaces, companies can optimize staffing levels, manage inventory more efficiently, and refine their marketing strategies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.