- Home

- »

- Medical Devices

- »

-

Per Diem Nurse Staffing Market Size & Share Report, 2030GVR Report cover

![Per Diem Nurse Staffing Market Size, Share & Trends Report]()

Per Diem Nurse Staffing Market Size, Share & Trends Analysis Report By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-599-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Per Diem Nurse Staffing Market Trends

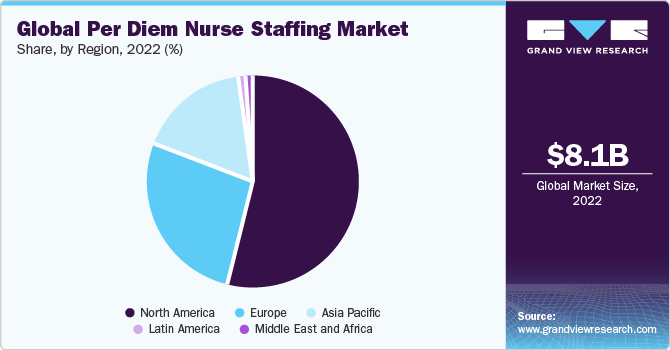

The global per diem nurse staffing market size was valued at USD 8.13 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. High demand for Medical-surgical nurses and increasing utilization of staffing agencies, shortage in demand for primary care physicians, in turn, increasing demand for Family Nurse Practitioners are some of the factors expected to boost the market growth. Per diem nursing staff is preferred to meet requirements comprising immediate needs or to compensate for last-moment shift cancellations where other nursing staff including travel nurses, cannot be employed. Proper nursing care is one of the most important factors determining patient satisfaction and facilitates the speedy recovery of patients. Thus, maintaining a sufficient nurse-to-bed ratio is crucial to ensure that each patient receives the required nursing services.

The nurse-to-bed ratio generally means the number of nurses per available hospital bed. Due to long working shifts and high patient volume in hospitals, nurses are sometimes overburdened. Per diem nursing services can help in reducing the work burden of nurses. Per diem nurses are employed in healthcare facilities temporarily. These nurses fill in for regular staff or can be employed during flu seasons or for sick calls. According to the 2020 United Nations Department of Economic & Social Affairs data, the global geriatric population is 727 million. The rise in life expectancy results in a higher risk of age-related chronic diseases like cardiovascular diseases (CVDs), diabetes, arthritis, etc.

This, in turn, is resulting in a higher burden on healthcare systems, giving a boost to the demand for per diem nurse staffing. Employment & payment of per diem nurses are done daily via hospital staffing pools or specialized job placement agencies. Nurses are looking for opportunities to gain more work experience to explore future job prospects. The per diem assignments, though, are temporary. The nurses get good compensation for working flexible schedules, which is driving more nurses to do these assignments. One of the important factors driving the market growth is the benefits and advantages of becoming a per diem nurse. Apart from their passion for serving others, nurses give high importance to flexible work schedules.

For instance, according to an article published by Norwich University, before the COVID-19 pandemic, there was a shortage of nurses in the healthcare industry. Because there weren't enough nurses, they sometimes had to work long hours or take care of more patients than they should, which could make them very tired and more likely to make mistakes. According to the U.S. Bureau of Labor Statistics, there are about 194,500 open positions for registered nurses (RNs) annually. One of the reasons for this shortage is that up to 57% of nurses stop being nurses within the first three years and between 17% and 30% leave in their first year. Also, many nurses start retiring when they're around 51 years old, which puts even more pressure on the nursing profession.

In addition, according to NITI Aayog, Government of India, there are currently 1.3 hospital beds for every 1,000 people in India. However, there's a shortage of skilled healthcare workers, with only 0.65 physicians and 1.3 nurses per 1,000 people, which is lower than the recommended standard set by the World Health Organization. To reach the goal of having 3 hospital beds per 1,000 people by 2025, the country will need an additional 3 million beds. Moreover, there's a demand for about 1.54 million more doctors and 2.4 million nurses to meet the growing healthcare needs. Initiatives like Ayushman Bharat (PM-JAY) will also create a need for more healthcare personnel in various cities and villages. To have at least 2.5 doctors and 5 nurses for every 1,000 people by 2034, India will have to train more healthcare professionals across different categories.

During the COVID-19 pandemic, to increase the supply of healthcare professionals in the current health crisis, governments of many countries have eased regulations for nursing licenses. For instance, in the U.S., the government allowed licensed nurses of one state to practice in another through enhanced Nursing Licensure Compact (eNLC). Currently, over 38 U.S. states have enacted eNLC. According to the Assistant Secretary for Planning and Evaluation, during the initial phase of the pandemic, many healthcare workers not directly involved with COVID-19 patients faced reduced work hours or temporary leave. In May 2020, around 15% of hospital workers and 23% of non-hospital healthcare workers couldn't work due to pandemic-related closures or business losses. These percentages dropped to 1-2% by the end of 2020. The overall employment in the healthcare sector decreased in the early pandemic months but has been gradually improving since the summer of 2020.

Regional Insights

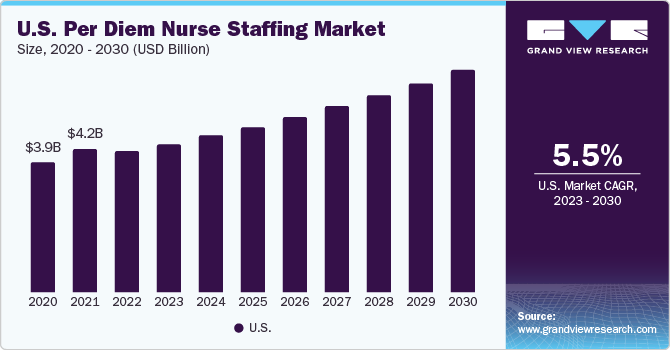

North America dominates the per diem nurse staffing market in terms of revenue, accounting for a share of over 50% in 2022. The region is expected to grow at a significant rate over the forecast period owing to factors such as the adoption of staffing services to allocate nurses at various healthcare facilities is expected to drive the market growth. For instance, according to the Bureau of Labor Statistics' predictions for job trends between 2021 and 2031, the number of Registered Nurses (RNs) is expected to go up by about 6%. This means that the group of RNs is likely to grow from 3.1 million in 2021 to around 3.3 million in 2031, adding nearly 195,400 more nurses. The Bureau also expects that there is expected to be about 203,200 job opportunities available for RNs every year up until 2031. This considers the fact that some nurses are expected to retire or leave the workforce during this time.

Asia Pacific is expected to be the fastest-growing segment with a CAGR of 7.2% over the forecast period Asia Pacific is expected to grow significantly in the coming years. Key factors driving the market for per diem nurse staffing include an increasing number of government initiatives to strengthen the healthcare systems and improve healthcare access in rural areas, resulting in various hospital projects. For instance, according to a report published by NITI Aayog, Government of India, from 2016 to 2021, India's healthcare industry experienced a Compound Annual Growth Rate of approximately 22%. At this pace, it was projected to have reached USD 372 Billion by 2022. Over this period, healthcare transformed into one of India's most significant sectors in earnings and workforce. In 2015, the healthcare sector became the fifth largest employer, directly providing jobs for 4.7 million people. According to the National Skill Development Corporation (NSDC), healthcare had the potential to generate 2.7 million additional jobs between 2017-22, amounting to over 500,000 new jobs annually. Over the last two decades, India emerged as one of the rapidly expanding emerging economies, attracting substantial Foreign Direct Investment (FDI) inflows. These inflows grew from USD 2.5 Billion in 2000-01 to USD 50 Billion in 2019-20.

Key Companies & Market Share Insights

The market is fragmented with the presence of well-established as well as small-scale players, leading to higher competition among smaller players to sustain their market position. The high demand for nursing services by healthcare facilities leads to players adopting various strategies, such as mergers & acquisitions, to maintain their market stronghold. For instance, in 2022, Cross Country Healthcare and the National Black Nurses Association (NBNA) teamed up to create a scholarship fund for black nurses in the U.S. The fund will provide scholarships to black nurses enrolled in accredited nursing programs in the U.S. The scholarships will be awarded based on academic merit, financial need, and leadership potential. The scholarship fund is a great way to support black nurses and help them achieve their dreams of becoming healthcare professionals.

Key Per Diem Nurse Staffing Companies:

- Cross Country Healthcare

- Health trust Workforce Solutions

- Maxim Healthcare Group

- Supplemental Health Care

- Accountable Healthcare Staffing

- AMN Healthcare

- Nurse Staffing LLC

- GHR Healthcare

- Interim HealthCare Inc.

- CareerStaff Unlimited

Per Diem Nurse Staffing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.60 billion

Revenue forecast in 2030

USD 13.07 billion

Growth rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan, China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cross Country Healthcare; Health trust Workforce Solutions; Maxim Healthcare Group; Supplemental Health Care; Accountable Healthcare Staffing; AMN Healthcare; Nurse Staffing LLC; GHR Healthcare; Interim HealthCare Inc.; CareerStaff Unlimited

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Per Diem Nurse Staffing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global per diem nurse staffing market report based on region:

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global per diem nurse staffing market size was estimated at USD 8.13 billion in 2022 and is expected to reach USD 8.6 billion in 2023.

b. The global per diem nurse staffing market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 13.07 billion by 2030.

b. North America dominated the per diem nurse staffing market with a share of around 53% in 2022. This is attributable to the lack of skilled professionals, the growing baby boomer population, and the presence of several healthcare recruitment agencies in the region.

b. Some key players operating in the per diem nurse staffing market are Cross Country Healthcare; Health trust Workforce Solutions; Maxim Healthcare Group; Supplemental Healthcare; Accountable Healthcare Staffing; AMN Healthcare; Nurse Staffing LLC; GHR Healthcare; Interim HealthCare Inc.; CareerStaff Unlimited.

b. Key factors that are driving the per diem nurse staffing market growth include the rising demand for healthcare facilities and the shortage of skilled healthcare staff, and growth in the incidence rate of diseases such as cardiovascular diseases, arthritis, Alzheimer’s disease among the older population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."