- Home

- »

- Disinfectants & Preservatives

- »

-

Peracetic Acid Market Size & Share, Industry Report, 2030GVR Report cover

![Peracetic Acid Market Size, Share & Trends Report]()

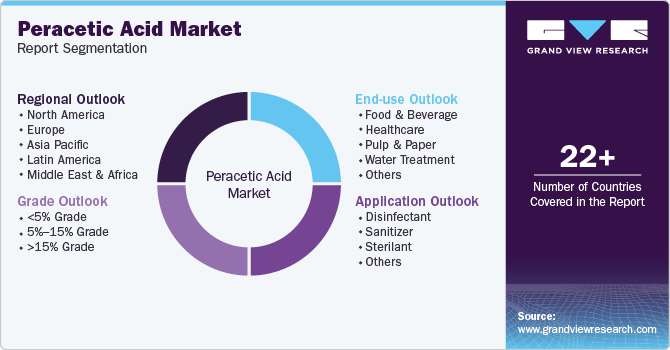

Peracetic Acid Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (<5%, 5%-15%, >15%), By Application (Disinfectant, Sanitizer, Sterilant), By End Use (F&B, Healthcare, Water Treatment), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-202-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Peracetic Acid Market Summary

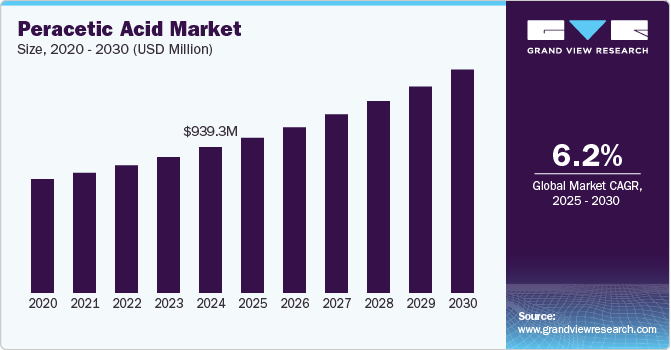

The global peracetic acid market size was estimated at USD 939.3 million in 2024 and is projected to reach USD 1.4 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. As the global population reached approximately 8 billion in 2023, urban areas continue to experience rapid population growth, intensifying the need for effective water treatment solutions.

Key Market Trends & Insights

- North America peracetic acid market held a substantial share in the global market in 2024.

- The U.S. dominated the North America peracetic acid market in 2024.

- Based on grade, the 5%-15% grade segment dominated the market in 2024.

- Based on application, the Disinfectants led the market with the largest revenue share in 2024.

- Based on end use, the healthcare segment held a substantial market share in 2024, fueled by peracetic acid’s efficacy as a medical instrument and equipment sterilizing agent.

Market Size & Forecast

- 2024 Market Size: USD 939.3 Million

- 2030 Projected Market Size: USD 1.4 Billion

- CAGR (2025-2030): 6.2%

- North America: Largest market in 2024

With projections indicating that nearly 1.6 billion people will encounter water shortages by 2030, the importance of robust disinfection methods, such as peracetic acid, becomes evident. Its efficacy in water treatment processes supports the market’s expansion by addressing critical public health concerns.

The need for stringent hygiene standards in the food and beverage sector propels the demand for effective antimicrobial agents such as peracetic acid. As food safety becomes increasingly paramount, especially for meat, poultry, and seafood products, peracetic acid’s role as a disinfectant is vital in preventing contamination and ensuring safe food production practices. According to the Food and Agriculture Organization (FAO), food security will remain a pressing issue, making the application of reliable disinfectants essential for maintaining high hygiene standards throughout the supply chain. This trend will continue to enhance the growth prospects of peracetic acid in this sector.

The healthcare industry is another significant driver for the peracetic acid market, as heightened global health expenditures and infection control measures contribute to increased demand for effective disinfectants. In 2022, the post-pandemic global healthcare spending reached approximately USD 8.3 trillion, with a substantial portion dedicated to sterilization practices in healthcare facilities. Peracetic acid’s proven effectiveness in disinfecting medical instruments and equipment positions it as a critical component in infection prevention protocols, solidifying its indispensable role in healthcare settings.

Furthermore, rising environmental awareness is influencing industries to adopt sustainable practices, further propelling the demand for peracetic acid. The United Nations Environment Programme (UNEP) indicates that over 70% of consumers today prefer environmentally friendly products, encouraging businesses to seek safer alternatives to traditional chlorine-based disinfectants. This shift toward eco-conscious solutions fosters a favorable market environment for peracetic acid, enhancing its appeal across various applications, including textile processing and pulp and paper manufacturing, particularly in rapidly industrializing regions.

Grade Insights

The 5%-15% grade segment dominated the market in 2024 due to its effective disinfectant and sanitizer properties across various industries, including food and beverage, healthcare, and water treatment. This concentration effectively controls pathogens while being gentler on equipment and surfaces than higher grades, making it a versatile and compliant choice for numerous applications.

>15% grade peracetic acid is expected to experience rapid growth over the forecast period as it is ideal for industrial applications requiring robust disinfection and sterilization. This concentration is particularly sought in healthcare for sterilizing medical instruments and food processing, where high-level sanitation is crucial. Its effectiveness against varied microorganisms further supports its adoption in demanding environments.

Application Insights

Disinfectants led the market with the largest revenue share in 2024, owing to the rising need for effective antimicrobial solutions in various sectors, notably healthcare, food processing, and water treatment. Peracetic acid’s broad-spectrum efficacy against bacteria, viruses, and fungi positions it as a preferred option for maintaining hygiene standards, with the increasing focus on infection control further promoting its use as a reliable disinfectant.

The sanitizer segment is expected to register lucrative growth over the forecast period. Peracetic acid’s rapid and safe pathogen elimination capabilities make it an effective sanitizer. Its utilization in personal care products, food processing, and healthcare reflects industry priorities toward sanitation, aimed at preventing infections and ensuring consumer safety.

End Use Insights

The healthcare segment held a substantial market share in 2024, fueled by peracetic acid’s efficacy as a medical instrument and equipment sterilizing agent. Its rapid action against a broad spectrum of pathogens ensures compliance with rigorous infection control protocols in medical, dental, and surgical settings. Increased focus on patient safety and hygiene standards drives its adoption in these vital healthcare applications.

The water treatment segment is projected to grow rapidly over the forecast period. The use of peracetic acid in tertiary disinfectants, CSO disinfectants, blend disinfectants, and more is anticipated to grow significantly. Peracetic acid is recognized for its effectiveness as a tertiary disinfectant and its role in wastewater treatment. Its capacity to eliminate harmful microorganisms is essential for ensuring safe drinking water. Growing concerns surrounding water quality and regulatory pressures for effective disinfection methods are anticipated to propel significant growth in this application area.

Regional Insights

North America peracetic acid market held a substantial share in the global market in 2024, driven by the growing demand for effective disinfectants across diverse industries such as food and beverage, healthcare, and water treatment. Strict regulations pertaining to sanitation and hygiene practices further augment market growth. Moreover, an increasing awareness of environmental sustainability propels the adoption of peracetic acid as a safer alternative to traditional chlorine-based disinfectants.

U.S. Peracetic Acid Market Trends

The U.S. dominated the North America peracetic acid market in 2024. A heightened focus on food safety and stringent hygiene standards significantly drives the demand for peracetic acid in various sanitizing applications. Furthermore, advancements in production technologies and a prevailing trend toward eco-friendly disinfectants contribute to the rising adoption of peracetic acid in the U.S.

Europe Peracetic Acid Market Trends

Europe peracetic acid market held substantial market share in 2024, fueled by stringent regulations governing hygiene and safety standards across multiple industries. The increased emphasis on sustainable practices is prompting a shift toward using environment-friendly disinfectants, including peracetic acid. Moreover, its proven effectiveness in food processing, water treatment, and healthcare supports increasing demand. Consequently, peracetic acid has emerged as a preferred solution for maintaining high regional sanitation levels.

The peracetic acid market in Germany is expected to grow rapidly over the forecast period, driven by the country’s strong industrial base and unwavering commitment to maintaining high hygiene standards, particularly in food processing and healthcare sectors. Stringent regulations regarding disinfection practices contribute to the increased adoption of effective antimicrobial solutions such as peracetic acid. Moreover, Germany’s proactive stance on sustainability and environment-friendly products enhances the growth prospects of this market.

Asia Pacific Peracetic Acid Market Trends

The Asia Pacific peracetic acid market is expected to grow significantly over the forecast period. The region is experiencing increased demand for effective disinfectants across food processing, healthcare, and water treatment sectors. The growing population necessitates safe drinking water and enhanced food safety measures. Furthermore, an increasing awareness of hygiene practices, coupled with regulatory support for effective sanitation solutions, plays a crucial role in market expansion in the region.

The peracetic acid market in China held a substantial share in the Asia Pacific peracetic acid market in 2024, propelled by the rapid expansion of its food processing industry and the implementation of stringent food safety regulations. The accelerated urbanization in the country is resulting in an increased demand for effective sanitation solutions in both industrial and domestic environments. Moreover, China’s commitment to improving water quality and addressing environmental challenges drives the adoption of peracetic acid as a reliable disinfectant, strengthening its market presence in the region.

Key Peracetic Acid Company Insights

Some key companies operating in the market include Ecolab, MITSUBISHI GAS CHEMICAL COMPANY, INC., and Evonik Industries AG. Companies are implementing strategic initiatives such as capacity expansion, product formulation enhancement, and partnerships to drive growth in emerging markets and meet rising demand in the food, healthcare, and water treatment sectors.

-

Evonik Industries AG provides high-quality products for applications such as food processing, water treatment, and healthcare. Their solutions are effective biocides and disinfectants designed to promote sustainability through environmentally friendly formulations and tailored innovations.

-

Kemira specializes in water treatment, pulp and paper, and disinfection applications. Their advanced solutions, such as KemConnect DEX, utilize performic acid for efficient wastewater disinfection, emphasizing sustainability, regulatory compliance, and enhanced operational efficiency.

Key Peracetic Acid Companies:

The following are the leading companies in the peracetic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Ecolab

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Evonik Industries AG

- Solvay

- Kemira

- Diversey, Inc

- FMC Corporation

- Enviro Tech Chemical Services, Inc.

- Aditya Birla Management Corporation Pvt. Ltd.

- SEITZ GmbH

Recent Developments

-

In November 2024, Ecolab acquired Barclay Water Management, enhancing its water safety solutions and digital monitoring capabilities, creating a new growth platform for industrial and institutional customers across North America.

-

In July 2024, Kemira acquired Norit’s UK reactivation operations, enhancing its water treatment portfolio by entering the activated carbon market to address the rising demand for micropollutant removal in Europe.

Peracetic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.0 billion

Revenue forecast in 2030

USD 1.4 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Grade, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Russia, China, Japan, India, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

Ecolab; MITSUBISHI GAS CHEMICAL COMPANY, INC.; Evonik Industries AG; Solvay; Kemira; Diversey, Inc; FMC Corporation; Enviro Tech Chemical Services, Inc.; Aditya Birla Management Corporation Pvt. Ltd.; SEITZ GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Peracetic Acid Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global peracetic acid market report based on grade, application, end use, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

<5% Grade

-

5%-15% Grade

-

>15% Grade

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Disinfectant

-

Sanitizer

-

Sterilant

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Bottling & Beverage

-

Fresh Produce

-

Meats, Poultry & Seafood

-

-

Healthcare

-

Medical

-

Surgical

-

Dental

-

-

Pulp & Paper

-

Bleaching

-

Others

-

-

Water Treatment

-

Tertiary Disinfectant

-

CSO Disinfectant

-

Blend Disinfectant

-

Others

-

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.