- Home

- »

- Disinfectants & Preservatives

- »

-

Peracetic Acid Market Size, Global Industry Research Report, 2025GVR Report cover

![Peracetic Acid Market Report]()

Peracetic Acid Market Analysis By Application (Food & Beverages (Fresh Produce, Meat, Poultry & Seafood), Healthcare (Surgical, Dental), Pulp & Paper, Water Treatment (Tertiary Disinfectant, CSO Disinfectant, Blend Disinfectant)) And Segment Forecast To 2025

- Report ID: GVR-1-68038-202-0

- Number of Pages: 91

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Bulk Chemicals

Industry Insights

The global peracetic acid market size exceeded USD 540 million in 2015. Growing usage of peracetic acid (PAA) as a sanitizer, disinfectant, and bleaching agent among key applications such as water treatment, food & beverages, and healthcare are expected to drive the market growth.

Key companies are using their resources such as R&D, sourcing channels to try to increase their footprint in developing regions. Also, private companies, with the help of government agencies, are trying to generalize usage of peracetic acid in applications such as water treatment.

Solvay S.A. entered into an agreement with the Environmental Protection Agency (EPA) of the U.S. for carrying out tests about the usage of PAA for water treatment. The agreement also included a study of the economic and commercialization aspects of PAA for water treatment applications.

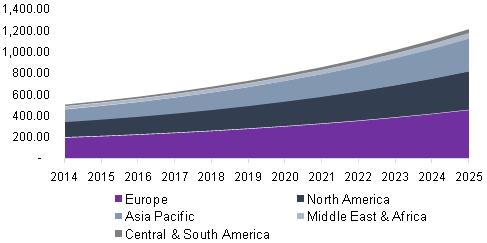

Global peracetic acid market revenue by region, 2014 - 2025 (USD Million)

Europe leads the peracetic acid market regarding valuation and is expected to do so over the forecast period. Generalization of PAA usage in the region and a strong presence of application industries are the reasons behind this scenario. Regarding revenue, Asia Pacific is expected to grow at the highest CAGR over the forecast period.

It has been gaining a lot of interest owing to its ability to provide bacterial inactivation performance at a cheaper cost over other disinfection technologies. Peracetic acid is being used in food, beverage, pharmaceutical, and medical industries for many years. The oxidation potential of the same is higher as compared to other disinfectants and, thus, it is used in wastewater and water treatment.Also, PAA does not produce halogenated DBPs, thus having a lower toxicity level as compared to chlorine. Their onsite usage also does not require special risk management plans as compared to certain toxic chemicals. These factors are expected to benefit global demand over the next nine years.

The concentrated peracetic form is considered to be hazardous and must be treated carefully owing to its corrosive nature. It may cause instant skin and eye burns on direct contact and is also prone to fire if the concentrate is allowed to soak in organic items, which primarily consist of rags, wood, or oily materials. However, regulations such as Globally Harmonized System of Classification and Labeling of Chemicals (GHS) have been prescribed to avoid potential hazards.

Application Insights

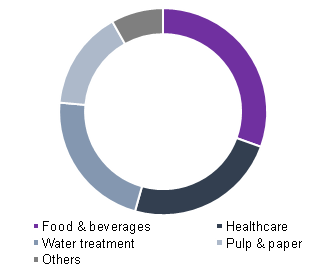

Food & beverages was the major application segment and the demand for it was 62.80-kilo ton in 2015. The effectiveness of peracetic acid in microbial contamination and development of application-based products are the primary contributors to this demand. Water treatment application segment demand is expected to grow at an anticipated CAGR of 8.0% over the forecast period. Government initiatives to inculcate peracetic acid to treat wastewater is expected to benefit demand growth.

Global peracetic acid market revenue share by application, 2015

PAA finds widespread applications in water treatment. It does not decompose into environmentally harmful by products thus is being favored by government agencies such as EPA. Also, it is cost-effective as well as efficient as compared to other options such as sodium hypochlorite. All these factors are expected to benefit the demand from water applications over the next nine years

Regional Insights

North American peracetic acid market demand was over 60-kilo tons in 2015 and is expected to grow at a moderate growth over the forecast period. Strong demand from the food & beverage sector in the region and increasing usage of PAA in water treatment are contributing to this demand.

In the U.S., demand for food & beverages was the highest in 2015, and this trend is expected to continue over the forecast period. Efforts taken by government agencies along with private companies to generalize PAA usage in water treatment is expected to contribute favorably to demand rise for water treatment and the segment is expected to witness the highest CAGR over the forecast period

Competitive Insights

The global peracetic acid market offers ample opportunities to new entrants due to the favorable regulatory scenario and rising awareness regarding its usage. Companies are providing their customers with technical assistance about troubleshooting of PAA applications. Major companies include Solvay S.A., Ecolab Inc., Peroxychem, Evonik Industries, FMC Corporation, Airedale Chemical Company, Diversey Inc, and others.

Peracetic Acid Report Scope

Attribute

Details

Customization Offer (15% free)*

Additional Cost

Base year

2015

NA

NA

Historic

2014 - 2015

Extended historic data (2012 to 2015)

Free

Forecast

2016 - 2025

Extended Forecast data (2025 - 2027)

Free

Report details

Size, company share, competitive Landscape, growth factors, trends

Contact us for specific information not available in this report

Quotation to be shared post feasibility

Market representation

Kilo Tons and USD Million

NA

NA

Geographic coverage

Global & Regional (by country)

Information on up to three additional countries

Free

Company profiles

All major industry players

Profiles of 10 additional companies

Free

*15% free customization - It is equivalent to work done by a research analyst for 5 working days

Segments covered in the report

This report forecasts volume & revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the peracetic acid market on the basis of applications and region:

- Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

- Food & Beverages

- Bottling & beverages

- Fresh produce

- Meats, poultry & seafood

- Health Care

- Medical

- Surgical

- Dental

- Pulp & Paper

- Bleach

- Others

- Water treatment

- Tertiary disinfectant

- CSO disinfectant

- Blend disinfectant

- Others

- Other applications

- Food & Beverages

- Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Asia Pacific

- China

- India

- Japan

- Central & South America

- Brazil

- Middle East & Africa

- Saudi Arabia

- North America

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."