- Home

- »

- Homecare & Decor

- »

-

Pest Control Service Market Size, Industry Report, 2030GVR Report cover

![Pest Control Service Market Size, Share & Trends Report]()

Pest Control Service Market (2024 - 2030) Size, Share & Trends Analysis Report By End-use (Insect, Rodents, Termite, Mosquito), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-973-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pest Control Service Market Summary

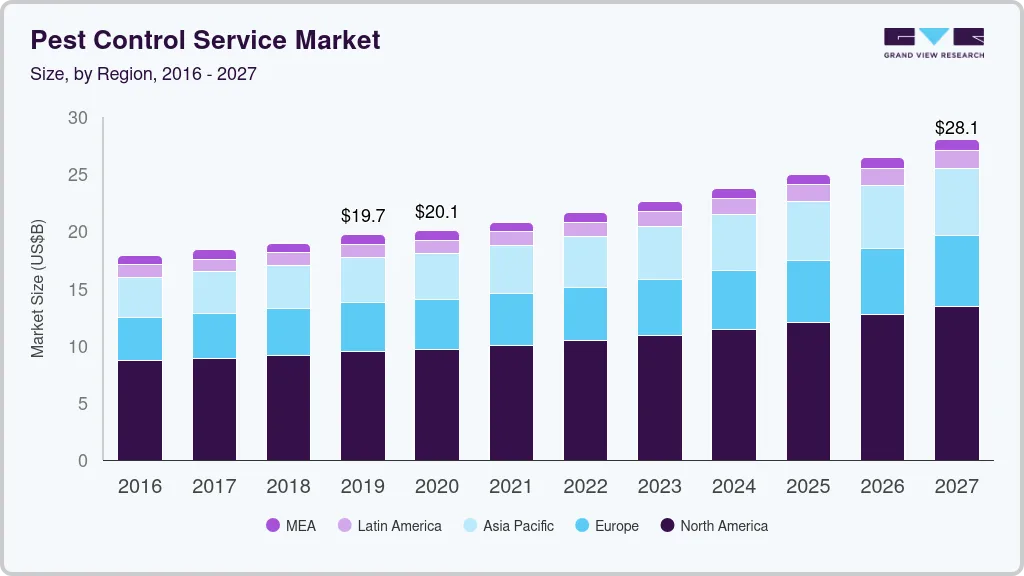

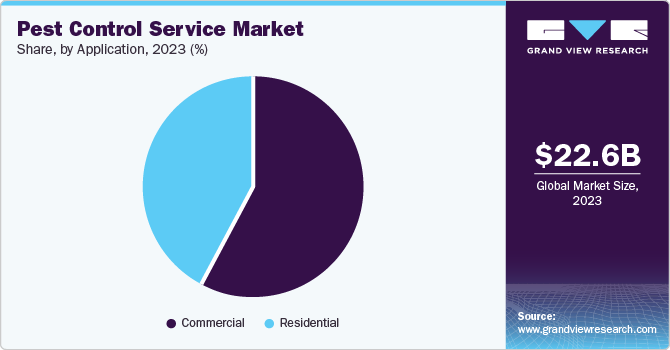

The global pest control service market size was estimated at USD 22.64 billion in 2023 and is projected to reach USD 34.3 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030. The increase in the need for pest control services for maintaining a hygienic environment in industrial areas, and residential & commercial settings is driving the market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, the insects segment dominated the market and accounted for a share of 42.4% in 2023.

- Residential segment is the most lucrative therapy segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 22.64 billion

- 2030 Projected Market Size: USD 34.3 billion

- CAGR (2024-2030): 6.3%

- North America: Largest market in 2023

The continuous research and development in pest control systems, growing awareness about health concerns, government initiatives regarding clean surroundings, and advancement in pest control technologies are the factors responsible for growth of the market.

Increasing focus on the usage of biocides is also acting as a major factor for market growth. These are increasingly being used to replace traditional pesticides as they are more environmentally friendly. The demand for pest control services is on the rise due to the ability to prevent the spread of pest-borne diseases such as viral and bacterial illnesses, malaria, and dengue caused by mosquito bites. Pest control also helps protect against property damage and ensures a safe and healthy living environment, contributing to overall public safety. The FDA's Food Safety Modernization Act (FSMA) highlights the impact of foodborne diseases, with approximately 48 million people in the U.S. falling ill, 128,000 being hospitalized, and 3,000 dying each year. This underscores the importance of pest control systems in safeguarding public health.The strict regulations regarding pest control, particularly in offices & workplaces, hospitals, hotels & restaurants, and industrial setups, are fueling the market growth. The increasing demand for pest control activities in the agriculture sector to prevent crop damage and yield loss. Additionally, the demand for pest control services in the food manufacturing sector is increasing, and manufacturers are largely investing in pest control systems to ensure clean and hygienic manufacturing of food products.

Application Insights

The commercial segment dominated the market in 2023. Commercial spaces have more rigorous health and safety rules, necessitating regular pest control to keep the environment healthy and free from pests. Commercial places, such as hospitals and food services, have strict government regulations regarding maintaining hygiene and cleanliness, driving the market's growth. Pest infestations in the commercial segment have severe consequences, and businesses are proactive about pest control. In industrial setups, pest control services are standard practices to avoid disruptions caused by pest outbreaks.

The residential segment is anticipated to grow at a significant CAGR over the forecast period. Residents are becoming aware of the health risks associated with pests. The mosquitoes and insects in and near residential areas transmit various diseases. The concern of property damage due to pests like termites and rodents is forcing homeowners to invest in preventative pest control services. Moreover, the rising disposable income of residents in various regions allows them to opt for pest control services, which is projected to drive the segment’s growth.

End-use Insights

The insects segment dominated the market and accounted for a share of 42.4% in 2023. Insects such as mosquitoes and ticks can cause severe harm to human health and transmit diseases. Insect pest control is important to prevent diseases such as allergies, malaria & dengue. The growing awareness about cleanliness in public places creates more demand for pest control. Additionally, the pest control industry is adopting new technologies for better monitoring and control methods, which drives the growth of pest control services in the market.

The termite segment is expected to grow at a significant CAGR over the forecast period. Termites threaten the wooden structures of homes and commercial buildings. This insect can extensively damage properties and wooden structures; therefore, timely detection and prevention are necessary. Pest control is the most effective method to get rid of termites. Furthermore, property owners are influenced by the developed, more specific, and environment-friendly termite control methods driving the market growth.

Regional Insights

North America pest control service market dominated the market with a revenue share of 48.1% in 2023. This is attributed to the use of Artificial Intelligence (AI) within the pest control service sector. AI-driven pest control solutions use data analysis to enhance pest control methods and crop health. Regulatory authorities in the region enforce stringent regulations regarding pest control practices. Consumers in the North American region are more receptive to adopting new technologies.

U.S. Pest Control Service Market Trends

The U.S. pest control service market dominated the North American market in 2023. Strict regulations in food safety and hospitality industries and increased awareness of pest-related health risks have further fueled market growth. Additionally, global leaders in the U.S. pest control industry, such as Rollins and Orkin, have contributed to the country's development.

Europe Pest Control Service Market Trends

Europe pest control service market was identified as a lucrative region in 2023. The growing urbanization in the region creates habitats for pests like rodents and pests. The increased density requires professional pest control services. The region has a strong focus on sustainable practices. The pest control industry is bringing eco-friendly solutions for environmentally conscious consumers.

The UK pest control service market is expected to grow rapidly in the coming years due to strict rules regarding pest control and public health. The UK government is increasingly outsourcing pest control services to private firms, boosting the country's market growth. Moreover, for effective waste management, the government is taking effective pest control measures to drive market growth.

Asia Pacific Pest Control Service Market Trends

Asia Pacific pest control service market is anticipated to witness significant growth in the coming years. The rapid urbanization in Asian countries such as India, China, and Japan provide opportunities for pest control service providers. The government is taking measures regarding cleanliness in the public areas further fueling the market.

Key Pest Control Service Company Insights

The global market is characterized by high competition. Companies are focusing on expanding their service footprint and are adopting strategies, such as mergers and acquisitions, to meet consumer demand for pest control services.

-

Rollins, Inc. is a holding company to several subsidiary companies such as Orkin, Inc., Home Team Pest Defense, Western Pest Services, and others. All these subsidiaries provide pest control services, including protection against termite damage, rodents, and insects in different countries across the globe.

Key Pest Control Service Companies:

The following are the leading companies in the pest control service market. These companies collectively hold the largest market share and dictate industry trends.

- Rentokil Initial plc

- Rollins, Inc.

- The ServiceMaster Company, LLC.

- Anticimex

- Arrow Exterminators

- Asante Inc.

- Dodson Pest Control, Inc.

- Ecolab

- Massey Services, Inc.

- Sanix

Recent Developments

-

In June 2024, Anchor Pest Control acquired A-Ablaze Pest Control. The acquisition is anticipated to expand Anchor Pest Control ‘s service offering and strengthen it market position in both commercial and residential segment.

-

In June 2024, Rentokil Terminix announced the opening of its State-of-the-art Innovation Center. The center focuses on developing pest control technology, research and development, innovative testing, training, and driving advancements in the pest control industry.

-

In March 2024, Terminix, a subsidiary of Rentokil, was named the official pest control partner of the United Soccer League (USL). This multi-year partnership will reinforce Terminix's commitment to what matters most: consumers and sports fans at the stadium or home.

-

In April 2023, Rollins, Inc. acquired Fox Pest Control (FPC Holdings, LLC), a leading pest management company. This acquisition will provide Rollins strategic growth opportunities in new geographies across the U.S.

-

In November 2021, Anticimex US announced the launch of the company’s new U.S. website.Anticimex has locations in more than 20 states and 18 countries, and the location can be accessed on the company’s user-friendly site.

Pest Control Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.7 billion

Revenue forecast in 2030

USD 34.3 billion

Growth Rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Rentokil Initial plc; Rollins, Inc.; The ServiceMaster Company, LLC.; Anticimex; Arrow Exterminators; Asante Inc.; Dodson Pest Control, Inc.; Ecolab; Massey Services, Inc.; Sanix

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pest Control Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pest control service market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Insect

-

Rodents

-

Termite

-

Mosquito

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.