- Home

- »

- Homecare & Decor

- »

-

Pet Care Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Pet Care Market Size, Share & Trends Report]()

Pet Care Market (2022 - 2030) Size, Share & Trends Analysis Report By Pet Type (Dog, Cat, Fish, Bird), By Type (Product, Food), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-133-7

- Number of Report Pages: 84

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global pet care market size valued at USD 150.67 billion in 2021 and projected to reach USD 236.16 billion by 2030, growing at a CAGR of 5.1% from 2022 to 2030.The rising trend of pet humanization and increased consumer spending in the household and pet care categories are the major growth drivers.

Market Size & Trends

- The North America pet care market generated a revenue of USD 68,675.2 million in 2022.

- The market is expected to grow at a CAGR of 4.9% from 2023 to 2030.

- In terms of segment, dog was the largest revenue generating pet type in 2022.

- Bird is the most lucrative pet type segment registering the fastest growth during the forecast period.

- Country-wise, U.S. is expected to register the highest CAGR from 2023 to 2030.

Key Market Statistics:

- 2021 Revenue: $150.67 Billion

- 2030 Estimated Value: $236.16 Billion

- CAGR: 5.1% (2022-2030)

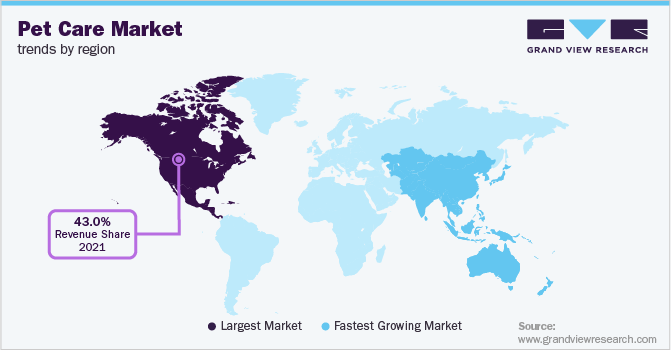

- North America: largest market in 2021

- Asia Pacific: Fastest growing market

The rising trend of pet humanization and increased consumer spending in the household and pet care categories are the major growth drivers. People are also adopting little pets (cats, dogs, etc.) Since they are easier to humanize and indulge than larger pets. As a result, people are willing to spend more to ensure their pets get the best care. Hence, pet care products such as feeders, bowls, and waterers have become more popular.The pet sector has been exploding in recent years. According to the American Pet Products Association, about 85 million homes own a pet, with pet ownership increasing from 56 % to 68 % in the last 30 years. Technology and the introduction of internet purchases have contributed to some of the changes in pet ownership.

Many people were forced to stay at home for an extended amount of time as a result of COVID-19's impacts, whether owing to shelter-in-place orders or work-from-home advice. Soon after this increased time spent at home, and pet shelters recorded an increase in adoptions and fostering.

However, the majority of the expansion is due to cultural shifts. As millennial and Generation Z consumers have grown into adulthood, they have embraced their pet-owning and pet-loving lives significantly more than their predecessors. In 2020, households headed by the younger generation account for roughly 60% of pet ownership, whilst households headed by baby boomers account for about 30% of pet ownership.

Furthermore, pet owners are demonstrating a strong desire to learn more about pet health issues. They are promoting companion animal preventive care. As a result, responsible pet ownership has been increasingly popular in recent years. This is also a crucial trend that is driving pet care product sales and, as a result, the pet care industry.

Moreover, people are making lifestyle upgrades to mark their share in reducing the ecological footprint in daily lives which includes pet products too. A significant share of pet accessories is made with more sustainable and recyclable materials instead of plastics. For instance, in February 2022, Neo Bites became the first Carbon-negative dog food company in the U.S.

Pet Type Insights

The dog segment accounted for over 39% of the revenue share in 2021. The most popular pets are dogs, followed by cats. Dogs are known to relieve anxiety, stress, and depression, as well as loneliness, promote cardiovascular health, and encourage exercise, all of which contribute to their popularity. Pet furniture is often preferred by people who live in flats and apartments and do not have a lawn or porch where their pets can live. This category is projected to boost the pet care market due to these factors.

Moreover, the cat pet type segment is projected to register a CAGR of 5.3% from 2022 to 2030. The increasing number of cat owners across the globe is expected to positively impact market growth. Furthermore, the rising number of single-person households coupled with the increasing willingness to own at least one pet has been majorly contributing to the market growth in developed countries over the past few years.

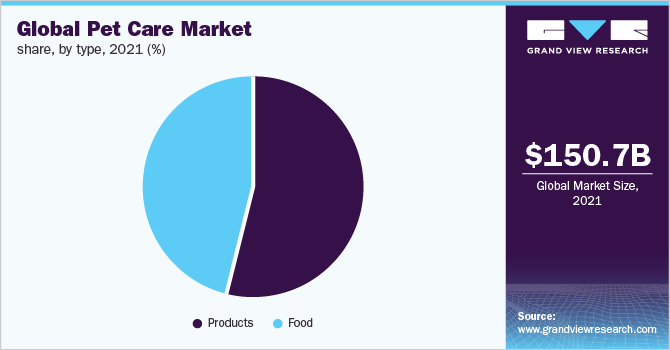

Type Insights

The product type segment accounted for over 54% of the revenue share in 2021. With a growing focus on climate change, more sustainably created and eco-friendly pet products are launched in the market which is likely to drive the growth of the pet care market during the forecast period. Moreover, growing consumer awareness about pet-related products is favoring the growth of the industry.

The pet food type segment is projected to register a CAGR of 5.3% from 2022 to 2030. Pet food consists of meat, meat byproducts, grains, cereals, vitamins, and minerals. Growing concerns among pet owners about the health and well-being of their companion animals are primarily driving the demand for quality pet food. Additionally, home delivery services provided by online stores and clean labeling are some of the factors expected to boost the growth of the segment.

Regional Insights

North America accounted for the largest revenue share of around 43% in 2021. The rising number of pet owners in the region, combined with high disposable incomes, is creating a demand for pet care products and services. According to the 2021-2022 National Pet Owners Survey conducted by the American Pet Products Association (APPA), around 70% of U.S. households owned a pet in 2020; this was up from 67% in 2019.

Asia Pacific is expected to expand at the fastest CAGR of 5.6% during the forecast period. The Asia Pacific pet care industry is likely to witness rapid growth, owing to rapid economic expansion and rising disposable income, which are expected to boost consumer spending on pet care products. Furthermore, rising pet ownerships and rising spending on pet care products are aspects that contribute to the regional market growth.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Companies have been expanding their product portfolios by incorporating new and innovative pet care products to widen their consumer base.

-

In December 2021, the Medium Slicker Head Brush, Double-Sided Bath Pin Brush, and Double-Sided Flex Slicker Brush are among the new premium dog grooming accessories offered by Wahl Animal

-

In October 2020, Armitage Pet Care Ltd., a company that specializes in premium pet treats and toys, has been acquired by Spectrum Brands Holdings, Inc. By adding pet items to the company's client base, capabilities, and reach, this acquisition expanded the company's customer base, capabilities, and reach

Some prominent players in the global pet care market include:

-

Ancol Pet Products Limited

-

Blue Buffalo Co., Ltd.

-

Champion Petfoods LP

-

Hill`s Pet Nutrition, Inc.

-

Mars, Incorporated

-

Nestle Purina PetCare

-

Petmate Holdings Co

-

Saturn Petcare GmbH

-

Tail Blazers

-

The Hartz Mountain Corporation

Pet Care Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 159.10 billion

Revenue forecast in 2030

USD 236.16 billion

Growth rate

CAGR of 5.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Ancol Pet Products Limited; Blue Buffalo Co., Ltd.; Champion Petfoods LP; Hill`s Pet Nutrition, Inc.; Mars, Incorporated; Nestle Purina PetCare; Petmate Holdings Co; Saturn Petcare GmbH; Tail Blazers; The Hartz Mountain Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Care Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global pet care market report based on pet type, type, and region:

-

Pet Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Dog

-

Cat

-

Fish

-

Bird

-

Others

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Products

-

Pet Litter

-

Pet Grooming Products

-

Fashion, Toys, and Accessories

-

-

Food

-

Dry Food

-

Wet/ Canned

-

Treats/ Snacks

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global pet care market size was estimated at USD 150.67 billion in 2021 and is expected to reach USD 159.10 billion in 2022.

b. The global pet care market is expected to grow at a compound annual growth rate of 5.1% from 2022 to 2030 to reach USD 236.16 billion by 2030.

b. North America region dominated the global pet care market with a share of 43.2% in 2021. This is attributable to the growing number of pet owners and increasing awareness about good veterinary health.

b. Some key players operating in the global pet care market include Ancol Pet Products Limited, Blue Buffalo Co., Ltd., Champion Petfoods LP, Hill`s Pet Nutrition, Inc., and Mars, Incorporated.

b. Key factors that are driving the pet care market growth include high demand for pet products, grooming & boarding services and the global rise in the adoption of pets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.