- Home

- »

- Electronic & Electrical

- »

-

Pet Monitoring Camera Market Size, Industry Report, 2030GVR Report cover

![Pet Monitoring Camera Market Size, Share & Trends Report]()

Pet Monitoring Camera Market Size, Share & Trends Analysis Report By Product (One-Way Video Functionality, Two-Way Video Functionality), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-439-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Pet Monitoring Camera Market Size & Trends

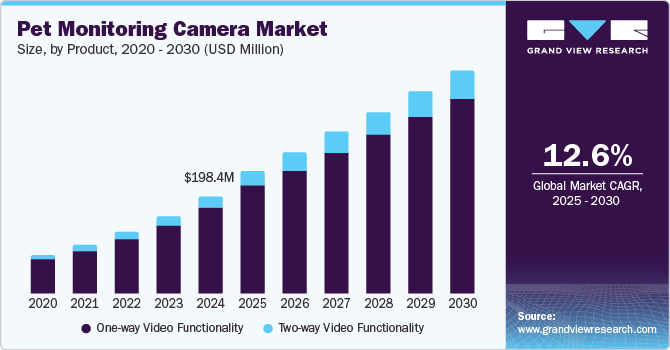

The global pet monitoring camera market size was valued at USD 198.4 million in 2024 and is expected to grow at a CAGR of 12.6% from 2025 to 2030. This growth can be attributed to the increasing number of pet owners who consider pets a part of their family and want to ensure their safety and well-being while away from home. As more people, particularly young generations, adopt pets, the demand for effective monitoring solutions is expected to surge, driving the market growth.

Modern pet monitoring cameras have features such as high-definition video streaming, two-way audio communication, and smart alerts to notify owners about the activities of their pets. Technological advancements are known to play a key role in the market expansion. For instance, some cameras have treat-dispensing capabilities, allowing owners to interact with their pets remotely and reward them for good behavior. These innovations enhance the user experience and meet the emotional needs of pet owners who want to stay connected with their pets.

There is a notable surge in the number of pet owners having the financial means to invest in technology with the rise in disposable income. Pet owners are willing to invest in high-quality monitoring devices to ensure that pets are safe and well-cared for when left alone at home. This trend is growing in urban areas where pet owners are more likely to have a busy schedule, leading to a greater demand for monitoring devices. An instance illustrating this trend is the introduction of multifunctional cameras by companies such as Petcube and PetSafe, which allow pet owners to monitor their pets and offer features such as automated feeding alerts based on pre-set schedules. This combination of convenience and innovative advanced technologies has increased the popularity of pet monitoring cameras among pet owners, further propelling the market growth.

Product Insights

The one-way video functionality segment accounted for the largest revenue share of 87.5% in 2024 due to the simplicity and effectiveness of these devices, allowing pet owners to monitor their pets remotely through live video feeds. One-way cameras typically offer high-definition video streaming and motion detection features, making them ideal for observing the behavior of pets and ensuring their safety while owners are away. Many pet owners prefer one-way cameras to keep a check on their pets and stay updated about their activities during the day, owing to their ease of setup and cost-effectiveness.

The two-way video functionality segment is expected to grow at the highest CAGR over the forecast period with the increasing demand for interactive pet care solutions. Pet owners are looking for ways to maintain a connection with their pets while they are away, and two-way video caters to this demand by offering real-time communication and enabling owners to see and speak with their pets. This feature provides reassurance, helps manage pet behavior, and reduces anxiety by allowing owners to engage with their pets remotely. For instance, many pet owners use two-way video cameras to comfort their pets during critical situations, such as thunderstorms or when they are left alone, enhancing the emotional bond between them and their pets.

Distribution Channel Insights

The offline segment dominated the market with the largest revenue share in 2024 due to the established presence of retail stores and the preference of many consumers to purchase products in person. Physical retail outlets, such as pet specialty stores and electronics retailers, allow customers to see and test the products before making a purchase, enhancing consumer confidence. In addition, these stores often offer expert advice and support, enabling pet owners to make informed decisions about which camera best suits their needs. This combination of accessibility and personalized service contributes significantly to the dominance of the offline distribution channel in the market.

The online segment is expected to grow at the fastest CAGR over the forecast period due to the increasing consumer preference for e-commerce. Pet owners benefit from the convenience offered by online channels, which includes browsing a wide range of products, reading customer reviews, and comparing prices from the comfort of their homes. Rising use of the internet and smartphones among all age groups has further facilitated this trend, allowing consumers to make quick purchase decisions with easy access to a range of products. In addition, online retailers often provide better deals and promotions, making it more appealing for consumers to shop online. For instance, many pet owners prefer buying monitoring cameras through platforms such as Amazon and Walmart, where they can find diverse options and take advantage of fast shipping services.

Regional Insights

The North America pet monitoring camera market dominated with the largest revenue share of 51.8% in 2024, primarily due to the high rate of pet ownership and the increasing focus on pet safety and well-being. Consumers in North America tend to invest more in premium pet care products, including advanced monitoring technologies that offer features including high-definition video and two-way communication. This trend is further supported by the growing integration of smart home devices, making it easier for pet owners to monitor their pets remotely. For instance, many pet owners use smart cameras that allow them to interact with their pets while away from home, enhancing both safety and emotional connection.

U.S. Pet Monitoring Camera Market Trends

The U.S. pet monitoring camera industry dominated the North America region due to a strong inclination among pet owners to invest in technologies that ensure the safety and well-being of their pets while they are away. The increasing number of families owning pets is expected to drive the demand for pet monitoring cameras. For instance, many pet owners choose interactive cameras, such as the Petcube Bites 2, Furbo, and Wyze Cam, which allows them to engage with their pets remotely while dispensing treats.

Asia Pacific Pet Monitoring Camera Market Trends

Asia Pacific pet monitoring camera market is expected to grow at the highest CAGR over the forecast period due to the increasing adoption of pets and the rising trend of pet humanization in countries including China, India, and Australia. As more people in this region view pets as family members, they are more inclined to invest in technologies related to the safety of pets. For instance, in Australia, according to the Australian Veterinary Association, where 76% of dogs and 92% of cats are kept as pets, there is a high demand for pet cameras that allow owners to monitor their pets remotely, reflecting the strong market potential in the region.

China dominated the Asia Pacific pet monitoring camera industry, driven by a significant increase in pet ownership and consumer spending on pet-related products. The growing e-commerce and digital influence, coupled with increased spending on smart pet care products by tech-savvy pet owners in China, has led to a rise in demand for monitoring solutions. With the rapid economic growth and increasing disposable incomes, consumers are willing to invest in high-quality technologies and devices related to pets, mainly including cameras that offer features such as real-time video streaming and two-way communication. As more households in the country adopt pets, there is a corresponding surge in demand for innovative products that enhance pet care and monitoring, reflecting a robust market potential in the region.

Europe Pet Monitoring Camera Market Trends

Europe pet monitoring camera market is expected to grow significantly over the forecast period, driven by increasing pet ownership, rising awareness of pet safety, and the trend of pet humanization. Pets are increasingly being treated as family members, leading to greater demand for advanced monitoring solutions that allow owners to watch them while away from home. For instance, in the UK, the rapid rise in pet ownership and favorable pet insurance policies have encouraged demand for monitoring cameras that help owners keep a check on and ensure the security of their pets when they have to be left unattended.

Key Pet Monitoring Camera Company Insights

Furbo Dog Camera (Tomofun LLC), Motorola Mobility LLC, Petcube, Inc, Zmodo, Acer Inc. (Pawbo Inc.), SpotCam Co., Ltd., Hangzhou Hikvision Digital Technology Co., Ltd. (Ezviz Inc.), Vimtag Technology Co., Ltd, The Clever Dog Company and PetChatz LLC are some of the key players in the pet monitoring camera industry. These companies dominate the market by leveraging advanced technology and innovation to offer smart, interactive features that cater to the diverse needs of pet owners. They continuously launch new products with enhanced functionality, such as two-way audio, HD video, treat dispensing, and remote monitoring, helping pet owners stay connected with their pets.

-

Petcube, Inc. offers smart cameras designed to help pet owners remotely interact with their pets. Their product range includes interactive cameras with features, such as two-way audio, live video streaming, and treat dispensing, aimed at enhancing the overall pet care experience. Petcube continues to innovate by integrating AI-driven features, allowing owners to monitor the health and well-being of pets effectively.

-

Tomofun, the company behind the Furbo Dog Camera, provides pet owners with real-time interaction capabilities for their pets. The Furbo camera features a two-way audio system, HD video, and a treat dispenser, allowing owners to communicate with and reward their pets remotely.

Key Pet Monitoring Camera Companies:

The following are the leading companies in the pet monitoring camera market. These companies collectively hold the largest market share and dictate industry trends.

- Furbo Dog Camera (Tomofun LLC)

- Motorola Mobility LLC

- Petcube, Inc

- Zmodo

- Acer Inc. (Pawbo Inc.)

- SpotCam Co., Ltd.

- Hangzhou Hikvision Digital Technology Co., Ltd. (Ezviz Inc.)

- Vimtag Technology Co., Ltd

- The Clever Dog Company

- PetChatz LLC

Recent Developments

-

In September 2023, Furbo launched the Furbo 360° Cat Camera, which features advanced technology designed specifically for cats. It includes a rotating 360° view, an interactive feather wand toy, and treat-tossing capabilities to keep pets engaged and entertained. It is also equipped with AI-powered smart alerts to keep owners notified about the activities of their cats.

-

In March 2022, Petcube launched Petcube GPS Tracker, which provides GPS location tracking and offers valuable insights into the daily activities of pets and their health, all accessible via a smartphone app. The tracker features customizable geofencing alerts, extended battery life of up to 30 days, and lightweight & durable design that is IP67 water-resistant.

Pet Monitoring Camera Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 250.1 million

Revenue forecast in 2030

USD 453.6 million

Growth rate

CAGR of 12.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa

Key companies profiled

Furbo Dog Camera (Tomofun LLC); Motorola Mobility LLC; Petcube; Inc; Zmodo; Acer Inc. (Pawbo Inc.); SpotCam Co., Ltd.; Hangzhou Hikvision Digital Technology Co., Ltd. (Ezviz Inc.); Vimtag Technology Co., Ltd; The Clever Dog Company; PetChatz LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Monitoring Camera Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet monitoring camera industry report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

One-way Video Functionality

-

Two-way Video Functionality

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."