- Home

- »

- Animal Health

- »

-

Pet Obesity Management Market Size, Industry Report, 2030GVR Report cover

![Pet Obesity Management Market Size, Share & Trends Report]()

Pet Obesity Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Therapeutic Food, Supplements), By Animal (Dogs, Cats), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-888-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Obesity Management Market Summary

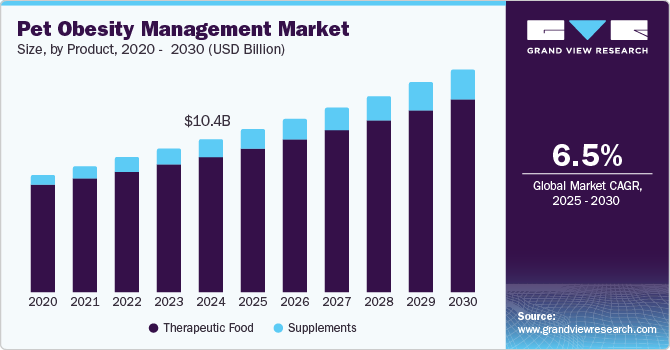

The global pet obesity management market size was estimated at USD 10.38 billion in 2024 and is projected to reach USD 14.50 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The market is primarily being driven by the increasing global prevalence of pet obesity, rising availability & adoption of pet insurance coverage, the ever-increasing population of pets globally, and supportive initiatives taken by industry players, as well as governmental & nongovernmental organizations.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- The pet obesity management market in the U.S. dominated the North American market.

- By product, the therapeutic food segment held the highest market share of 89.12% in 2024.

- By animal type, the dogs segment held the highest market share in 2024.

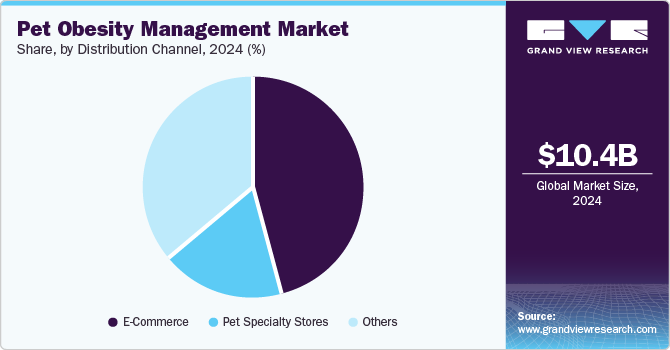

- By distribution channel, the e-commerce segment dominated the market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.38 Billion

- 2030 Projected Market Size: USD 14.50 Billion

- CAGR (2025-2030): 6.5%

- North America: Largest market in 2024

For instance, in August 2023, Mars Inc. proposed investing Rs 800 crore (USD 95.94 million) for the phase-II expansion of its Telangana plant, where it produces popular pet food brands like Pedigree and Whiskers with a previous investment of Rs 200 (USD 23.98 million) crore. The Telangana government and Mars Inc. have formed a comprehensive partnership to enhance initiatives focused on pet care & nutrition in India.

It was reported that since the outbreak of the COVID-19 pandemic, 33% of pet parents with overweight pets have reported that their pets gained weight as a result of the pandemic. This has increased demand for pet obesity treatment products. However, the majority of pet parents (73%) felt comfortable admitting to others that their pet is overweight without seeking medical advice.

Furthermore, findings from a recent analysis by Hill's Pet Nutrition in collaboration with Kelton Global demonstrated that pet obesity and overweight have been rising for years. Moreover, Covid-19 has made this problem worse. Veterinarians report that over 71% of pet professionals believe that the outbreak has affected pet food habits. The COVID-19 pandemic has made pet obesity more severe. To keep their pets busy while working from home, pet owners fed them more. In addition, according to senior veterinarian Dr. Kitty Cheung, pet obesity has long been a problem in Australia, where 32% of cats and 41% of dogs are obese, according to the Australian Veterinary Association.

The rise in pet obesity globally is a major factor driving lucrative market growth. For example, in the U.S., in 2022, 61% of cats and 59% of dogs were overweight or obese, according to the Association for Pet Obesity Prevention (APOP). Furthermore, a European study published in 2018 stated that upon estimation of Body Mass Index (BMI), 32% of dogs were overweight or obese, 62% were of normal weight, and 6% were underweight. Body Fat Index (BFI) chart showed that 56% of the dogs were overweight or obese. However, the owners' assessment of the dogs' Body Condition Scores (BCS) indicated that 22% were overweight or obese.

Furthermore, Pet insurance ensures that obesity-related issues are compensated for and that pet owners are not paying for associated costs. Acceptance of pet insurance is on the rise due to a number of factors, including humanization of pets, growing pet population, increasing initiatives by major corporations, rising veterinary care expenses, and growing adoption of pet insurance in underserved areas. Over the course of projected period, it is expected that an increase in the number of insured pets would support the growth of pet insurance enrollment rates globally, which have risen as a result of the increasing humanization & ownership of pets in many countries.

The North American Pet Health Insurance Association (NAPHIA) Organization released its 2024 report, which states that the insurance-covered pet population in the U.S. grew by 16.7% between 2023 and 2022. This increase was led by a 26.3% increase in cats and a 20.9% surge in insured dogs. According to the same source, the gross written premium (GWP) for pet insurance increased from CAD 208.7 million (USD 153.46 million) in 2019 to CAD 485.5 million (USD 356.99 million) in 2023, which amounts to a growth rate of over 29.8% in 2023 when compared to 17.3% in 2020. Dogs were enrolled for a majority of insurance, followed by cats.

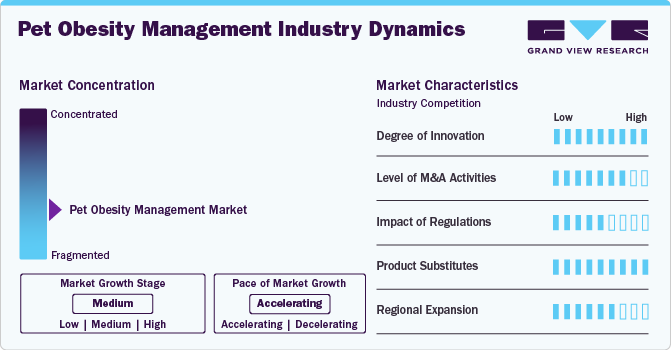

Market Concentration & Characteristics

The market is characterized by a high degree of innovation owing to advancements such as the emergence of specialized supplements, a flourishing startup culture focusing on developing innovative products for pet obesity management, the aging pet population, and the rising danger of obesity-related conditions. For instance, in September 2024, a research study conducted at the University of Winchester-UK inferred that out of the thousands of dogs studied, those on a vegan diet exhibited a lower occurrence of health disorders.

The market is characterized by high mergers and acquisitions activity, which indicates ongoing consolidation and strategic collaborations among industry leaders. In March 2023, for instance, Sun Pharmaceutical Industries Limited signed an agreement to purchase a 60% stake in Vivaldis Health And Foods Private Limited. Vivaldis Health & Foods operates in the companion animal healthcare industry, focusing on trading, distributing, manufacturing, and marketing drugs, food supplements, and OTC products.

The market experiences a moderate impact of regulations. Regulatory Authorities, such as the U.S. FDA, EU, European Food Safety Authority (EFSA), Therapeutic Goods Administration (TGA), Food Safety & Standards Authority of India (FSSAI), etc., approve and regulate the drugs intended for animal use. On the other hand, government initiatives, subsidies, and financial assistance programs help promote healthy management of obesity in pets. For instance, in India, The Prevention of Cruelty to Animals Act (1960) promotes responsible pet ownership, and pet animals are required to undergo regular healthcare checkups, treatments, & vaccinations. Pet owners found guilty of any offense against pet animals are punishable under the 428 and 429 sections of the Indian Penal Code.

The risk of substitutes is expected to be high. From region to region and country to country, the type and standard of care varies in both human and veterinary medicine. Though globally, these products are considered a standardized type of treatment for veterinary use, in some countries, alternate forms of treatments do exist: substitution treatments like traditional methods (Ayurveda, Chinese Traditional Medicine, etc.), off-label medications, home remedies, etc.

The impact of regional expansion is estimated to be moderate-high in this industry. Leading manufacturers worldwide are expanding their operations in terms of production capacity and geographical presence. For instance, in October 2023, Hill's Pet Nutrition officially opened a state-of-the-art manufacturing plant in Tonganoxie, Kansas. The 365,000-square-foot smart facility is dedicated to boosting production capacity for canned pet food, facilitating the growth of Hill's Science Diet and Prescription Diet brands.

Product Insights

The therapeutic food segment held the highest market share of 89.12% in 2024, owing to increased awareness of pet obesity, a higher level of nutritional education among pet owners, the influence of veterinary recommendations, the availability of specialized pet foods, and a rise in demand for therapeutic foods for obesity management in pets. Similarly, the growing launch of therapeutic pet foods has enhanced availability and accessibility in the market. This, coupled with effective distribution channels, makes it easier for pet owners to access and incorporate these specialized diets into their pets' daily nutrition. For instance, in March 2023, Nestlé Purina PetCare introduced the OM Metabolic Response+Joint Mobility Canine Formula under the Purina ProPlan Veterinary Diet brand.

The supplements segment is anticipated to grow the highest CAGR of 9.9% over the forecast period of 2025-2030. With evolving health complications in pets, their owners are becoming more aware of these risks and are seeking effective multiple ways to manage their pets' weight, including obesity management supplements. In addition, there is a growing emphasis on preventive care for pets, including obesity prevention. Pet owners proactively seek methods to manage their pets' weight before it becomes a serious health issue, driving the demand for pet obesity management supplements.

Animal Insights

By animal type, dogs held the highest market share in 2024. Dogs are most widely adopted pets in the world, and the American Pet Products Association's National Pet Owners Survey indicates that 69.0 million American households have dogs. Companies are offering new dog supplements, which are expected to fuel market growth over the forecast period. For instance, Royal Canin has launched an obesity management dry food formulated to reduce excessive body weight in dogs. High protein content in the food helps maintain muscle mass during a weight loss program. Furthermore, rising rate of obesity in dogs contributes to demand for obesity management products. Pet owners are becoming more aware of associated health risks when their pets are overweight, leading to a higher demand for effective solutions.

Other animals is expected to register a high CAGR during the forecast period. Obesity is a common health issue in small animals, including rabbits, guinea pigs, etc. The industry is experiencing active R&D in developing specialized foods for these pets, leading to the segment’s market growth. Ongoing research and development in pet supplement industry led to development of innovative formulations designed specifically for small animals. For instance, Small Pet Select launched Rabbit Essentials Adult Rabbit Food with 14% protein content, making it a suitable option for obesity management in rabbits. Similarly, Supreme Petfoods provides a weight loss diet for overweight rabbits, which includes Timothy hay, a natural source of fiber and protein with appealing flavors & textures, which caters to the preferences of small pet owners, driving market growth.

Distribution Channel Insights

E-Commerce dominated the market share in 2024 and is estimated to grow at the highest rate growth rate of 7.6% over the forecast period. This segment is anticipated to witness growth due to the extensive online availability of pet food and supplements for various pets, coupled with rising customer loyalty fostered by subscribe and save programs. Leading and reputable online suppliers of pet supplements catering to dogs, cats, fish, and birds are Chewy, Petco Animal Supplies, Inc., BestVetCare.com, and Amazon.

E-commerce platforms offer a wider selection of obesity management supplements, including niche and specialty products that may not be available in physical stores. After the COVID-19 pandemic, the e-commerce supply of pet food and supplement products significantly increased. Such online websites have become a convenient option for pet parents to purchase supplements for pet obesity management. These platforms provide various products in different ranges and quantities at competitive prices. In addition, they allow customers to compare the specifications of products before purchasing them. They also enable consumers to shop faster in the most efficient way.

The second-most lucrative segment is the other distribution channels segment. It includes channels like hypermarkets, supermarkets, vet clinics & hospitals, etc. Penetration and availability of pet obesity management food and supplements at these channels significantly drive the market. For instance, in August 2023, Pet Honesty launched its line of pet health supplements at PetSmart, a leading pet retailer in the U.S. Recognized as a leader in the development of nutritional supplements for pets, the company’s products are currently available at the top three pet retailers in the country, namely Petco, Pet Supplies Plus, and PetSmart.

Regional Insights

North America pet obesity management market held the largest share of 41.85% of the global market in 2024, attributed to a high prevalence of obesity in dogs & cats in the region. A 2022 survey stated that more than 50% of the North American canine population is obese, and 40% to 45% of dogs aged between 5 years & 11 years are overweight. This excess weight in dogs can further lead to a risk of developing obesity. Major factors causing this are overfeeding and lack of exercise. Many public-private partnerships are emerging in the region, focusing on creating and implementing initiatives to improve companion animal health. Various awareness campaigns are being initiated to create awareness among pet owners to initiate timely management of obesity before it leads to further complications.

U.S. Pet Obesity Management Market Trends

The pet obesity management market in the U.S. dominated the North American market. The key driver for this is that pet obesity is considered an epidemic in the country. American Animal Hospital Association (AAHA), in collaboration with the North American Veterinary Community (NAVC), published a report in 2020 on the connection between excess weight and the diagnosis & treatment of osteoarthritis. According to the study, in 2019, nearly 51% of the 1.9 million adult dogs that visited Banfield Pet Hospitals across the U.S. were overweight. The study further inferred that only 10% of these dogs successfully reduced weight to the recommended range, whereas 40% gained weight over 12 months. Considering these figures, the AAHA declared pet obesity in the U.S. an epidemic. 64% of pugs were overweight, topping the list of most overweight breeds.

Europe Pet Obesity Management Market Trends

The pet obesity management market in Europe held the second-largest share in 2024. The region is expected to experience consistent growth over the forecast period due to favorable government regulations. Pet food in the EU is subject to the same rules as animal feed, which is expected to comply with all applicable EU regulations. The feed business operator's (FBO) responsibility ensures feed product compliance. EU law states that pet food, supplement, or treat products can be marketed to all 27 EU countries if an ingredient is a legal entity within the European Economic Area.

The UK pet obesity management market is expected to grow significantly over the forecast period. Apart from traditional drugs and supplements, gadgets for management of pet obesity are emerging in the UK. For instance, the veterinary R&D activities undertaken across the country are developing new animal care products. This helps build a knowledge base in the industry to create novel products for efficient pet care. The UK-based company PitPat developed an activity monitor for dogs. This device is attached to the dog's collar, and it measures the amount of exercise the dog is getting, which can be monitored by the owner remotely. The implementation of such technologies is a crucial factor in boosting the UK market and promoting further innovation in this field.

Asia Pacific Pet Obesity Management Market Trends

The pet obesity management market in Asia Pacific is anticipated to witness significant growth. China dominated the market in 2024, and India is anticipated to grow at the fastest CAGR from 2025 to 2030. The Asia Pacific pet obesity management market is characterized by a diverse landscape influenced by specific national characteristics. Japan's aging pet population strongly impacts the regional market; elderly dogs and cats are more susceptible to obesity-related illnesses.

India pet obesity management market is expected to grow significantly over the forecast years. This growth can be characterized by increasing participation from multiple sectors to ensure a healthy pet. For instance, according to August 2024 by the Indian Express, experienced chefs and an IT professional from Pune launched a company known as Pet Feast, which designs & provides specialized therapeutic diets for pets, including the ones that are overweight.

Latin America Pet Obesity Management Market Trends

The pet obesity management market in Latin America is expected to grow significantly over the forecast period. A prevalent issue in Latin America is pet owners' lack of knowledge about the significance of controlling pet obesity. According to a study conducted in Brazil, although a sizable dog owner population acknowledged that their dogs were overweight, very few sought expert help to manage their obesity. Mexico also has a disparity between estimated and reported dog obesity rates, highlighting the need for pet owner education.

Brazil pet obesity management market is driven by the need for the management of pet obesity by trained professionals. A 2020 study published in PLOS ONE examined the understanding of pet owners in Brazil about pet obesity. The research concluded that out of the study population, 52% of dogs were of ideal weight, 34% were overweight, and 14% were obese. Nearly 96% of pet owners agreed that their dogs were overweight; however, only 20% felt the need for trained professionals to manage obesity, expressing concerns about high potential treatment costs. This highlights the fact that proper education about the importance of trained professionals can lead to effective management of pet obesity and contribute to market growth.

Middle East & Africa Pet Obesity Management Market Trends

The pet obesity management market in MEA is influenced by several characteristics unique to its countries, such as Saudi Arabia, Kuwait, the United Arab Emirates, and South Africa. The market in South Africa is driven by the realization that obesity is a major health issue, further exacerbated by the conduct of pet parents, as overweight pets are more prone to numerous ailments. To encourage appropriate management, October is recognized as Pet Obesity Month. Despite such efforts, there is still a serious issue known as the Fat Gap, when pet parents frequently mistake their overweight pets as normal or healthy.

South Africa pet obesity management market dominated the MEA market. Obesity is deemed the top health risk for pets in South Africa, driving the country's pet obesity management market and further influencing pet parent behavior. Pets with excess weight are more likely to suffer from illnesses and may have shorter lives of up to 2.5 years. Over 20 diseases, including cancer, heart disease, rheumatoid arthritis, skin issues, and urinary tract issues, have been connected to obesity in pets. October is designated as Pet Obesity Month in South Africa to encourage appropriate management of obesity.

Key Pet Obesity Management Company Insights

The market is highly fragmented and competitive due to the presence of several domestic industry participants. These companies offer various pet obesity management solutions, such as therapeutic pet food designed for tackling obesity, supplements, and custom product manufacturing, to capture a greater share of the overall market. In addition, market players implement various strategic initiatives, such as mergers & acquisitions, partnerships, & collaborations, to support their growth objectives. Industry leaders like Zoetis, Inc.; Mars Incorporated, Hill's Pet Nutrition, Inc., Nestlé S.A, Virbac S.A., Dechra, Neogen Corporation, NOW Foods Drools Pet Food Pvt. Ltd., Delicate Care, Vivaldis Health & Foods Pvt. Ltd. (Sun Pharmaceutical Industries), ProBalance, Masterpet Australia Pty Ltd., VioVet Ltd (Pinnacle Pet Group), Rolf C. Hagen, Inc., etc. are investing significantly in research and development of novel products for obesity and weight management in dogs and cats.

Key Pet Obesity Management Companies:

The following are the leading companies in the pet obesity management market. These companies collectively hold the largest market share and dictate industry trends.

- Mars Incorporated

- Hill's Pet Nutrition, Inc.

- Nestlé S.A

- Drools Pet Food Pvt. Ltd.

- FARMINA PET FOODS

- NOW Foods

- Virbac S.A.

- VioVet Ltd (Pinnacle Pet Group)

- Rolf C. Hagen, Inc.

- Dechra

- Vivaldis Health & Foods Pvt. Ltd. (Sun Pharmaceutical Industries)

- ProBalance

- Masterpet Australia Pty Ltd.

- Neogen Corporation

- Delicate Care

Recent Developments

-

In September 2024, Virbac announced partnership with the Association for Pet Obesity Prevention (APOP). Through this partnership, both organizations aim to address the growing issue of pet obesity by tacking its root causes like lack of exercise, genetics, ageing, neutering, etc.

-

In Aug 2024, Akston Biosciences forged a partnership with Energesis Pharmaceuticals Inc for researching and developing a new drug for companion animal obesity.

-

In February 2024, research conducted by scientists at the College of Agriculture and Life Science, Seoul National University, South Korea has identified strains of 2 probiotic bacteria, namely, Enterococcus faecium IDCC 2102 & Bifidobacterium lactis IDCC 4301, that have proven to be effective in reducing weight of obese dogs by altering their gut microbiota.

-

In February 2024, Better Choice (manufacturer of Halo Elevate - a pet food brand) completed acquisition of Aimia Pet Healthco Inc. The both companies had worked previously as R&D partners.

-

In March 2023, Sun Pharmaceutical Industries Limited signed an agreement to purchase a 60% stake in Vivaldis Health And Foods Private Limited. Vivaldis Health & Foods operates in the companion animal healthcare industry, focusing on trading, distributing, manufacturing, and marketing drugs, food supplements, and OTC products.

-

In February 2022, Mars Petcare, a division of Mars Incorporated, officially entered into a binding agreement to purchase Champion Petfoods, a prominent global pet food manufacturer. The acquisition was set to be completed by an investor consortium primarily led by Bedford Capital and the Healthcare of Ontario Pension Plan

-

In October 2022, Pinnacle Pet Group acquired Crum & Forster Pet Insurance Group's operations in the UK, encompassing Pet Protect and VioVet.

Pet Obesity Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.04 billion

Revenue forecast in 2030

USD 14.50 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Mars Incorporated; Hill's Pet Nutrition, Inc.; Nestlé S.A.; Drools Pet Food Pvt. Ltd.; FARMINA PET FOODS; NOW Foods; Virbac S.A.; VioVet Ltd (Pinnacle Pet Group); Rolf C. Hagen, Inc.; Dechra, Vivaldis Health & Foods Pvt. Ltd (Sun Pharmaceutical Industries); ProBalance; Masterpet Australia Pty Ltd.; Neogen Corporation; Delicate Care.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Obesity Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet obesity management market report based on product, animal, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Food

-

Supplements

-

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pet Specialty Stores

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pet obesity management market size was estimated at USD 10.38 billion in 2024 and is expected to reach USD 11.04 billion in 2025.

b. The global pet obesity management market is expected to grow at a compound annual growth rate of 6.54% from 2025 to 2030 to reach USD 14.50 billion by 2030.

b. North America dominated the pet obesity management market with a share of 41.85% in 2024. This is attributable to rising pet ownership and rise in prevalence of obesity in pets.

b. Some key players operating in the pet obesity management market include Mars Incorporated, Hill's Pet Nutrition, Inc., Nestlé S.A, Drools Pet Food Pvt. Ltd., FARMINA PET FOODS, NOW Foods, Virbac S.A., VioVet Ltd (Pinnacle Pet Group), Rolf C. Hagen, Inc., Dechra, Vivaldis Health & Foods Pvt. Ltd. (Sun Pharmaceutical Industries), ProBalance, Masterpet Australia Pty Ltd., Neogen Corporation, Delicate Care and FARMINA PET FOODS.

b. Key factors that are driving the market growth include growing global prevalence of pet obesity, rising availability & adoption of pet insurance coverage, the ever-increasing population of pets globally, and supportive initiatives taken by industry players, as well as governmental & nongovernmental organizations

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.