- Home

- »

- Homecare & Decor

- »

-

Pet Toys Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Pet Toys Market Size, Share & Trends Report]()

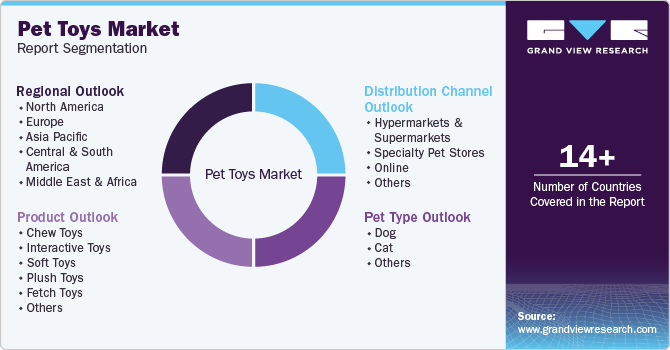

Pet Toys Market (2024 - 2030) Size, Share & Trends Analysis Report By Pet Type (Dog, Cat, Others), By Product (Chew Toys, Interactive Toys, Soft Toys, Plush Toys, Fetch Toys), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-333-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pet Toys Market Summary

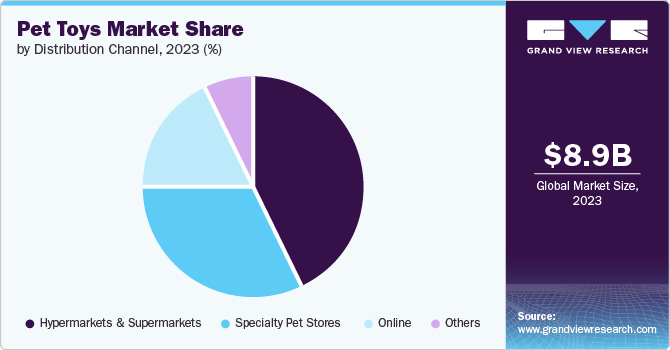

The global pet toys market size was valued at USD 8.88 billion in 2023 and is projected to reach USD 16.81 billion by 2030, growing a CAGR of 9.6% from 2024 to 2030. The rising demand for pet toys can be attributed to the growing awareness of pet health and well-being, leading pet owners to seek engaging and interactive toys to enrich their pets' lives.

Key Market Trends & Insights

- North America pet toys market accounted for a revenue share of 31.86% of the global industry in 2023.

- The pet toys market in the U.S. is expected to grow at a CAGR of 8.5% from 2024 to 2030.

- Based on pet type, the dog toys segment held the largest market share of 51.94% in 2023.

- Based on distribution channel, the hypermarkets/supermarkets segment dominated the industry with the largest revenue share in 2023.

- Based on product, the chew toys segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.88 Billion

- 2030 Projected Market Size: USD 16.81 Billion

- CAGR (2024-2030): 9.6%

- North America: Largest market in 2023

Additionally, the humanization of pets has increased, driving a desire to provide pets with stimulating and entertaining toys similar to those enjoyed by humans. The increasing trend in pet adoption, with 4.1 million animals finding forever homes annually according to an article by Forbes published in January 2024, is significantly boosting the demand for pet toys. As more households welcome pets into their lives, the need for engaging and stimulating toys to keep these pets happy and healthy is on the rise. This trend is particularly pronounced among millennials, who have the highest share of pet owners at 33%, indicating a growing market for pet-related products, including toys. Additionally, the decline in euthanasia rates, coupled with more cats being adopted annually than dogs, underscores the importance of providing these adopted pets with the necessary toys and accessories for their well-being and happiness in their new homes.

The substantial increase in pet spending, totaling USD 136.8 billion in 2022 and representing a 10% rise from the previous year and a 50% increase since 2018 according to FinMasters article published in January 2024, is a key driver behind the flourishing of the market. With the average dog owner spending USD 912 and the average cat owner spending USD 653 annually, there's a growing emphasis on providing pets with quality toys and accessories. Even those with lower incomes, spending around 1% of their earnings on pets, contribute significantly to this trend. As pet owners increasingly view their pets as family members, the demand for innovative and engaging toys continues to surge.

Millennials are driving a significant shift in the pet industry, particularly in the realm of pet toys. With a growing number of Chinese millennials opting to delay traditional life milestones in favor of pet ownership, the global market is experiencing a surge. According to an article by the South China Morning Post published in February 2022, in 2020, urban areas in China alone housed over 100.8 million pet dogs and cats, marking a 10.2% increase from 2018. The urban pet market in China was valued at a staggering USD 46 billion, showcasing the willingness of millennials to invest in their pets' well-being. This demographic's perception of pets as companions and family members has led to a demand for innovative and engaging toys, propelling the growth of the global pet toys industry.

The expansion of the market is being propelled by the emergence of new luxury companies in the pet care segment, offering fashionable and high-end products spanning clothing to accessories. With pets increasingly seen as family members, consumers are inclined to splurge on premium items, including innovative and stimulating toys. For instance, in November 2023, True Religion, a premium brand, launched its first-ever pet collection in collaboration with Wiesner Pet Types Inc., featuring a range of products such as beds, toys, leashes, harnesses, and more, catering to this growing demand for upscale pet care products.

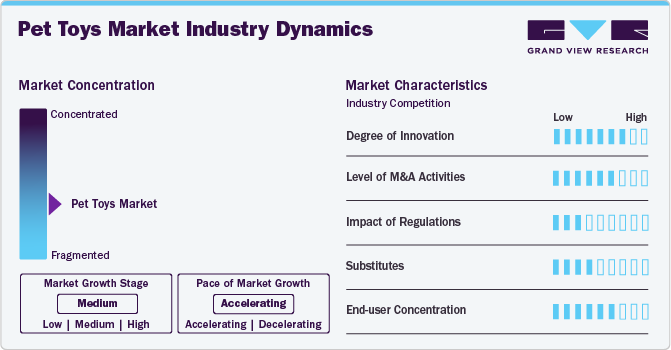

Market Concentration & Characteristics

The global market is witnessing a high degree of innovation, with companies introducing interactive and tech-enabled toys that enhance pets' play experiences. From smart toys that can be controlled via mobile apps to puzzles that stimulate mental engagement, pet owners now have a wide array of innovative options to keep their furry friends entertained and mentally stimulated.

Regulations play a crucial role in the global market, ensuring the safety and quality of products. Compliance with regulations such as those set by the FDA and ASTM International is essential for manufacturers to meet safety standards, protecting pets from potential hazards. Additionally, regulations can drive innovation and development of safer materials and designs in the pet toys industry.

The market offers a wide array of substitutes, ranging from traditional toys like balls and ropes to more innovative interactive toys such as puzzle feeders and electronic toys. Additionally, DIY toys using household items are popular among pet owners looking for cost-effective options. As the market continues to expand, new substitutes are constantly being introduced, providing pet owners with a variety of choices to suit their pets' preferences.

In the global market, end-user concentration is diversified across a broad spectrum of pet owners, including individuals, families, and households. This market segment encompasses a wide range of demographics, from millennials to seniors, each with varying preferences and purchasing behaviors. As pet ownership continues to rise globally, the demand for pet toys is driven by this diverse and expanding consumer base.

Pet Type Insights

Based on pet type, dog toys held the largest market share of 51.94% in 2023. The humanization of pets, where dogs are increasingly viewed as family members, drives owners to invest more in their well-being and entertainment. Rising disposable incomes allow for higher spending on premium and innovative toys. Additionally, there is growing awareness of the importance of physical and mental stimulation for dogs, leading to a higher demand for toys that promote exercise and cognitive development.

The demand for cat toys is expected to increase at a CAGR of about 9.4% from 2024 to 2030. The availability of technologically advanced toys, such as laser pointers and automated playthings, caters to the modern pet owner's desire for convenience and innovation. Furthermore, the focus on eco-friendly and sustainable products aligns with the values of environmentally conscious consumers, driving the demand for green pet toys.

Distribution Channel Insights

Based on distribution channel, sales of pet toys through hypermarkets/supermarkets dominated the industry with the largest revenue share in 2023. These large retail chains offer a wide variety of pet toys, providing a one-stop shopping experience that is convenient for pet owners. The accessibility and widespread presence of hypermarkets and supermarkets make it easy for customers to purchase pet toys during regular grocery shopping trips. Competitive pricing and frequent promotions in these stores attract budget-conscious consumers looking for value. The ability to physically examine and choose products appeals to buyers who prefer to assess the quality and durability of pet toys before purchasing.

The sales of pet toys through online channels are expected to rise at a CAGR of about 6.7% in the forecast period from 2024 to 2030. The convenience of shopping from home allows pet owners to easily browse and purchase a wide variety of toys at any time. Online platforms often provide detailed product descriptions, reviews, and ratings, helping consumers make informed decisions. Furthermore, the rise of social media and influencer marketing drives awareness and demand for trendy and innovative pet toys.

Product Insights

Based on product, chew toys held the largest market share in 2023. Chew toys are essential for promoting dental health in pets, helping to clean teeth and reduce plaque buildup, which appeals to health-conscious pet owners. The natural chewing instinct in dogs drives the necessity for durable and safe chew toys to prevent destructive behaviors. Furthermore, innovations in materials and designs, such as eco-friendly and flavored chew toys, attract environmentally conscious and discerning consumers. The convenience of online shopping platforms also makes it easier for pet owners to access a wide variety of chew toys.

The demand for soft toys is expected to grow at a CAGR of about 10.9% from 2024 to 2030. Soft toys provide comfort and companionship, which is especially important for pets who spend a lot of time alone. The trend of treating pets as family members encourages owners to invest in plush, cuddly toys that mimic the comfort of a human touch. Additionally, soft toys are often safer for pets, particularly for smaller breeds and young animals, due to their gentle materials.

Regional Insights

North America pet toys market accounted for a revenue share of 31.86% of the global industry in 2023. North America pet toys market is increasing due to high pet ownership rates, strong consumer spending on pet products, and a culture that views pets as family members. The region's robust economy and advanced pet care industry also contribute to its dominance in the global market. Pet spending among Americans is on the rise, with total expenditures reaching USD 102.71 billion in 2022, up 2.7% from the previous year. Millennials and Gen Xers are leading this trend, with Millennials alone spending USD 25.61 billion on their pets in 2022, up 2.0% from 2021. As pets increasingly become integral parts of families, North America will continue to dominate the market.

U.S. Pet Toys Market Trends

The pet toys market in the U.S. is expected to grow at a CAGR of 8.5% from 2024 to 2030. The pet toys sector is expected to experience notable growth in the U.S. due to rising pet ownership rates, driven by both millennials and baby boomers, fueling the market as more households welcome pets as family members. Additionally, the growing number of single-person and childless households often results in pets being the primary focus of care and spending.

Asia Pacific Pet Toys Market Trends

The pet toys market in Asia Pacific is set to grow at a CAGR of about 10.9% in the forecast period from 2024-2030. This is due to the growing trend of humanization, where pets are increasingly treated as family members, and the rise of collaborations, catering to the pet parents in countries like China and South Korea. In December 2022, KFC's collaboration with pet brand PURROOM introduced a special Christmas-themed cat toy filled with catnip and a bell, exclusively available to consumers in Shanghai purchasing a set meal, offering a festive and interactive experience for pets and their owners.

Key Pet Toys Company Insights

The market is highly competitive, with both large- and small-scale manufacturers vying for market share. Leading companies are employing various strategies, including mergers and acquisitions, partnerships, product launches, innovation, and promotional activities, to maintain their competitive edge in the industry.

Key Pet Toys Companies:

The following are the leading companies in the pet toys market. These companies collectively hold the largest market share and dictate industry trends.

- Fluff and Tuff, Inc.

- Petsport USA, Inc.

- Cosmic Pet

- ZyppyPaws

- Ethical Products, Inc.

- Benebone LLC

- Jolly Pets

- Honest Pet Products

- Petmate

- Coastal Pet Products, Inc.

Recent Developments

-

In July 2023, Earth Rated, renowned as the leading brand in the multi-use wipes and clean-up categories, announced the launch of their new line of innovative dog toys. With this strategic expansion into the play segment, Earth Rated aimed to enhance the bond between dogs and their owners while broadening their product portfolio. his toy collection featured two toys designed to reduce boredom and provide mental stimulation, along with three toys aimed at promoting daily exercise and enhancing quality bonding time between owners and their dogs.

-

In May 2023, Playology launched "We’ve Got Happy Down to a Science," marking a significant milestone for the Nashville-based company as it showcases its entire product lineup. This initiative underscores Playology’s dedication to crafting toys that stimulate instinct-driven play using scientifically informed designs. The campaign coincides with Playology’s sponsorship of the 147th Westminster Kennel Club Dog Show, scheduled for May 6, 8, and 9 at Arthur Ashe Stadium in Queens, New York.

Pet Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.70 billion

Revenue forecast in 2030

USD 16.81 billion

Growth Rate (Revenue)

CAGR of 9.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet type, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; Spain; China; Japan; India; Australia & New Zealand & New Zealand; South Korea; Brazil; and South Africa

Key companies profiled

Fluff and Tuff, Inc.; Petsport USA, Inc.; Cosmic Pet; ZyppyPaws; Ethical Products; Inc.; Benebone LLC; Jolly Pets; Honest Pet Products; Petmate; and Coastal Pet Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Toys Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet toys market report based on pet type, product, distribution channel, and region.

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dog

-

Cat

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Chew Toys

-

Interactive Toys

-

Soft Toys

-

Plush Toys

-

Fetch Toys

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Pet Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pet toys market was estimated at USD 8.88 billion in 2023 and is expected to reach USD 9.70 billion in 2024.

b. The global pet toys market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 16.81 billion by 2030.

b. Europe dominated the pet toys market with a share of over 35.83% in 2023. The growth of the regional market is mainly driven by high pet ownership rates, strong consumer spending on pet products, and a culture that views pets as family members.

b. Some of the key players operating in the pet toys market include Fluff and Tuff, Inc.; Petsport USA, Inc.; Cosmic Pet; ZyppyPaws; Ethical Products, Inc.; Benebone LLC; Jolly Pets; Honest Pet Products; Petmate; and Coastal Pet Products, Inc.

b. Key factors driving the pet toys market growth include the growing awareness of pet health and well-being, leading pet owners to seek engaging and interactive toys to enrich their pets' lives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.