- Home

- »

- Medical Devices

- »

-

Pharmaceutical Contract Sales Organizations Market Report 2030GVR Report cover

![Pharmaceutical Contract Sales Organizations Market Size, Share & Trends Report]()

Pharmaceutical Contract Sales Organizations Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (Personal, Non-personal Promotion), By Therapeutic Area, By End Use (Pharma, Biopharma Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-034-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Contract Sales Organizations Market Summary

The global pharmaceutical contract sales organizations market size was estimated at USD 21,925.0 million in 2024 and is projected to reach USD 36,288.2 million by 2030, growing at a CAGR of 8.8% from 2025 to 2030. The growth of the market is due to the increasing number of new drug launches, a rise in pharmaceutical R&D activities, and the growing demand to reduce costs associated with in-house sales.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, personal promotion accounted for a revenue of USD 6,383.9 million in 2024.

- Non-personal promotion is the most lucrative service segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 21,925.0 Million

- 2030 Projected Market Size: USD 36,288.2 Million

- CAGR (2025-2030): 8.8%

- North America: Largest market in 2024

In addition, during the COVID-19 pandemic, the sales activities of drugs were mostly done remotely. i.e., via phone, web conference, email, and through website engagement.

Furthermore, the growth of the market is due to the rising complexity of drug commercialization, increasing regulatory oversight, and the ongoing need for cost optimization. Pharmaceutical companies are under constant pressure to introduce new drugs while maintaining competence in marketing. As a result, many are turning to CSOs to streamline operations, reduce in-house expenses, and adapt to changing market demands. Additionally, the traditional model-where representatives made frequent in-person visits to healthcare providers-is evolving. Physicians and healthcare professionals are increasingly preferring digital interactions, making companies rethink their strategies and invest in more flexible, tech-driven engagement methods.

Opportunity Analysis

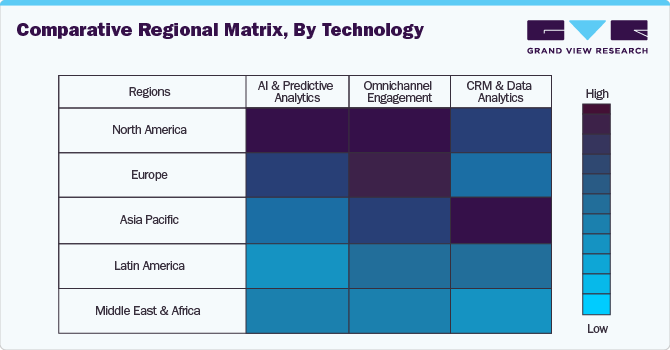

The market presents significant opportunities driven by the increasing adoption of digital sales strategies, the expansion of specialty drugs, and the growing outsourcing trend among pharmaceutical companies. As companies focus on reducing operational costs while maintaining strong market penetration, CSOs have a chance to offer innovative, tech-driven solutions that enhance marketing efficiency. The rising demand for personalized engagement, powered by AI and data analytics, further opens avenues for CSOs to provide targeted and effective approaches. Companies like Syneos Health and IQVIA are leading the way by integrating AI-driven analytics, omnichannel engagement, and real-time data insights to enhance efficiency. Their ability to provide flexible and scalable solutions has positioned them as key partners for pharmaceutical companies looking to streamline operations.

Technological Advancements

The market is undergoing significant transformation with the integration of advanced technologies that enhance customer engagement, and data-driven decision-making. The rise of omnichannel engagement, where CSOs are combining multiple digital touchpoints such as virtual meetings, chatbots, and automated email campaigns to improve interactions with healthcare professionals, is also contributing to market growth. For instance, Ashfield Engage has developed digital-first sales models that blend traditional face-to-face detailing with remote engagement through video conferencing and mobile apps. This hybrid approach ensures continuous communication with physicians, even in geographically restricted or highly regulated markets.

Pricing Analysis

The pricing in the market varies based on service type, region, and technology integration. Traditional field sales representatives remain the most expensive, especially in North America and Europe, due to high labor costs and regulatory requirements, while remote and hybrid sales models offer more cost-effective alternatives, particularly in Asia-Pacific and Latin America. AI-driven sales and CRM-integrated solutions, like those from IQVIA and Syneos Health, come at a premium but provide enhanced efficiency and data-driven targeting. Post-pandemic, the shift toward digital engagement and omnichannel strategies has made models more flexible, with companies adopting performance-based and subscription pricing structures to optimize costs while maximizing outreach.

Market Concentration & Characteristics

The market is rapidly evolving with the adoption of AI-driven analytics, omnichannel engagement, and automation. Companies like IQVIA, EPS Corp., and Peak Pharma Solutions are integrating machine learning and real-time data insights to enhance sales efficiency and optimize engagement with healthcare professionals (HCPs).

The market is witnessing high M&A activity, as leading CSOs seek to expand their service portfolios and technological capabilities. Syneos Health and Axxelus have actively acquired specialized firms to strengthen their AI-driven capabilities and global reach.

Regulatory compliance is a major factor shaping the industry, especially in North America and Europe, where GDPR, HIPAA, and pharmaceutical marketing regulations dictate engagement strategies. Companies like Promoveo Health and QFR Solutions ensure that their marketing approaches remain compliant by integrating AI-powered compliance tracking and digital detailing solutions that align with industry guidelines.

CSOs are broadening their service offerings beyond traditional sales, incorporating market access consulting, patient engagement solutions, and digital marketing strategies. For instance, Mednext Pharma and Peak Pharma Solutions have expanded into medical affairs and commercialization support.

Leading CSOs are expanding aggressively into Asia-Pacific, Latin America, and the Middle East, where the pharmaceutical market is experiencing rapid growth. CMIC Holdings Co., Ltd. has strengthened its presence in Japan and China, while IQVIA and Syneos Health continue to expand across Latin America.

Service Insights

The personal promotion segment captured the highest market share in 2024. The growth is driven due to increasing investment by pharmaceutical companies to advance their R&D, making commercial marketing crucial for overall revenue growth. With an increasing focus on year-on-year revenue expansion, companies are prioritizing new product launches to strengthen their market presence. Personal promotion, which includes face-to-face interactions, sales representatives, and tailored marketing strategies, remains the preferred approach for building strong relationships with healthcare professionals (HCPs) and driving prescription growth.

The non-personal promotion segment is projected to experience fast growth due to the increasing adoption of digital marketing strategies, AI-driven sales automation, and omnichannel engagement. Pharmaceutical companies are shifting toward remote detailing, virtual interactions, email marketing, and AI-powered content personalization to reach healthcare professionals (HCPs) more efficiently. The rising preference for cost-effective and scalable marketing solutions, coupled with the growing influence of data-driven insights and targeted advertising, is accelerating the expansion of this segment.

Therapeutic Areas Insights

The oncology segment dominated the industry with a 32.8% market share in 2024. The segment’s growth is due to the increasing prevalence of cancer, continuous advancements in targeted therapies, and a surge in drug approvals. Pharmaceutical companies are investing heavily in oncology R&D, leading to a higher demand for specialized sales representatives and tailored marketing strategies. The complexity of oncology treatments, including immunotherapies, biologics, and precision medicine, makes highly trained sales teams essential for effective communication with healthcare professionals (HCPs).

The neurology segment is expected to experience a considerable growth rate during the forecast period. Increasing investments in neurology-focused drug development and a surge in new product approvals are accelerating demand for specialized sales teams and targeted marketing strategies. The growing need for education and engagement with healthcare professionals (HCPs), along with advancements in gene therapies and neurodegenerative disease treatments, is contributing to the expansion of this segment.

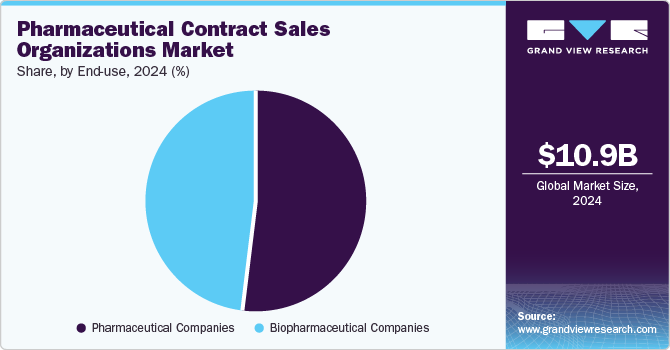

End Use Insights

The pharmaceutical companies segment dominated the industry in 2024. The growth of the market is due to an increasing need for cost-effective sales solutions, expanding drug pipelines, and rising commercialization efforts. As pharmaceutical firms focus on maximizing market reach and optimizing sales strategies, the reliance on contract sales organizations has grown significantly. The high costs associated with in-house sales teams, coupled with the demand for specialized sales expertise in complex therapeutic areas, have further strengthened this segment’s dominance.

The biopharmaceutical companies segment is expected to witness the fastest growth in the coming years due to the increasing adoption of biologics, rising investments in advanced therapies, and a surge in innovative drug development. The growing demand for personalized medicine, gene therapies, and monoclonal antibodies is driving biopharma firms to seek specialized sales expertise from contract sales organizations (CSOs).

Regional Insights

North America pharmaceutical contract sales organizations market accounted for the largest share of 38.0% in 2024 due to the strong presence of major pharmaceutical and biopharmaceutical companies, high healthcare expenditures, and advanced commercialization strategies. The region's well-established regulatory framework and increasing adoption of digital sales and omnichannel engagement have further strengthened its dominance.

U.S. Pharmaceutical Contract Sales Organizations Market Trends

The pharmaceutical contract sales organizations market in the U.S. is driven due to the strong presence of pharmaceutical and biopharmaceutical companies, increasing drug approvals, and rising demand for cost-effective sales solutions. The growing outsourcing trend among pharma firms to optimize commercial operations and reduce overhead costs has further fueled market expansion.

Europe Pharmaceutical Contract Sales Organizations Market Trends

The pharmaceutical contract sales organizations market in Europeis experiencing growth due to the increasing adoption of outsourcing strategies, expanding biopharmaceutical sector, and rising demand for specialized sales expertise. Pharmaceutical companies are focusing on cost reduction and operational efficiency, leading to a greater reliance on CSOs for commercialization, market access, and digital sales engagement.

The UK pharmaceutical contract sales organizations market held a significant share in 2024. The country’s market growth is due to its expanding pharmaceutical and biopharmaceutical sectors, increasing adoption of digital sales strategies, and rising demand for cost-effective commercialization solutions. With a strong focus on outsourcing sales operations, pharmaceutical companies in the UK are leveraging contract sales organizations to enhance market reach, optimize engagement with healthcare professionals (HCPs), and improve sales efficiency.

The pharmaceutical contract sales organizations market in France is driven by the rising demand for temperature-sensitive pharmaceuticals, increasing biologics and vaccine distribution, and strict regulatory requirements. Growing investments in specialized cold storage infrastructure and advanced monitoring technologies are further supporting market expansion.

Germany pharmaceutical contract sales organizations market is anticipated to grow significantly over the forecast period. The country’s growth is due to the strong focus on cost efficiency, regulatory compliance, and digital transformation is driving pharmaceutical companies to collaborate with CSOs for market access, sales optimization, and omnichannel engagement.

Asia Pacific Pharmaceutical Contract Sales Organizations Market Trends

The pharmaceutical contract sales organizations market in Asia Pacificis projected to grow at the highest CAGR over the forecast period. The growth of the market is due to the rapid expansion of the pharmaceutical and biotechnology industries, increasing drug commercialization, and rising demand for cost-effective sales solutions. Growing healthcare investments, a large patient population, and a surge in clinical trials are further accelerating market growth.

China pharmaceutical contract sales organizations market is expected to grow over the forecast period. The growth of the market is due to rising investments in biopharmaceutical research, growing demand for specialized sales expertise, and government initiatives supporting healthcare innovation are further driving market growth.

The pharmaceutical contract sales organizations market in Japan is witnessing significant growth over the forecast period. The growth of the market is due to the expansion of the pharmaceutical and biopharmaceutical industries, increasing drug launches, and rising demand for specialized sales expertise. A rapidly aging population, along with a growing prevalence of chronic diseases, is fueling the need for effective commercialization and market access strategies.

India pharmaceutical contract sales organizations market is witnessing considerable growth due to the large and growing patient population, along with rising healthcare investments and government initiatives. In addition, pharmaceutical companies are increasingly leveraging digital sales platforms, AI-driven analytics, and remote engagement models to optimize sales force efficiency.

Latin America Pharmaceutical Contract Sales Organizations Market Trends

The pharmaceutical contract sales organizations market in Latin Americais projected to grow over the forecast period. The growth in the region is due to the expanding pharmaceutical industry, increasing drug commercialization efforts, and rising demand for cost-effective sales solutions. A growing population, improving healthcare infrastructure, and higher investments in pharmaceutical R&D are further driving market growth.

Brazil pharmaceutical contract sales organizations market is expected to grow over the forecast period. The growth is due to the expansion of the pharmaceutical and biopharmaceutical industries, increasing drug commercialization, and rising demand for outsourced sales solutions. A large patient population, improving healthcare access, and growing government support for the pharmaceutical sector are driving market growth.

Key Pharmaceutical Contract Sales Organizations Company Insights

Key players in the market are actively engaging in strategic actions such as partnerships, collaborations, mergers, acquisitions, and geographic expansion to enhance their service offerings and gain a competitive edge. For instance, in April 2024, IQVIA entered into a partnership agreement with Salesforce to develop the Life Sciences Cloud is set to transform pharmaceutical contract sales organizations by enhancing AI-driven, omnichannel engagement with healthcare professionals. This collaboration enables CSOs to leverage advanced analytics, automation, and remote detailing for more effective sales strategies.

Key Pharmaceutical Contract Sales Organizations Companies:

The following are the leading companies in the pharmaceutical contract sales organizations market. These companies collectively hold the largest market share and dictate industry trends.

- CMIC Holdings Co., Ltd.

- Axxelus

- EPS Corp.

- QFR Solutions

- MaBico

- Mednext Pharma Pvt. Ltd.

- Peak Pharma Solutions Inc.

- IQVIA, Inc.

- Promoveo Health

- Syneous Health

Recent Developments

-

In March 2024, EPNextS Group's collaborated with Frontage Laboratories which aims to streamline early-phase clinical trials in the U.S., addressing Japan’s “drug lag” and “drug loss” challenges. This initiative is expected to accelerate new drug approvals, benefiting pharmaceutical CSOs by enhancing commercialization opportunities.

Pharmaceutical Contract Sales Organizations Market Report Scope

Report Attribute

Details

Market size in 2025

USD 11.89 billion

Revenue forecast in 2030

USD 18.14 billion

Growth rate

CAGR of 8.83% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service,therapeutic areas, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

CMIC Holdings Co., Ltd., Axxelus, EPS Corp., QFR Solutions, MaBico, Mednext Pharma Pvt. Ltd., Peak Pharma Solutions Inc., IQVIA, Inc., Promoveo Health, Syneous Health

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Contract Sales Organizations Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pharmaceutical contract sales organizations market report on the basis of:

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Promotion

-

Promotional sales team

-

Key account management

-

Vacancy management

-

-

Non-personal promotion

-

Medical affairs solutions

-

Remote medical science liaisons

-

Nurse educators

-

Others

-

-

-

Therapeutic Areas Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular

-

Neurology

-

Infectious Diseases

-

Metabolic Disorders

-

Orthopedic Diseases

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical contract sales organization market size was estimated at USD 10.96 billion in 2024 and is expected to reach USD 11.89 billion in 2025.

b. The global pharmaceutical contract sales organization market is expected to grow at a compound annual growth rate of 8.83% from 2025 to 2030 to reach USD 18.14 billion by 2030.

b. By services, the personal promotion segment held a market share of 58.2% in 2024. The increasing rate of pharmaceutical companies outsourcing their commercial services will support the segment's growth.

b. Some key players operating in the market include CMIC HOLDINGS Co., LTD., Axxelus, EPS Corporation, QFR Solutions and a few others.

b. High adoption of new technologies for contract sales by pharmaceutical contract sales organizations, an increase in the interest among end users to increase the sales of biopharmaceutical and small molecule drugs, and the surge in demand for reducing the cost associated with in-house sales are some of the key factors supporting the growth of the Pharmaceutical Contract Sales Organization market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.