- Home

- »

- Medical Devices

- »

-

Pharmaceutical Dissolution Testing Services Market Report, 2033GVR Report cover

![Pharmaceutical Dissolution Testing Services Market Size, Share & Trends Report]()

Pharmaceutical Dissolution Testing Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Method (In Vitro, In Vivo), By Dosage Form (Capsules, Tablets), By Dissolution Apparatus, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-003-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Dissolution Testing Services Market Summary

The global pharmaceutical dissolution testing services market size was estimated at USD 450.3 million in 2024 and is projected to reach USD 966.3 million by 2033, growing at a CAGR of 8.98% from 2025 to 2033. Rising demand for generic drugs and bioequivalence studies, constant regulatory emphasis on consistent drug release profiles and quality control, and growing outsourcing activities are driving the growth of the market.

Key Market Trends & Insights

- North America pharmaceutical dissolution testing services market held the largest share of 53.14% of the global market in 2024.

- The pharmaceutical dissolution testing services industry in the U.S. is expected to grow significantly over the forecast period.

- By method, the in vitro segment led the market with the largest revenue share of 57.8% in 2024.

- Based on dosage form, the tablets segment led the market with the largest revenue share in 2024.

- By dissolution apparatus, the paddle segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 450.3 Million

- 2033 Projected Market Size: USD 966.3 Million

- CAGR (2025-2033): 8.98%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is being driven by the increasing regulatory stringency surrounding drug quality, safety, and bioavailability. Health authorities such as the U.S. FDA, EMA, and CDSCO mandate dissolution testing as a core requirement in the approval process for both branded and generic pharmaceuticals. This has led to a growing need for advanced, reliable, and standardized dissolution testing to ensure consistent drug release profiles. The rising volume of generic drug approvals globally has intensified the demand for comparative dissolution testing in bioequivalence studies, making it essential for companies to outsource these services for faster and cost-effective regulatory compliance. Moreover, the complexity of modern drug formulations, such as sustained-release and poorly soluble drugs, necessitates customized and high-precision testing protocols, prompting pharma firms to rely on specialized contract service providers with technical expertise and instrumentation capabilities.

Furthermore, the rapid expansion of pharmaceutical R&D pipelines, especially in emerging markets, creates heightened demand for dissolution testing across early- and late-phase development. Small and mid-sized pharmaceutical and biotech firms, often operating with limited in-house infrastructure, are increasingly turning to third-party service providers for dissolution testing to accelerate timelines and reduce operational burdens. Furthermore, the rise in personalized medicine and novel drug delivery systems, including nanotechnology and 3D-printed tablets, reshapes dissolution testing needs. Advances in automation, real-time analytics, and integration of dissolution testing with other quality control technologies are streamlining workflows and improving data accuracy, further incentivizing outsourcing.

Opportunity Analysis

The pharmaceutical dissolution testing services market is poised for significant growth as drug development becomes more globalized and complex. A major opportunity lies in the increasing demand for dissolution testing in developing regions such as Asia-Pacific, Latin America, and the Middle East, where local regulatory bodies align with global drug quality and bioavailability standards. Multinational pharmaceutical companies expanding into these regions often require local testing partners to meet compliance, which opens opportunities for regional CROs and analytical service providers.

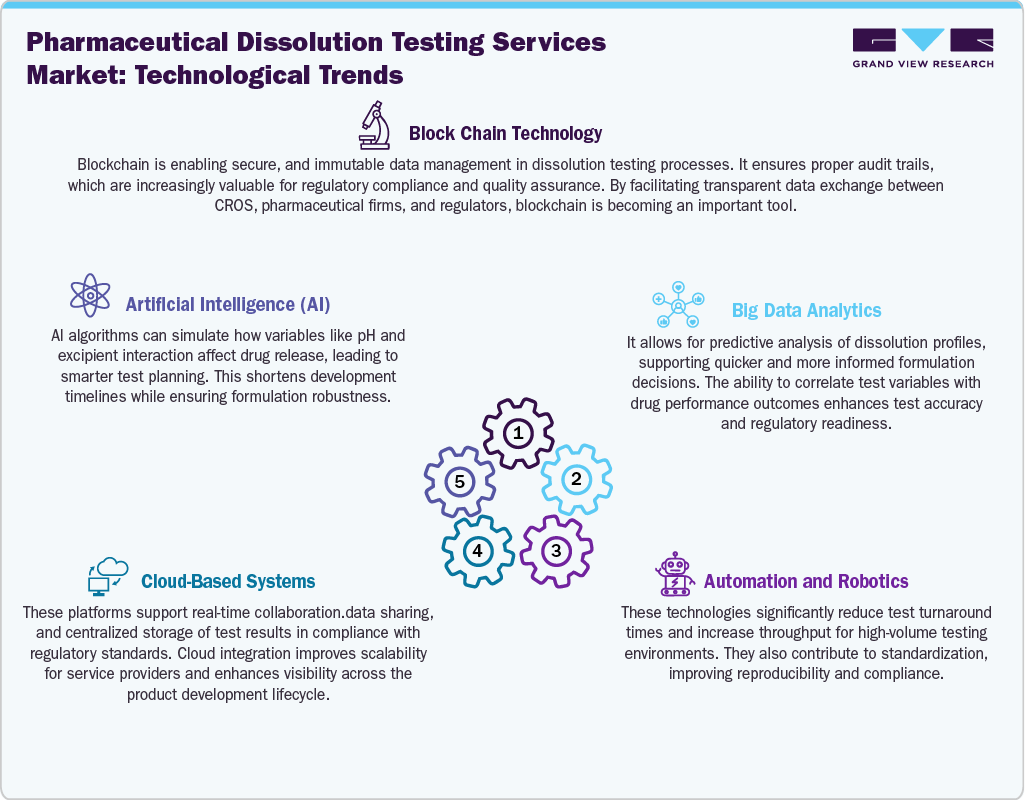

Technological Advancements

The market is experiencing significant evolution driven by rapid technological advancements that enhance testing accuracy, efficiency, and regulatory compliance. Automated dissolution systems equipped with robotics and integrated data analytics are reducing manual errors and increasing throughput, especially for high-volume generic drug production. Technologies such as UV fiber optic systems allow real-time monitoring without interrupting the dissolution process, aligning with Process Analytical Technology (PAT) principles. In addition, integrating software platforms for 21 CFR Part 11 compliance and cloud-based data management has streamlined regulatory submissions and remote auditing. These innovations not only accelerate formulation development and bioequivalence testing but also expand the service scope of CROs, making advanced dissolution testing more accessible for virtual pharma companies and complex drug developers.

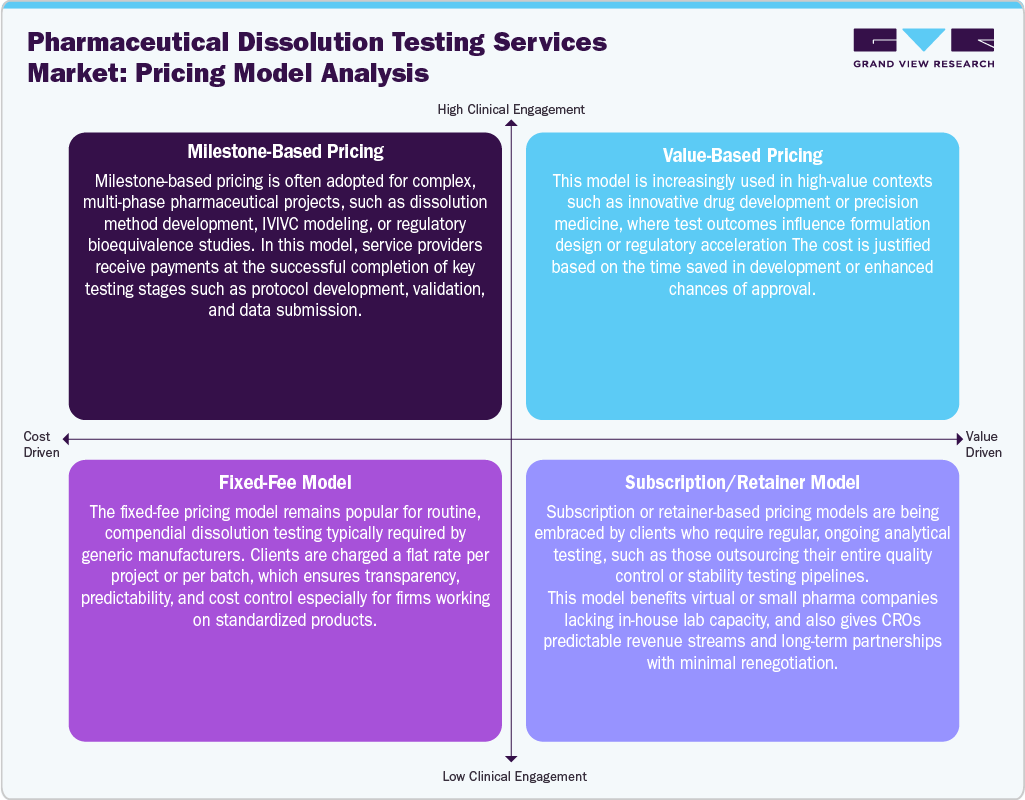

Pricing Analysis

The pricing analysis model for the pharmaceutical dissolution testing services market is primarily structured around test complexity, drug type (immediate vs. controlled release), method validation needs, regulatory requirements, and sample volume. Service providers offer tiered pricing models, with basic in-vitro dissolution tests priced lower than customized, USP-compliant, or IVIVC-based studies. Pricing also depends on whether the service includes method development, stability testing, or bioequivalence support. In addition, bundled pricing for high-throughput screening or long-term contracts is increasingly adopted to attract virtual pharma and generic drug developers. At the same time, premium charges apply for rapid turnaround and 21 CFR Part 11-compliant digital reporting.

Method Insights

The market is classified into in vitro and in vivo methods. The in vitro segment accounted for the largest revenue share in the pharmaceutical dissolution testing services industry, 57.65%, in 2024. The growth of the segment is due to its cost-effectiveness, regulatory acceptance, and widespread use in early-stage drug development and quality control. In vitro methods are less complex, quicker to execute, and do not require human or animal subjects, making them ideal for high-throughput screening of generic formulations and routine batch testing.

The in vivo segment is anticipated to grow at a lucrative CAGR during the forecast period. The segment's growth is driven by its crucial role in bridging in vitro data with real-world drug performance. The growing need for IVIVC (in vitro-in vivo correlation) studies, especially for complex formulations like controlled-release and poorly soluble drugs, is fueling this demand. In addition, innovations in pharmacokinetic modeling and increasing regulatory support for biorelevant dissolution assessments are making in vivo testing services more strategic and necessary.

Dosage Form Insights

Based on the dosage form segment, the market is segregated into capsules, tablets, and others. The tablets segment held the largest market share in 2024, due to the widespread use of solid oral dosage forms in branded and generic pharmaceuticals. Tablets are the most common and cost-effective drug delivery method, and regulatory agencies mandate robust dissolution testing for quality assurance, bioequivalence, and batch consistency. This segment benefits from a high volume of generic product filings and routine quality control testing.

The capsule segment is anticipated to grow at the second fastest CAGR over the forecast period. The segment's growth is due to its increasing application in specialty drugs and modified-release formulations. The rising demand for personalized therapies and innovations in capsule-based multiparticulate systems is pushing the need for more sophisticated and tailored dissolution testing protocols, particularly in bio-relevant media.

Dissolution Apparatus Insights

The market is segregated into basket, paddle, and others based on the dissolution apparatus segment. The paddle segment held the largest market share in 2024 due to its widespread use and versatility in testing various dosage forms. Its adoption is due to the paddle apparatus's ability to provide consistent and reliable dissolution results, making it a preferred choice among pharmaceutical companies.

In addition, the basket segment is anticipated to witness the second fastest CAGR growth during the forecast period. This growth can be attributed to its suitability for testing formulations that tend to float or have low density, which the paddle method may not handle as effectively. Increasing demand for specialized dissolution testing methods to accommodate diverse drug formulations drives the basket segment's expansion, positioning it as a key growth area within the overall dissolution testing services market.

Regional Insights

North America accounted for the largest revenue share of 56.56% in the pharmaceutical dissolution testing services market 2024. This is attributed to its advanced pharmaceutical industry, stringent regulatory environment, and high adoption of technologically advanced testing methods. Increasing R&D investments by pharmaceutical companies and the presence of leading contract research organizations (CROs) further fuel market growth. The U.S. dominates the region with substantial demand driven by a large generic drug market and regulatory requirements set by the FDA to ensure drug quality and efficacy.

U.S. Pharmaceutical Dissolution Testing Services Market Trends

The pharmaceutical dissolution testing services market in the U.S. held the largest share in 2024. The country’s growth is due to a strong pharmaceutical sector, extensive clinical research activities, and stringent FDA regulations mandating dissolution testing for drug approval. Rising demand for outsourcing testing services and growing focus on generic drug approvals contribute to the robust market growth.

Europe Pharmaceutical Dissolution Testing Services Market Trends

The pharmaceutical dissolution testing services market in Europe is expected to grow significantly due to the well-established pharmaceutical sector and stringent regulations from agencies such as the EMA. Moreover, growth is driven by the need to comply with regulatory standards, increasing generic drug approvals, and rising outsourcing of testing services to specialized labs.

The pharmaceutical dissolution testing services market in Germany held the largest share in 2024, owing to the country’s focus on quality assurance and regulatory compliance, coupled with investment in pharmaceutical innovation, which fuels growth. German CROs are expanding their dissolution testing capabilities to serve domestic and international clients.

The pharmaceutical dissolution testing services market in the UK held the largest share in 2024. The UK market benefits from a strong R&D pharmaceutical base and a growing number of CROs offering dissolution testing. Regulatory compliance with MHRA and EMA guidelines drives demand for dissolution testing services, supporting steady market growth.

Asia Pacific Pharmaceutical Dissolution Testing Services Market Trends

Asia Pacific is expected to be the fastest-growing market due to growing pharmaceutical manufacturing hubs, increasing outsourcing trends, and regulatory harmonization with global standards. Rapid industrialization, an expanding generics market, and cost advantages encourage pharmaceutical companies to outsource dissolution testing services here.

The pharmaceutical dissolution testing services market in China held the largest share in 2024. The growth is due to an increasing domestic pharmaceutical manufacturing, especially in the generic and innovative drug segments, which is fueling demand for robust dissolution testing to ensure drug quality and regulatory compliance. The Chinese regulatory authorities, including the National Medical Products Administration (NMPA), have strengthened their guidelines and enforcement around dissolution testing, aligning more closely with global standards such as those from the USFDA and ICH, which is pushing pharmaceutical companies to adopt advanced testing methods.

The pharmaceutical dissolution testing services market in Japan is expected to grow over the forecast period. The demand for dissolution testing services is driven by the need to comply with the PMDA’s requirements and continuous innovation in drug formulations. Established CROs and testing laboratories support market growth.

The pharmaceutical dissolution testing services market in India is anticipated to grow at a lucrative CAGR over the forecast period. This can be attributed to its status as a major generic drug producer and increasing regulatory alignment with global standards like the USFDA and EMA. The country offers cost-effective testing services, attracting outsourcing from international pharmaceutical companies. Rising R&D investment and government initiatives to improve pharmaceutical quality assurance drive the market.

Key Pharmaceutical Dissolution Testing Services Company Insights

Several key players are acquiring various strategic initiatives to strengthen their market position and offer diverse services to customers. The prominent strategies adopted by companies are service launches, mergers and acquisitions/joint ventures, partnerships and agreements, expansions, and others to increase market presence and revenue and gain a competitive edge, which drives market growth.

Key Pharmaceutical Dissolution Testing Services Companies:

The following are the leading companies in the pharmaceutical dissolution testing services market. These companies collectively hold the largest market share and dictate industry trends.

- Intertek Group Plc.

- Avivia BV

- Almac Group

- Agilent Technologies, Inc.

- Catalent, Inc.

- Thermo Fisher Scientific Inc.

- Cambrex

- Charles River Laboratories

- Boston Analytical

- Pace Analytical Life Sciences

- SOTAX

- AMRI

- SGS SA

Recent Developments

-

In February 2025, Thermo Fisher Scientific Inc. acquired Solventum's Purification & Filtration business for USD 4.1 billion. The acquisition aims to strengthen the company’s ability to offer integrated, end-to-end drug development solutions, increasing pharmaceutical companies' demand for comprehensive testing and purification services.

-

In October 2022, Agilent Technologies, Inc. announced that it would open its Dissolution Center of Excellence in Craven Arms, UK-a new site that consolidates dissolution R&D, quality control, customer support, and application development under one roof. This strategic move strengthens Agilent’s global footprint, enabling enhanced training, virtual demonstrations, and direct workflows centered on dissolution processes.

Pharmaceutical Dissolution Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 485.8 million

Revenue forecast in 2033

USD 966.3 million

Growth rate

CAGR of 8.98% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Method, dosage form, dissolution apparatus, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Intertek Group Plc.; Avivia BV; Almac Group; Agilent Technologies, Inc.; Catalent, Inc.; Thermo Fisher Scientific Inc., Cambrex Corp; Charles River Laboratories; Boston Analytical; Pace Analytical Life Sciences; SOTAX; AMRI; SGS SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Dissolution Testing Services Market Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmaceutical dissolution testing services market report based on method, dosage form, dissolution apparatus, and region.

-

Method Outlook (Revenue, USD Million, 2021 - 2033)

-

In-Vitro

-

In-Vivo

-

-

Dosage Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Capsule

-

Tablets

-

Others

-

-

Dissolution Apparatus Outlook (Revenue, USD Million, 2021 - 2033)

-

Basket

-

Paddle

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical dissolution testing services market size was estimated at USD 450.3 million in 2024 and is expected to reach USD 485.8 million in 2025.

b. The global pharmaceutical dissolution testing services market is expected to grow at a compound annual growth rate of 8.98% from 2025 to 2033 to reach USD 966.3 million by 2033.

b. North America dominated the pharmaceutical dissolution testing services market with a share of 56.56% in 2024. This is attributable to the rapid increase in the manufacturing of pharmaceuticals to meet the rising demand for efficient healthcare and specialized expertise offered by CDMOs in the region.

b. Some key players operating in the pharmaceutical dissolution testing services market include Avivia BV, Almac Group, Agilent Technologies, Inc., Catalent, Inc., Thermofisher Scientific Inc., Cambrex, Charles River laboratories, Boston Analytical, Pace Analytical Life Sciences, SOTAX, AMRI, and SGS SA.

b. Key factors that are driving the pharmaceutical dissolution testing services market growth include the Rising burden of chronic and infectious diseases and Increasing R&D activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.