- Home

- »

- Advanced Interior Materials

- »

-

Pharmaceutical Packaging Equipment Market Report, 2030GVR Report cover

![Pharmaceutical Packaging Equipment Market Size, Share & Trends Report]()

Pharmaceutical Packaging Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Machine (Filling, Labelling, Form Fill & Seal, Cartoning, Wrapping, Palletizing, Cleaning), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-3-68038-894-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Packaging Equipment Market Summary

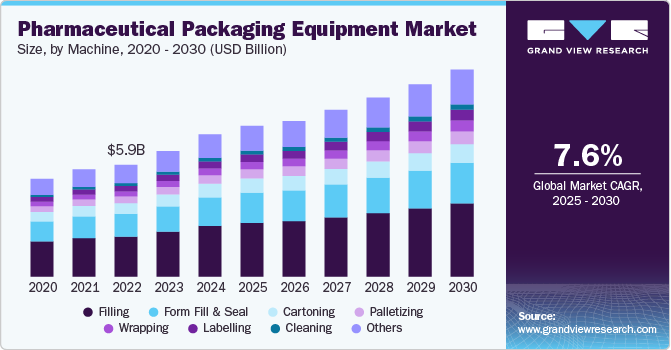

The global pharmaceutical packaging equipment market size was estimated at USD 6,498.7 million in 2024 and is projected to reach USD 10,047.4 million by 2030, growing at a CAGR of 7.6% from 2025 to 2030. Rising global health awareness, coupled with the growing prevalence of chronic diseases, is propelling pharmaceutical production, which is, in turn, fueling the need for efficient and compliant packaging equipment.

Key Market Trends & Insights

- The Asia Pacific region dominated the market and accounted for 40.2% share in 2024.

- The pharmaceutical packaging equipment market in the U.S. held a significant share in 2024.

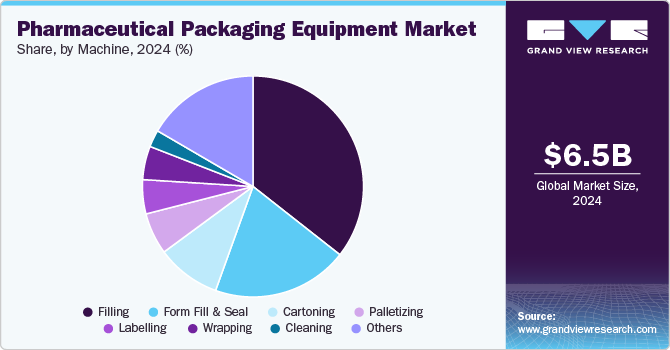

- Based on machine, the filling machine type led the market and accounted for 35.6% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,498.7 Million

- 2030 Projected Market Size: USD 10,047.4 Million

- CAGR (2025-2030): 7.6%

- Asia Pacific: Largest market in 2024

The market is further influenced by various driving factors, reflecting the dynamic landscape of the pharmaceutical industry. Furthermore, the growing demand for a diverse range of pharmaceutical products, driven by factors such as an aging population, increasing healthcare needs, and advancements in medical research, necessitates efficient and advanced packaging solutions.

Moreover, the pharmaceutical industry is subject to strict regulations imposed by agencies such as the Food and Drug Administration (FDA). Compliance with these regulations is essential to ensure the safety, efficacy, and quality of pharmaceutical products. As a result, pharmaceutical companies invest in packaging equipment that meets the stringent standards set by regulatory authorities, such as tamper-evident packaging and serialization requirements.

Pharmaceutical production in Europe increased significantly from USD 137,704 million in 2000 to USD 421,200 million in 2023, representing an impressive rise of approximately 205%. This surge in production can be attributed to factors such as rising global health demands, increased prevalence of chronic diseases, and a heightened focus on healthcare innovation. As pharmaceutical companies expand their operations to meet this growing demand, the need for efficient and scalable manufacturing processes becomes critical.

As the pharmaceutical industry expands, the demand for advanced packaging equipment will likely surge. Manufacturers will need packaging solutions that can accommodate increased production volumes while ensuring quality and compliance with regulatory requirements. Furthermore, the focus on sustainability will drive innovation in packaging materials and processes, creating opportunities for equipment suppliers to meet these evolving needs.

Drivers, Opportunities & Restraints

The pharmaceutical packaging market is primarily driven by the increasing demand for advanced packaging solutions that enhance product safety and extend shelf life. As the global pharmaceutical industry expands, driven by rising healthcare needs and innovations in drug formulation, the demand for packaging that ensures product integrity during transportation and storage grows. Additionally, the rising prevalence of counterfeit drugs has led to a surge in demand for secure packaging that includes anti-counterfeiting technologies, such as holograms and QR codes, further propelling market growth.

Despite its growth, the pharmaceutical packaging market faces several restraints, including stringent regulatory requirements and compliance issues. Adhering to global and regional regulations, such as those set by the FDA and EMA, can increase the costs and complexity of packaging solutions. Moreover, small and medium-sized enterprises (SMEs) may struggle with these compliance demands, limiting their ability to compete in the market. Additionally, fluctuating raw material prices can adversely impact packaging costs, adding another layer of challenge for manufacturers.

The pharmaceutical packaging market presents numerous opportunities, particularly through the integration of smart packaging technologies, such as sensors and RFID elements, which can improve monitoring and traceability. The growing trend of personalized medicine opens avenues for customizable packaging solutions that cater to specific patient needs. Furthermore, the rising focus on sustainable packaging materials, driven by consumer preferences and environmental regulations, provides opportunities for innovation in eco-friendly packaging designs that minimize waste and enhance recyclability, thus aligning with global sustainability goals.

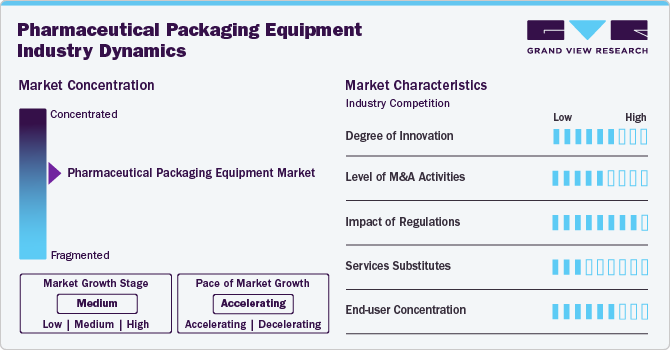

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as mergers & acquisitions and collaborations, to strengthen their position in the global market.

The market is also characterized by a high level of merger & acquisition activity by the leading players. Players adopt this strategy to increase the reach of their products in the market and enhance the availability of their products & services in diverse geographical areas. Further, the market for pharmaceutical packaging equipment is also subject to increasing regulatory scrutiny. Regulations governing the market are crucial to ensuring the safety, efficacy, and quality of pharmaceutical products. Various regulatory bodies around the world establish guidelines and standards that manufacturers must adhere to.

For instance, In the U.S., the FDA plays a central role in regulating pharmaceuticals and their packaging. Manufacturers of pharmaceutical packaging equipment must comply with FDA regulations, including those related to Current Good Manufacturing Practice (cGMP) for finished pharmaceuticals. The FDA also provides guidance on specific aspects of packaging, such as tamper-evident packaging and barcoding. Moreover, in Europe, the EMA issues guidelines to ensure the quality and safety of medicines. These guidelines cover various aspects of pharmaceutical manufacturing, including packaging. Manufacturers must adhere to EMA guidelines to obtain and maintain marketing authorization for their products.

The pharmaceutical industry has been adopting advanced automation and robotics in packaging processes to improve efficiency, reduce errors, and enhance overall productivity. Automated packaging lines can handle tasks such as filling, labeling, and packaging with precision, contributing to higher throughput. Moreover, the integration of smart packaging technologies has been on the rise. This includes the use of RFID (Radio-Frequency Identification), QR codes, and sensors to enable real-time monitoring of pharmaceutical products throughout the supply chain. Smart packaging enhances traceability and helps in maintaining product quality.

Machine Insights

Filling machine type led the market and accounted for 35.6% of the global revenue in 2024. Filling machines in the pharmaceutical industry play a pivotal role in ensuring the precise and sterile dispensing of pharmaceutical products into various containers such as vials, bottles, and syringes. Moreover, advanced filling machines employ state-of-the-art technologies, including peristaltic pumps or volumetric fillers, to handle a diverse range of liquid or powder medications. Additionally, these machines often feature automated controls and monitoring systems to enhance efficiency, reduce human error, and ensure compliance with pharmaceutical quality standards. The flexibility of modern filling machines allows pharmaceutical companies to accommodate various container sizes and formulations, contributing to streamlined production processes and the delivery of high-quality, precisely dosed medications to meet the dynamic demands of the pharmaceutical industry.

Wrapping machines are integral to the pharmaceutical industry, serving the crucial function of securely packaging pharmaceutical products for protection and preservation. These machines are designed to handle a variety of packaging materials, including blister packs, strip packs, and sachets. Employing advanced technology, pharmaceutical wrapping machines ensure the aseptic and tamper-evident sealing of medicines, maintaining their integrity and compliance with regulatory standards. With capabilities for high-speed and precision, these machines contribute to the efficient packaging of pharmaceuticals in standardized formats, enabling convenient distribution and use.

Regional Insights

The pharmaceutical packaging equipment market in North America accounted for a market share of 22.2% in 2023. The North America pharmaceutical packaging equipment market is significantly driven by the increasing demand for advanced packaging equipment that ensure drug safety and efficacy. As the pharmaceutical sector continues to evolve, there's a growing need for packaging methods that comply with stringent regulatory requirements. Innovations such as smart packaging, which includes temperature control and tamper-evident features, are becoming essential in preserving product integrity and enhancing patient safety.

U.S. Pharmaceutical Packaging Equipment Market Trends

The pharmaceutical packaging equipment market in the U.S. held a significant share in 2024. The U.S. pharmaceutical packaging equipment market is experiencing robust growth, fueled by the increasing demand for efficient and automated packaging solutions to meet stringent regulatory standards. Innovations in technology, such as serialization and smart packaging, are driving advancements in equipment capabilities, enhancing safety and traceability. Additionally, the rising prevalence of chronic diseases and the corresponding need for pharmaceutical products are contributing to the expansion of packaging operations.

The pharmaceutical packaging equipment market in the Canada is expected to grow at a CAGR of 4.8% over the forecast period. This continuous rise in health expenditures directly correlates with the growing demand for pharmaceutical products and, subsequently, for pharmaceutical packaging equipment in Canada. As the healthcare system expands, the need for efficient, compliant, and innovative packaging solutions becomes increasingly critical.

The pharmaceutical packaging equipment market in the Mexico is expected to grow at a CAGR of 6.6% over the forecast period. According to the International Trade Administration, pharmaceutical sales in Mexico from 2020 to 2023 indicates some fluctuations over the years. In 2020, sales reached USD 11.10 billion, which slightly decreased to USD 11.00 billion in 2021. This decline might reflect challenges faced during the pandemic, including supply chain disruptions. However, in 2022, sales dropped significantly to USD 10.12 billion, suggesting a notable setback for the sector. Moreover, the market rebounded in 2023, with sales rising to USD 10.83 billion, indicating a recovery trend and renewed demand for pharmaceutical products, thereby driving the demand for market.

Europe Pharmaceutical Packaging Equipment Market Trends

The European pharmaceutical packaging equipment market is experiencing robust growth driven by several key factors, including stringent regulatory requirements and a rising emphasis on patient safety. The implementation of regulations such as the Current Good Manufacturing Practice (CGMP) and EU Falsified Medicines Directive (FMD) has mandated enhanced packaging solutions, including serialization and tamper-evident features. This regulatory model not only ensures the integrity of pharmaceuticals but also fosters innovation among manufacturers who are investing in advanced packaging technologies.

Germany pharmaceutical packaging equipment market held 11.9% share in the European market. In 2023, pharmaceutical sales in Germany rose by 5.7%, reaching USD 64.58 billion. As Germany continues to be a leading exporter and producer of medicinal products and biopharmaceuticals, manufacturers require advanced packaging solutions to ensure compliance with stringent EU regulations and maintain product integrity. The emphasis on personalized medicine further necessitates specialized packaging that can accommodate diverse formulations and smaller batch sizes.

UK pharmaceutical packaging equipment market held 8.8% share in the European market. According to the Association of the British Pharmaceutical Industry, the UK is regarded as a life sciences powerhouse that is driven by the solid scientific foundation, a growing attitude towards foreign pharmaceutical investments, a skilled manufacturing workforce, and a strong emphasis on safeguarding innovation through intellectual property rights. The UK's regulatory bodies are also considered among the most experienced and sophisticated worldwide.

Asia Pacific Pharmaceutical Packaging Equipment Market Trends

The Asia Pacific region dominated the market and accounted for 40.2% share in 2024. The region has seen a significant rise in pharmaceutical production, fueled by population growth, increasing healthcare demands, and higher investments in the pharmaceutical industry. Countries such as Japan, Australia, and Singapore have traditionally aligned well with global industry standards, while others are progressing in that direction. As a result, there is a growing need for advanced and efficient packaging equipment to accommodate the rising production levels.

China pharmaceutical packaging equipment market held 11.9% share in the Asia Pacific market. The demand for pharmaceutical packaging equipment in China is driven by several key factors such as the rapid growth of the pharmaceutical industry. This is fueled by increasing investment in healthcare and a rising prevalence of chronic diseases, which has created a need for efficient packaging solutions.

India pharmaceutical packaging equipment market held 8.8% share in the Asia Pacific market. The demand for pharmaceutical packaging equipment in India is driven by several specific factors related to the country's unique landscape. The expansion of the pharmaceutical sector, supported by government initiatives like the Pharma Vision 2020, aims to make India a global manufacturing hub and a leader in end-to-end drug innovation and discovery. This growth necessitates advanced packaging solutions to ensure product integrity and compliance with international standards.

Central & South Pharmaceutical Packaging Equipment Market Trends

The pharmaceutical packaging equipment market in Central & South America is experiencing significant growth, fueled by increasing healthcare investments and a rising demand for pharmaceuticals across the region. The pharmaceutical market in Central & South America is driven by factors such as a growing middle class, improved access to healthcare, and heightened awareness of health issues.

Brazil is one of the dominant markets for pharmaceutical packaging in Central & South America owing to the presence of big pharmaceutical manufacturing companies and a large population base. Leading pharmaceutical manufacturers operating in the country include Ache, EMS Pharma, Eurofarma, NEO Quimica, Mantecorp Farmasa, and others. Presence of such prominent pharmaceutical manufacturing companies makes Brazil an attractive market for manufacturers of pharmaceutical packaging equipment.

Middle East & Africa Pharmaceutical Packaging Equipment Market Trends

The Middle East & Africa pharmaceutical packaging equipment market is witnessing significant growth, driven by increasing healthcare investments and a rising demand for pharmaceutical products. This growth is bolstered by governments in the region prioritizing healthcare infrastructure development, such as the Saudi Vision 2030 initiative, which aims to enhance healthcare services and boost local pharmaceutical manufacturing capabilities.

This robust push for local production and innovation is significantly driving demand for pharmaceutical packaging equipment in Saudi Arabia. As the country enhances its manufacturing capabilities and expands its range of pharmaceutical products, there will be a heightened need for advanced packaging solutions that ensure compliance with regulatory standards and maintain product integrity.

Key Pharmaceutical Packaging Equipment Company Insights

Some of the key players operating in the market include IMA Group, Marchesini Group, and Uhlmann.

-

IMA Group is a global company that designs and manufactures automatic machines for processing and packaging in various sectors, including pharmaceuticals, cosmetics, food, tea, and coffee. The company specializes in creating advanced automated solutions that enhance efficiency and productivity for its clients. IMA’s product range includes machines for filling, sealing, labeling, and cartoning, among others. With a strong international presence, it operates in about 80 countries and has established numerous subsidiaries and partnerships worldwide. This global reach allows the company to cater to diverse market needs while focusing on local customer requirements.

-

Uhlmann Group is an international provider of packaging solutions primarily focused on the pharmaceutical sector. The company has evolved from a mechanical engineering company into a comprehensive network of brands that includes Uhlmann Pac-Systeme, Koch Pac-Systeme, Cremer Special machines, Wonder Packing Machinery, and Axito. The company has a strong global presence with sales in 18 locations across 14 countries. It specializes in high-tech packaging machines and services for various industries, such as blistering, bottling, and cartooning. The company offers integrated services that encompass consulting, project management, implementation, and ongoing support.

Vanguard Pharmaceutical Machinery, Inc., BONFIGLIOLI ENGINEERING (TASI Group) are some of the emerging market participants in the market.

-

Vanguard Pharmaceutical Machinery, Inc., is a global manufacturer of processing, packaging, and laboratory equipment. The company offers equipment to customers in over 85 countries, including prominent clients such as Aventis, Schwarz Pharma, Cardinal Health UK, Kimberly Clark, Procter & Gamble, Bayer, and Novartis. The company serves industries including pharmaceuticals, food, beverage, cosmetics, and chemicals. It emphasizes investing resources in streamlining how companies purchase equipment and eliminating the traditional premium costs associated with high-quality products and services.

-

Bonfiglioli Engineering is an Italian company and is part of the TASI Group. It specializes in inspection machines pertaining to pharmaceutical packaging. The company focuses on noninvasive leak testing inspection and serves a variety of sectors, including pharmaceuticals, food and beverages, aerosols, and cosmetics. Its product offerings encompass sachets, pouches, bags, bottles, vials, ampoules, and metal cans. The company has a global presence in 75 countries and over 5,000 installations worldwide. It invests significantly in research and development and has an extensive global sales network.

Key Pharmaceutical Packaging Equipment Companies:

The following are the leading companies in the pharmaceutical packaging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch

- Romaco Holding

- Marchesini Group

- Korber AG

- I.M.A. Industria Macchine Automatiche S.p.A.

- Uhlmann Group

- Accutek Packaging Equipment Companies

- Bausch + Ströbel

- Coesia

- Vanguard Pharmaceuticals Equipment

- MULTIVAC Group

- OPTIMA Packaging Group

- ACG Worldwide

- BREVETTI CEA S.P.A

Recent Developments

-

In August 2024, I.M.A. Industria Macchine Automatiche S.p.A. acquired Sarong's packaging machinery and e-packaging materials divisions, a move aimed at enhancing its product offerings in the packaging sector. This acquisition will expand the company’s capabilities in providing innovative and sustainable packaging solutions, particularly in the food and pharmaceutical industries. The integration of Sarong's expertise allows I.M.A. Industria Macchine Automatiche S.p. A. to strengthen its market position and respond effectively to evolving customer demands. The deal aligns with the company’s strategy to enhance its technological portfolio and offer comprehensive solutions to its clients.

-

In December 2023, MULTIVAC Group inaugurated its latest production facility in India. With an investment of approximately USD 9 million, the state-of-the-art Sales and Production complex boasts a 10,000-square-meter floor area and is set to commence operations in early 2024. The facility will initially employ about 60 individuals, aiming to enhance customer service in India, Sri Lanka, and Bangladesh by strategically positioning itself regionally and reducing delivery times.

Pharmaceutical Packaging Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6969.9 million

Revenue forecast in 2030

USD 10,047.4 million

Growth Rate

CAGR of 7.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; Russia; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE

Key companies profiled

Robert Bosch; Romaco Holding; Marchesini Group; Korber AG; I.M.A. Industria Macchine Automatiche S.p.A.; Uhlmann Group; Accutek Packaging Equipment Companies; Bausch + Ströbel; Coesia; Vanguard Pharmaceuticals Equipment; MULTIVAC Group; OPTIMA Packaging Group; ACG Worldwide; BREVETTI CEA S.P.A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Packaging Equipment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pharmaceutical packaging equipment market report based on Machine, and region.

-

Machine Outlook (Revenue, USD Million, 2018 - 2030)

-

Filling

-

Labelling

-

Form Fill & Seal

-

Cartoning

-

Wrapping

-

Palletizing

-

Cleaning

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical packaging equipment market size was estimated at USD 6,498.7 million in 2024 and is expected to be USD 6,969.9 million in 2025.

b. The global pharmaceutical packaging equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 10,047.4 billion by 2030

b. Asia Pacific region dominated the market and accounted for 40.2% share in 2024. The region has been experiencing a surge in pharmaceutical production, driven by factors such as population growth, rising healthcare needs, and increasing investments in the pharmaceutical sector.

b. Some of the key players operating in the pharmaceutical packaging equipment market include Robert Bosch, Romaco Holding, Marchesini Group, Korber AG, I.M.A. Industria Macchine Automatiche S.p.A., Uhlmann Group, Accutek Packaging Equipment Companies, Bausch + Ströbel, Coesia, Vanguard Pharmaceuticals Equipment, MULTIVAC Group, OPTIMA Packaging Group, ACG Worldwide, BREVETTI CEA S.P.A.

b. The market is anticipated to be driven by the growing focus on brand enhancement and product differentiation by pharmaceutical manufacturers. Besides, increasing prevalence of chronic diseases due to changing lifestyles, and growing government focus towards strengthening of healthcare facilities and insurance coverage are expanding the demand for pharmaceuticals, which in turn, fueling pharmaceutical packaging equipment market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.