- Home

- »

- Advanced Interior Materials

- »

-

Pharmaceutical Packaging Equipment Market Report, 2030GVR Report cover

![Pharmaceutical Packaging Equipment Market Size, Share & Trends Report]()

Pharmaceutical Packaging Equipment Market Size, Share & Trends Analysis Report By Machine Type (Filling, Labelling, Cartoning), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-894-7

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Market Size & Trends

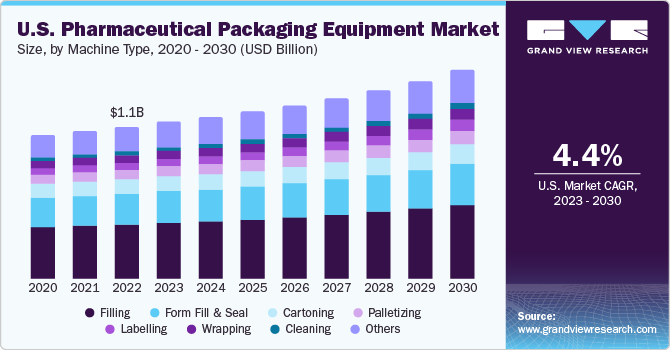

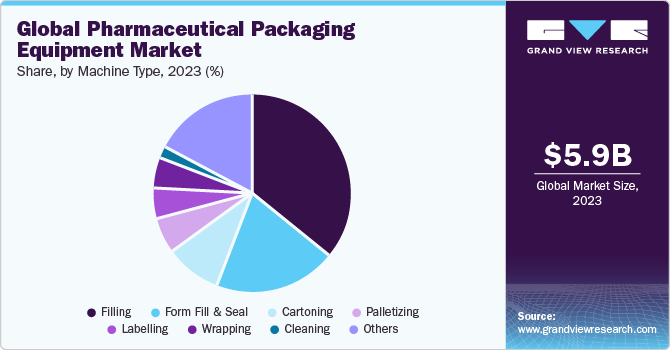

The global pharmaceutical packaging equipment market size was estimated at USD 5.91 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. The market is anticipated to be driven by growing focus on brand enhancement and product differentiation by pharmaceutical manufacturers. Increasing prevalence of chronic diseases due to changing lifestyles and growing government focus on strengthening healthcare facilities and insurance coverage are expanding the demand for pharmaceuticals, fueling the market.

The U.S. pharmaceutical packaging equipment market is influenced by various driving factors, reflecting the dynamic landscape of the pharmaceutical industry within the country. One significant factor is the continuous expansion of the pharmaceutical sector in the U.S. The growing demand for a diverse range of pharmaceutical products, driven by factors such as an aging population, increasing healthcare needs, and advancements in medical research, necessitates efficient and advanced packaging solutions.

According to the National Health Expenditure Data, U.S. medicare spending increased 8.4% to USD 900 billion in 2021. Moreover, Medicaid spending has increased by 9.2% to USD 734 billion compared to 2020. Furthermore, in 2021, U.S. spending for medicines has increased by 12% due to increased demand for COVID-19 vaccines, boosters, treatments, and prescription medication usage was 194 billion daily doses across the U.S.

The pharmaceutical industry is subject to strict regulations imposed by agencies such as the Food and Drug Administration (FDA). Compliance with these regulations is essential to ensure safety, efficacy, and quality of pharmaceutical products. As a result, pharmaceutical companies invest in packaging equipment that meets the stringent standards set by regulatory authorities, such as tamper-evident packaging and serialization requirements.

Technological advancements also play a pivotal role in driving the market. Automation, robotics, and smart packaging technologies increase efficiency, reduce errors, and enhance traceability throughout the packaging process. For example, the integration of track-and-trace systems helps pharmaceutical companies comply with serialization regulations and ensures the authenticity of products in the supply chain.

Furthermore, the emphasis on sustainability and environmental responsibility is becoming a noteworthy driver. Global pharmaceutical companies are adopting eco-friendly packaging solutions to minimize their environmental footprint. It includes recyclable materials and sustainable packaging practices, contributing to the demand for innovative packaging equipment that supports these initiatives.

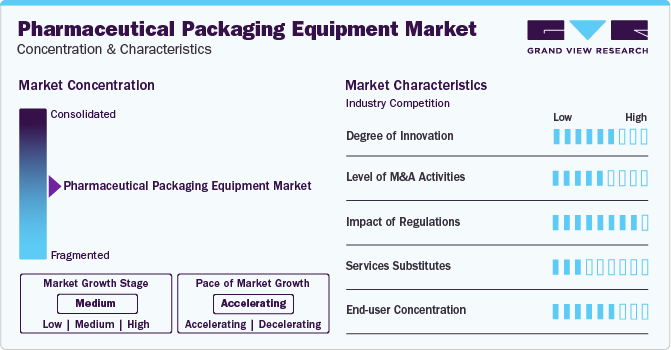

Market Concentration & Characteristics

The market growth stage is medium, and the pace of market growth is accelerating. This market is characterized by a high degree of innovation due to rapid technological advancements. Moreover, the companies are adopting various organic and inorganic growth strategies, such as mergers & acquisitions and collaborations, to strengthen their position in the global market.

The pharmaceutical packaging equipment market is characterized by high merger & acquisition activities by the leading players. Players adopt this strategy to increase the reach of their products in the market and enhance the availability of their products & services in diverse geographical areas. Further, this market is also subject to increasing regulatory scrutiny. Various regulatory bodies worldwide establish guidelines and standards that manufacturers must adhere to.

For instance, In the U.S., the FDA plays a central role in regulating pharmaceuticals and their packaging. Pharmaceutical packaging equipment manufacturers must comply with FDA regulations, including those related to Current Good Manufacturing Practice (cGMP) for finished pharmaceuticals. The FDA also provides guidance on specific aspects of packaging, such as tamper-evident packaging and barcoding. Moreover, in Europe, the EMA issues guidelines to ensure the quality and safety of medicines. These guidelines cover various aspects of pharmaceutical manufacturing, including packaging. Manufacturers must adhere to EMA guidelines to obtain and maintain marketing authorization of their products.

Automated packaging lines can handle tasks such as filling, labeling, and packaging with precision, contributing to higher throughput. Moreover, the integration of smart packaging technologies has been on the rise. It includes RFID (Radio-Frequency Identification), QR codes, and sensors to enable real-time monitoring of pharmaceutical products throughout the supply chain. Smart packaging enhances traceability and helps in maintaining product quality.

Machine Type Insights

Filling machine type led the market, accounting for 35.6% of the global revenue in 2023. Filling machines in the pharmaceutical industry play a pivotal role in ensuring the precise and sterile dispensing of pharmaceutical products into various containers, such as vials, bottles, and syringes. Moreover, advanced filling machines employ state-of-the-art technologies, including peristaltic pumps or volumetric fillers, to handle a diverse range of liquid or powder medications. Additionally, these machines often feature automated controls and monitoring systems to enhance efficiency, reduce human error, and ensure compliance with pharmaceutical quality standards. The flexibility of modern filling machines allows pharmaceutical companies to accommodate various container sizes and formulations, contributing to streamlined production processes and the delivery of high-quality, precisely dosed medications to meet the dynamic demands of the pharmaceutical industry.

Wrapping machines are integral to the pharmaceutical industry, serving the crucial function of securely packaging pharmaceutical products for protection and preservation. These machines are designed to handle a variety of packaging materials, including blister packs, strip packs, and sachets. Pharmaceutical wrapping machines ensure the aseptic and tamper-evident sealing of medicines by employing advanced technology and maintaining their integrity and compliance with regulatory standards. With high speed and precision capabilities, these machines contribute to the efficient packaging of pharmaceuticals in standardized formats, enabling convenient distribution and use. The automated features, coupled with the ability to incorporate serialization and traceability, make wrapping machines indispensable in meeting the stringent requirements of the pharmaceutical sector while enhancing packaging efficiency and product safety.

Regional Insights

Asia Pacific dominated the market and accounted for a 39.0% share in 2023. The region has been experiencing a surge in pharmaceutical production, driven by population growth, rising healthcare needs, and increasing investments in the pharmaceutical sector. This growth has led to a corresponding demand for advanced and efficient packaging equipment to meet the increased production volumes. Furthermore, demand for pharmaceutical packaging equipment in China is witnessing substantial growth, propelled by the expanding pharmaceutical industry and the need for advanced packaging solutions. With China being a key player in pharmaceutical manufacturing, there is an increasing focus on enhancing production efficiency, ensuring product safety, and complying with stringent regulatory standards. The demand for blister packaging machines, vial filling equipment, and track-and-trace systems has surged as pharmaceutical companies seek modern, automated solutions to meet the rising demand for diverse, high-quality pharmaceutical products.

One of the crucial drivers for the growth of the packaging equipment market in Europe is the flourishing pharmaceutical industry in the region. The ongoing advancements in technologies employed in the pharmaceutical industry and new medicine launches are fueling the demand for pharmaceutical packaging equipment, leading to market growth in Europe. This trend is anticipated to continue over the forecast period as well. In February 2023, Gerresheimer launched a Clinical Trial Kit specifically produced to meet the development requirements of vaccines, novel medications, and biologics. It also contains sterile Gx RTF vials in a tub, nest, or tray with matching closures.

Key Companies & Market Share Insights

Some of the key players operating in the market include Robert Bosch, MULTIVAC Group, and Korber AG.

-

MULTIVAC is a global provider of packaging solutions, focusing on packaging machines, complete lines, and comprehensive packaging services. The company is recognized for its expertise in packaging technology and has a significant presence in various industries, including food, medical, healthcare, and industrial products.Moreover, the company has established a strong international presence with subsidiaries, sales offices, and service centers worldwide. The company operates in over 140 countries. Furthermore, the company manufactures various packaging machines, including vacuum chamber machines, tray sealers, thermoforming packaging machines, and tray sealers with handling modules.

-

A multinational technology company with a worldwide footprint, Robert Bosch GmbH stands as one of the largest providers of automotive components, industrial technologies, consumer goods, and energy and building technology. Bosch is renowned for its extensive product range and groundbreaking innovations across multiple sectors.

Coesia and BREVETTI CEA S.P.A are some of the emerging market participants.

-

Coesia, founded in 2008, operates as a group of companies specializing in industrial solutions and innovation across various sectors. The group is known for its focus on packaging machinery, industrial process solutions, and precision gears. Each company within the Coesia group operates independently in its area of expertise, collaborating to provide integrated solutions.

-

BREVETTI CEA operates as a provider of innovative packaging solutions, focusing on machinery designed to meet the specific needs of pharmaceutical and cosmetic manufacturers.

Key Pharmaceutical Packaging Equipment Companies:

- Robert Bosch

- Romaco Holding

- Marchesini Group

- Korber AG

- I.M.A. Industria Macchine Automatiche S.p.A.

- Uhlmann Group

- Accutek Packaging Equipment Companies

- Bausch + Ströbel

- Coesia

- Vanguard Pharmaceuticals Equipment

- MULTIVAC Group

- OPTIMA Packaging Group

- ACG Worldwide

- BREVETTI CEA S.P.A

Recent Developments

-

In December 2023, MULTIVAC Group inaugurated its latest production facility in India. With an investment of approximately USD 9 million, the state-of-the-art Sales and Production complex boasts a 10,000-square-meter floor area and is set to commence operations in early 2024. The facility will initially employ about 60 individuals, aiming to enhance customer service in India, Sri Lanka, and Bangladesh by strategically positioning itself regionally and reducing delivery times.

-

In May 2023, MULTIVAC Group introduced the Pouch Loader designed for chamber belt machines. This semi-automatic solution represents a notable enhancement in the overall performance, hygiene, efficiency, and ergonomics of filling film pouches and loading them into the packaging machine.

Pharmaceutical Packaging Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.18 billion

Revenue forecast in 2030

USD 8.69 billion

Growth Rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

January 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Machine type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; Russia; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE

Key companies profiled

Robert Bosch; Romaco Holding; Marchesini Group; Korber AG; I.M.A. Industria Macchine Automatiche S.p.A.; Uhlmann Group; Accutek Packaging Equipment Companies; Bausch + Ströbel; Coesia; Vanguard Pharmaceuticals Equipment; MULTIVAC Group; OPTIMA Packaging Group; ACG Worldwide; BREVETTI CEA S.P.A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

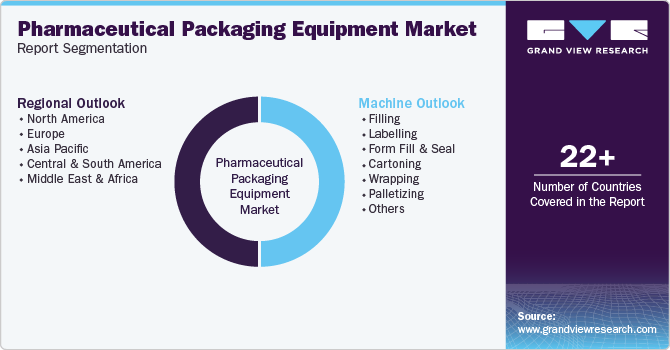

Global Pharmaceutical Packaging Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical packaging equipment market report based on machine type and region:

-

Machine Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Filling

-

Labelling

-

Form Fill & Seal

-

Cartoning

-

Wrapping

-

Palletizing

-

Cleaning

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical packaging equipment market size was estimated at USD 5.91 billion in 2023 and is expected to be USD 6.18 billion in 2024

b. The global pharmaceutical packaging equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 8.69 billion by 2030

b. Asia Pacific region dominated the market and accounted for 39.0% share in 2023. The region has been experiencing a surge in pharmaceutical production, driven by factors such as population growth, rising healthcare needs, and increasing investments in the pharmaceutical sector

b. Some of the key players operating in the pharmaceutical packaging equipment market include Robert Bosch, Romaco Holding, Marchesini Group, Korber AG, I.M.A. Industria Macchine Automatiche S.p.A., Uhlmann Group, Accutek Packaging Equipment Companies, Bausch + Ströbel, Coesia, Vanguard Pharmaceuticals Equipment, MULTIVAC Group, OPTIMA Packaging Group, ACG Worldwide, BREVETTI CEA S.P.A.

b. The market is anticipated to be driven by the growing focus on brand enhancement and product differentiation by pharmaceutical manufacturers. Besides, increasing prevalence of chronic diseases due to changing lifestyles, and growing government focus towards strengthening of healthcare facilities and insurance coverage are expanding the demand for pharmaceuticals, which in turn, fueling pharmaceutical packaging equipment market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."